The best trading tools should be reliable, functional, and affordable. If you're a beginner, there are specific tools to accommodate your needs. Where can you find them for free?

Do not underestimate the practicality of the best trading tools. These tools can make your trading life easier as well as help you gain more profit. There are many kinds of tools out there, each has its own purpose and utility. For beginners, choosing the right tools can help them gain more insight into the market and help them make better decisions. So, what are the best trading tools for beginners?

The Qualities You Should Look For

Essentially, the best forex trading tools were created to help you make better decisions before deciding to open a position. There are many things to consider in trading, such as fundamental news, market trends, the volatility of the market, and many more. This is where the best trading tools play their part. So, what you should look for in trading tools?

1. Reliability and Functionality

First and foremost, the best trading tools should be reliable. You need these tools to help you analyze the market. Most trading tools from brokers or trading platforms are most likely reliable. However, you should test it out just to be sure. Besides reliability, you need to make sure that the tools can function without problems. It's very crucial to know that you can rely on them during important times.

See Also:

2. Affordable

You should look for the best forex tools that are affordable to you. There are plenty of cheaper solutions you can choose out there. Sure, sophisticated tools may seem more interesting, but that doesn't mean you should spend all your money on them. After all, your goal is to make more money. Beginners can access free tools either from their brokers or using online tools provided by independent websites.

Trading Tools For Novice Traders

There are different kinds of trading tools, but which one is the best forex trading tool for a beginner? Fundamentally, there are only 5 tools you need to use if you are new to trading. These are the basic tools to enhance your decision-making. What are they?

1. Economic Calendar

The economic calendar is the best forex trading tool, especially for traders who rely on market news. This tool refers to the scheduled date of important releases or events that may affect prices or the market as a whole. Most investors and traders rely on this tool to plan trades or to protect their portfolios against unpredictable risks. Furthermore, the economic calendar can help them studying the chart patterns after high-impact events and releases.

Some economic news listed in this tool is made of regular reports from central banks, financial institutions, government entities, and research companies. Economic calendars are available on a lot of platforms. You can even access it on most brokers' websites.

While this calendar is a good starting point for new traders, the more experienced traders choose to customize it. Not that there is anything wrong with it, but the economic calendar consists of a wide range of information. So, a commodity trader may set the calendar around major releases that will affect oil or gold. This way, they can filter the information according to their needs.

2. Forex Pip Calculator

Apart from being the best forex trading tool in general, the forex pip calculator is also very crucial for beginners. For those who aren't familiar with trading, counting how much money to risk per trade can be a difficult task.

A forex pip calculator can help to estimate it more accurately and efficiently. This tool is pretty straightforward, as traders only need to enter their position details such as currency pair, lot size, account currency, leverage, and so on. The tool then determines the value pip in the desired base currency.

3. Technical Indicators on MT4

Did you know? The best forex trading tools can also be found directly on the MetaTrader. It offers plenty of useful tools for technical analysis. They are particularly essentials for traders who rely on technical indicators, in the way they can help to find opportunities from different perspectives that may be more accurate than the more common indicators.

There are plenty of indicators in MT4. However, new traders only need to focus on simple indicators that revolve around Moving Average (MA), Moving Average Convergence Divergence (MACD), and Relative Strength Index (RSI). MetaTrader's demo account can be used to back-test the performance of such indicators so traders can understand how they will perform on live market.

4. Trading Journal

A trading journal is simpler than other best forex trading tools. Almost all professional traders keep records of their trading decisions. That way, they can learn to form their past trades to understand their habits. Learning past failures can be a good way to gain new information about what they should or should not do.

In fact, trading journals help them keep as many trading details as they can and gain insight into their decisions. This includes the reason why they initiate the trade, which signals they used when making a position, how were the results, or anything else that can help them find their trading behavior. So, when they make a mistake, they can learn from it and grow better.

Brokers With the Best Trading Tools for Beginners

The next question is where to find the best trading tools that really matter for new traders. One of the most commonplace is brokers' websites. Naturally, brokers should supply their clients with trading tools.

