Level 2 market data is a useful tool that can elevate your trades. It provides you with better information about potential prices in the market.

There are a lot of tools that can help you navigate easily in the market. Some of these tools provide useful information to help you understand the situation.

One such tool is called "level 2 market data". This tool is like a more detailed view of the market. It shows you a list of all the buy and sell orders for a particular instrument, including the price people are willing to buy or sell at and the number of shares they want. What else should you know about level 2 market data?

What Is Level 2 Market Data?

Technically, there are various types of market data in trading. Each type offers different information for traders. For example, the level 1 market data only gives traders information about the best bid-ask quotes in real time.

On the other hand, level 2 market data could give more insights into the market activities. It shows you the best bid-offer-volume quotes in real-time, market depth, and buy and sell orders at different prices. It also reveals how many orders are waiting at different prices. In short, it can help you compose better trading analysis.

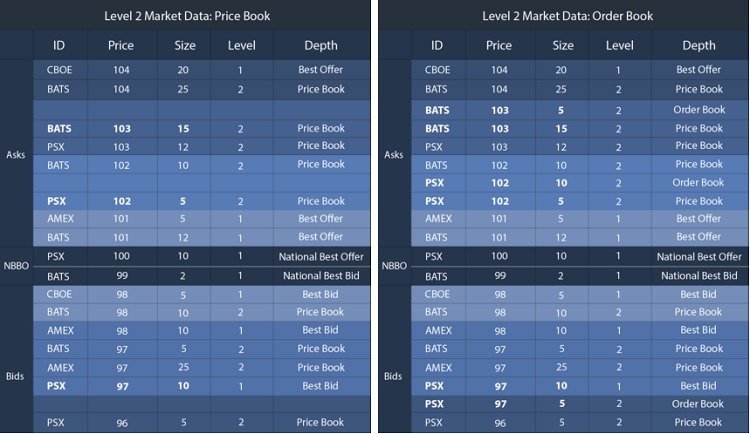

The illustration below shows what level 2 market data may look like for a better understanding.

How to Read Level 2 Market Data

To better understand level 2 market data, knowing how to read it is important. There are three factors you should understand about the level 2 market data. Those are order and price books, order size, and weighted information. Here is what each feature tells us:

- Order and Price Books: Imagine it as a list of bid and ask prices. The list has the highest bids and lowest asks at the top. The first item on each side represents the best available price (BBO).

- Order Size: Each bid and ask shows how many units of instruments traders want to trade. It also tells you which bank or market maker placed the order.

- Weighted Information: Level 2 data also shows where many bids and asks are gathered. These points are like hotspots, showing where there's a lot of interest to buy or sell. This helps traders predict what is the best way to trade the instrument.

See also: Buy/Sell Ratio

How to Get Level 2 Market Data

You can get Level 2 market data from various sources. Here are the main places to obtain Level 2 market data:

- Third-Party Data Providers: Some independent providers offer Level 2 market data services. These providers often aggregate data from multiple exchanges and provide it to traders and investors as a premium tool. Some good examples of this are Nasdaq TotalView and NYSE OpenBook.

- Trading Platforms: If you use advanced trading software or platforms, they may include Level 2 data as part of their features. Check with your software provider to see if level 2 data is available and whether there are additional costs associated with it. Some examples of this are TradingView and Bloomberg Terminal.

- Financial News and Information Services: Some financial news websites and information services provide limited level 2 data for free or as part of a paid subscription. A good example of this is the Reuters Eikon.

- Your Brokerage: Many online brokerages offer level 2 market data as part of their trading platforms. Depending on your brokerage, you may have to pay an additional fee or meet certain trading volume requirements to access it. Some brokers with good level 2 market data features are Interactive Brokers, Robinhood, and Charles Schwab.

If you're particularly curious about getting level 2 market data from a forex broker, you could perform these steps:

- Visit the broker's official website. They often provide information about the types of data and services they offer, including the level of market data.

- Contact the broker's customer support team via phone, email, or live chat. Ask them whether they provide level 2 market data and inquire about their fees.

- Some brokers offer level 2 market data as an add-on, so explore the broker's trading platform. Check for an option to subscribe to or access level 2 data.

- You can check their demo account as well. This account tends to mimic the actual features of the broker's live account.

See Also:

How to Use Level 2 Market Data Effectively?

Now that you understand the basics of using level 2 market data, it is also important to know how to make the most of these tools. Here is how you can get better results with these tools.

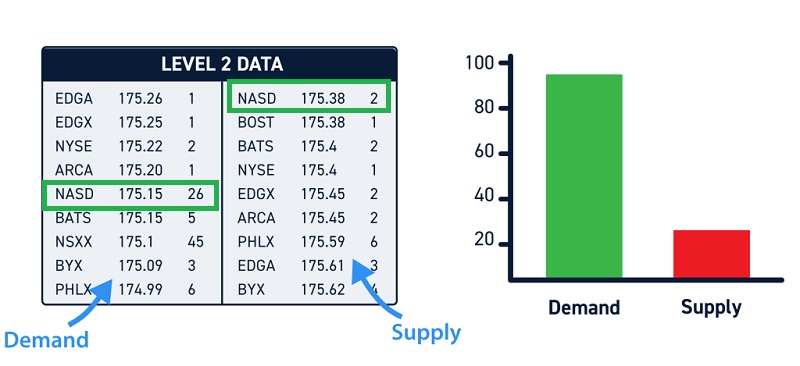

1. Use Supply and Demand

Level 2 market data allows you to see the supply and demand of the listed instruments. This tool will show you whether there are more outstanding orders to buy or sell a stock at prices around the current best bid and ask. Here is how you can use them:

The picture above is an example of how the supply and demand might look on the tools. The demand is on the left side, and the supply is on the right. Now, look at the NASD. You can see that there are 26 demands with only two supplies. That means there are more demands for this asset. More demands mean the asset has a lot of liquidity and, therefore, is better for your trades.

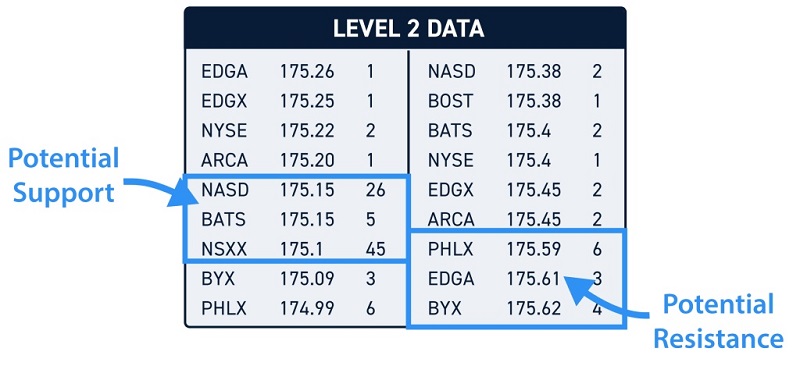

2. Find the Support and Resistance

Support and resistance are very important levels in various strategies. Many traders use this level to decide their entry and exit levels. Did you know that level 2 market data can help you identify them?

The picture above is an example of how the level 2 market data might look like. The left side shows you the potential support levels, while the right side shows the potential resistance levels. However, it is always safe to add your insights with technical analysis on the chart.

Bottom Line

Level 2 market data offers a deeper and real-time perspective on market orders, providing traders and investors with valuable insights for informed decision-making. Additionally, this tool offers several other benefits where traders can use it to spot potential price trends and reversals by monitoring order flow.

It also aids in risk management by helping traders adjust strategies based on current market conditions. Moreover, those accessing level 2 data gain a competitive advantage over those relying solely on level 1 data. This useful resource enhances your overall knowledge of what's going on in the financial markets.

The level 2 market data is closely related to DOM (Depth of Market). Brokers providing DOM are mostly capable of supporting level 2 market data. Find out more in "Top 6 Trading Platforms with the Best DOM (Depth of Market)".

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance