The US Housing Statistics is one of the most extensive data on housing/property market in the world. There are several housing data released from the country periodically, in which each data reported could have low to moderate impact in the financial market.

When we take on a mortgage on our house, we usually think about how we would pay it back and regain ownership of our house. We are not likely to think that the simple act of taking a mortgage could impact the financial market. However, when we get to know fundamental calendar for trading purposes, we learn that a number of housing statistics command considerable impact toward price movements. This is especially true for United States housing statistics.

The Significance of US Housing Statistics

The US Housing Statistics is one of the most extensive data on housing/property market in the world. There are several housing data released from the country periodically, in which each data reported could have low to moderate impact in the financial market. This can be understood as the implication of the country's property market tendency that easily influenced by interest rates changes; it swells when interest is low, and drops when interest is high.

The magnitude of the Subprime Mortgage Crisis in 2008/2009 has shown that US Housing has the potential to crush worldwide finance in the event of sharp decline. The thing is, not only US is one of the countries with largest territory, it is also one of with the best standard of living and economic growth. To compound the effect, US houses a huge number of leading global companies, which makes property prices in the country deserve considerable attention from worldwide investors. The creation of derivatives like mortgage-backed securities and its fellows multiply the effect that US property market already hold, and expand it in the financial market.

Due to these circumstances, the market usually monitor the development of this sector through a number of indicator.

Building Permits, Housing Starts

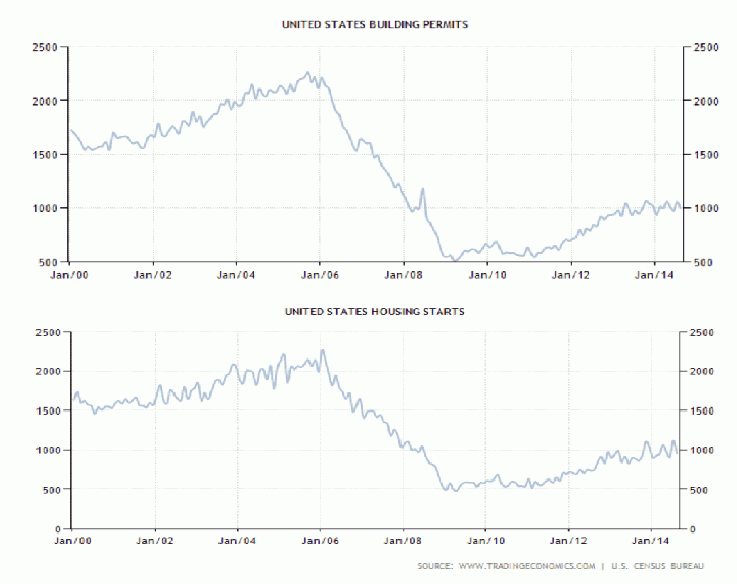

Data on US Building Permits is released by US Department of Commerce's Census Bureau around the middle of each month. Building Permits refer to the number of permits released in order to start building properties, while Housing Starts refer to the number of residential property construction that is started each month. If interest rates sagged, then Housing Starts and Building Permits tend to go up in the next few moments. Contrarily, a rate hike might be aimed to restrain growth of the two data.

You might have noticed that Building Permits precedes Housing Starts. However, the number might be different because not all parts of the US requires such permits.

The graphic above depict US Building Permits and Housing Starts data from January 2000 to August 2014. As you can see, US Housing Starts numbered above US Building Permits. There was a sharp drop in 2008 following the end of US property bubble that preceded Subprime Mortgage crisis. However, the two has picked up since then.

Existing, Pending, And New Home Sales

Existing Home Sales refers to the sales of existing houses, while New Home Sales refers to the sales of newly constructed houses. Unexpectedly, the number of Existing Home Sales is generally higher than New Home Sales. However, a sale is counted as Existing Home Sales only when its mortgage has been closed. If the sale contract of an existing house has been signed, but the transaction has not been closed, it is categorized as Pending Home Sales.

On the other hand, the sale of a new house is done when the sales contract is finalized and or the deposit on the house is accepted. The new house construction could be already completed, still underway, or not yet started. As such, US home sales data is subject to seasonal cycles, projecting sharp alteration when the weather changes.

The dataset are represented in unit and percentage of changes, and each consists of many components. They are published by different body. US New Home Sales data is released by the Census Bureau, while Existing Home Sales and Pending Home Sales is released by National Association of Realtors. Among these data, the most influential in financial market is arguably the Existing Home Sales data

Low-to-Moderate Impact of US Housing Statistics

Beside of the aforementioned reports, there are also housing indices like NAHB Housing Market Index and S&P/Case-Shiller Home Price Indices, as well as reports on Mortgage Applications and Mortgage Rate. With the exception of data on mortgages, all of US Housing Statistics are released monthly.

As is the custom in fundamental analysis, not every data is created equal. This will make it easier for people to screen the data and use only the necessary ones. The following list explained how US Housing Statistics influence financial market.

- Building Permits (Unit MoM) - Moderate

- Housing Starts (Unit MoM) - Moderate

- Existing Home Sales Change (Percentage MoM) - Moderate

- Existing Home Sales (Unit MoM) - Low

- Pending Home Sales (Percentage MoM) - Moderate

- Pending Home Sales (Percentage YoY) - Moderate

- New Home Sales (Percentage MoM) - Moderate

- New Home Sales (Unit MoM) - Low

- NAHB Housing Market Index - Moderate

- S&P/Case-Shiller Home Price Indices - Low

- Mortgage Applications (Percentage) - Low

- Mortgage Rate (Percentage) - Low

Periodical changes in US Housing Statistics provide regulators and market players with an insight into how the economy reacts to the most recent policy changes. Beside of that, year on year change of home sales data is a component of consumer spending and price inflation. Consequently, it is also used to measure economic health and recovery after a bout of crisis or recession.

Central banks as the country's monetary authority also monitor housing market through US Housing Statistics to prevent another housing bubbles that might undermine the country's financial condition again. If the housing market rises to a new high not dissimilar to the one that triggered Subprime Mortgage crisis, then speculation will run on the possibility of housing bubbles and its dangers. Consequently, the central bank will be pressured to hike interest rates in order to control it.

It needs to be noted that US Housing Statistics primarily influence bonds market, therefore its impact on the USD is only low-to-moderate level. On busy weeks when there are highly influential schedule around, such as US unemployment reports and US The Fed FOMC Meeting, housing stat usually has little to no impact. But on quiet weeks when market players are looking for reasons to move the market, moderate-rated housing stat stands as the next source of price movement.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance