Trading signals are created to give ideas and recommendations to enter the market, but are they really helpful? Should you use them in your strategy?

Forex trading is no easy business. There are several factors that might contribute to your success as a forex trader, such as skill, knowledge, emotional stability, and experience. It's also pretty obvious that every trader needs to have a solid trading strategy in order to keep the trade on the right side of the spectrum. But what about trading signals?

Nowadays, there are loads of popular tools and indicators that claim to be the best solution for traders to grow their account balance. The question is do we really need them to find trading opportunities and are they always accurate in providing signals? Here's a complete explanation to help you get started.

Contents

What is a Forex Trading Signal?

Forex signals are a common concept in forex trading. They aim to solve the most critical activity any trader has to do – to find profitable trading opportunities at the right time. By definition, a forex trading signal is an idea or recommendation on a specific currency pair to be executed at a certain time and price. You can use these signals to help you decide when is the right time to enter or exit your trade. So, regardless of your level of expertise, trading signals are supposed to enhance your trading performance and give you the chance to increase your profitability.

Trading signals come in all shapes and sizes, and although they are generally used in the forex market, trading signals can actually be used across many different trading assets. It is worth noting that most trading signals are not free, so you will have to pay a monthly subscription. You can look for free signals if you're really interested, but surely there are limitations that come with it.

The Benefits of Using Trading Signals

Forex trading signals are made to enhance the trading activity of any type of trader. To start with, they allow traders to use different strategies in the market. Forex traders can choose to use any strategy and forex signals can still provide trading opportunities for each one.

For novice traders or beginners, trading signals can be beneficial because they can learn how the market works while still making money with their trades. In fact, it is a pretty good method to learn market analysis as traders can understand the logic behind every recommendation they receive. Some trading signals actually come with reports that explain the details and breakdown of the recommendation, so traders can learn from them and build a better understanding of the market. Without such knowledge, you can easily make mistakes that could lead to significant losses.

Furthermore, trading signals can also save traders' time. The forex market is open 24/5 and there are many opportunities available around the clock. However, the truth is that not all traders have the time in front of the computer to find all of these opportunities. It is almost impossible, to catch such detail every single time without missing any chances. Therefore, forex trading signals can help traders to maximize their limited time by providing the best trading suggestions. This way, traders are able to manage their time better in order to take full advantage of the market.

The Risks of Trading Signals

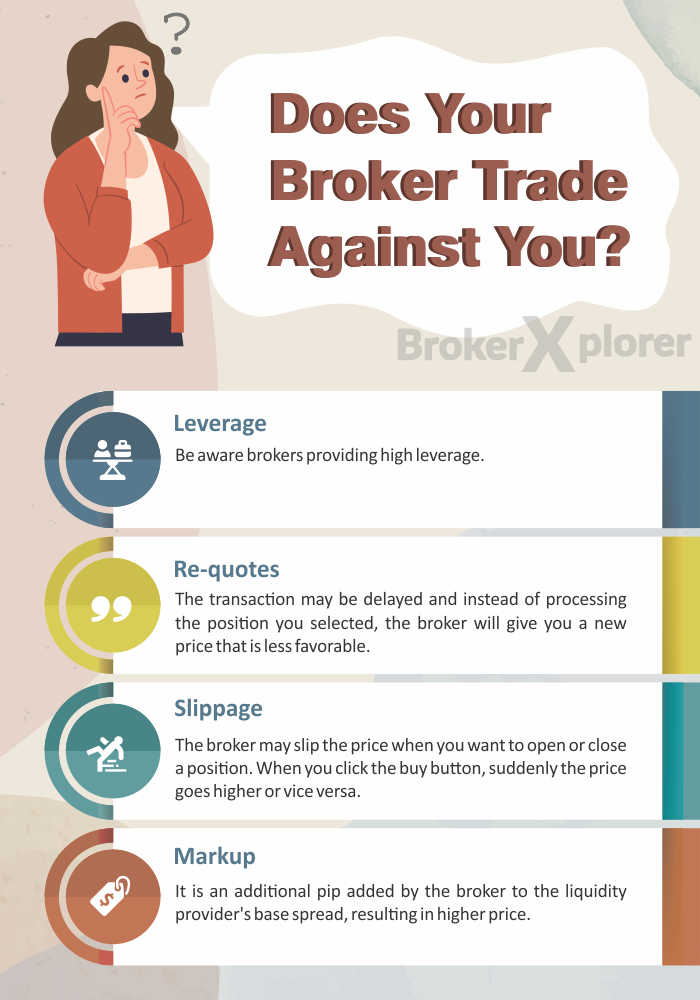

It is important to note that trading signals are as risky as they are beneficial. They are also subject to market risks, so you need to use them carefully. Keep in mind that not all trading signals are high quality and accurate. Trading signals give out trade-related recommendations, so you would assume that they are provided by experts who are already familiar with the market through and through. However, this isn't always the case.