Aside from being a helping feature, providing trading tools can serve as a good attraction to gain new clients. Below are some of the best brokers well-known for their commitments in providing the best trading tools.

OANDA

OANDA is a broker that offers plenty of trading tools for its clients. For starters, this broker uses advanced charts powered by TradingView. The features include continuous intraday market scanning, automated alerts for specified patterns, correlating signals, spot potential trading opportunities, volatility analysis, and many more. Traders will receive notifications of trading opportunities from their email.

Besides indicators, OANDA also provides economic overlay tools. This tool allows their clients to receive updates about important economic releases that are accessible from their trading platform. OANDA's economic overlay has a customizable view, reference results, and many more. These features can be very helpful for new traders who want to focus on news trading and fundamental analysis.

Traders looking for brokers with accurate precision, OANDA can be an option. That is because OANDA is a broker that provides quotes with 5-digit accuracy and active price movements that follow market developments. Order execution speed is also faster in this broker.

It provides benefits for novice traders, as they can trade with smaller volumes using the calculation system based on currency value, unlike other brokers adopting the lot system.

Founded in 1996, OANDA was built by Dr. Michael Stumm who is a lecturer in Computer Engineering at the University of Toronto, Canada, along with his colleague, Dr. Richard Olsen of The Olsen Ltd., which is one of the leading econometric research institutes. They have a head office in San Francisco, United States.

OANDA branch offices can be found everywhere. Some of these offices are located in the United Kingdom, Singapore, Japan, and Canada. With this number of offices spread, OANDA has increasingly attracted the attention of clients worldwide.

OANDA's company is registered under several well-known jurisdictions in financial trading. They are regulated by CFTC and NFA in the US, FCA in the UK, ASIC in Australia, and many others. Traders do not need to worry anymore about security when trading in OANDA. However, these advantages make trading rules at OANDA more stringent compared to other brokers.

For example, OANDA only allows maximum leverage of 1:20, because the rules in the US and Japan do not allow leverage above that. Besides, the registration procedure is more complex due to various additional requirements that are not submitted by other forex brokers. On top of that, hedging is not allowed in one trading account as the client must open an additional account to hedge.

Nevertheless, OANDA is known for being a leading broker with many advantages offered. OANDA faces increased market risk during periods of price volatility, such as economic and political news announcements. When market spreads increase or decrease, their pricing engine widens or narrows spreads accordingly. That way, traders can get the latest conditions from price movements in the market more quickly.

Prices move very fast in the market. Especially when news releases have a large impact on market volatility. This condition is often exploited by brokers to take advantage of clients with Requotes. However, traders do not need to worry about additional costs when trading with OANDA.

The company never withdraws Requotes so traders can get maximum profit. When traders are unavailable to monitor open positions, they can set take profit orders to lock in profits and Stop Loss orders to help protect against further losses.

As an experienced and well-known online forex broker, OANDA is committed to maintain an efficient trading environment that reduces latency and provid tools to help clients manage the degree of acceptable slippage.

With a fast & reliable trading platform by OANDA, clients' trades are executed in 0.012 seconds. This suits traders who choose brokers based on execution speed.

Because of this exceptional execution service, it is not surprising that OANDA won many awards, including the winner of the world's Best Retail FX Platform at the prestigious e-FX awards. The broker is also voted number 1 for Consistency of filling trades at quoted prices, Execution speed, and Reliability of platforms.

There is no minimum deposit or minimum balance required to open an OANDA account. Deposit and withdrawal can be done easily. OANDA provides a variety of payment method facilities, including Paypal, Wire Transfer, Credit Card, and Debit. Traders can adjust it to the region where they live.

OANDA provides more than 100 trading instruments, including 71 currency pairs, 16 indices, 8 commodities (Brent Crude Oil, Copper, Corn, Natural Gas, Soybeans, Sugar, etc.), 6 Bonds, and 23 Metals.

The fxTrade and MetaTrader platform are available at OANDA. These platforms can be used for Desktop and Mobile. Another plus is they have an OANDA Technical Analysis that exists in collaboration with a technical analysis provider called Autochartist.

With these platforms, clients can monitor price movements easier and automatically recognize patterns created on charts, as well as receive alerts when the awaited patterns appear. Access to this technology can be enjoyed free of charge.

In conclusion, OANDA is an ideal broker for traders in need of fast execution backed by many years of experience. The company is also a good alternative for those looking for a well-regulated broker with flexible trading and deposit conditions.

InstaForex

One of the best trading tools that can be found in InstaForex is the trader calculator. Forex trading needs accurate calculations to support analysis and strategies. This is why a forex calculator is needed. InstaForex also has a dividend calculator for CFD traders. These tools are pretty user-friendly, even for new traders.

Besides calculators, Instaforex provides beginners with a forex calendar. It consists of important news and releases that might impact the market. The best part? Traders don't have to register in advance if they want to use InstaForex's tools.

InstaForex is an international broker that provides trading services to traders globally. Since it was founded in 2007, InstaForex has provided for clients from various countries as many as 7 million traders. Based in Kaliningrad, Russia, InstaForex always attempts to improve the quality of the company in order to captivate the hearts of their clients.

Their hard work can be proven, one of which is by achieving a variety of awards, including Best Forex Cryptocurrency Trading Platform 2018 by UK Forex Awards, Best ECN Broker Asia 2018 by IBM, Forex Broker of the Year for Eastern Europe 2018 according to le Fonti Awards, Development, and Success award at Financial Olympus 2016-2017, etc.

There are 4 types of account offered by InstaForex representing a universal trading tool that help to work on international financial markets, such as Insta.Standard, Insta.Eurica, Cent.Standard, dan Cent.Eurica. Trading account types differ by the methods of accounting spreads and commissions, which are picked by the trader opening an account.

Insta.Standard account is relevant for standard trading terms on the Forex market and allows a trade to be settled with classical spread and with no fees. Traders will be charged a fixed spread every time they make a transaction. Spreads that are provided ranging from 3-7 pips. The main advantage of this type of accounts is its universality, as a trader can change the trading leverage and work with a deposit size convenient for traders.

Different from Insta.Standard accounts, Insta.Eurica accounts do not require payment of any spread on opening a deal. Therefore, this type of InstaForex account is suitable for beginner trader with a minimum transaction of 0.01 lots.

There are also other types of accounts InstaForex, namely Cent.Standard and Cent.Eurica which can be used for beginner traders because they can use the minimum transaction volume, which is 0.0001 lots (the cost per lot is USD0.1 cent). Deposit currencies that can be used by traders are EUR and USD (for all types of accounts).

Trading in InstaForex is quite a given as traders can choose to trade with leverage between 1:1 to 1:1,000. With a minimum initial deposit requirement of only USD1 (for all types of accounts), InstaForex clients have the opportunity to get a 30% to 100% deposit bonus.

Not only that, but beginner traders are also exempt from confusion in determining forex trading strategies. Because Instaforex provides ForexCopy services that allow traders to copy orders from professional traders in just a few minutes.

And then, there are around 300 trading instruments offered by InstaForex for traders. In addition to currency pairs, there are also futures, shares, gold, silver, CFDs, Bitcoin, and others.

Every InstaForex client is free to choose a trading platform that can be tailored to their needs. There are four types of trading platforms available, including InstaBinary, WebIFX, MetaTrader4, and MetaTrader5. Each platform has advantages and disadvantages. InstaForex also provides video tutorials on how to register on each platform. It aims to make it easy for beginner traders who want to join InstaForex.

If a trader still confused after seeing the video tutorials, traders can contact customer service available 24 hours connected to various social media, including email, Skype, Whatsapp, Telegram, Viber, Twitter, and Phone Call. On the InstaForex website, there are around 30 languages provided to facilitate traders from various countries.

The trader can also help themselves with trading calculators provided on the InstaForex website. Traders can accumulate currency pairs, Leverage, volume, and currency used.

The payment system in InstaForex is also diverse. Traders can pay deposits via Visa, Mastercard, Skrill, Neteller, PayCo, as well as Wire Transfer. All in all, InstaForex is a well-rounded broker for many types of traders.

HotForex

Hotforex equipped its website with plenty of tools, for example, different kinds of trading calculators. This broker also provides tools to calculate risk percentage, multitarget, pip value, pivot points, and risk/rewards. The user interface is simple and easy to use, making HotForex's tools line-up one of the best trading tools out there.

Traders who want to keep track of the financial market events and announcements can use economic calendars provided on Hotforex's website. Filters can be applied for those who want to focus on some forex pairs.

Hotforex also has an exclusive partnership with Autochartist. With the provided tool, traders can identify different kinds of patterns, such as chart patterns, Fibonacci, and key levels from the current market. Autochartist can analyze the volatility of the market, which is useful to read the price movement. This tool can be installed on both MT4 and MT5 platforms.

HF Markets is an award-winning forex and commodities broker. Established since 2010, the company provides trading services and facilities to both retail and institutional clients. For more than 9 years in business, HF Markets has around 1,500,000 live accounts opened and 200 employees globally.

Based on its services, HF Markets can be regarded as middle-class category. Clients do not need to prepare a big deposit for joining to trade with this broker. Also, there are various account types, trading software, and tools to facilitate individuals and institutional customers to trade forex and CFD online.

HF Markets is a registered brand name of HF Markets (Europe). Based on the location, the company is regulated by various financial regulators. Here are the details:

- HF Markets (SV) Ltd, registered in St. Vincent & the Grenadine as an International Business Company with the registration number 22747 IBC 2015.

- HF Markets (Europe), authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC) with Licence Number 183/12.

- HF Markets SA (PTY), is authorized and regulated as a Financial Service Provider (FSP) by the Financial Sector Conduct Authority (FSCA) in South Africa, under license number 46632.

- HF Markets (Seychelles), incorporated under the laws of the Republic of Seychelles with registration number 8419176-1, regulated by the Seychelles Financial Services Authority (FSA) under Securities Dealer Licence number SD015.

- HF Markets (DIFC) Ltd, authorized and regulated by the Dubai Financial Services Authority (DFSA) under license number F004885.

- HF Markets (UK) Ltd, authorized and regulated by the Financial Conduct Authority (FCA) under firm reference number 801701.

If traders have more experienced, knowledgeable, and sophisticated trading environment, they can join to become Professional Clients, who can manage and assess their own risks. For that reason, these kinds of clients are granted access to more favorable rates but afforded lesser regulatory protections than retail clients.

Trading with HF Markets can enable traders to access a variety of trading instruments like CFDs on Forex, Cryptocurrencies, spot metals (gold, silver, and others), energies (oil and gas), commodities (such as coffee, copper, and sugar), indices, bonds, and popular shares such as Google, Apple, and Facebook.

HF Markets offers some of the tightest spreads in the market, starting from 0 pips in Zero Account. This broker quote major foreign exchange currency pairs to five decimal places. Therefore, traders have the opportunity to get more accurate pricing and the best possible spreads.

HF Markets receives numerous highly prestigious titles, including the huge honor of being ed to join the ranks of the World Finance Top 100 Global Companies. Others are Best Client Funds Security Global by Global Brands Magazine, Best Global Forex Copy Trading Platform by Global Forex Awards 2019, Fastest Growing Forex Broker Mena 2019 by International Business Magazine, and many more.

After opening an account in HF Markets, traders will obtain various forex trading platforms to accommodate all of their trading demands. Whether traders like to trade on desktop or prefer to trade on-the-go, they can use MetaTrader 4 on desktop (terminal, multi-terminal, and web terminal) and phone (iPhone, iPad, and Android).

Clients' funds are held in segregated accounts. Only major banks are used by Markets because they believe that successful traders have to give their full attention to their trading rather than worrying about the safety of their funds.

Traders do not need to worry about transaction fees when depositing and withdrawing. Transaction fees are not charged, and diversity of payment methods enable them to choose between Wire Transfer, Bank Card, and online payments (Neteller, iDeal, Sofort Banking, and Skrill). HF Markets ensures that traders make fast transactions 24/5 during the standard hours.

Traders can earn extra income by joining the affiliate program offered by Markets. Clients who join this program will get some advantages, such as 60% of Net Spreads based on the volume traded by sub-clients, up to $15 per a lot of net revenue, and many more. More information about HF Markets can be obtained on their official website which is supported in 27 languages.

From the review above, it can be concluded that HF Markets is one of the award-winning forex and commodities brokers. There are various account types traders can choose in HF Markets, and the broker itself becomes a favorite among traders for its low spreads. This condition is very suitable for traders with limited funds and a desire to get more opportunities to gain maximum profit.

Admirals

The economic calendar on Admirals can help traders to prepare themselves regarding financial releases. This tool has a simple and straightforward user experience. Not only does this tool shown the affected currency, but it also shows how big the news impacts the correlated markets.

Other trading tools available on Admiral's website are MT5 and MT4 Supreme Edition. But, how are these tools any different from the regular features on MetaTrader? Admirals stated that these tools use Advanced Technical Analysis Indicators and Analyst Opinion to help traders optimize their strategies. Day traders can benefit from the Forex Featured Ideas that give unbiased outlooks, as well as intraday trading ideas detected by Trading Central.

Admiral also provides market sentiment widgets. This tool allows traders to see the sentiment between buyers and sellers in the form of a percentage. Another tool to read the market is the Heat Map. In short, it's a market radar to track daily trading intelligence and price movement. This tool allows traders to recognize trading opportunities, daily trends, volatility, and many more.

After Thought

Although it's a simple feature, trading tools can be very helpful for inexperienced traders. The best trading tool should be reliable, functional, and affordable, so traders can use it to help them trade. You can get them from brokers' official websites as most brokers cater to their client's needs through different kinds of tools.

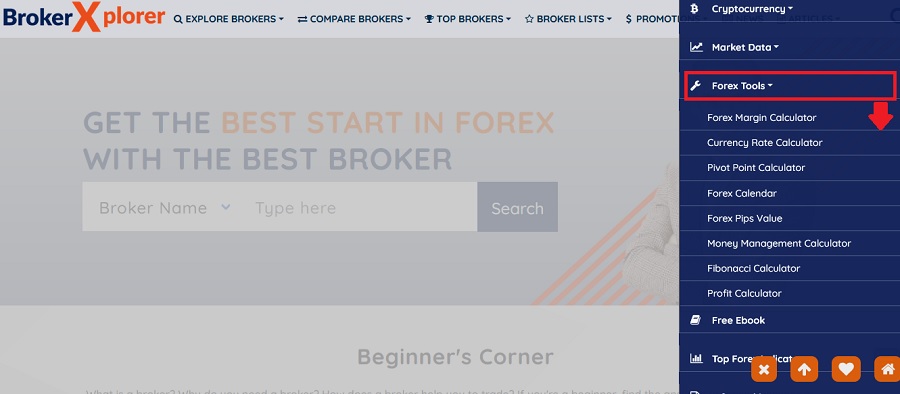

Another place to find the best trading tools is on forex websites. Traders can access these tools free of charge anytime using the provided tools. BrokerXplorer offers plenty of trading tools including different kinds of calculators ranging from forex margin calculator, pivot point calculator, Fibonacci calculator, and many more.

To use these tools, simply click on the options icon on the bottom right corner. It will show a tab with plenty of menus. Find the "Forex Tools" menu and click it to get the full list of tools you can get.

Analyzing the forex market can be so complex for some traders that it may discourage them to continue further. That's why using trading tools can be mandatory. Besides these basic tools, you can use other trading tools to start making money.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance

1 Comment

Rony

Jan 1 2023

I think all traders may have a different Activtrades spread because there are different assets and trading times. I mean every trader has his own trading strategy. It can be different assets. Some people like to trade stocks. Some like to trade currency pairs. For example, EUR USD spread here is only 0.5 pips. As you see it's very low spreads. Not many brokers can show such results. That's why ActivTrades has a large number of clients.