If applied correctly, channels could provide useful and powerful signals for buying or selling in accordance with the prevailing trend.

Channels in forex trading are often used in technical analysis to determine trend directions and look for buy or sell entry levels to an extent. A channel consists of two parallel lines. The top line indicates the potential resistance area, whereas the bottom line indicates the potential support area.

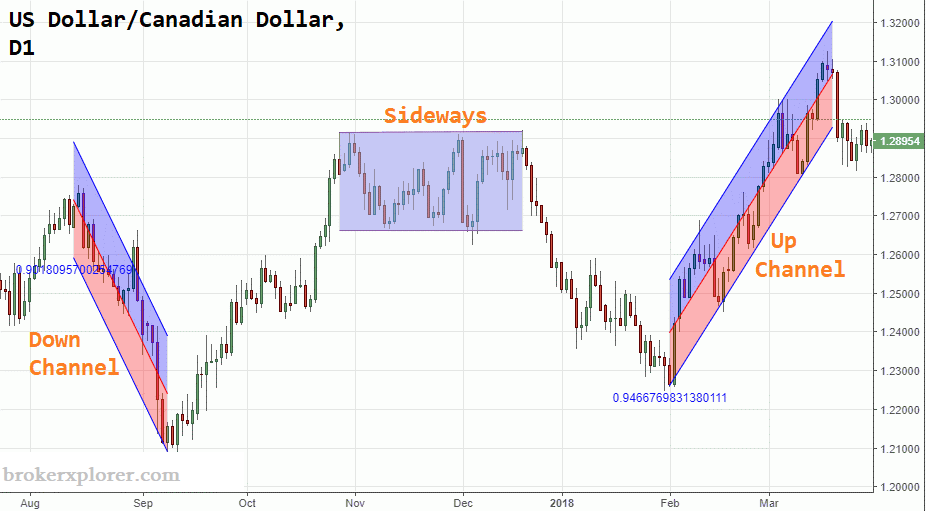

Based on the shape, there are three types of channels:

- Rising channel or ascending channel (occurs when the price is in an uptrend).

- Falling channel or descending channel (occurs when the price is in a downtrend).

- Sideways channel or horizontal channel (occurs when the price is ranging).

Here's what it looks like on the chart:

How to Draw a Channel

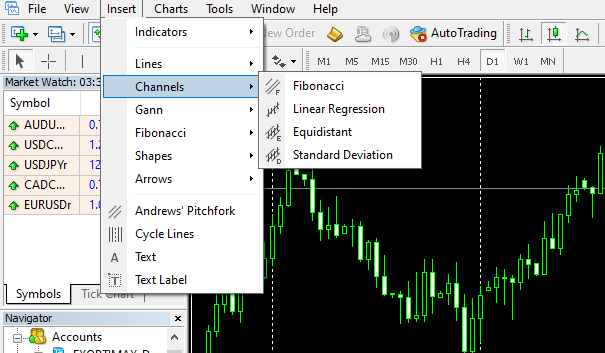

Typically, you can just easily draw channels on your trading platform that are provided by the broker. For this demonstration, we're going to use the MetaTrader platform charting feature.

First things first, open the platform and hover on the "insert" option on the top part of the screen. Pick "channels" as shown in the picture below.

Most trading platforms offer multiple channel types to draw, but in order to create simple channels like the ones we use in this article, you only need to use the Linear Regression Channel. So the next step is to click "Linear Regression" and then the high and low points on the chart, based on the following rules:

- Draw an ascending channel if the price is in an uptrend, meaning the price is making new higher lows and higher highs. Draw a line that connects at least two lows by dragging the mouse, then draw another line in parallel to that first line. Adjust the position so that the line touches at least one high.

- Draw a descending channel if the price is in a downtrend, meaning the price is making new lower highs and lower lows. Draw a line that connects at least two highs, then draw another line in parallel to that first line. Adjust the position so that the line touches at least one low.

- To create a horizontal channel, simply draw lines that connect at least two lows and two highs. If you make a mistake when setting the high and low points, you can just drag it later until you find the right channel shape.

Things to Consider When Drawing a Channel

- There is no exact rule when it comes to creating a channel in forex trading, but essentially, the steeper the angle of the channel you make, the less valid or reliable it will be. This is because sharp price movements, whether it's going upward or downward, have a higher chance to break your channel.

- A channel's resistance or support lines are not always fully accurate because they only indicate areas (range), not the exact level.

- Channels that are often tested and proven to be hard to break are considered more reliable or valid.

Trading with Channels

Traders usually trade with channels by opening a sell order around the resistance area or opening a buy order around the support area. It's also important to set a tight stop-loss order to minimize the loss if the price moves against you and breaks the channel unexpectedly. Meanwhile, the profit target is set on the opposite side, usually near the support or resistance.

Take a look at the chart below.

To confirm the signal, you can use technical indicators like Moving Averages or oscillators like RSI, Stochastics, etc. Apart from that, you can also observe the candlestick patterns near the resistance or support levels.

Keep in mind that price movements in the forex market are unpredictable most of the time. Even if you're confident that the price will move in a certain way within the channel, there's no guarantee that it won't break and move outside the channel. This is why you need other methods to confirm the trade and minimize the chance of getting losses.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance

10 Comments

Yerim Kim

May 15 2022

Can we use channels in financial markets other than forex?

Divany

Jun 30 2022

Yerim Kim: For sure! Channels can be used to identify trends in various markets, such as stocks, commodity, ETF, and forex pairs.

Bernard Quinn

May 23 2022

What is the difference between channels and trend channels?

Divany

Jun 30 2022

Bernard Quinn: The two terms actually refer to the same concept. Channels in forex trading are also often known as trend channels or price channels, so you can use these terms interchangeably.

Sicillia

Jun 23 2022

When is the best time frame to use channels?

Divany

Jul 18 2022

Sicillia: Like most indicators, channels in forex trading can be used across multiple time frames and you can choose the time frame based on the trading strategy that you use. However, keep in mind that trading channels may look differently depending on the time frame you choose.

Brandon Wells

Jun 30 2022

How to determine the best exit point when trading with channels?

Divany

Jul 18 2022

Brandon Wells: If you have opened a long position at the bottom of the channel, then exit near the top of the channel. if you have taken a short position at the top of the channel, then exit near the bottom of the channel. In the meantime, set your stop loss slightly below or above your entry point to make room for volatility.

Vinerella

Jul 2 2022

Do channel lines always have to be parallel?

Divany

Jul 18 2022

Vinerella: When drawing a channel, both trend lines must be parallel to each other. However, it's important to remember that you should never force the price to fit to the channels you draw as it could lead to bad trades.