Swissquote introduced a new investment and savings product, the well-known Invest Easy, to make it easier for users to benefit from long-term investments.

Swiss banking group specializing in financial services and online trading, Swissquote, has been developing its trading platforms and services by launching a new investment and savings product, well known Invest Easy, this July, which focuses on customers outside CFD traders looking for a simple form of capital savings. It provides traders access to a wide range of assets such as bonds, real estate, and investments based in Switzerland.

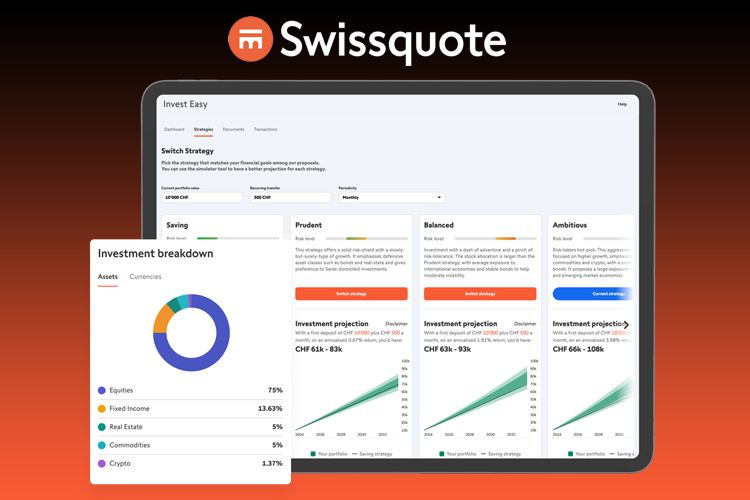

By Invest Easy, users benefit from interest on savings and can allocate funds for investment. Interest rates for cash deposits vary depending on the currency, including rates for Swiss Francs, US Dollars, Euros, and Pounds sterling, up to 1%, 1.75%, 1.5%, and 2% severally.

According to the official website, Invest Easy is integrated with Swissquote online banking accounts and allows one-click investments tailored to each individual's preferences for long-term investments. Moreover, Invest Easy provides four professional strategies (prudence, balance, and ambition) with tiered growth opportunities and risk profiles for the right investment decisions.

The four strategies emphasize long-term investment with a prudent approach, investment with little risk tolerance, and aggressive high-growth investment in stocks, commodities, and crypto, with exposure to international and emerging markets.

Chief Sales and Marketing Officer at Swissquote, Jan De Schepper, commented, "Invest Easy offers noteworthy savings combined with competitive investment fees and fee-free savings. This offering also strengthens Swissquote's position as a premier bank for clients who want to reduce the complexity and cost of banking in everyday life."

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance