BDSwiss offers a wide range of payment methods so traders can choose whatever method suits their needs. Find out the full BDSwiss deposit and withdrawal guide in this article.

Aside from trading strategy, every trader also needs to learn about fund management. This includes understanding how to deposit and withdraw from your trading account. Being able to manage your capital effectively will be a huge advantage to your overall portfolio, especially if you have several different accounts.

Your choice of broker can also determine your success. BDSwiss is a good example of a broker that offers easy deposit and withdrawal. To ensure their client's satisfaction, the broker works closely with a number of trusted service providers in providing a wide range of payment methods suitable for all traders.

| 💳Payment Method | ⏳Processing Time | 💸Fees | 💲Currencies |

| Bank Wire Transfer | 1-5 days | $0 | EUR, USD, GBP, PLN, CHF, SEK, DKK, NOK |

| VISA | Instant | $0 | EUR, GBP, USD |

| MasterCard | Instant | $0 | EUR, GBP, USD |

| Skrill | Instant | $0 | EUR, GBP, USD |

| Neteller | Instant | $0 | EUR, GBP, USD |

| AstroPay | Instant | $0 | EUR, CAD, BRL, COP, MXN, RMB, BOB, CNY, GBP, USD, PEN, INR, AED, CLP, PYG, JPY, SAR, THB, RUB, ARS, SEK, VND, NGN, MYR, ZAR, UYU, KES, IDR, GHS, TWD, AUD |

| Cryptocurrency | Instant | Network fees | BTC, BCH, ETH, PAX, TUSD, USDT, USDC, LTC, XRP, DASH, ZCASH, ADA |

All deposit and withdrawal fees are covered by BDSwiss, so you can sit back and enjoy seamless transactions without extra costs. Just keep in mind that you may still be charged additional fees by your bank or payment provider.

How to Make a Deposit in BDSwiss

Making a deposit in BDSwiss is very easy and straightforward. You can immediately begin the process right after creating a live account. There are several account types available on the platform. Check here for each account description.

- Cent Account: Suitable for beginner traders who want to trade in real markets but are still not ready to invest a huge amount. You can trade in Cents and enjoy trading with lower risks.

- Classic Account: The default account for traders with any expertise level. With this account, you can trade 250+ trading instruments with zero commission and spreads starting from 1.3 pips.

- VIP Account: Offers a professional trading environment with a set of advanced tools and exclusive services. Get your personal manager and real-time alerts in this account.

- Raw Account: Allow clients to trade with low spreads starting from 0 pips. In exchange, there's a commission of $6 per round lot.

To make a deposit, you can either use your PC or mobile phone app. Don't worry though, the steps in both devices are generally the same. Here is the tutorial.

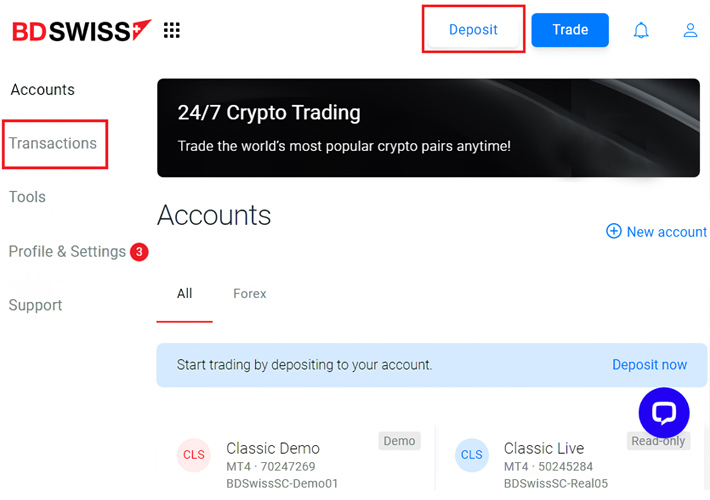

- Open BDSwiss' official website or mobile app, then login to your account.

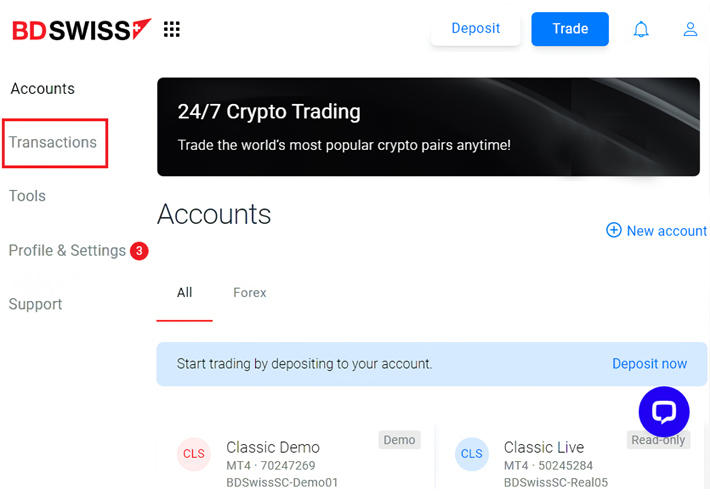

- Click "Transactions" on the left-side menu. For quick access, you can also click "Deposit" on your dashboard.

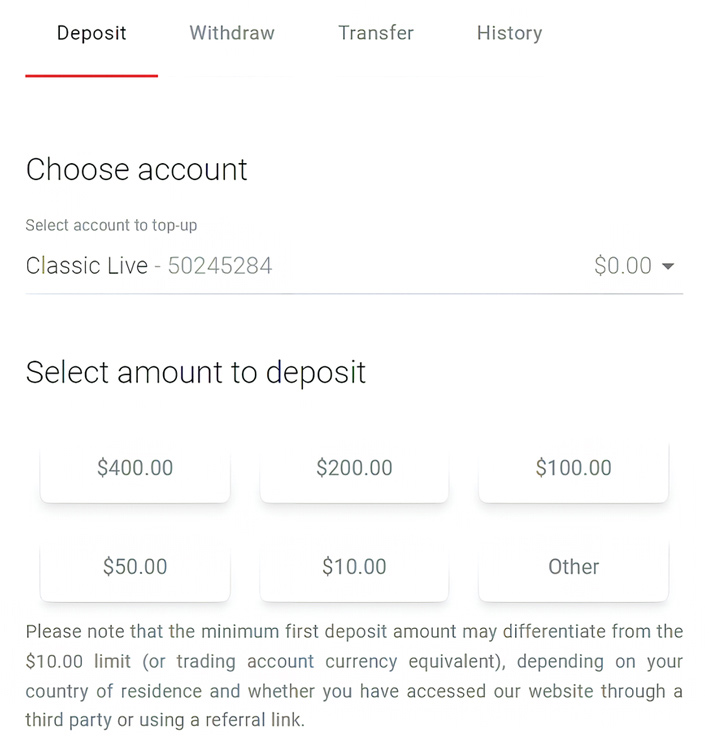

- Choose the account that you'd like to deposit into, then enter the deposit amount.

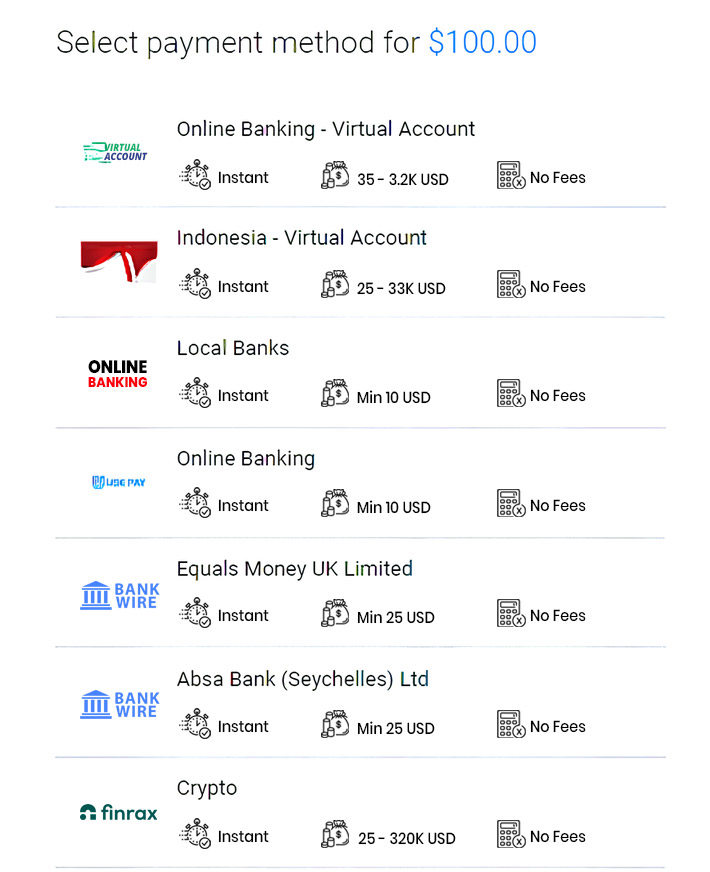

- Select your preferred payment method. Make sure to consider the processing time, minimum deposit, and fees.

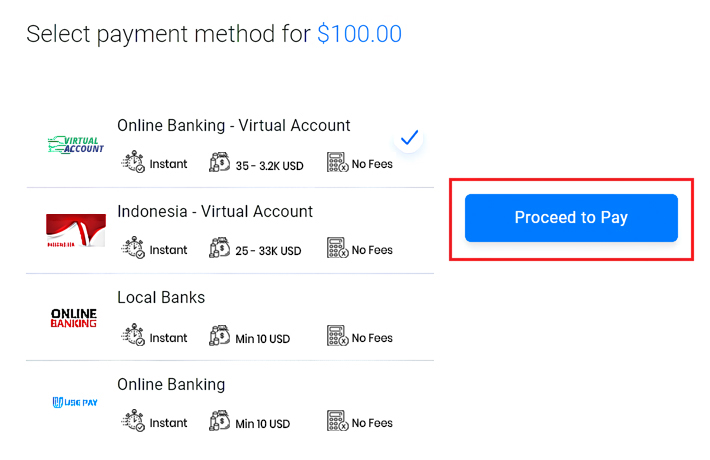

- Click "Proceed to Pay" to continue to the next step.

- Confirm your deposit details on the next page and finish the transaction.

How to Withdraw from BDSwiss

Before making any BDSwiss withdrawal, please read these terms and conditions:

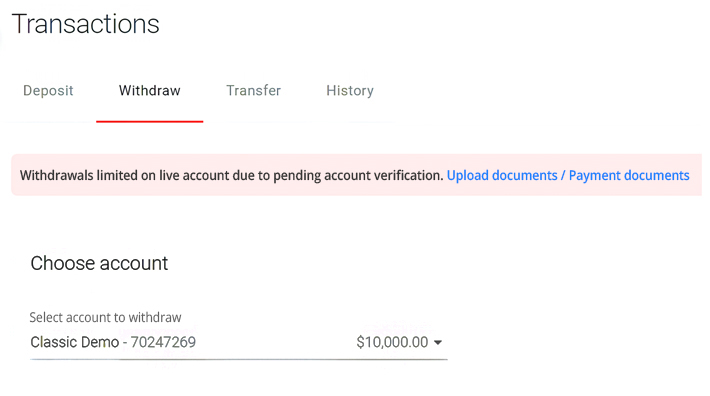

- Withdrawal is only available to verified clients — those who have completed the appropriate KYC procedure on the platform.

- Withdrawals must be made using the same method as deposits.

- All withdrawal requests will be processed within 24 hours, but it might take longer for the funds to reflect in your account.

- You may withdraw the profits you earned using the available methods. If your credit card supports OCT, you can withdraw amounts that exceed the sum of your previous deposits.

To start withdrawing funds from your BDSwiss account, here are the steps:

- On your Client Portal, click "Transactions" and enter the Withdrawal page.

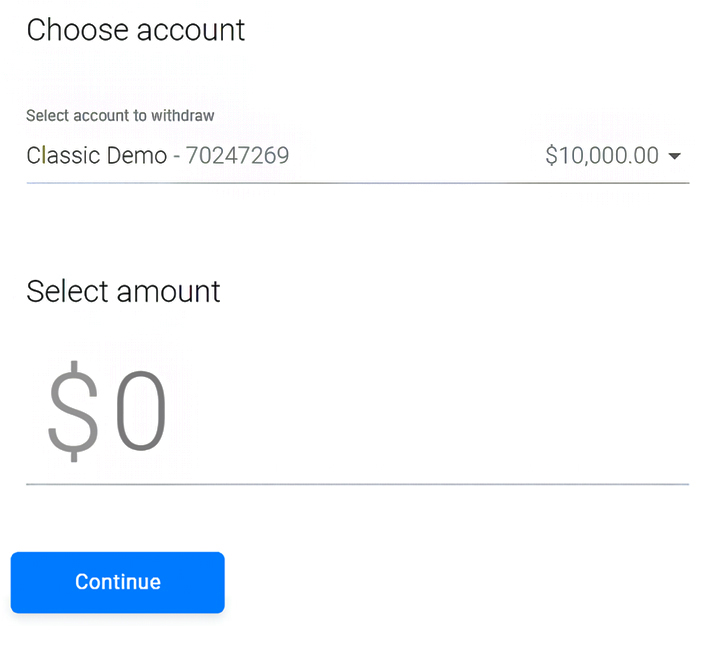

- Select the account that you'd like to withdraw from, then specify the withdrawal amount. Make sure you have sufficient funds for the withdrawal.

- Choose the payment method of your choice and don't forget to enter your bank account or card account details.

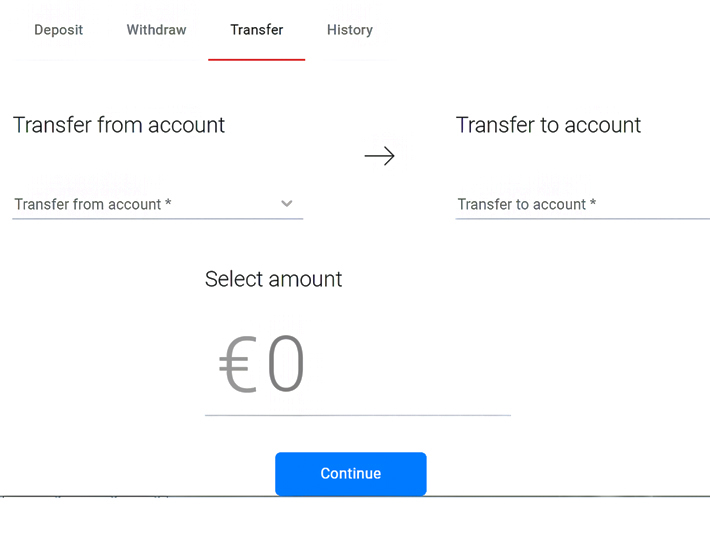

- Alternatively, you can also withdraw to another of your trading account rather than an external bank account. Simply open the "Internal Transfer" page and fill in the details.

The Bottom Line

When choosing a broker, it is important to consider the ease of deposit and withdrawal as it can heavily affect your daily trading activities. For instance, if you keep having trouble depositing, you could lose a lot of valuable opportunities in the markets. You should also be able to transfer between accounts seamlessly so that all trades can run smoothly.

Thankfully, deposit and withdrawal in BDSwiss is very straightforward. It's even available on the broker's online trading app, which can be installed on your phone. On top of that, you don't need to worry about extra costs as the broker covers both deposit and withdrawal fees.

BDSwiss is one of the top brokers established in 2012 that has served no less than one million clients from 180+ countries. It offers various trading services, starting from diverse tradable instruments, trading tools, account types, and educational content. Not only that, the broker also offers fast account opening and reliable 24/5 customer support for all clients.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance