To master trading psychology, there are six essential keys that you should be aware of. Those include having faith in your strategy to steer clear of greediness.

Emotions are an inseparable aspect of trading. However, this does not mean that emotions should entirely influence trading. As a good trader, it is mandatory to master trading psychology to control your emotions. If not, emotions can carry you away and make wrong decisions.

Many risks lurk if you cannot control your mental state while trading—for example, being too hasty to follow a trend because of FOMO or, on the contrary, closing positions too quickly due to fear of loss. Such things can cause traders to experience significant losses because of their emotions.

How to Master Trading Psychology?

There are six steps to mastering trading psychology. Those include trusting your strategy, facing the risk of trading, avoiding seeking too much information, learning from past mistakes, applying a trading plan, and avoiding greed. Why are these steps important, and how can they improve a trader's psychology? Here are the explanations.

1. Trust Your Strategy

A common mistake traders make is to change their strategy too frequently. Instead of achieving good results, traders become confused because of their strategies. This is quite common among novice traders. Usually, they have just gathered a lot of information about trading from various sources.

They have also prepared themselves with various trading strategies to face the market. However, they were surprised when they entered the market because their strategy did not work as expected. To overcome this, they hurriedly switch to a better strategy. However, the market still does not favor them and they lose twice.

Such a situation can be easily overcome if the trader believes in their abilities. If the strategy has been thoroughly calculated, have confidence in the trading results. Don't make hasty decisions because panic will lead to significant losses. If the strategy does not yield the expected results, learn from it.

Find out what caused the trading results to fall short of expectations. That's where the trader can find the answer. If you are unsure, you can always backtest your strategy first.

2. Face the Risk

Sudden fluctuations in market prices can occur at any time. Regrettably, many traders tend to panic when faced with such changes. Typically, this is because they are unwilling to experience any losses.

However, being courageous in confronting risks is one of the essential aspects of mastering trading psychology. Numerous traders hastily close their positions due to fear, only to regret it when the price moves favorably.

