Stop losses are used to protect traders from losing more money than they can afford. So, let's discuss the best stop loss strategy you can try.

Every trader needs a trading plan and a good risk management system. In case the trade goes against their initial expectation, you need a stop loss order to prevent you from losing too much cash. Stop loss refers to a trading order that closes your trade once a predetermined price level is reached.

The tricky part is that a stop loss order should not be placed randomly. The ideal place for a stop loss should give enough room for some price fluctuations, but not so much that it lets you get huge losses if the price turns against you. If you place a stop loss too close to your entry-level, you could miss the chance of getting a bigger profit when the stop loss is triggered early due to price corrections. In contrast, if you place the stop loss too wide, you could lose a lot of money if the price does move against you. That is why it's vital to have the right stop loss strategy.

There are various ways to set stop loss orders, but here are some of the best strategies you can try:

- Confluence stop

- Volatility stop

- Time-based stop

- Trailing stop

- The bottom line

Let's discuss them one by one in the article below.

Confluence Stop

Confluence stop is perhaps the most common type of stop loss on the market. The term 'confluence' basically means two or more things that join or come together. In the trading sense, this means you need to find two or more signals to trigger an action. In order to find confluence, traders can combine several tools or indicators such as trendlines and channels, support and resistance levels, Moving Averages, Fibonacci Retracements, previous highs and lows, and so on.

The confluence is the meeting area where all of the signals from your indicators meet. Therefore, you should place the stop loss order around this area. Some traders recommend placing a stop loss 5 pips below the confluence point, but it actually depends on one's preference, trading style, and market condition.

However, it's worth noting that the drawback of this strategy is that traders typically use very obvious price levels with the confluence stops, which makes them vulnerable to stop runs. Oftentimes, the stops just get barely hit before the price reverses back into the original direction. Thus, if you see this happen, you can either put more confluence levels or add a little padding to your stop loss and place it outside the prominent "danger zone".

Volatility Stop

Professional traders commonly use this stop loss type almost exclusively as it is pretty complicated and requires more time to analyze the market. As the name suggests, volatility stops adapting in response to evolving market conditions.

The idea is that when the volatility is high, traders will use a larger stop loss in order to anticipate greater market swings. But when the volatility is low, traders would use tighter stop loss as the chances of the price moving quickly are less.

Keep in mind that stops and profits are always interconnected. Thus, the same method can be applied to take profit as well. In times of high volatility, it would be wise to widen your target in order to capture more dramatic price changes. In contrast, the profit target should be set closer when the volatility is low as the price won't go as far.

But how do we know exactly if the market's volatility is high or low? In this case, you can use the following tools:

1. Average True Range (ATR)

ATR is a trading indicator commonly used to determine the range of movement of an asset price. With the help of this indicator, you will be able to see the number of average movements (in pips) based on the chart that you use.

So, for example, if you use 30 ATR, it will display the average pip range for the price movement in the last 30 days. Let's say that the ATR result is 50 pips per 30 candles formed, it means that the ideal stop loss level is around 50 pips. Alternatively, you can use a risk-to-reward ratio of 1:1. So if the ATR shows an average movement of 50 pips, then you can set a stop loss and take profit at around 25 pips from the initial entry price.

2. Bollinger Bands

The second tool to measure the market's volatility is Bollinger Bands. Basically, the indicator consists of three bands at the top, middle, and bottom of the price movement. The middle Band is typically a Moving Average, while the upper and lower Bands will expand or contract depending on the strength of the trend. In other words, Bollinger Bands can give you an idea of how volatile the current market movement is.

Placing a stop loss based on Bollinger Bands is actually quite simple. First, draw a straight line from the upper band to the lower Band. Then, find out the "distance" in pips to show the current volatility level and the ideal location to set your stop loss. Say the volatility level is 76 pips, then it's best to put the stop loss in 76 pips as well.

Time-based Stop

Time is another factor that you should think about when placing a stop loss. But keep in mind that this approach can't be used alone, so it's best to add it to the confluence or volatility stop to minimize the risk further.

The purpose of a time-based stop is to know when is the right time to exit a trade, especially if there's a long phase of inactivity and sideways movement.

Sometimes, a price action pattern or other technical signals would suggest that the price will move drastically, but in reality, the price just hovers around and moves sideways for hours. When this situation occurs, time-based stops would suggest that it's best to exit the trade and wait for the next trading signal rather than wait and hope for something to happen.

Another situation where a time-based stop can be helpful is when you open a position and the trade goes against you straight away. If you enter the trade hoping that the price will go higher but it doesn't move as expected, it's usually best to just exit the trade immediately. Time-based stops can help you realize that, so it will help you avoid uncertain and unprofitable trade scenarios.

Trailing Stop

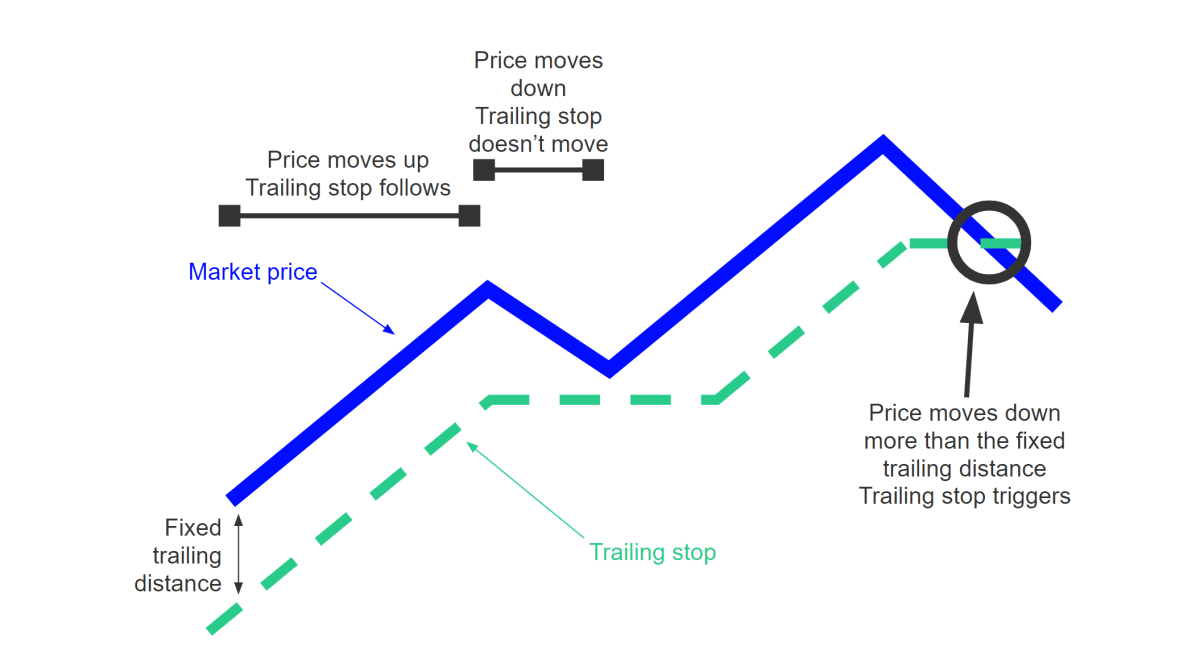

Apart from protecting you from losing money, stop loss can also be used to lock profits. This is important because as the price moves, your profit increases, but you might lose it all if the price suddenly reverses and drops fast.

As the name suggests, trailing stops will trail the market movement by fixed amounts. So if the price moves toward profit, the trailing stop will move alongside the market price. This means the percentage of loss that you're willing to tolerate remains the same. If the price reverses and moves against you at some point, the trailing stop can protect the profits you've earned before. That being said, the purpose of trailing stops is to protect the profits from getting back to zero or even minus.

Here's how trailing stop loss basically works:

Some trading platforms, including MetaTrader 4, provide a trailing stop to help traders lock their profits. This is very convenient as it can automatically trail the stops and save profits. However, if your trading platform does not support automatic trailing stops, this technique can be quite a struggle if done manually. You would have to keep your eyes on the screen at most times and manually reset the stop losses.

The Bottom Line

Stop loss levels are not supposed to be placed at random locations. Where you place a stop loss is a strategic choice that should be based on a specific approach or method. There are various strategies to use, but it's important to pick them depending on your trading style and market condition. For instance, day traders would want to place their stop losses close to the daily price range so that when the price suddenly reverses, the stop loss could instantly save the trade. In contrast, those who use the swing trading method would prefer their stop losses as wide as they can expect the price to make more significant moves.

Your task is to find out what strategy works best for you. You can write down questions related to your stop loss strategy, such as whether you have an alternative strategy if the first one doesn't work or how you will manage the risk of the trade. Lastly, make sure to test out the strategy on a demo account so you don't risk your money just to try out a few strategies.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance