If you can have a shotrcut to optimize risk management, why not try with Autochartist that also provides trading opportunities along the way?

We may be familiar with many types of tools that we use in our day-to-day life like hammers to strike, tapes to paste, or calculators to calculate. More specifically, during scientific research, we may be granted great help from a scientific calculator. However, as traders, what tools do we have to calculate? And what is to be calculated, anyway?

In this article we would like to introduce the use of Autochartist as a risk calculator, provided by HF Markets.

Contents

Autochartist: What Is It?

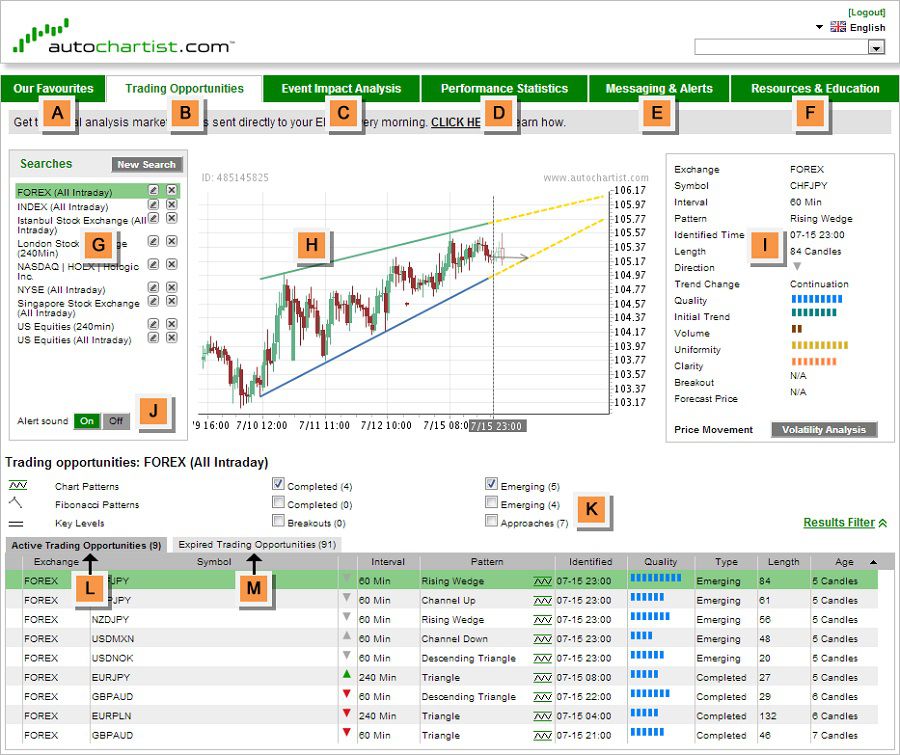

Autochartist is a market-scanning tool that is powerful to help traders find the best trading opportunities and ultimately make the best decision regarding what and when to trade.

In real time, this tool allows traders to figure out market opportunities from various technical perspectives. This feature will save time when we are looking for potential trade setups.

What are the Features?

This cutting-edge trading technology from HF Markets will instantly recognize trading opportunities from chart patterns, key levels, Fibonacci patterns, and other analysis methods. The signals would then be delivered in real-time. Traders are notified of pattern formations within minutes by virtue of their pattern recognition algorithms, which continuously scan financial markets including Forex, Indices, Commodities, Stocks, CFDs, and Futures.

There are two types of signals provided, namely approaching signals and breakout signals. Emerging patterns provide an early warning of developing trading opportunities, where the price is approaching support or resistance. These are particularly useful when swing traders are looking for ranges at which they may trade.

PowerStats, a feature that gives traders important statistical information about the instruments they trade, is also offered. It improves the estimation of risk and volatility and is useful when determining stop loss and take profit levels.

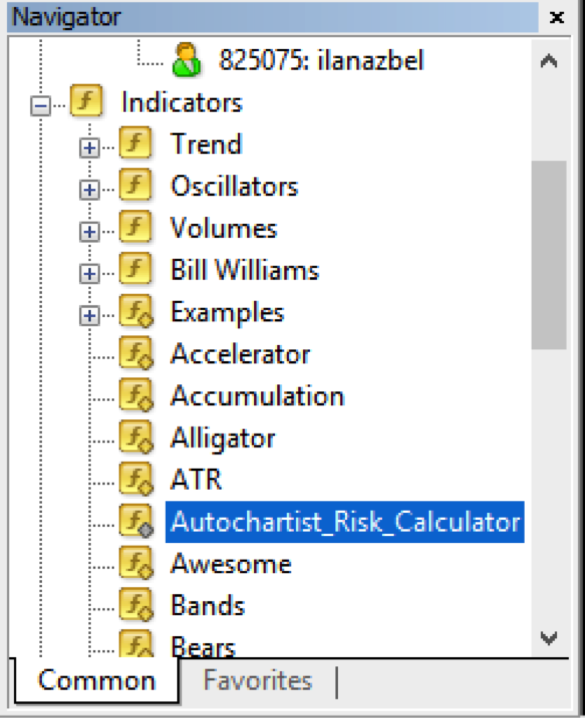

Through a customized plug-in that connects easily to the Autochartist service, all of the Autochartist functionalities are now also provided directly to the MT4 application.

See Also:

What are the Benefits?

HF Markets' trades may take pleasure in Autochartist due to the many benefits which include:

- In the financial markets of Forex, Indices, Commodities, Stocks, CFDs, and Futures, Autochartist offers more than 1000 opportunities for trading that can be taken.

- While markets are open, real-time identification of chart patterns, Fibonacci patterns, and Key Levels is accessible to traders.

- Having Autochartist regularly search the market for new, high-quality trading opportunities, traders may benefit from significant time-saving advantages.

- Visual quality indicators facilitate more experienced traders to execute advanced search operations while also improving the capacity of inexperienced traders to identify patterns.

- The Autochartist website and online interface include a ton of resources for research and education. Access to articles, videos, e-books, webinars, and other things is provided to users.

Working with Autochartist Risk Calculator

Not only scanning markets and presenting trade opportunities, but Autochartist is also a way to eliminate manual calculation that seems to take forever. Indeed, there's an added feature in Autochartist called Risk Calculator, where we can simply enter the equity percentage and amount to risk on a trade. Subsequently, Autochartist will calculate the correct trading volume so we can minimize losses.

"The best investment is in the tools of one's own trade."

Along with Benjamin Franklin's quotation above, let's walk the talk. The first step to take is to drag the Risk Calculator onto any chart window, as seen below:

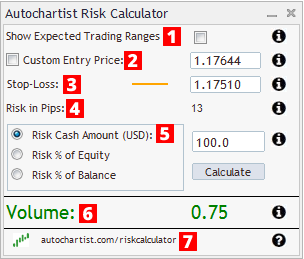

Once successfully initiated, the Risk Calculator will show the following display:

The Risk Calculator control panel consists of a number of features. Therefore, there is a recommended setting as seen below:

In reference to the figure above, pay attention to the following details:

- Show Expected Trading Ranges. By ticking the checkbox, you will show ranges that can be used to determine price changes that have been recorded over the past six months to the present day of the week and time of day.

- As to the Custom Entry Price, you can check the box to set your own price in the next column.

- Adjust the Stop-Loss to set your preferred price at which you're comfortable losing your positions.

- Risk in Pips indicates the number of pips difference between the entry price and stop loss.

- Risk Cash Amounts refers to the amount of money to risk on this trade.

- The Volume should be considered as the position size to take, with the goal of risking the amount of money stated at the desired Stop-Loss level.

See Also:

Setting Trade: Current Market Price

When trading the current market price, setting the trade size is performed as follows.

- Determine the level at which you are going to set the stop loss and move the orange line to that level.

- Should the orange line be below the current price, the indicator would perceive that you are planning on a LONG position. On the contrary, should the orange line be above the current price, the indicator would perceive that you are planning a SHORT position.

- Determine the level of money to risk on this trade. Set the Cash Amount, or the Risk as % of Equity or Risk as % of Balance value.

- Click the "Calculate" button.

The position size that must be entered into the order window as indicated by the following chart:

Setting Trade: Pending Orders

When setting pending orders, getting the correct trade size is performed as follows:

- Click the Checkbox next to "Custom Entry Price". Right after, a green line will appear. This represents the entry level according to your setting on the pending order.

- Move the green entry line to your trade entry level.

- Move the orange stop loss line to the desired stop loss level.

- Determine the level of money to risk on this trade. Set the Cash Amount, or the Risk as % of Equity or Risk as % of Balance value.

- Click the "Calculate" button.

The position size that must be entered into the order window can be seen in the following picture:

Using the Expected Trading Range as Volatility Guide

Data from Autochartist's Volatility Analysis in HF Markets is also connected with the Risk Analyzer. Therefore, if you tick the "Show Expected Trading Ranges" checkbox along with the position sizing for the various levels, you will receive anticipated trading ranges like this:

As a result, you may take into account both the anticipated price volatility and the trading approach when determining stop loss levels. You can observe how each level's position size is defined. Setting a position size of 0.11 in this example will allow you to risk 1% of your capital with an entry at the current market price and a stop loss at 1.17598%.

Conclusion

Analyzing trends and patterns in the market is certainly beneficial to improve your returns or profit while also learning more about how the market functions. Leveraging a variety of digital and online tools may provide you with more accomplished information and signals than just browsing common news and free signals available out there.

In order to control the risks associated with the forex market, a trader might use a simple instrument called a forex calculator. But unlike the calculator we used to bring to school as kids, this calculator is really specific. There are over a dozen different types of forex calculators, which were created to ensure that anyone can be a top-level trader despite their aptitude for math. To make things even easier, these calculators are available online for free. We may find them on a wide array of brokerage sites including Authochartist Risk Calculator.

Using the Authochartist Risk Calculator on HF Markets would hopefully help you maximize profits and mitigate risks in advance without manually counting every aspect of your trading positions. Apart from Autochartist signals and the risk management tool, there are more trading features to explore in HF Markets. If you want to know more, here's a good summary that describe the broker:

HF Markets is an award-winning forex and commodities broker. Established since 2010, the company provides trading services and facilities to both retail and institutional clients. For more than 9 years in business, HF Markets has around 1,500,000 live accounts opened and 200 employees globally.

Based on its services, HF Markets can be regarded as middle-class category. Clients do not need to prepare a big deposit for joining to trade with this broker. Also, there are various account types, trading software, and tools to facilitate individuals and institutional customers to trade forex and CFD online.

HF Markets is a registered brand name of HF Markets (Europe). Based on the location, the company is regulated by various financial regulators. Here are the details:

- HF Markets (SV) Ltd, registered in St. Vincent & the Grenadine as an International Business Company with the registration number 22747 IBC 2015.

- HF Markets (Europe), authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC) with Licence Number 183/12.

- HF Markets SA (PTY), is authorized and regulated as a Financial Service Provider (FSP) by the Financial Sector Conduct Authority (FSCA) in South Africa, under license number 46632.

- HF Markets (Seychelles), incorporated under the laws of the Republic of Seychelles with registration number 8419176-1, regulated by the Seychelles Financial Services Authority (FSA) under Securities Dealer Licence number SD015.

- HF Markets (DIFC) Ltd, authorized and regulated by the Dubai Financial Services Authority (DFSA) under license number F004885.

- HF Markets (UK) Ltd, authorized and regulated by the Financial Conduct Authority (FCA) under firm reference number 801701.

If traders have more experienced, knowledgeable, and sophisticated trading environment, they can join to become Professional Clients, who can manage and assess their own risks. For that reason, these kinds of clients are granted access to more favorable rates but afforded lesser regulatory protections than retail clients.

Trading with HF Markets can enable traders to access a variety of trading instruments like CFDs on Forex, Cryptocurrencies, spot metals (gold, silver, and others), energies (oil and gas), commodities (such as coffee, copper, and sugar), indices, bonds, and popular shares such as Google, Apple, and Facebook.

HF Markets offers some of the tightest spreads in the market, starting from 0 pips in Zero Account. This broker quote major foreign exchange currency pairs to five decimal places. Therefore, traders have the opportunity to get more accurate pricing and the best possible spreads.

HF Markets receives numerous highly prestigious titles, including the huge honor of being ed to join the ranks of the World Finance Top 100 Global Companies. Others are Best Client Funds Security Global by Global Brands Magazine, Best Global Forex Copy Trading Platform by Global Forex Awards 2019, Fastest Growing Forex Broker Mena 2019 by International Business Magazine, and many more.

After opening an account in HF Markets, traders will obtain various forex trading platforms to accommodate all of their trading demands. Whether traders like to trade on desktop or prefer to trade on-the-go, they can use MetaTrader 4 on desktop (terminal, multi-terminal, and web terminal) and phone (iPhone, iPad, and Android).

Clients' funds are held in segregated accounts. Only major banks are used by Markets because they believe that successful traders have to give their full attention to their trading rather than worrying about the safety of their funds.

Traders do not need to worry about transaction fees when depositing and withdrawing. Transaction fees are not charged, and diversity of payment methods enable them to choose between Wire Transfer, Bank Card, and online payments (Neteller, iDeal, Sofort Banking, and Skrill). HF Markets ensures that traders make fast transactions 24/5 during the standard hours.

Traders can earn extra income by joining the affiliate program offered by Markets. Clients who join this program will get some advantages, such as 60% of Net Spreads based on the volume traded by sub-clients, up to $15 per a lot of net revenue, and many more. More information about HF Markets can be obtained on their official website which is supported in 27 languages.

From the review above, it can be concluded that HF Markets is one of the award-winning forex and commodities brokers. There are various account types traders can choose in HF Markets, and the broker itself becomes a favorite among traders for its low spreads. This condition is very suitable for traders with limited funds and a desire to get more opportunities to gain maximum profit.

HF Markets is a global Forex and Commodities broker that facilitates both retail and institutional clients. Previously known as HotForex in the brokerage industry, HFM has positioned itself as the forex broker of choice for traders worldwide through their various account types and trading tools. Furthermore, HF Markets allow scalpers and traders use Expert Advisors unrestricted.

Xbox Series Giveaway

Xbox Series Giveaway Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024

30 Comments

Guilermo

Jan 30 2023

if I already had an autochartist account before, is it necessary to create a new account connected to hfx? How does the Autochartist risk calculator work in Forex trading and how can it help a trader determine the level of risk associated with a specific currency pair trade, such as EUR/USD?

Messi

Feb 13 2023

Guilermo: If autocharist account is not from HFX I think you can't connect it to HFX but if autocharist is yours or in the world you pay for autocharist I think you can connect with Metatrader. For note, autocharist is another plugin that may or may not be installed in Metatrader. So you have to try to see if it's possible or not. But in my opinion you can connect them with HF Market account.

Hilda Barnett

Feb 14 2023

Messi: Wait, let me make this clear. So the Autochartist account has to be created from HFX? I don't understand how to do this. Is there any tutorial or guidance regarding this? So sorry if this question is annoying. I have never used Autochartist before and people have been telling me that it is good to assist me with trading. So, I really want to try it.

Bennica

Feb 21 2023

Hilda Barnett: As far as I know HFM provides a very good set of trading tools compared to other brokers. The HFM trading tools suite includes Autochartist, a free VPS service, and a set of Premium Trading Tools. Although all these tools are provided free of charge, traders are required to make a large deposit before access is made available.

Autocartista can be accessed in two ways, namely via desktop and mobile Android. Each of these uses has its own advantages. If you are a very mobile trader, using the Autochartist app on your smartphone will make things easier for you.

When you download the app from Autochartist, you don't have to worry about missing market conditions. As long as the internet connection is good, you can check price changes even when stuck in traffic, waiting in line at the bank, or doing other things. On the other hand, if you are a dealer who wants to do a full analysis on the big screen, then using Autochartist online is the right choice.

You can use Autocartista online by opening directly on the website or applying the software on the MetaTrader 4 and 5 platforms that you use for trading on HFM. In my opinion, because it is already available on HFM, I am more comfortable applying it directly to the trading platform in the broker HFM.

Robert

Feb 21 2023

After I searched for what tools were provided by HF Market, someone reading this article, I was interested in the Authochartist tool as a tool to find the best signals in trading.

Autochartist is a forex trading software that specifically provides a market scanner facility to identify chart patterns that are being and have been formed on the chart in real-time. This is inseparable from the Autochartist service which is considered capable of providing useful trading signals for traders, especially those who rely more on reading chart patterns than the platform's built-in indicators.

But on one side, I also found that there are several brokers that provide central trading with functions that are almost similar to Autochartist. the problem is that HF ​​Market only provides the Autochartist tool, not for central trading. If anyone knows, can you help explain, what's the difference between Autochartist and trading central? which level of accuracy is more accurate in trading signals?

So I myself am confused about Trading Central and Autochartist, are they related to each other or are they an analysis of different trading signals? Thank You!

Jackson

Feb 21 2023

Robert: The scope of the trading central includes not only technical analysis but from fundamental analysis, market news/sentiment, economic analysis, to expert research which are combined in one product called Trading Central.

Meanwhile, Autochartist is a premium feature that also needs to be purchased, which is devoted to analyzing charts, and helping traders find chart patterns that even traders themselves haven't found yet. For me, auto chartist is like a technical analysis feature specifically for charts.

Because basically Autochartist is software for recognizing chart patterns, Fibonacci Retracements and their combinations, key levels of Support and Resistance, as well as volatility levels; so to be able to trade with the signals provided by Autochartist, you must first understand the elements of technical analysis.

Even though HF Market only provides Autochartist as a signal search tool, and yes, its function is almost similar to trading central. So even though HFM only provides Autochartist without a trading center, it doesn't really matter. but yes, for me, I prefer brokers that provide these 2 tools to make comparisons.

It should be understood that signals from the Trading Central and Autochartist features cannot guarantee that traders will always be profitable. Occasionally, this feature will also generate inaccurate signals. Thus, it is highly recommended that traders not be all-in when considering Trading Central and Autochartist signals. So you also have to study trading analysis such as technical and fundamental.

Anne Cleves

Feb 23 2023

Jackson: I see; I was under the wrong impression about Autochartist. I honestly thought that this tool was able to determine which was the best entry for me. Technically showing signals would also help me see where I should enter and exit the markets. But that means it requires me to possess some amount of knowledge about trading. Nevertheless, it's still pretty useful. But I am unsure if I would be willing to pay extra to unlock more features. Are these paid features worth it?

Jokovich

Mar 13 2023

Can the Autochartist Risk Calculator be used for all types of trading strategies and financial instruments, or are there any limitations to its use? Is it limited to Forex Trading only or can I use it to another markets, like crypto, etc?

Omer Dere

Mar 23 2023

Jokovich: The Autochartist Risk Calculator is a versatile tool that can be used for a variety of trading strategies and financial instruments beyond Forex trading. It can be used to calculate risk for other markets such as cryptocurrencies, commodities, indices, and stocks. However, it's important to note that the effectiveness of the Risk Calculator may vary depending on the specific instrument and the trading strategy being used. This is because different instruments and strategies may have unique risk profiles and factors that may impact the accuracy of the calculations. Therefore, while the Autochartist Risk Calculator can be a useful tool for managing risk in different markets and strategies, it's recommended to consider its limitations and use it in conjunction with other risk management strategies and tools for a more comprehensive risk management approach.

Poppy

Mar 25 2023

@Jokovich:

Hey there! Great question! The Autochartist Risk Calculator is a useful tool for evaluating risk in trading, but its applicability may vary depending on the trading strategies and financial instruments you're using.

While the Autochartist Risk Calculator is commonly used in Forex trading, its functionality extends beyond just the Forex market. You can also utilize it for other financial instruments such as stocks, commodities, and indices. This allows you to assess risk across different markets and make informed decisions based on your trading preferences.

However, it's worth noting that the Risk Calculator's effectiveness might depend on the availability and accuracy of data for the specific instruments or markets you're interested in. Make sure to verify the compatibility of the Risk Calculator with your desired trading instruments and consult the platform or broker you're using for any specific limitations or considerations.

Daxak Bjoriz

Mar 13 2023

How accurate autochartist is? And should a beginner trader rely on autochartist alone? I mean if I'm just starting out as forex trader, can I rely on autochartist to generate considerable profit?

Ragib Day

Mar 23 2023

Daxak Bjoriz: The accuracy of Autochartist will depend on various factors such as the quality of the data being analyzed, the settings and parameters being used, and the volatility and liquidity of the markets being traded. While Autochartist uses advanced algorithms and machine learning to analyze market data and identify potential trade opportunities, it's important to note that no trading tool or strategy can guarantee accurate predictions or profits. As a beginner trader, relying solely on Autochartist to generate profit may not be the most effective approach. It's essential to gain a strong foundation in trading fundamentals, such as risk management, market analysis, and technical analysis, before using any trading tool or strategy. Autochartist can be a helpful tool to assist with identifying potential trade opportunities and managing risk, but it should not be used as the sole basis for making trading decisions. It's recommended that beginner traders use Autochartist with other tools and strategies, and always practice good risk management techniques such as setting stop-loss orders and limiting exposure to any single trade or asset. Ultimately, success in trading depends on a combination of knowledge, skill, and experience, and it's essential to continue learning and practicing to improve your trading abilities over time.

Eleanor

Apr 15 2023

Actually, I'm still new to the world of trading, and yes, I rarely hear about brokers that provide trading instruments and platforms. You must have known FBS and OctaFx which always appear in several advertisements on social media. As for the HF Market broker, to be honest I have never heard of this broker.

And yes, I just found out in this article, and yes, what is being discussed here is related to the accounts and trading methods offered by this broker. Actually, even after it was explained, I didn't really understand and actually just found out that there is also a broker called HF Market. As already explained, this broker has only been established since 2007, but I can't say for sure whether this broker is good and safe. I ask for an explanation, friends, is the IC Markets broker safe for trading and my funds? Is my personal data also safe here? If anyone knows, could you please explain...

Kirsteen

Apr 15 2023

@Eleanor: HFM takes the safety and security of its clients' funds very seriously. Initial steps indicated that the broker is regulated by leading financial authorities worldwide. HFM is registered as a legal entity in St. Vincent & the Grenadines Act.

These authorities are responsible for the conduct of the business of financial institutions in various regions, and since brokers are regulated by the top guidelines, it gives traders a sense of confidence and self-confidence. Brokers disclose the license number of each law they comply with, and after checking the license number in the relevant list we have found that the license is active and valid, so you can rest assured that HFM complies with these regulations.

There are additional security measures that brokers put in place, such as negative balance protection, segregation of funds, and trader insurance schemes.

In addition, HFM participates in a civil liability insurance program of up to €5 million, and this package ensures traders and creditors if the broker defaults and goes bankrupt. This insurance scheme protects traders from any fraudulent practices, negligence, or misconduct by the broker.

Whalen

Apr 15 2023

@Kirsteen: I want to add your explanation. HFM has won numerous awards for its services and offerings over the years, recent honors include:

Excellence in Global Customer Service 2020 (International Investor Awards),

With years of responsible operation, regulation by some of the strictest authorities in the world, and a long list of customer satisfaction awards, HFM is considered a reliable and safe Forex broker. While HFM's Indonesian clients are not as protected as their EU and UK counterparts, the FSA provides adequate security including ensuring that HFM segregates client accounts from its own funds and undergoes frequent audits.

Panzer

Apr 15 2023

@Eleanor: HF Market was founded in 2010 as an online forex and commodities broker offering a wide choice of accounts, trading software, and trading tools to provide optimal trading conditions for individuals, Fund Managers, and institutional customers.

Before giving an assessment of the features and services provided, it's a good idea to know how this broker guarantees the safety of the funds you deposit. This is very important, in my opinion, because you cannot trade with peace of mind if you are overthinking your trading funds. I want to give an explanation of what security is guaranteed by HF Market.

Client deposits are protected. HFM goes the extra mile to protect its obligations to Clients and other third parties with a Civil Liability insurance program of up to EUR 5,000,000 which covers the best protection on the market against the risks of error, negligence, negligence, fraud, and various other risks that could result in financial wrongdoing.

Client funds are held in a separate bank account from Company funds. Client funds are not included in the company's balance sheet and cannot be used to pay debts to creditors if the company goes bankrupt or defaults.

Negative Balance Protection. the client will not be liable to pay a negative balance if market conditions are highly volatile and margin calls and stop-outs do not function properly.

Seung Gi

Apr 16 2023

Even though I haven't tried real trading yet, I really like brokers that provide copy trading platforms because I feel all beginners really need this platform to trade while learning plus getting profit too. At least with this platform, I can get trading knowledge from professionals.

It turns out that HF ​​Market also provides many accounts that are suitable for beginners, scalpers and experienced traders. there is also a MyHf Market account for traders who like copy trading but are more friendly with novice traders. HFM has a competent in-house research team and has partnered with several third-party analysis firms to provide more useful market analysis than is available at most other brokers.

In addition, Free to all HFM clients with a minimum deposit of 100 USD, Autochartist is an award-winning automated technical analysis tool that plugs into MT4 and MT5 and scans all available CFD markets for trading opportunities. starting from chart pattern recognition, Fibonacci pattern recognition, key level analysis, and pattern quality indication are available in this broker.

In my opinion opening an account at HF ​​Market is not much different from other brokers which is quite easy and sophisticated. Besides opening an account, there's usually a document verification process right? If I want to join me trading in this broker, do I have to verify my account? please explain also How do traders verify documents?

Jimin

Apr 16 2023

@Seung Gi: To get started with HFM, there are a few steps you need to take. Registration only takes 3 minutes. The registration process is easy to use and we will guide you through the whole process.

First things first, go ahead and head over to the broker's main page. You will see a green "Open Live Account" in the top-right corner of the page. Fill out the application by providing your personal data. Click "register" and an email will be sent to you with an activation link. Check your email and click on the activation link. After that, you will be redirected back to the HFM site to complete the registration process.

In the myHF area, you will be asked to complete detailed information about your account, and your trading experience. You will need to enter more detailed information such as your tax number, detailed address and nationality. In addition, you will be asked a few questions regarding your trading experience, what financial instruments you are familiar with, and how long you have been trading. Checking your experience level is required by strict regulators to protect the interests of traders.

The next step is to upload the documents required by the regulatory authorities to ensure that the trading platform is clean from money laundering activities, and that no blacklisted persons are involved in trading. There are two types of documents required for verification: proof of residence and proof of your identity. You can send a copy of your passport, national identity or driver's license to prove your identity. For proof of residency, you can provide a copy of your utility bill or a government-issued document that clearly shows your address.

The last part is choosing your trading platform, depositing funds to your account and starting trading. There are MetaTrader 4 and MetaTrader 5 to choose from. Don't forget to download and install the mobile apps available for Android and Apple devices. Once your trading platform is set up, you are ready to make your first deposit. Choose your preferred payment method, and fund your trading account to start trading and make money.

Snoopy

Apr 16 2023

Even though I just started trading at HF ​​Market about 2 months. But yes... I have experience in the world of trading for almost 1 year. Even though I'm still new to HF Market, I like the copy trading service which makes it easy to learn trading strategies. Well, although not all strategies can provide benefits. But at least we can more easily find solutions by imitating other traders. So, because I'm still new to trying this broker here, I'm a bit confused, usually, brokers charge an inactivity fee to their customers, how much is the inactivity fee at this broker? Is it low or high enough? Bro, if anyone knows, please enlighten me...

Dalton

Apr 16 2023

@Snoopy: Hey, let me help explain... I've only been in the RF market for about a year. Yes, my answer may help answer your question. The traditional copying platform offered by this broker is very good and I found it interesting to discuss. But before that, the HFCopy account with copying service from this broker is very good and I really want to tell you it is really worth it... But of course, there are drawbacks to it. And in my opinion, the fees investors have to pay strategy providers are exorbitant because they represent half (50%) of the profits. In my opinion, if the inactivity fee with this broker is very low, FXTM charges an inactivity fee of $5/month after the account has been inactive for 6 months and most withdrawal methods will also be charged. But to redeem it, there are no account or deposit fees.

Marvel

Apr 16 2023

@Snoopy: HFM brokers charge a flat fee for inactive accounts. If there is no trading activity or no transactions for at least 6 months, the account will be considered inactive.

Inactive accounts will be charged a flat fee of $5 per month for up to a year. If the inactivity period increases between 1 year to 2 years, the broker will increase the inactivity fee to $10.

Moreover, if the inactive status is extended for more than 2 years, the broker will charge $20 per month. And in subsequent years, the inactivity fee will increase by $10 annually.

Remember that your account will never be negative. Therefore, no inactivity fee will be charged if your balance is less than 5 USD.

Chaplhin

Apr 16 2023

In my opinion, while hands-on practice in the trade is important, we shouldn't neglect education. Apart from learning from experience, trading motivation also needs to be improved to get even better profits.

taking part in webinars, listening to podcasts related to trading is one of the efforts to increase trading knowledge and motivation to make profits. For beginners, of course, you need guidance from trading experts to improve your trading skills.

Trying a demo account is also important before trading. and the good news is that HF ​​Market provides this. HFM offers an unlimited demo account, which allows aspiring traders to test trading strategies in real market conditions. The demo account is filled with 100,000 USD in virtual currency and has access to the MT4 and MT5 platforms. HFM has a competent in-house research team and has partnered with several third-party analysis firms to provide more useful market analysis than is available at most other brokers.\

Plus, Free to all HFM clients with a minimum deposit of 100 USD, Autochartist is an award-winning automated technical analysis tool that plugs into MT4 and MT5 and scans all available CFD markets for trading opportunities. Autochartist's advanced pattern recognition engine identifies the strongest potential trading opportunities and predicts future price movements.

Between the analytical tools and scale of market research offered – in audio, text, and video formats – from in-house and third-party experts, HFM market analysis is far more useful than most other brokers – even if it comes close to comparison. international broker with a good research and analysis budget.

Estrith

Apr 16 2023

Even though I haven't tried real trading yet, I really like brokers that provide copy trading platforms because I feel all beginners really need this platform to trade while learning plus getting a profit too. At least with this platform, I can get trading knowledge from professionals.

It turns out that HF ​​Market also provides a Zero Spread account with lower spreads and is more friendly to novice traders. The Zero Spread account is for high-frequency and algorithmic traders. Because the fee structure is more beneficial for short-term trading. As the name implies, this account allows you to trade using a basic spread of 0 pips without any additional price. The leverage offered is up to 500:1. You can trade using the HFM zero spread account with a minimum deposit of $200.

In my opinion, opening an account with a Zero Spread account is not much different from other brokers, which is quite easy and sophisticated. Besides opening an account, there's usually a document verification process, right? If I want to join my trading account with this broker, do I have to verify my account? please explain also How do traders verify documents?

Petrict

Apr 17 2023

@Estrith: To get started with HFM, there are a few steps you need to take. Registration only takes 3 minutes. The registration process is easy to use and we will guide you through the whole process.

First things first, go ahead and head over to the broker's main page. You will see a green "Open Live Account" in the top-right corner of the page. Fill out the application by providing your personal data. Click "register" and an email will be sent to you with an activation link. Check your email and click on the activation link. After that, you will be redirected back to the HFM site to complete the registration process.

Step 2: Complete your profile. In the myHF area, you will be asked to complete detailed information about your account, and your trading experience. You will need to enter more detailed information such as your tax number, detailed address, and nationality. In addition, you will be asked a few questions regarding your trading experience, what financial instruments you are familiar with, and how long you have been trading. Checking your experience level is required by strict regulators to protect the interests of traders.

The next step is to upload the documents required by the regulatory authorities to ensure that the trading platform is clean from money laundering activities and that no blacklisted persons are involved in trading. There are two types of documents required for verification: proof of residence and proof of your identity. You can send a copy of your passport, national identity, or driver's license to prove your identity. For proof of residency, you can provide a copy of your utility bill or a government-issued document that clearly shows your address.

The last part is choosing your trading platform, depositing funds in your account, and starting trading. There are MetaTrader 4 and MetaTrader 5 to choose from. Don't forget to download and install the mobile apps available for Android and Apple devices. Once your trading platform is set up, you are ready to make your first deposit. Choose your preferred payment method, and fund your trading account to start trading and make money.

Taeyang

Apr 18 2023

@Estrith.

Opening a live account at HFM including the Zero Spread HF Market account is very easy and only takes less than 3 minutes. You simply copy the HF account type and complete online registration, submitting documents. We advise you to read the risk disclosure, customer agreement, and terms of the business before starting to trade.

Proof of Identification – a valid (non-expired) color scanned copy (in PDF or JPG format) of your passport. If you don't have a valid passport, similar identification documents bearing your photo such as a KTP or driver's license are also acceptable. Proof of Address – Bank Statements or Utility Bills. However, make sure that the documents provided are not older than 6 months and that your name and physical address are clearly displayed.

Important Note: The name on the Proof of Identity document must be the same as the name on the Proof of Address document.

Potter

Jun 11 2023

I've been hearing a lot about the cutting-edge trading technology offered by HF Markets, and I'm intrigued to learn more about it. It's fascinating to hear that this technology has the ability to instantly recognize trading opportunities based on various analysis methods, such as chart patterns, key levels, and Fibonacci patterns. I'm particularly curious to understand how this technology works and what sets it apart from other trading platforms in terms of accuracy and efficiency.

Could you provide some insights into the specific mechanisms employed by this trading technology? How does it analyze chart patterns and key levels to identify potential trades? Does it incorporate artificial intelligence or machine learning algorithms to enhance its performance? Additionally, I'd like to know if it offers any advanced tools or indicators that can help traders make more informed decisions.

Sebastian

Nov 18 2023

Hey, I've got a question about pending orders. I'm pretty new to all this trading stuff, just dipping my toes into learning the ropes. I've been practicing by placing orders, and whenever I click, I get an open position. Now, I've come across Autochartist, and it looks like a handy tool to minimize risks in trading.

So, going back to the beginning, could you explain what exactly pending orders are? Also, the orders I've been making in my practice sessions, what type of orders are those? Thanks a bunch!

Agan

Nov 23 2023

Let me explain to you. So, pending orders are instructions you give to your broker to execute a trade once the market reaches a specific price level. Unlike market orders, which are executed immediately at the current market price, pending orders are only triggered if the market reaches the price you've specified.

In your practice sessions, the orders you've been placing are likely market orders. When you click to open a position, you're essentially entering the market at the current price. On the other hand, pending orders include different types such as:

Buy Stop: A buy order placed above the current market price, anticipating a breakout.

Buy Limit: A buy order placed below the current market price, expecting a retracement.

Sell Stop: A sell order placed below the current market price, expecting a breakout to the downside.

Sell Limit: A sell order placed above the current market price, anticipating a retracement to the upside.

You can also read this article to get more insight about types of order : The Simple Guide to Types of Orders in Forex Trading.

Indra

Feb 23 2024

According to the article, HF Markets' advanced trading technology can swiftly identify trading prospects by analyzing chart patterns, key levels, Fibonacci patterns, and other analytical techniques. I'm particularly interested in learning more about the Fibonacci aspects mentioned. As far as I understand, Fibonacci methods are rooted in mathematics. So, I'm curious, how effective is this approach? And could you explain what Fibonacci methods entail exactly?

Hans

Feb 27 2024

Let me explain about Fibonacci shortly and for more information, you can read this article : Learn How to Use Fibonacci in Financial Trading.

Fibonacci methods in trading involve using mathematical ratios derived from the Fibonacci sequence to identify potential support and resistance levels, as well as predict price movements. These ratios, such as the Golden Ratio and its inverse, are applied to financial markets, aiming to catch trading opportunities. While some traders find Fibonacci retracement levels valuable for spotting potential reversal points in price trends, others may use Fibonacci extensions to project future price targets. However, the effectiveness of Fibonacci methods can vary depending on factors like market conditions, timeframe, and individual trading strategies. It's crucial for traders to understand that Fibonacci analysis is just one tool among many in technical analysis, and it's best used in conjunction with other indicators and risk management strategies. Ultimately, the effectiveness of Fibonacci methods depends on how well traders grasp the concepts and integrate them into their overall trading approach, making thorough research and testing essential before implementation.