Some signal providers are not regulated, so there's no guarantee that the signals are reliable at all. Even with regulation, there's still a chance of getting false suggestions.

One of the most popular places to come across a signal scammer is Instagram. The issue is that most of them don't have the knowledge or experience to give out trading recommendations, but they trick their followers by posting about their successful lives and high-class lifestyles. In reality, their income is generated from the commission they earn by luring innocent traders to sign up for shady platforms and products.

The Guardian even has a specific term to describe this phenomenon as "the wolves of Instagram", particularly referring to the case of Elijah Oyefeso who is known to have started the traders of Instagram subculture. Said "influencer" basically used his platform to offer thousands of his followers (who were mostly young people) a chance of earning money without any experience needed. He charged them around £69.99 a month and sent them messages about what to trade next in order to become a millionaire like him. Little did they know, all of those products were unsafe and only beneficial for him as the paid marketing affiliate.

Do Trading Signals Really Help You?

The answer is that it depends on where you're getting them from and your attitude to risk. If you use unreliable signal providers or individuals, then it's definitely not worth your time and capital. But if you use trading signals from regulated providers with good track records, you might want to consider using them for your trades.

It's worth noting that forex trading signals are merely suggestions, meaning that you can choose to use or not use them in your trade. In another word, you still have the power to control your trade and lead it in the direction you want. This is why you need to weigh the risks and make sure that you're confident with the signal before actually adopting them.

However, some traders prefer to give up that control and fully trust the expert behind the signal provider to handle their money. This practice is called copy trading, which basically requires you to bind your account to another trader so that you can automatically copy their strategy. You are allowed to customize your trading style, asset type, stop loss and take profit orders, and trade size, but other than that, you must leave the execution to the trader you copy.

Completely trusting another trader to control your money is actually quite a risky move. If they make a fatal choice, you could lose a huge amount of capital and there's nothing you can do about it. You won't be able to stop that until it's too late to realize.

Another problem is regarding the accuracy of the trader's profile. When it comes to copy trading, surely you'd want to leave your money to someone with a good track record. But what happens if you find that the information on their past performances is often hypothetical and not based on actual events? For your information, their data could be taken from demo accounts that don't require real money.

The next factor to consider is the cost. We've mentioned that most trading signals are not free. You need to think about whether the overall cost is worth it compared to the help that you will get from the signals. Remember that you might even not be making any profit since you need to pay the subscription fee. This means you would have to generate a huge amount of consistent profit in order to break even. You can look for free signal providers, but there might be some extra effort that you need to put in.

The EndNote

All in all, the decision of whether you should or shouldn't use trading signals depends on your trading goals and ambition. Trading signals might be able to provide useful insights and help you identify hidden trading opportunities, but they are also risky. Some traders prefer not to use trading signals because they refuse to make a decision based on a suggestion by a third party. If your trade ends up successful, you'll get to enjoy the full advantage and celebrate your win; yet if you lose, you'll be the one to bear all the losses, not the signal provider.

Before you go, here are some recommendations to help you take full advantage of trading signals:

- You'll need to make sure to choose a reputable broker or platform. A good broker will ensure the reliability of the forex signals that it provides, so you'll have a better chance of winning.

- Before registering with a signal provider, make sure that you can test their trading performance. Some providers offer a trial period or demo account that you can use to run a back-test and observe how the software would have performed in various market conditions.

- Make sure to customize your trade well according to your trading capability and preference. You need to make sure that the signals match your strategy and are able to improve your trade's profitability. Just take your time to modify the charts, choose the right signals, and consider the risks for your trading journey, both in the short-term and long-term.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance

10 Comments

Bellinda

May 20 2022

Can I use forex signals on my phone?

Divany

May 26 2022

Bellinda: Yes, you totally can! There are many great mobile apps that provide forex signals, such as eToro and ZuluTrade.

Vanessa

May 23 2022

Are free trading signals good enough?

Divany

May 26 2022

Vanessa: They may or may not be. You need to make sure that the signal have a proven track record before using it. Remember that some free signals may not be completely "free" anymore in the long-term because they could potentially make you lose money.

Barton Wilder

Jun 3 2022

Which broker provides the best trading signals?

Divany

Aug 15 2022

Barton Wilder: In the context of trading signals, here are some brokers that you could try: eToro, Learn2Trade, and FXTM. As for signal providers, you can go for 1000pip Builder.

Juliette

Jun 18 2022

What are the types of trading signals?

Divany

Aug 15 2022

Juliette: There are several categories that you can use to determine the type of a trading signal, some of them are manual and automated signals, paid and free signals, and entry and exit signals.

Marco Dienary

Jul 5 2022

Which currency pair is the best to use trading signals on?

Divany

Aug 15 2022

Marco Dienary: Essentially, trading signals can be used in all currency pairs. Just remember that trading signals are subjet to market risks, so you need to be able to limit them accordingly. For instance, highly volatile assets should be traded with smaller lot sizes, and vice versa.