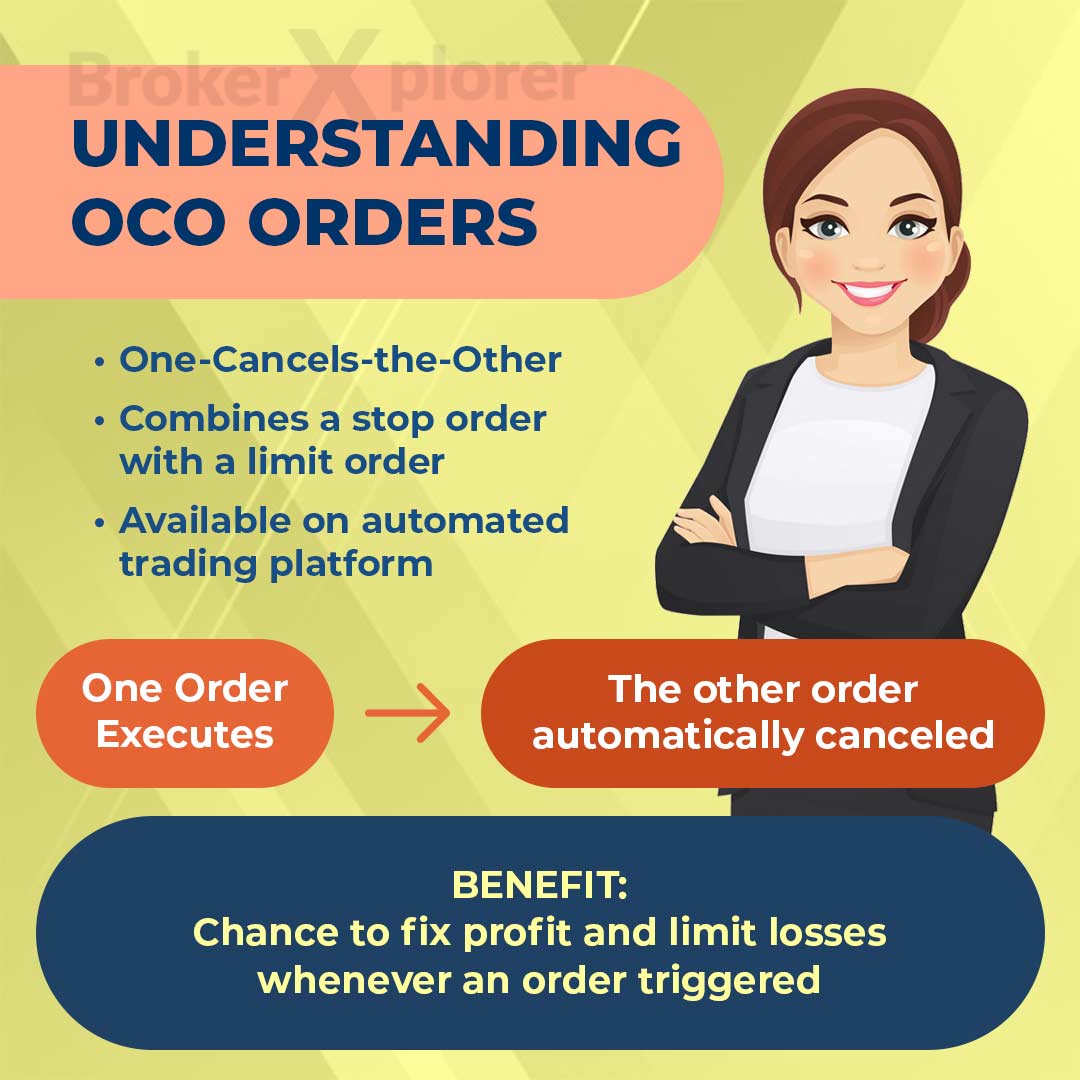

To mitigate such risks, traders are advised to apply good risk management. This can be done by setting Stop Loss and Take Profit orders. It is crucial not to set these orders too close to the entry position.

Additionally, traders can calculate their risk/reward ratio to predict the ratio of potential profits to losses. While protecting oneself from risks is crucial, it is equally important not to become overly conservative in trading.

3. Avoid Seeking Too Much Information

This point may seem a bit unconventional to some traders. After all, isn't more information always better?

Information can indeed support trading analysis to make it more accurate. However, seeking too much information can make it difficult for traders to digest. Often, the received information may contradict each other. When this happens, traders confuse their analysis instead of becoming more accurate.

The key to mastering trading psychology is to seek just the right information. This can be achieved by filtering the sources of information. Look for the latest news through reputable websites or professional analysis. In this way, traders can ensure that the quality of information they receive is always maintained.

With reliable sources, analysis results can be more accurate, and traders can feel more at ease when opening positions.

4. Learn From Your Mistake

One of the important aspects of mastering trading psychology is having the willingness to admit errors. Though it may seem trivial, this attitude can aid in a trader's personal growth.

Making errors while trading and resulting in losses are common for all kinds of traders, regardless of their level of expertise. However, traders who cannot manage their emotions frequently blame the market for their losses. This prevents them from learning from their mistakes and repeating the same errors.

It's important not to be overly confident in one's abilities. Instead, acknowledge any mistakes and investigate their causes. By doing so, traders can learn how to enhance their trading abilities and handle problems more rationally.

Always maintain a positive mindset when dealing with the market and believe there is always a solution to any challenge. Traders can enhance their ability by learning from many sources, such as broker's free classes.

5. Apply a Trading Plan

Another important aspect of mastering trading psychology is to implement a trading plan. While this term may be familiar to many traders, some underestimate its significance. However, traders can improve their trading discipline by applying a trading plan.

It is crucial to adhere to the rules established in the trading plan. Traders should not deviate from their planned actions. For instance, if a trader plans to set a stop loss of 10 pips below the entry point, it is essential to stick to this rule.

Breaking a trading plan can lead to chaotic trading activities. Traders may continue disregarding the established plan and disrupting their schedule. Ultimately, the funds invested in trading may be lost due to disregarding the trading plan.

Creating a trading plan is relatively straightforward as long as traders have clear goals for the positions they want to open. Additionally, there are now many trading applications available in the market, both free and paid, that can assist traders in implementing their trading plans.

6. Avoid Greed

Avoiding greed is a crucial aspect of mastering trading psychology. Unfortunately, many modern traders lack this quality. For instance, even after hitting the take profit point, many traders hesitate to close a position when the price rises because they want to make even more profit.

However, this can be highly risky because there's a chance that the price will reverse and eat away at the previously earned profit. Ultimately, traders can suffer losses by being too eager to make more profit.

Greed can result in overtrading. When traders want to earn large profits quickly and make transactions outside their plan, they might not properly calculate and manage their money. They may forget that the more transactions they make, the greater the losses they may incur. It's important to plan and decide how much money to spend and stick to it. That way, traders won't spend money irresponsibly.

Conclusion

Trading psychology pertains to the thought patterns, emotions, and mental conditions traders go through when participating in trading activities. For this reason, mastering trading psychology is very important. Proficiency in trading psychology can greatly influence a trader's ability to make sound decisions and succeed in the market.

By applying the six aspects mentioned above, traders are anticipated to enhance their trading performance and achieve their desired success.

Trading psychology is an important factor for not only professionals but beginners as well. What are the basics of trading psychology for novice traders?

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance