Moving Average is one of the most useful indicators for scalping. How to apply it in a strategy? This article reveals how the 34 EMA can be utilized for a scalping strategy

Scalpers like to take advantage of small market movements or in other words, seek to profit from short-term opportunities that occur every day on the market. In order to support such strategy, scalpers need some specific tools that can be applied in small time frames.

One of the most popular indicators for scalping strategy is Moving Average (MA). Using moving averages can help scalpers focus on particular spots to trade. In this case, the Moving Average type that we're going to use is the Exponential Moving Average (EMA) because it is designed to respond quickly to price changes.

The Setups

Essentially, there's a wide choice of forex Moving Average strategy that you can use, but not all of them are particularly helpful for scalping. Today, we're using 34 EMA as part of a breakout trading strategy, which is suitable for scalping because it can point the direction of the trend. If you combine it with trend lines, you are going to be able to enter trades based on counter-trend opportunities.

See Also:

Indicator Used

- 34 Period-EMA

- Trend lines

Time Frames for Scalping

- One minute

- Five minutes

- Fifteen minutes

Currency Pairs for Scalping

Generally, you are free to use any currency pair you like. However, scalpers need currency pairs with strong movements in order to earn enough profit during the short time their trades last. To make sure of it, choose the pairs with decent Average True Range (ATR) measurements.

Although slower moving currency pairs will also get their own momentum at some point, it's still safer to stick with the more commonly traded pairs such as:

- EUR/USD

- GBP/USD

- EUR/JPY

- GBP/JPY

How to Use Forex Moving Average Strategy for Scalping

After setting up the indicators, time frames, and currency pairs of your choosing, make sure that all of the conditions below met to open to start scalping:

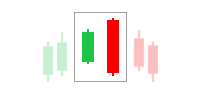

1. Rules for a Buy Position

- Check if the market is in a downtrend as shown by the 34 EMA.

- The price breaks above the 34 EMA line.

- The price also breaks above the downward trend line.

- Search for a bullish candlestick or chart pattern.

Based on the illustration above, there are several key points to analyze:

- The 34 EMA is showing that the market is in a downtrend.

- The trend line (inner trend line) contains the price for a while.

- The price suddenly breaks above the trend line and then breaks above the 34 EMA line.

- Afterward, a change of direction is confirmed by a series of higher highs.

See Also:

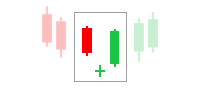

2. Rules for a Sell Position

- Search for the 34 EMA to show that the market is in an uptrend.

- Wait until the price breaks below the upwards trend line.

- Price breaks below the 34 EMA line.

- Search for a bearish candlestick or chart pattern.

Take a look at the chart above. If you compare it to the previous example, this one is a bit less perfect because the price pulls back across 34 EMA shortly after breaking down. The following are the key points:

- With the 34 EMA moves below the price, it shows that the price is in an uptrend.

- Price has broken the EMA first and then push below the trend line.

- Bearish reversal is confirmed by a series of lower lows formed following the break.

3. Spotting the Stop Loss Level

The 34 EMA breakout candlesticks low can be used to determine where to put stop loss in a buy position, while the high of a breakout candlestick is ideal for a stop loss target in a bearish position. You can also use the previous pivot highs to take profit.

The Bottom Line

Based on the explanation above, we can see that the forex Moving Average strategy can be useful for scalping as long as you know how to use it correctly. There are various methods that you can choose, but using 34 EMA is one of the easiest ones.

In a nutshell, the most important thing to remember in this strategy is consistency. Whatever you do, you must be able to stay focus and draw your trend lines in a consistent manner. Before trading, always make sure that you already prepared a proper trading strategy and really use it as the basis for your trades. This way, you can save yourself from emotional trading that potentially leads to losses and higher risks.

When using the forex Moving Average strategy, scalpers should also consider a few other things such as exit points, what candlestick patterns to use, and how much risk they can afford.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance

2 Comments

Arhan

Jan 29 2024

Thanks for the info! Now I have an idea of the currency pairs suitable for scalping, as suggested in the article:

Since I'm a beginner with limited capital, it seems challenging to trade more than one pair simultaneously. Opening positions for both EUR/USD and GBP/JPY, for instance, would require more capital, right? So, I'm thinking of starting with just one pair. Among the four mentioned, which one would be a good choice for me to begin scalping as a beginner?

Ospina

Jan 31 2024