Social trading in the UK began on trader forums, then evolved into the currently popular social trading platforms created by FCA-licensed brokers.

Social trading trends in the UK follow a worldwide craze that started in the early 2000s. Social trading combines the concept of social media and trading through online platforms with eye-catching monikers such as copy trade, mirror trade, etc.

Are you interested? We'll go over the fundamentals of social trading, social trading trends in the UK, and various social trading platforms you can use right now.

What Is Social Trading?

Social trading is a type of trading platform feature that operates on the tenet that people may learn from one another. It enables traders around the world to discuss their ideas with fellow traders by sharing updates about their own deals, commenting on each other's trades, liking or disliking each other's actions, and explaining or questioning certain trading decisions.

Social trading builds a network where beginners may learn from professionals and professionals may learn from each other. A social trading platform may also enable their members to gain extra income as their follower base grows and attracts more people to copy their transactions.

Advantages and Disadvantages

Social trading has various advantages, including, but not limited to:

- Knowledge sharing

- Earning extra income

- Duplicating strategies employed by other traders

Additionally, social trading platforms may help traders identify market bias by analyzing data gathered by the platform if it is made available to members.

Still, social trading has its own risks. It conveyed the (incorrect) idea that people can simply leave the job of making trades to the pros. This is dreadfully wrong because everyone can make fatal mistakes, including those we consider pros.

We encourage you to conduct a bit of research before copying any trades. Know the pros you are following and learn their method. It is important for you to weigh the risk and determine whether you can bear it. No matter how experienced they are, just because you are replicating someone else's transaction does not guarantee that your own will be profitable.

How Does Social Trading Work in the UK?

Social trading in the UK began on trader forums, social media groups, mailing lists, and chatrooms. Both novice and experienced traders would visit an online chat room to discuss trading ideas and obtain the knowledge required to duplicate the more prospective ones.

As technology advanced, it evolved into the current mode of social trading, in which financial institutions customized specific platforms for their members to exchange ideas and follow each other. This allowed short-term traders to obtain information as soon as it was delivered and act upon it. On the other hand, the most popular traders will be rewarded with a high ranking and some pretty pennies.

Anyone can join social trading in the UK, either as a follower or a pro trader. Here's how:

- The average UK social trader begins by choosing the best social trading platform.

Register yourself as a follower and link your trading account with the platform. Look through the board ranking and choose the most interesting pro trader for you. Visit their profile page to learn more about their trading strategy and how much they charge. If you are agreeable with it, follow them, and you will then be able to see their trades and copy them. Otherwise, browse through other pros and choose one or more that match your ideas. - UK pro traders can boost their popularity and income by registering on the same platform.

Link the platform with your trading account, determine your fees, and create an attractive profile page. Make sure to share the page with your acquaintances and social media friends. The platform will automatically record your trades and regularly summarize your performances in eye-catching graphs.

Most importantly, choose a legitimately licensed platform. There are numerous social trading platforms in the trading industry. It could be challenging for traders to select the ideal alternative for them with so many available, but as a UK trader, you won't go wrong with any platform supported by FCA-licensed brokers.

The Best Social Trading Platforms in the UK

Choosing the right social trading platform can significantly impact your experience. Although the functions offered by many UK social trading platforms are similar, there can be significant differences in how those features are implemented.

In light of this, let's examine some of the most prominent social trading platforms in the UK.

1. eToro

eToro is arguably the most popular social trading platform in the world. Unsurprisingly, eToro is also licensed to operate in the UK.

The platform has an easy-to-use and responsive social trading function that lets users mimic and follow the transactions made by profitable traders. eToro also offers a highly diversified selection of financial assets, including equities, cryptocurrencies, indices, commodities, and more.

eToro established in early 2007, with a mission to make trading accessible to anyone, anywhere, and reduce dependency on traditional financial institutions. The company has head offices in the United Kingdom, Cyprus, USA, and Australia.

eToro (Europe) Ltd operates as a Financial Services Company authorized and regulated by the Cyprus Securities Exchange Commission (CySEC) under license no. #109/10. Meanwhile, eToro (UK) Ltd is authorized and regulated by the Financial Conduct Authority (FCA) under the license FRN 583263.

As for eToro AUS Capital Pty Ltd, the legal standing is acknowledged by the Australian Securities and Investments Commission (ASIC) to provide financial services under Australian Financial Services License 491139.

A broker that belongs to the 4-digit type, eToro offers both short-term options for day traders and long-term options for investors, such as their innovative Smart Portfolios, a fully managed thematic portfolio.

Since 2007, eToro has been at the forefront of the Fintech revolution. The most recent was launched in 2017, which is Smart Portfolios powered by Machine learning Al. Beyond developing Smart Portfolios, the company integrated Microsoft's machine learning technology into Momentum DD.

The new Smart Portfolios investment strategy uses artificial intelligence to find the steadiest traders who are most likely to generate a double-digit return and bundle traders into one fully-managed portfolio. eToro has hundreds of financial assets for trading across several categories including stocks, commodities, crypto assets, currencies, indices, and ETFs. Each asset class has characteristics and can be traded using a variety of investment strategies.

Some positions on eToro involve ownership of underlying assets, such as non-leveraged positions on stocks and cryptos. Employing CFDs will enable a variety of options, such as leveraged trades, short (sell) positions, fractional ownership, and more. For example, traders can invest as little as USD100 in gold, even if a single unit of gold cost USD1,000. Some of eToro's most popular CFD commodities include gold, oil, natural gas, silver, and platinum.

Currencies are traded on eToro only as CFDs. Also, CFDs enable Sell (short) positions and leveraged trade, even for assets that don't offer the option in traditional trading. Some of the popular currencies include EUR/USD, GBP/USD, AUD/USD, USD/JPY, and USD/CAD.

Furthermore, An Exchange-Traded Fund (ETF) is a financial instrument comprising several assets grouped to serve as one tradable fund. After opening an account in eToro, traders can invest as little as USD250 in an ETF that costs USD500. Some of the popular ETFs on eToro include SPY, VXXB, TLT, and HMMJ.

However, eToro also offers additional functions using CFD trading. All leveraged ETF positions in the UK are under FCA regulations. Meanwhile, all CFD positions executed by eToro Australia are under ASIC regulations.

The company has other advantages. In all financial assets that can be traded, eToro does not charge any deposit or trading frees other than spreads.

eToro charges a USD25 fee for withdrawals and the minimum withdrawal amount is USD50. Long (Buy), non-leveraged crypto, stock, and ETF positions are not executed as CFDs and do not incur any fees. eToro does charge overnight or weekend fees for CFDs positions, such as leveraged positions and short (sell) orders.

Fee updates always apply to open positions. Fees are subject to change at any given time and could change daily, without prior notice, depending on market conditions.

As a beginner, trader can use CopyTrading eToro. Different from the features of other brokers, traders can copy the strategies of professional traders without fee or profit-sharing. Therefore, 100% profit is fully owned by traders. For example, while trader A who is copied by trader B, produces a profit of 10% this month, then trader B also gets a profit of 10%.

The company is the world's leading social trading network. Since eToro operates in complete transparency, each trader has valuable information on their eToro profiles, so other traders that are interested to copy their trades can have assistance in creating their best portfolios.

Another feature that is unique to eToro is the personalized, social News Feed. Just like on any social media, traders can post their updates on feed, comment on other's posts, and gradually create a feed that is tailor-fitted to trader's trading and investing interests. On eToro social trading platform, traders will also get notifications when a trader writes a new post and many other important updates.

2. MT4 Signals

Metatrader4 (MT4) is the most widely used trading platform in the world for many reasons, including the existence of an integrated trader forum and a signal marketplace. As such, MT4 Signals provides access to thousands of strategies and signals from expert traders.

MT4 users can subscribe to any signal provider by selecting them in the MetaTrader Signals tab; all trades done by the provider will then be automatically copied to the account. MT4 Signals is available at almost all Metatrader-supported forex brokers, including FXPro, Pepperstone, and many others.

3. ZuluTrade

ZuluTrade is the trading platform with the biggest user base in the last few years. It lets users observe and replicate the moves of seasoned traders from various affiliated brokers at once. It also gives users access to a large range of tools for evaluating their risk and performance profiles.

ZuluTrade itself currently does not have any licenses from the FCA, but it is regulated within the EU. To connect with ZuluTrade's huge network, traders can first register with affiliated brokers such as AvaTrade, Tickmill, and so on.

Successful UK Social Traders

Is social trading profitable? We can get the answer by observing longtime social traders on popular platforms. Here are several UK social traders with prominent results on eToro.

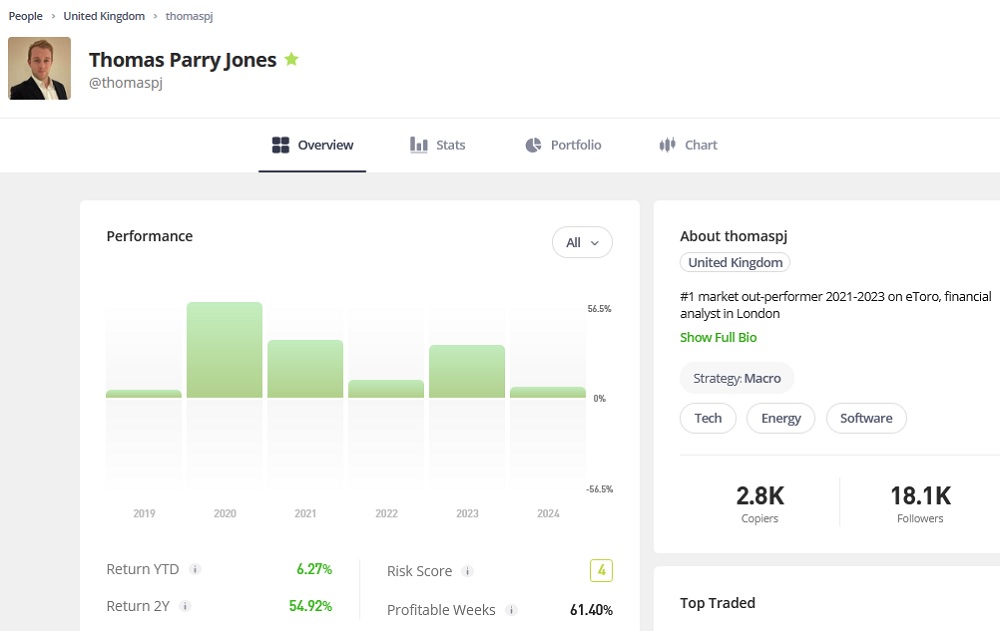

Thomas Parry Jones is the top market outperformer on eToro in 2021–2023. His 2Y returns were 54.92%, while his YTD returns (per January 30, 2024) reached 6.9%.

Jones applies a mixed strategy to find stocks with solid fundamentals for long-term profits and swing trading. Positions are held for weeks or months with the purpose of outperforming major indices. As such, he suggested his followers copy for at least six months, with a minimum higher than $400.

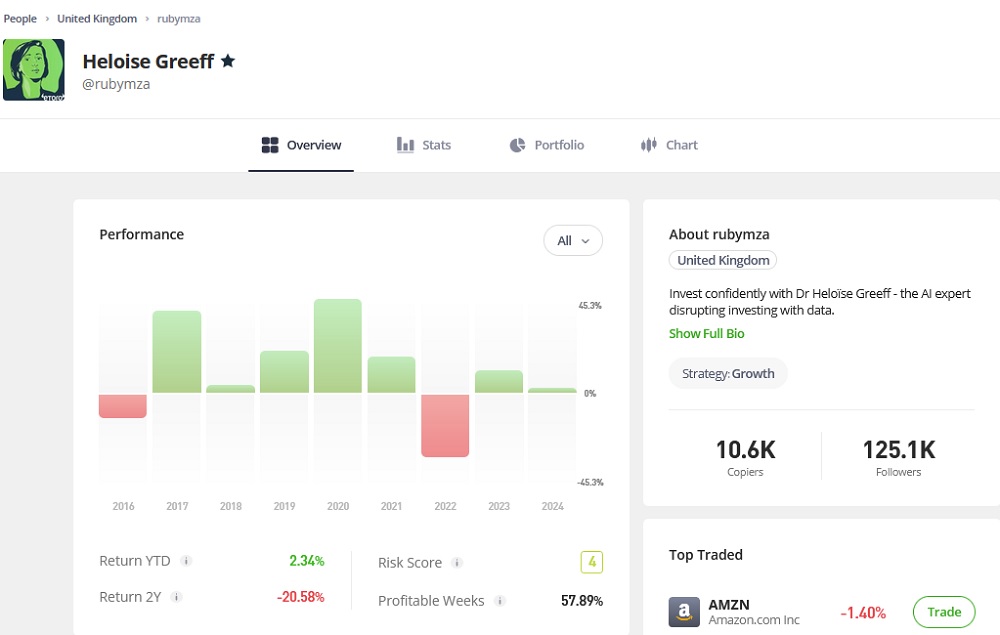

Heloïse Greeff dubbed herself an investor and AI expert. She has one of the most-copied portfolios on eToro. Her profile has been featured on Forbes, Bloomberg, and many others.

Greeff's 2Y return currently is -20.58%, but this is not surprising because she is a long-term equity investor. She combined fundamentals, data-driven methodologies, and sophisticated algorithms to find global equities with promising 5- to 10-year growth. She suggested followers copy with a minimum of $1000 for more than 5 years.

So, are you interested in emulating their results? Register yourself on any legitimate social trading platform and copy the pros!

If you happen to choose eToro as your social trading platform, there are certain methods to choose the best traders to follow. Find out all about it in 10 Ways to Find the Best eToro Trader.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance