The way you set an order could determine the fate of your trades. In that case, Exness has market and pending orders as well as Market and Instant Executions.

During order execution, a buy or sell position may be accepted or completed in favor of the client. However, there is a number of order execution types with different mechanisms and purposes to elevate one's trading experience. In relation to it, Exness accounts provide several order types.

By and large, Exness account types offer two standard order types, namely the market order and the pending order, that are applied to all Standard and Professional ones. There's also an addition of 2 order execution types: Market and Instant Executions.

In relation to market and pending orders, the earlier is brought into execution once activated, provided that Buy and Sell as the primary orders have been made completely part of it. 'Buy' refers to a buy order, which opens with the Ask price and closes at the Bid price, whereas 'Sell' refers to a sell order which opens with the Bid price and closes at the Ask price. The latter aims to set conditions for automatic execution of orders.

Meanwhile, pending orders facilitate a condition where you can set a position now to be executed later. Once you arrive at a certain price or level, the order will be activated automatically. Pending orders can include but are not limited to:

- Buy Limit, i.e. setting a buy price at a lower rate than that of the current ask price.

- Sell Limit, i.e. setting a sell price at a higher rate than that of the current bid price.

- Take Profit, i.e. closing the order, immediately after reaching the user-set level of profit.

- Buy Stop, i.e. setting a buy price at a higher level than that of the current ask price, as well as executing the order, once arriving at that price.

- Sell Stop, i.e. setting a sell price at a lower level than that of the current bid price, as well as executing the order, once arriving at that price;

- Stop Loss, i.e. closing the order, once arriving at the user-set level of loss.

- Buy Stop Limit (limited to MT5)- The combination of Buy Stop and Buy Limit.

- Sell Stop Limit (limited to MT5) – The combination of Sell Stop and Sell Limit.

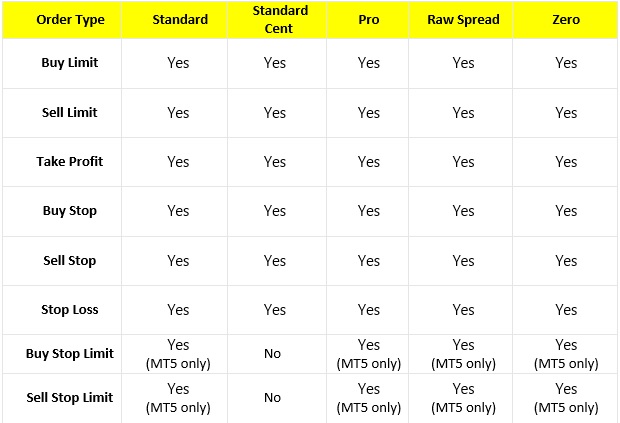

Exness account types may not provide all order types at the same time. Here's a table explaining how Exness divides their order execution types in each account:

What Are Types of Order Executions in Exness?

Exness provides 2 types of order execution, namely Market Execution and Instant Execution. With slight differences, each order execution brings different benefits and features:

The choice of broker is adjusted to the needs of each trader. If you are a trader who only needs a basic platform and trading features with the best attributes, then Exness can be your best choice.

Exness covers its lack of feature variations with other advantages like low spreads starting from only 0.1 pip. This is very suitable for traders who use scalping strategies (Scalper). Spreads on major pairs in certain account types can also be as low as 0.0 pip, depending on market conditions.

Not only that, but traders can also enjoy other advantages such as automatic fund withdrawals. Exness processes the majority of client withdrawals instantly, without manual checks; however, withdrawals may be subject tos depending on the payment provider or method of choice.

The safety of traders' funds is also guaranteed as Exness is one of the European-based STP/ECN brokers. Exness's ability to become an official partner of the Real Madrid soccer team for 3 years, starting July 2017, also provides evidence that the company has high solidity.

Deposits and withdrawals may be made 24 hours a day, 7 days a week. However, it is important to note that the company shall not be liable fors in processing deposits and withdrawals if suchs are caused by the payment system.

Traders do not need to worry about transaction fees when depositing and withdrawing. Exness doesn't charge any transaction fees to traders even though some charges may be incurred depending on the payment provider of choice. A variety of payment methods are provided for traders, including Wire Transfer, Bank Card, Neteller, Skrill, and many others.

The financial reports and metrics on the Exness website are audited quarterly by Deloitte, one of the four largest public accounting firms globally.

Moreover, Exness is one of the mote transparent brokers in the online trading industry. Traders can find out all information about this company on the website, such as trading volume, number of active clients, client deposits, company funds, and many more.

The platforms provided by Exness vary in MetaTrader 4, MetaTrader 5, Web, and Mobile platforms. This makes it easy for traders when trading on Exness, as they can also access Exness platforms anywhere and anytime.

Over the years, Exness has developed into a broker that attracts traders. Trader's trust is further enhanced by its compliance with financial regulations like the FCA and CySEC.

One measure of client confidence can be put on the trading volume. By December 2018, their clients' monthly trading volume reached USD348.4 billion and active traders around the world surpassed 50,342.

Through the program offered by Exness, traders also have the opportunity to earn extra income by becoming their partners. From the Introducing Broker (IB) program, partners can earn up to 33% spread commission from every new client that registers with them.

Additional income can also be obtained from Exness Partners. Traders can get a spread commission of up to 25% per transaction made by traders who register through an affiliate link.

When trading with Exness, clients can also make use of its free VPS hosting services. A VPS (Virtual Private Server) offers increased reliability and stability for traders as they can maintain their trades and expert advisors without interruption in the event of unexpected technical issues, such as internet or electricity downtime.

From the review above, it can be concluded that Exness is a favorite broker for traders because of low spreads and flexible account types. This condition is very suitable for traders with limited funds but is in need of more opportunities to get maximum profit. This broker is also well known for its maximum support on both new and existing partners.

Instant Execution

Instant Execution refers to a method where brokers execute orders at prices requested by the trader, or else, zero orders. The following terms commonly occur in Instant Execution:

- Requote

A requote may result from the clash between the order and price requested by the trader due to the constantly changing price. Thereby, traders are informed about their requested price, which is no longer available. Responding to this, they are prompted to accept or reject the new price. Their acceptance will activate the new price, while rejection or failure to answer the requote will end with the entire order cancelation. - Deviation

Automatic order setting is also available should traders prefer automatic order execution when a certain range or deviation takes place, regarding the price requested. Should a price change due to the trader's setting, order execution is to be made on a price correction. When the price exceeds the deviation, a requote will be provided for the trader where options to accept, reject or ignore it are available, coming with the identic previous outcome.

Here is an example. A trader may request a price on 1 lot of GBPUSD at 1.30442, with a deviation set to 0.5. Should the price change to 1.80442 or 0.80442, such an order will automatically be executed at 1.80442 or 0.80442. However, when the higher price is, for example, 1.80443 or the lower price is, 0.80441, a requote will occur.

Market Execution

Market execution refers to a method where traders execute orders at the current price, within fractions of a second during the order processing. Such prices may either be lower or higher than that seen by traders in the terminal window, along with constantly changing prices.

Market Execution and Instant Execution are separated by a strong line, in which requotes are not to occur with the earlier. Still, be aware that during a period of market volatility, you are at a higher risk since a strong price fluctuation may take place shortly.

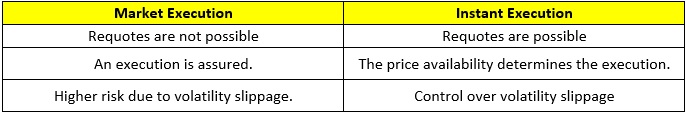

The following table will compare the two types of order execution:

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance

36 Comments

Enoch Mccurdy

Oct 22 2021

I thought instant execution was faster, but how come requotes still happen? How comes the market execution is safer from requotes? I have a hard time understanding these two. Most brokers I trade with always offer Market Executions. So I was under the impression that this is the slower method. Was I wrong?

Rendy

Feb 19 2023

Enoch Mccurdy: I know your frustration. There are two factors that explain why quotes always happen. From the market itself or from your brokers, it is not as fast as expected.

Market execution is like an "now" bid order. It is not instant if your broker can't afford it. But just in case, if you are dealing with a highly volatile or volatile market, re-quotes may be more happen. This is because prices can move so fast that the forex market server can become too slow for a period of time.

So basically, requotes often happen in Forex, especially during an economic event or market opening that causes the Forex market to fluctuate at a very high level. But in very few cases if it happens in a sideways market. And if happen in the sideway situation, it 100% your broker lie about the fastest execution.

Jason

Feb 27 2023

Rendy: Sorry to say this, but I think you misunderstood about the Instant execution and Market Execution. I will explain in the list :

Instant execution allows traders to enter trades at the price shown on their trading platform. When a trader clicks the buy or sell button, the trade is executed at the exact price displayed on the platform.

Market execution, on the other hand, executes trades at the best available price in the market at the time the order is received. This means that the price at which the order is executed may be different from the price initially shown on the platform

In terms of speed,

instant execution is generally faster than market execution because it executes trades immediately at the displayed price. However, instant execution is more prone to slippage, which occurs when the execution price is different from the intended price due to market movements or order processings.

Market execution may take a few seconds or more to execute, depending on market conditions and liquidity. However, it is less prone to slippage and ensures that trades are executed at the best available price in the market.

I believe It will answer the question about why Instant Execution is faster but still can requote.

Mendy

Feb 19 2023

Enoch Mccurdy: Man, I think instant execution has a meaning like this:

where brokers execute orders at the price requested by the trader, or alternatively, zero orders. This means that you, as a trader, set the price you want at a certain level and the broker executes it when the price reaches the price you set. So because of this, the order was sent to the market by the broker at that time. And due to a slower process, quotes may arrive.

Whereas, market execution is the execution of the order you want at that moment with a single click. So most brokers will have default settings with market execution instead of instant execution.

Kamala

Feb 10 2023

Thanks for the insight. I'm a newbie on forex market and not really understand how the order works. I trade through my cellphone, manually input the lot and value, then I'll just wait. I'm wondering what happens if my order is not executed? Is it gonna kept until next day? Or gonna automatically closed?

Tora

Feb 13 2023

Kamala: What do you mean by order not executed? In both cases, the actual execution has instant execution with little difference. Market execution is also instant execution with a of a few seconds after the buy or sell button is pressed while instant execution is an order executed when you press the buy or sell button.

In the meantime, if you say something about pending order, the condition can happen as you said. So, you set the price you want and just press the buy/sell button, then you will have to wait for the market level to reach your pending order level and it will be executed automatically. BUT you have to watch the timeout, because you can't keep the setting for 10 minutes. In other words, if your pending order does not touch the market price in 10 minutes, it will be automatically cancelled.

Stan

Feb 27 2023

Tora: You are half right and half wrong. Yes, pending orders can be canceled due to time limit. But it is wrong to say that all pending orders have same time limit. In other word, you can setting the pending order level and if you dont set the time limit, the trading platform will automatically set 10 minutes time limit. Several conditions can occur until your pending order reach the price you want:

If you manually cancel a pending order, it will be removed from the market and will not be executed.

Pending orders have an expiration time, usually placed by the trader when placing an order. If the order has not been executed before the expiry time, it will be automatically canceled by the trading platform.

If the market finally reaches the price of your pending order, the order will be executed automatically.

Thank you!

Giovanni

Feb 19 2023

Okay, both executions are provided by Exness. And whether it's in the market or instant execution, everything has its own purpose in trading and I'm a bit curious what kind of broker Exness has. It is STP type or ECN type. Because I think the order matching provided in Exness is really complete and also from the article, market execution can execute faster. And because of this, I am thinking of STP or ECN broker. You can also choose to use market execution or instant execution.

What about trading conditions set forth by Exness in trading. And what leverage is offered by Exness? And the account I can choose in Exness

THANK!

Agus

Feb 19 2023

Giovanni: I can said, the Exness is a STP brokers although it offer Raw spread but they are not evem say they are ECN Broker. It means, the execution will be guarantee fast. And I think, all the STP Broekers will have both market and instant execution.

Trading condition that offered in Exness is different based on what account that you can choose. There is total 5 accounts that you can choose : standard, Raw Spread, Pro, standard cent, and Zero.

The leverage is maximum to 1:2000 with minimum deposit $1 for standard cent and standard. Meanwhile Raw spread, Zero and Pro at $200

It is better to read all the condition more complete at this article : Exness Review

Luinto

Feb 19 2023

Agus: Man, I read about the details of Exness and found that the raw spread is actually a fixed spread. Don't get me wrong, I think Exness is half STP broker and half market maker. For what? Because only the type of market maker offers fixed spreads and in this case RAW spreads are offered.

You know, RAW SPread is the actual spread that occurs in the forex market. So in other words, the spread can be high or low depending on the forex market. There can be no fixed spreads in forex trading, especially RAW spreads. But for other accounts, such as standard accounts, floating spreads are used, which is very similar to the broker's STP.

Correct me if I'm wrong

Dest

Feb 27 2023

Luinto: You can be right about that! I mean, a forex broker that offers Raw Fixed Spreads may can be a market maker broker because Market maker brokers typically provide fixed spreads that are higher than raw spreads to cover their costs and generate profits.

You need to noted that Raw Spreads is not same with ECN RAW Spread. So in some case, the brokers can have fixed spread that also low since they are market makers that can provide more lower spread than STP Brokers.

Therefore, it's important to investigate a broker's business model and regulatory status to determine whether they are a market maker or an ECN/STP broker that provides true Raw Spreads.

Udin

Feb 27 2023

A little bit off topic. I have read about Exness trading conditions in the broker reviews section of this website. I find that Exness actually offers some really weird but interesting insights that give high leverage up to 1:2000 and with a very low minimum deposit of 1$. Moreover, the trading volume can be opened at a minimum of 0.01 lots, which is great for beginners.

The problem is that sometimes many traders and professional traders have stated that high leverage can be dangerous for new traders. What does this mean, and what is the best leverage? ?

Sarah

Feb 27 2023

Udin: As beginner traders often lack experience, discipline and risk management skills, this can leave them vulnerable to making impulsive and emotional trading decisions that can lead to losses. High leverage can exacerbate the impact of these mistakes and quickly lose an account.

For example, with 1:100 leverage, a trader can control a $100,000 position with a margin of $1,000. If the trade goes in their favor, they can make a significant profit, but if the trade goes against them, they can lose their entire account or more.

The best leverage for a beginner trader depends on their risk tolerance, trading strategy and financial situation. In general, a conservative approach is recommended, and the leverage ratio is 1:10 to 1:50. But for me, I think the leverage ratio 1:100 up to 1:500 is still acceptable, with note : the deposit needs to be at $100. This allows them to trade with smaller capital, while still having enough margin to cover potential losses and avoid margin calls. I decide my leverage with this article: How to decide the best leverage forex for beginner

Nonce Ti

Apr 5 2023

I've just learned forex trading in some few weeks ago. I noticed that most of the time I got panicked when price moves in opposite direction. I don't know how much loss I should tank before I cut loss.

So in order to improve my trading, I'd like to learn what are some common mistakes that novice traders make when it comes to order execution, and how can they avoid these pitfalls to maximize their profitability and minimize their risks?

Dakkar Hammish Boy

Apr 5 2023

In the past few years I've been trading with different brokers, I'd say Exness is one of the best for retail traders. Their low fee and spread rate are unmatched and their trading instrument are abundant. The only problem was, I still couldn't figure out how to make profit consistently. On some ocassion, I can make large sums of profits, but unfortunately, it was all gone cuz I forgot to cut loss on some other positions.

eventhou I've traded for quite some time, I'm still pretty weak at managing risk and planning trading strats. So, I'd like to know how can traders determine which order execution type is best suited for their trading strategy and risk appetite, and what factors should they consider when making this decision?

Harrison

Apr 30 2023

Actually, I'm still new to the world of trading, and yes, I rarely hear about brokers that provide trading instruments and platforms. You must be familiar with FBS and OctaFx which always appear in several advertisements on chrome and YouTube. while For the Exness broker, to be honest I have never heard of this broker.

And yes, I just found out about this in this article, and yes,, it seems that this broker is quite good and the service is quite instant. As already explained, this broker has only been established since 2003, but I can't say for sure whether this broker is good and safe. I asked my friends, is the Exness broker safe for my trading and funds? Is my personal data also safe here? If anyone knows, could you please explain...

Yolanda

Apr 30 2023

@Harrison:

I have been opening accounts with Exness for about 5 years and I have experienced the advantages and disadvantages of Exness. I really like the system and service at this broker, so I feel comfortable keeping my money here. Exness is regulated by several second-tier authorities including the CySEC of Cyprus and the FSCA of South Africa.

I still consider Exness a safe broker to trade with. Firstly, this broker holds licenses from a number of regulators around the world. Second, this broker provides all clients with negative balance protection, which means that traders cannot lose more than their initial deposit. Lastly, this broker is regularly audited by Deloitte, one of the most reputable auditing firms in the world.

In addition, this Broker also provides users with access to advanced trading tools and services, such as technical analysis and charting capabilities. Apart from that, this broker also offers excellent customer service, which ensures that any questions or concerns are resolved quickly. One of the biggest advantages of this broker is the low trading fees. This means that users can maximize their profits by using lower spreads and leverage.

Tabitha

Apr 30 2023

@Harrison: Exness is an international, regulated multi-asset broker operating since 2008 offering global trading in stocks, foreign currencies, metals, commodities, cryptocurrencies and energies. This broker is registered under the name Exness (Cy) Ltd and is officially regulated by CySEC. CySEC is the supervisory and regulatory authority for investment services companies in Cyprus. CySEC is also a member of the European Securities and Markets Authority (ESMA).

This international broker is known as a user-friendly platform and has a high level of transparency. Customer service support is available 24/5 and is available in 13 languages, including Indonesian.

This broker has over 300,000 users and trading volume exceeds $2.4 trillion. With a capital of $ 10, everyone can trade on this platform. These brokers also segregate customer funds from company accounts and store them securely in segregated trust accounts overseen by CySEC. This is to ensure that client funds will not be taken away and not used for the company's operational activities. So, this platform can be said to be a safe broker.

Sandy

May 4 2023

Wait, I am little bit confuse about the 4 execution orders that I can choose. In the article, the author mentioned that Exness has market order and pending order. And then there are 2 additional execution order which are Market and Instant Execution. IT also explained that pending order means you can executed the order at the level that you want and market order is the order in that time. Meanwhile the market execution means you can order at the current price and instant execution that you can request what price that you want.

SO, I focus on instant order and pending order. It looks very similar but what makes them different?

Victor

May 5 2023

In trading, the main difference between instant order and pending order lies in the timing of the execution. With an instant order, the trade is executed immediately at the current market price. This means that you get in and out of the trade quickly, but you may not always get the exact price you want.

On the other hand, a pending order allows you to set a specific price at which you want to enter or exit a trade. This means that you can set a buy or sell order at a certain price level, and the trade will be executed automatically when the market reaches that level. This can be useful when you want to enter a trade at a specific price or exit a trade to limit your losses or take profits.

Enzo

May 6 2023

let me give you an example of how instant and pending orders work:

Let's say you want to buy a currency pair at a certain price, but the current market price is not at the level you want. Here's how the two orders would work in this situation:

Instant order: You can request to buy the currency pair at the exact price you want, regardless of the current market price. If the price reaches the level you set, the order will be executed immediately. For example, if you want to buy EUR/USD at 1.2000 but the current market price is 1.2050, you can set an instant order at 1.2000. If the price drops to that level, your order will be executed instantly.

Pending order: With a pending order, you can set a price level at which you want to buy the currency pair, and the order will be executed automatically if the market price reaches that level. There are three types of pending orders: buy limit, sell limit, and stop orders. For example, if you want to buy EUR/USD at 1.2000 but the current market price is 1.2050, you can set a buy limit order at 1.2000. If the price drops to that level, your order will be executed automatically.

Fendi

May 4 2023

I'm a beginner in forex trading and I've been trying to understand the different execution orders available. In the article, I read about market order, pending order, market execution, and instant execution. I understand that market order and instant execution orders allow me to buy or sell at the current market price, while pending order allows me to execute a trade at a specific price level in the future.

However, I'm still unsure about the advantages of using a pending order over the other types of execution orders. Are there any benefits to using a pending order, such as minimizing risk or capturing profit at a certain level? And is it recommended for beginners to use pending orders, or is it better to stick with market orders and instant execution?

Nandu

May 6 2023

So, to break it down for ya, Exness offers four types of execution orders, including market order, pending order, market execution, and instant execution. Now, let's focus on the instant and pending orders.

Basically, the main difference between the two is the timing of execution. With instant execution, you can buy or sell at the current market price, while with pending orders, you can set an order to buy or sell at a specific price in the future.

Now, there are definitely some advantages to using pending orders. For one, they can help you avoid constantly monitoring the market and placing trades manually. You can set your pending order at the price you want and let the market do the work for you. Plus, it can also help you minimize losses by setting stop-loss and take-profit levels in advance.

As for whether it's good for beginners to use pending orders, it really depends on your trading strategy and risk tolerance. If you're more comfortable with a slower-paced approach and don't want to be glued to your computer screen all day, pending orders could be a great option for you. However, if you prefer a more hands-on approach and want to make trades based on real-time market movements, instant execution might be more your speed

Cabello

Jun 2 2023

In this article there is something that discusses pending orders that interest me. In my opinion, of course all traders often use this type of executing orders. I think that Pending orders are a very good option for traders who still work full time or are generally very busy. You don't have to wait in front of the screen to see price movements. Just set the order and wait for it to be executed.

However, can pending orders be used on the MT4 and MT5 platforms? Pending orders MT4 vs MT5, which is the best? Please reply..

Marsmello

Jun 4 2023

Actually, both MT4 and MT5 can use this feature. However, there are differences between the two platforms: MT4 : Suitable for basic orders such as stop orders and limit orders, whereas, MT5 : Best if you need to adopt a strategy that requires more flexibility in setting pending orders

MT5 by nature offers more advanced features than MT4, from better tools to more technical indicators and pending order types to choose from. Hence, it allows traders to explore more items and diversify their portfolios with various advanced trading techniques.

Maybe to further understand the pending order functions on the two platforms, you can read this.

MT4 vs MT5 Execution: Types of Pending Orders

Victory

Jun 7 2023

There are several advantages when we use pending orders in trading. The advantage when trading using pending orders is that there is no need for a permanent presence in the trading terminal. The disadvantage is that if the levels to enter by pending orders are not set correctly, then they will remain in pending status.

It should be remembered that pending orders set at a price better than the current price (sell above the current market, buy below the current market) are copied to the order glass and also require an appointment.

If you want to open a pending order at a price that is worse than the current price (for you), for example, if the current price is 1000 and you want to buy at 1100 or sell at 900 (if the price reaches this level) your application is not visible in cup price. A gap in pending orders. The gap is the price difference in the quote.

Jimin

Jun 10 2023

So, even though you have to install a separate MT5 account, according to this, it's almost the same as other brokers. and i have no problem because of that. I've actually been interested in trading at Exness for a long time, but it turns out that I just joined Exness this month.

I have tried what you described via PC, it's quite easy to open MT5 in an Exness account. because it's my first time using Exness I'm a bit confused, how do I operate MT5 and start trading? Do you have to use a desktop when trading with MT5?

I'm still a bit confused bro, please explain the part on how to start trading with MT5... thanks in advance...

Marcail

Jun 11 2023

OK, bro, let me help explain again how to start trading with MT5 at Exness. To open a new order, you have three options:

Then click 'Sell by Market' or 'Buy by Market' to open a trade.

You can close the order by double-clicking on the order and clicking "Close Market" or by right-clicking the order and ing "Close Order".

Now let's move on to an example of placing a pending order: a pending buy-order means the order "buy the asset when the price level specified in the order is reached (in the image below you see the action required for this select the" pending "checkbox, set the price that desired in the additional window and click the buy button);

Hirotada

Jun 21 2023

I'm confused about which platform to trade with because, in my opinion, the two platforms have their own charm. the one with advanced and simple interface features, and the MT5 with a wider ion of advanced tools, which makes it more suitable for experienced traders.

Even though I can't be considered a novice trader, the dilemma of choosing these two accounts still occurs. Apart from the same instruments offered, the number of accounts offered is also not much different. and for market execution, it's just as easy and instant, depending on the type of account.

So, is it possible to open an account by ing the platform at the same time (MT4 and MT5)? because it's hard for me to choose.

Camilla

Jun 22 2023

Actually, I was like that at first, which was difficult to choose which platform I should open. Both platforms have their own advantages and disadvantages. MetaTrader 5 is the advanced 5th generation trading platform from goliath trading software, MetaQuotes Software Corp. MetaTrader 4 is a new and improved version of MetaTrader 4 which comes with additional features and tools, such as new order types and customizable time frames.

However, If you open a MetaTrader 4 account, you will not be able to use MetaTrader 5 with your MT4 credentials and vice versa. If you want an account for both MT4 and MT5 you will need to open separate trading accounts for both.

So, in my opinion, in choosing which account is better for you, the trick is that you also have to pay attention to other things if you want to make profits in trading. don't just look at the advantages of each platform, but rather match it to your needs. okay...

Okinawa

Sep 19 2023

What's the deal with that 0.0 pips spread in Exness' Professional account? I mean, how awesome is that? Can you imagine the advantage it gives you as a trader? With such a tight spread, your trading costs are practically non-existent, dude! It means you get to keep more of your hard-earned profits instead of paying hefty spreads. And let's not forget about potential profitability, man. A low spread like that can make a huge difference in maximizing your gains. But hey, does this sweet deal hold up in all market conditions? Like, even when things get crazy volatile or liquidity is low?

Liam T

Sep 21 2023

You got it, my friend! That 0.0 pips spread in Exness' Professional account is definitely something to get excited about. It's like having a trading superpower, allowing you to minimize your trading costs and potentially boost your profitability.

With such a tight spread, you can enter and exit trades more efficiently, which means you get to keep more of your profits in your pocket. It's like getting a discount on every trade you make! And when it comes to maximizing gains, every pip counts. A lower spread can make a significant difference in your overall profitability, especially for traders who frequently execute trades or employ scalping strategies.

Now, let's talk about its reliability in different market conditions. Exness strives to maintain competitive spreads, including the 0.0 pips spread, across various market conditions. However, it's important to note that market volatility and liquidity levels can impact spreads in general. During times of high market volatility or low liquidity, spreads may widen temporarily, affecting all brokers, including Exness. This is a common occurrence in the financial markets, and it's something traders should be mindful of.

Overall, that 0.0 pips spread in Exness' Professional account is indeed a fantastic advantage for traders. It allows you to reduce your trading costs, potentially increase profitability, and take advantage of tight pricing conditions. Just keep in mind that spreads can vary based on market conditions, but Exness strives to provide competitive spreads even in challenging market situations.

Nels

Nov 18 2023

According to the article, we have the option to go for either instant execution or market execution, and it's highlighted that not many brokers provide such a choice. Now, my question, especially considering I'm a beginner: while it might be cool and professional for a broker to offer these options, which execution type is more suitable for someone like me who just wants to keep things simple? I'm looking to dive into live trading without getting into the complexities of setting orders. What would be safer and more beginner-friendly in terms of execution?

Roger

Nov 23 2023

Let me explain to you dude! As a beginner, you might find instant execution to be a more straightforward and user-friendly option. With instant execution, your order is executed at the price you see on the platform. It's a quick and simple way to enter trades without dealing with additional complexities like setting orders.

Market execution, on the other hand, involves executing trades at the current market price. While it provides a real-time execution, it may require setting up orders, which might introduce a bit more complexity for someone just starting out.

So, for a beginner looking to keep it simple and dive into live trading without the fuss of setting orders, instant execution could be a safer and more convenient choice. It allows you to enter trades swiftly at the displayed price, making the trading process more straightforward as you get the hang of things. Hope it can help!

Ferdi

Feb 24 2024

I'm curious to delve into the process by which traders can effectively evaluate and select the most suitable order execution type that aligns with their unique trading strategies and risk appetites. Furthermore, I'm interested in exploring the various factors that should be carefully considered in this decision-making process, as it pertains to optimizing trading outcomes and minimizing potential risks.

Yasin

Feb 28 2024

In my opinion, market execution is like the jack-of-all-trades for traders. It's versatile and tends to suit all types of traders, whether you're a seasoned pro or just starting out. With market execution, you're diving right into the action at the current market price, no fuss, no muss. It's quick, straightforward, and gets the job done, which is why many traders find it convenient. Plus, it works well across different market conditions, whether it's calm waters or stormy seas. Of course, everyone's got their own preferences and strategies, so it's worth exploring other options too. But for me, market execution's simplicity and reliability make it a solid choice for most trading scenarios.