If I have to say what matters the most in Forex trading, honestly it's going to be profit-taking. That's why you need to learn how to Take Profit.

If I have to say what matters the most in Forex trading, honestly it's going to be profit-taking. I mean, making a profit is the first thing that comes into your mind when you do Forex trading. That's why you need to learn how to Take Profit!

Measure how much money you can make by learning Take Profit. But the truth is, many beginners still don't know how to take profit properly.

In a nutshell, it's a price level entry at which you'll exit and liquidate a running position. In your daily lingo, it's like an "X-mark the spot" in treasure hunting, yes, that final spot where you claim your trophy.

Take Profit will automatically close any position just when the price is reaching the designated profit level. This is quite beneficial as you may not be able to watch the chart all the time and close it manually. It's a neat feature if you ask me. The bottom line is, it's an automatic profit-taking system where you don't have to glue your eyes to a chart. Leave it and be free from all forms of emotional intervention. Let me illustrate it by actual demonstration:

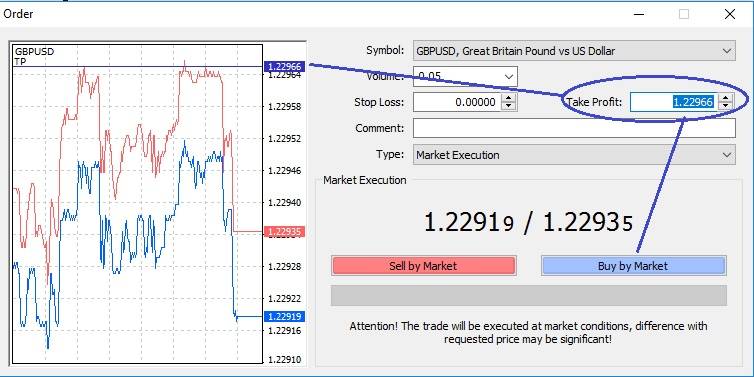

So, Thomas wants to set a Take Profit, but before he can do that, he needs to make sure where his current price level is. In the picture above, the current bid price is at 1.22919. In order to make Take Profit works, Thomas has to set it in accordance with his initial position.

- Scenario number one; Take Profit for a long position. If Thomas is going to open a long (buy) position, then he would need to set Take Profit higher than the current ask price (1.22935). By doing so, Take Profit will lock his gains when the market price rises to his Take Profit level.

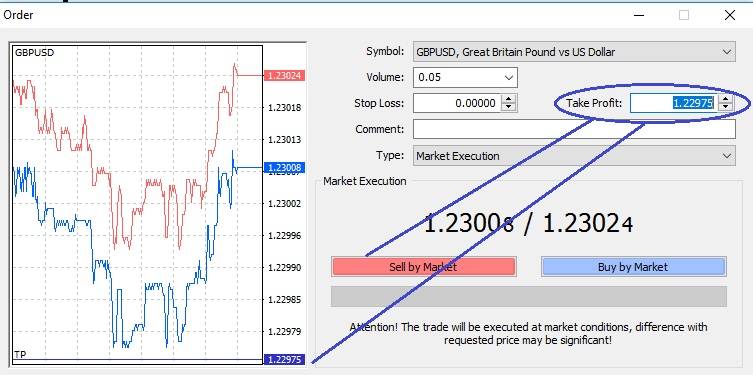

- Scenario number two; Take profit for a short position. Should Thomas open a short (sell) position, he'll set take profit lower than the current bid price (1.23008). Therefore, Take Profit will automatically secure his gains when the price slings down to his lower target level.

Why does Take Profit Matter?

Your proficiency at using Take Profit can make a big difference in setting apart losing or winning trades. That's because the market is rather unpredictable when it comes to volatility. At such a moment, the price can bounce up, down, and back up again in a relatively short amount of time; possibly turning your once green number gains into reds without prior warning.

I mean, you're not going to make any success at profit taking if you let market beats you at each turning point. To anticipate that volatile price movement, you must lock your profit by setting a limit, which is Take Profit. So, once the price hits your targeted Take Profit level, it will immediately secure the gains.

Secondly, it can also help you to remove emotional intervention from your running position(s). That is possible if you leave the terminal and letting the price movement reach your take profit according to your trading system. In turn, it helps you build a consistent approach to risk vs. reward management.

Conversely, without Take Profit, you'll suffer market whiplash at reversal points. Also, you are more likely to make an emotional decision as you keep watching market price goes this way and that way, resulting in a premature exit.

Where to Take Profit?

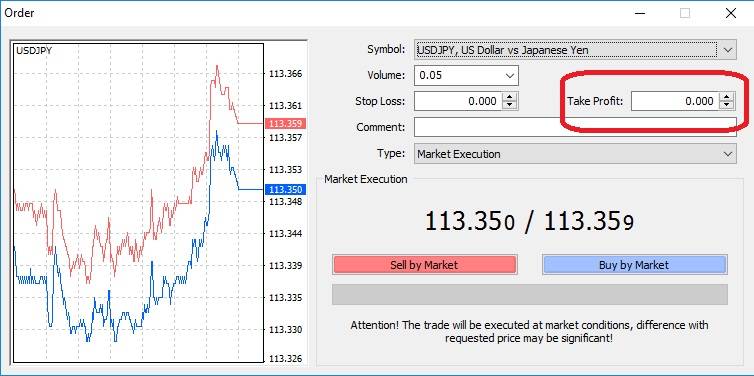

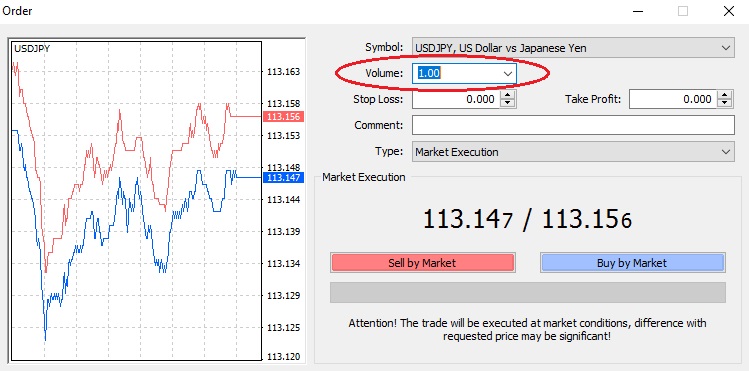

You can set Take Profit from either a trading terminal or via broker's phone call. The former option is way more popular, though. Anyhow, if you choose the latter one, you can simply call the broker's support line (or a fund manager) to stop the position once it hits your target price level. So, if you got a trading terminal like MT4 or sorts, press F9 to bring up the market order interface. Like so:

Look at the bright red rounded rectangle, that is where you can input your Take Profit price level. Meanwhile, it may look slightly different on the other trading terminals, but the essence and basic function remain the same. Be careful with your Take Profit price level, don't set it way too far or too near from your entry-level.

If you set it too far, it won't be effective as the price may not reach your Take Profit target. Conversely, if you set it too near, your position will be stopped way too soon, meaning that you'll lose potential gains.

How Far Should You Set Take Profit from Entry Price?

This can be either a simple or rather difficult question to answer, depending on your experience with Forex trading. Obviously enough, you should use Take Profit whenever you open a position. More importantly, it hinges on how precise you can predict market price direction.

I mean, setting up Take Profit takes more than just randomly inputting target price levels. Instead, you should be able to calculate how far you can stretch its value according to market conditions.

For instance, when the market is trending with strong momentum, you can stretch Take Profit level much farther from its entry price. In that regard, you may try to target hundreds of pips away from your Take Profit goal. On other occasions, the market can also enter the consolidation period.

During that period, it's rather wiser to set your Take Profit considerably narrower to your entry-level. Let's say, it's about 10 to 20 pips away.

Furthermore, the market condition isn't the only factor you should consider. There's also a trading style as well. If your trading style is quick and frequent Scalping, you'll usually set narrow Take Profits for each position. Contrarily, if your trading style is swing trading, you'll make fewer positions but each position will have way farther Take Profit target level.

Read More: How to do Scalping Like a Pro

How Big is the Success Rate of Take Profit?

The success rate for each position to hit Take Profit level lies in probability. In essence, even the best Take Profit setup isn't guaranteed 100% to work all the time. Even so, a high success rate Take Profit setup isn't absolutely necessary. Still, you can manage a good income even with a low success rate.

To better illustrate it, let's take this daily-life example:

You are going to throw two six-sided dies against the house. The house offers two options for the reward; low rolls (2-12) or high rolls (13-24). To sum it up, each option yield roughly 50% to show up.

You know that you only have about a 50% win rate, which is rather low. But here's the catch: to make profit you only have to make income bigger than your loss. To do so, you can limit your losses with Stop Loss, the counterpart of Take Profit. With Stop Loss, you can limit how much money you can afford to lose.

Therefore, you can manage to make each position ends up with higher gains that cover losses from half the total positions (50% chance). We'll learn more about how to set up Stop Loss along with Take Profit later on. So, keep reading and cheers!

Read More: Don't Wait! Learn Forex Stop Loss Before It's Too Late

When to Use Take Profit?

Obviously every single serious trader needs to use Take Profit. Whenever the opportunity comes; no matter how experienced or how much you have gone through personal trading, Take Profit is indispensable. So be it from beginners to professionals, you'll always be better with Take Profit. However, there are special cases when you can forgo Take Profit.

First, that special situation occurs if you're position trader with a massive amount of capital at stake.

I'm not talking about your average-Joe rich retail trader, it's way bigger, and the amount of capital can reach staggering bulks of actual non-leveraged (1:1) trading lots. In that situation, position traders (most likely hedge funds and investment banks) can expose their massive capital to float indefinitely with "controlled" risk and in doing so they become liquidity providers.

Their massive capital enables them to endure market volatility even during low liquidity period.

So much so, they'd often hold their trading position(s) to outlast their counter-traders. In other words, their huge capital can survive sudden reversals while their opponents already suffer from losses. Now, you know who your liquidity providers actually are. Yeah, those big fishes!

Secondly, you may waive using Take Profit if you're using Scalping method during news release

This way, traders are forced to either use preset profit taking levels or none at all. That's because they simply don't have that window of time to slow down and set Take Profit. In fact, they have to be and reactive, open position(s) whenever a momentary pullback presents itself.

During that short amount of time, pullbacks usually lead to a readjustment of current trend. Simply put, if a pullback occurs from a current rally, it has a high chance of resuming its trend. On top of that, volatility during news release occurs rapidly. That's the main reason why news trading Scalper has to be quick as they can't afford to lose any moment.

In the long run, Scalping during news trading does more harm than good to your capital exposure. Mainly because it's very risky and rather difficult to manage with manual Take Profit.

But then again, you are a retail trader with limited capital. So, don't try to mimic their trading strategy. Always use Take Profit whenever you open any position.

The Method

Now that we're done with the introduction, we can move to a more complex subject; the actual step to determine the Take Profit target. At this section, I'll walk you through step by step practical guide, starting from how to find the "sweet spot".

1. Identify the Sweet Spot

Sweet spots are the range of price levels which most traders or investors think where the market is going to head. Bear in mind, these price ranges aren't set in stone. It will move dynamically according to the power of the masses. Especially when either buyer or seller just recently shifts in balance or when one side dominates the other. So, with that said, the first step you should do is to identify where the sweet spots are:

Fundamental Take Profit Levels

Fundamental Take Profit levels are price ranges suggested by fundamental analysis. As fuzzy as it sounds, you will often come across senior analysts stating their rough estimates (price ranges) for certain pairs or assets. That, if you follow those economic pundits on a daily basis.

According to their fundamentals, some analysts may come up with various or even contradicting predictions. But that's okay, it's pretty much natural for them to put out arguments. The real pains start when you actually put your faith based on their prediction. You may as well praise them like a god or keep the resentment to your grave.

Here's an example:

Janet is an expert Forex analyst. To maintain his credibility, she regularly posts daily Forex report and market analysis. And so, today she states that USD/JPY will soar to its highest previous quarterly levels. On her analysis, she says that the price will break consolidation ranges, and resuming bullish trend to 118.5oo in USD/JPY pair. Of course, she backs her statements with this and that fundamental, just to name a few.

Now, you can either take all her words plain and simple or challenge it with your own view. If you think the goal is too far-fetched, probably you are right. Remember, the expert analyst is ballparking their prediction toward their investors, which may not suit your own Forex trading profit taking strategy.

My suggestion; it's your own money on the line, you are the one that shall have the final say.

Technical Take Profit Levels

If you like independence and accuracy, technical Take Profit levels are your best bet. You will draw out your own price ranges according to your chart. Meaning that you'll deal with Price Action, Resistance, and Support level from past price movement.

Look at this chart below:

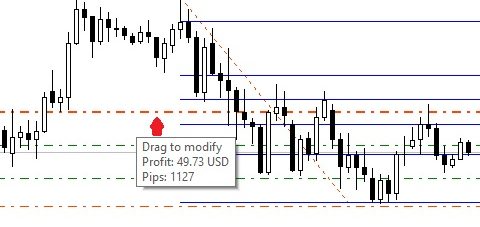

As you can see in the chart above, technical analysis can help you to predict where the price will likely end up. Look closely, the price bounces inside two horizontal lines. Those lines are support and resistance levels.

Next, you can anticipate two scenarios when market price about to close in on either of those horizontal lines:

In the first scenario, you'll anticipate that the price will bounce again, making U-turn.

Take a look at the circles, within those ellipses, certain price action patterns are forming. If you spot one prominent pattern, prepare to set Take Profit level inside the range of those two horizontal lines.

For instance, if you see a pin bar shaft touching resistance limit (red lines), get ready to sell and place Take Profit level anywhere above the support level. The opposite is also true, prepare to buy and set Take Profit anywhere below resistance when you see a pattern forming near the support.

You can also use Fibonacci retracement to guide your Take Profit level. When a bounce happens, it usually retraces from 38% to 78% of its previous trend. So, you may set your Take profit between 0.382 to 0.786, like this picture shown below:

On second scenario, breakout does occur.

Breakout is sudden surge of trend formation as the price breaks away outside the horizontal limit. This is a bit more tricky as you try to catch the initial formation of a strong trend. The key is the trading volume. When you see a sudden rise in trading volume, either the buyer or seller is trying to dominate the market.

You can spot trading volume below the candlestick. They usually take forms as vertical bars with varying heights to indicate market trading volume. If those bars gain sudden sharp heights, you should anticipate a possible breakout.

Next, set your Take profit level with this breakout trading strategy. Be wary though, breakout strategy is rather risky for beginners as there is no clear profit taking stops when this breakout happens.

Even if you're content with technical Take Profit levels, doesn't mean that you can overlook fundamentals completely. Especially if you find out that fundamental levels intersect or come near to your technical levels. On that occasion, you should exert more caution as the market may react to those sweet spots.

2. Manage Risk Reward Ratio

Let me tell you a hint; Forex trading profit taking ain't gonna work if you skip this essential part. There's a principal truth about general investment, big returns are mostly gained from high-risk assets. So, you have to face a higher risk in order to make higher Forex trading profit.

However, taking possible risks isn't the same as accumulating unnecessary losses. Risk vs. Reward ratio guide you to make more profit than losses. In order to do so, you'll have to measure how big is your risk appetite and starting capital is. Let's start with risk appetite. Each trader is subject to their own risk tolerance, so each trader may prefer a different risk level.

For example, one trader is willing to take high risk, seeking every opportunity aggressively. On the other hand, another trader can't afford to lose all his deposit, so he's doing Forex trading conservatively.

Furthermore, starting capital also plays a huge part. Bigger capital means that you can hold your position much longer. Ultimately, you may hold it long enough to reach Take Profit level. Lastly, it mostly hinges upon your trading system win rate. A higher win rate usually follows a strict and tight risk vs. reward ratio.

In contrast, a lower win rate can still work with a large reward ratio, so the winning positions can compensate for losing ones. With all those factors combined, you can start to measure how much profit you should make to offset the risk. Here's how:

Risk only a small portion of your trading capital for each position.

Risking only a limited amount of capital to open each trading position is necessary. By doing so, not only that you can save your account from total loss, but also making profit-taking easier to manage.

There's a golden rule of thumb for this. You should invest about 2% of your starting capital for each position. But this isn't an absolute. Still, you can flex the number according to your risk appetite. For example, you start with the US10,000, so each position is worth about US200.

Next, determine your risk vs. reward ratio. If you haven't figured it, start with a 1:1 ratio. With that in mind, you can stretch (drag) Take Profit and Stop Loss limit to be as far as you can afford to risk.

Use position sizing for each open position

Position sizing regulates just how much trading lot is exposed for each position. The bigger the trading lot, the bigger the profit and the risk that comes with it.

First, set the trading volume (lot) according to a targeted Take Profit level. For instance, you can only afford to risk about US200 for each position. By then, you should know that in standard forex account each pip is worth about US10.

So, if you set the trading volume at 1, then it only takes 20 pips movement to reach your Take Profit level. On the other hand, if you set volume (trading lot) to be smaller than 1, then it will take much longer to achieve Take Profit. For example, if you set the volume to be at 0.5, it takes 40 pips movement to attain the US200 Take Profit limit.

At first glance, you may think that a bigger lot accrues profits much faster than the smaller one. Unfortunately, the risk is also higher. Essentially, with large volume, every single pip movement matters as it can amass to either huge gains or losses.

Therefore, I don't recommend you to use large volumes when you're still learning how to Take Profit. Instead, scale down your trading volume according to your preferred pips movement range.

Let's say, according to your past performance, you think it's safe to trade within 50 pips. Also, you don't want to risk more than US200 per position. To do so, you'll trade in 0.4 volume, where each pip movement is worth about US4.

Here's the formula for the example above;

Risked amount/(pips range 1 pip worth at 1 volume). So, it's 200/(50 x 10) = 0.4 lot.

Use a trading journal to record and evaluate your past trading performances.

Let's be frank, how many of you still keep their trading record in a trading journal? I bet most of us didn't even bother keeping tab on why and when we open each trading position. Instead, we let them slip and forget it once we're done with it. Subsequently, when we are going to open new position(s), we have no reference to manage possible risks.

Starting from now, you should put more attention to your trading decisions and record it on a trading journal. Additionally, with trading journals, you can also evaluate how far your trading system has improved compared to past results.

Believe me, trading with a trading journal can make significant changes. Practically, it shows you how much money you should risk and its position sizing for each opened position, consistently! So, you can use it as a reference when you are about to open new ones.

Identify your trading system win rate

Each trader has their own trading system that works best under their personal trading style. Generally, a trading system with a high win rate is favorable to generate steady income. However, that isn't absolutely necessary. In fact, you can still manage Forex trading profit-taking from a trading system with a relatively low win rate.

The first you need is a consistent trading system. But, I know that many beginners don't start with one, so you can start recording your trading strategy, decision making, and Take Profit target into a trading journal. Along with time, you'll end up with a trading system that suits your trading style.

When you already have one, then calculate how many times you have accumulated Forex trading profit. Divide your winning positions by total opened positions so far, and then multiply it by 100. That's your winning percentage.

So, if you have attained 13 Take Profit target out of 20 opened positions, then your winning rate is 65%. Not bad!

After identifying your winning rates, you can use it to adjust the best risk vs. reward ratio. This step is the core of maintaining consistent Forex trading profit. With a higher ratio, the ultimate goal is to make higher gains from Take Profit that can cover the losses.

Here's a Case For You to Study

Thomas has 60% success rate with his Take Profit level so far. In short, in every 10 positions, he may successfully reach 6 Take profit targets. Then, what do you think he should do to those remaining losing positions?

Let me repeat. Thomas has to make sure that his profit gains from Take Profit targets outmatch the losing positions. So, he has to find a suitable risk vs. reward ratio that grants the aforementioned condition. Considering that, he starts to pick a 1:1 risk vs. reward ratio, so he set stop losses as far as the take profit level is.

He sets his Take Profit target and Stop Loss limit at 50 pips away from initial open price. Also, he setups his volume at 0.5 lot, so each pip movement is worth US $ 5. As a result, he got a total of 6(505) = 1,500 pips from winning positions minus 4(505) = 1,000 pips from losing positions. At the end of the day, he still got 500 pips gains with a 1:1 risk vs. reward system (while discounting spreads and commissions).

But what happens if he raises his risk vs. reward ratio?

Say, he raises his ratio to 1:2, meaning that he stretches his Take Profit target twice as far as Stop Loss limit. For instance, if he sets his Stop Loss at 50, then his Take Profit target will be at 100.

With the same volume as before (0.5 lot), theoretically, he can accumulate the whooping US2,000 from 10 positions. Wow, such difference just by skewing the ratio by one integer higher! But there's a catch, did I say "theoretically"?

Yes, by skewing the ratio higher, it makes it practically harder to reach your Take Profit target!

To sum it up, a high risk vs. reward ratio isn't always necessary. In fact, a high win rate is usually followed by a tight ratio, while a low win rate may take a high ratio as compensation.

What's Next?

Have you noticed that I had mentioned about Stop Losses a few times already? If you wonder if that thing is as vital as Take Profit, you bet! Let's put it this way: Forex trading is a risky game, don't even dream of making money if you're not prepared to face the risks. Therefore, if you don't secure your position with Stop Loss, you are basically exposing yourself to huge losses.

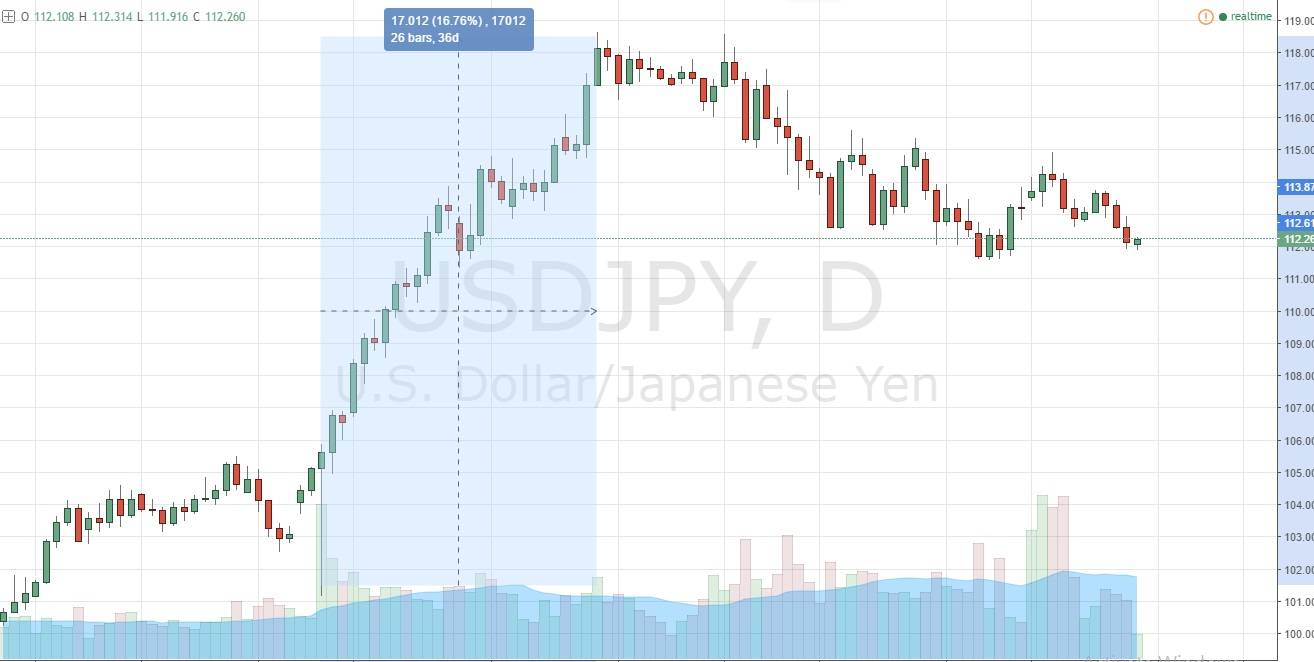

The chart above formed during the US Presidential Election on 8th November 2016. During that moment, trading volume increased massively, almost three to five times larger than normal. The price plunged sharply, losing about a 4% decrease or approximately 418 pips for the first 4 hours (4 red bars). As a seller, you can reap huge Take Profit goals here.

However, it didn't take long before the market corrected itself. The price was appreciated back to its original bid price 17 hours later. From there onward, the price went into a strong bullish trend, spotting USD/JPY from 101.5 to 118.

Just imagine if you only set Take Profit and totally neglect Stop loss:

- In the first scenario; the price eventually reaches your Take Profit goal somewhere between USDJPY 103 to 102. Congratulation, you earned it.

- Second to follow; you got greedy and set Take Profit too far deep like say at USD/JPY 100, you'd bite the dust. The price didn't continue to drop that far. Instead, it shot upward. While all that happened, your live account was drained to the margin call level.

I know, no one likes to admit defeat by setting Stop Loss. Still, learning how to set one properly will bring more benefit than if not at all.

Conclusion

Learning how to Take Profit professionally in Forex trading takes some trials and errors. With that said, I'd suggest you use a demo account first. As your skill progresses, you'd be more consistent at it while at the same time perfecting your trading system as well. Remember, Take Profit is only a tool to help you make consistent Forex trading profit.

It can not miraculously make money without your direct intervention. So, don't expect it to work all the time. In other words, you'll also need to learn how to limit your losses with Stop Loss. At the end of the day, it's all about money management. Loses are inevitable, but a great trader can turn more profits to cover that loss.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance