From the central bank statements to retail sales data, here are the most important UK economic events for currency traders, along with their impacts and chart examples.

UK economic events are the latest economic data, reports, and updates from the UK that might be highly or moderately influential on the United Kingdom's own currency and market performances. Some are usually scheduled, such as the latest release of unemployment reports and the central bank's regular meetings. Some others are often unscheduled, such as the Chancellor of the Exchequer's appointment and resignation.

UK economic data, such as inflation rates and unemployment rates, might incite sharp market movements within seconds of their release.

Every. Single. Month.

The same goes for other UK economic events.

The impact of UK economic events might vary. They can have low, mid, or high impacts; in the short term or in the long term; in a single market or across markets.

In any case, traders and investors dealing with the pounds or UK securities markets have to note down key economic events in order to forecast the impact on their portfolio.

Which are the key economic events of the United Kingdom? Here are the most important UK economic events scheduled for currency traders:

- Bank of England (BOE) Statements and Reports

- Inflation Data Releases

- GDP Data Releases

- Retail Sales Data Releases

Bank of England (BOE) Statements and Reports

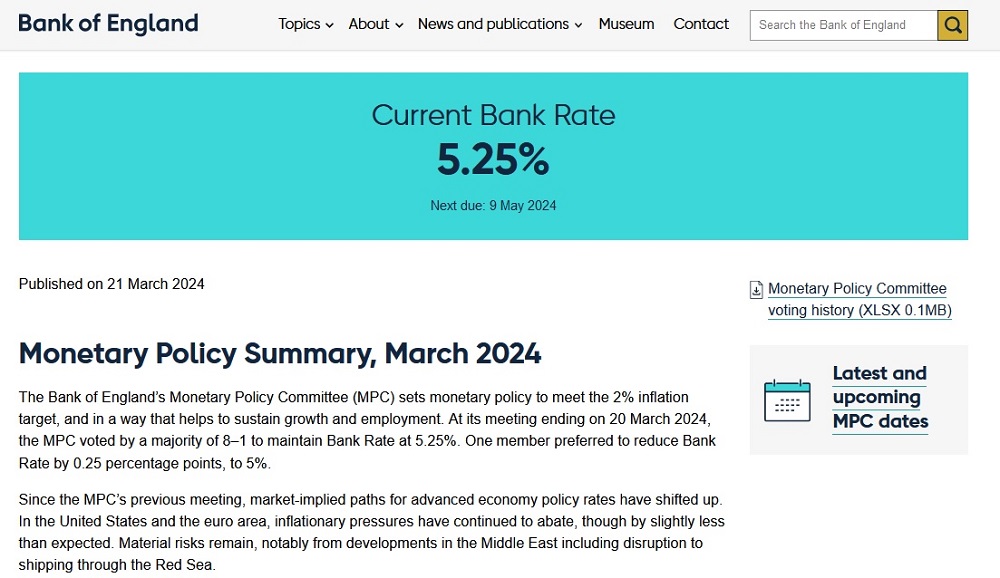

Source: bankofengland.co.uk

Source: bankofengland.co.uk

The BOE determines key interest rates and other monetary policies that would directly affect market sentiments on the pound and other GBP-denominated securities. As such, traders have to focus on the BOE's monthly interest rate announcements, economic projection reports, and official speeches.

The BOE would use monetary policy measures to limit inflation whenever it perceives inflation to be approaching a point where it poses a threat to the stability of the pound. What traders want to anticipate is when these monetary measures, such as interest rate changes, will occur. Any deviations from market expectations in the latest BOE statements could have a big impact on the GBP.

💡The impact of BOE decisions on the pounds is highly varied. |

For example, higher interest rates are usually good for the pound, while any rate cut would negatively affect the pound. However, if the UK interest rates are already near an all-time high, the market might sell the pound at any hint of rate hikes, as they may be bad news for the economy.

Inflation Data Releases

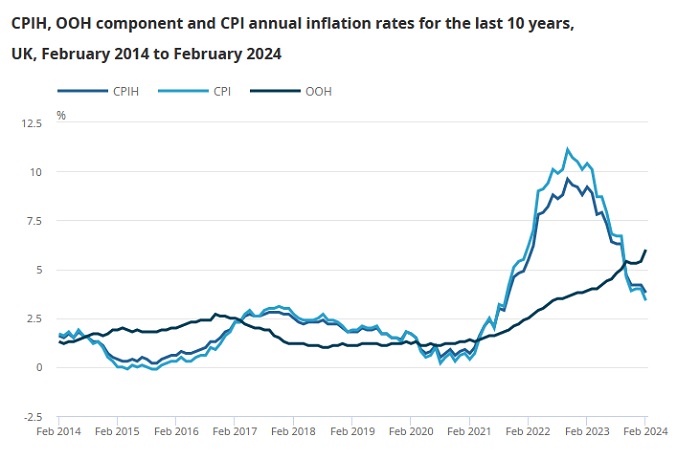

There are three popular measures of inflation in the UK: the Consumer Price Index (CPI), the Producer Price Index (PPI), and the House Price Index (HPI). They are released separately every month by the Office for National Statistics (ONS).

The CPI shows the most important figures because it is used by the BOE to determine its inflation target. It measures how much the prices of goods and services have changed over a specific time period for consumers.

Source: ons.gov.uk

Source: ons.gov.uk

The PPI and the HPI have comparatively moderate impacts on pounds. Policymakers and market participants mainly use the two data sets to confirm inflation trends and the UK's economic health.

In recent years, the Bank of England and experts have also paid close attention to wage growth as an alternate measure of underlying inflation pressures. The specific dataset consists of average earnings excluding bonuses and average earnings plus bonuses; both are usually released along with unemployment data.

💡The impact of inflation data on the pound is highly dependent on the BOE inflation target, which is currently set at 2%. |

See the story below to learn the impact of recent UK inflation data and BOE statements on the GBP/USD pair.

🔍Case Study

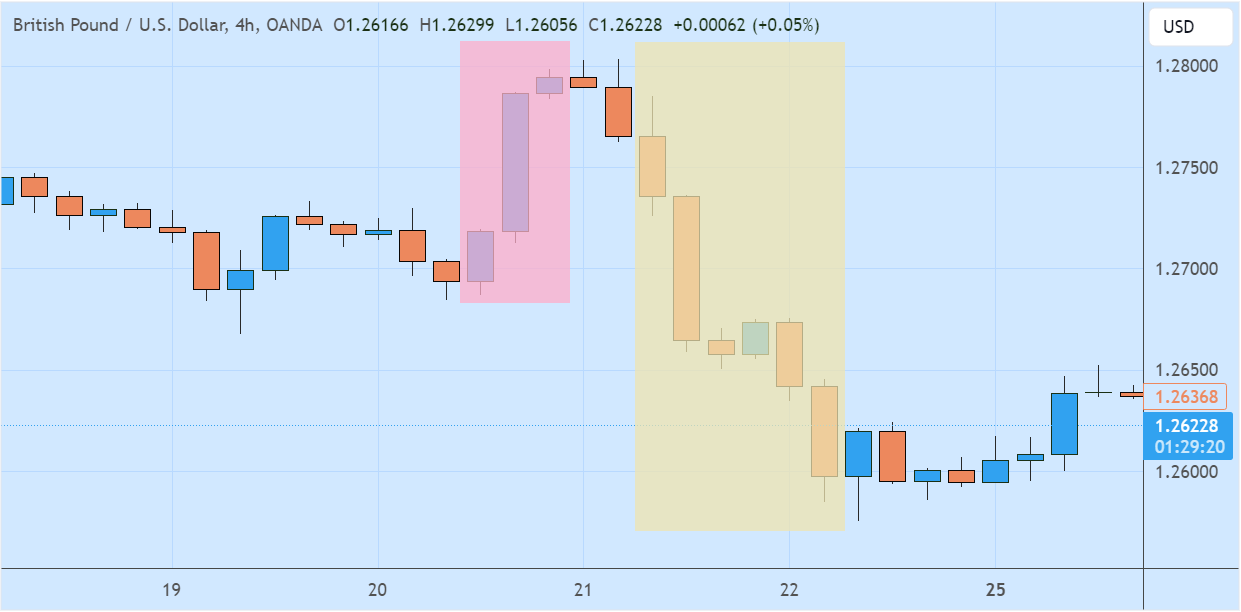

The most recent CPI data was released on 20 March 2024. Consumer prices in the United Kingdom rose by 0.6% (m/m) in February 2024, following a 0.6% decline in January. Slightly lower than market expectations of a 0.7% advance.

It was a mixed data bringing both good and bad news, where:

👍the CPI rose higher in February than January, while

👎the increases were lower than market expectations.The GBP/USD rose following the news (pink area) as the market at the time sought any signs that might support the BOE to keep rates higher for longer. However, it fell significantly on the following day (yellow area), because BOE's newly released statements confirmed the possibility of rate cut in the next few months despite of the higher inflation rate in early 2024.

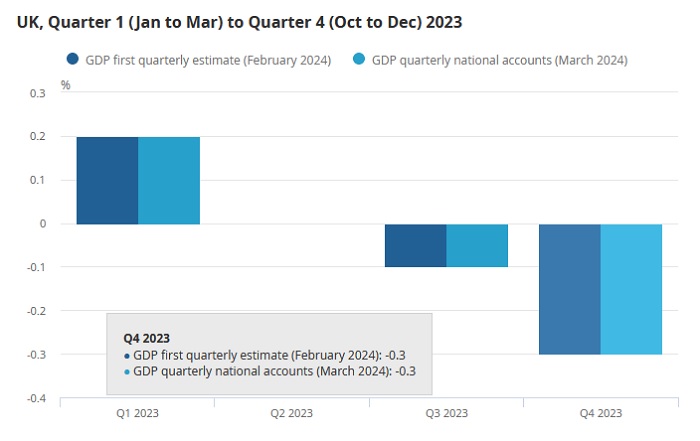

GDP Data Releases

In the United Kingdom, as in many other countries, the Gross Domestic Product (GDP) serves as the main indicator of economic growth. There are three GDP data releases that traders need to be aware of: the preliminary GDP, the revised GDP, and the final GDP.

The preliminary GDP has the greatest influence because it provides traders with an early glimpse into the state of the British economy. However, it is also the least accurate; the revised and final GDP reports frequently update the figures later.

Source: ons.gov.uk

Source: ons.gov.uk

The impact of GDP data releases on the pound is easy to measure.

🔺Higher UK GDP growth corresponds to a stronger GBP in the long term |

Nevertheless, their short-term impacts are less significant compared to other UK economic events in this list because they are particularly lagging. Even the most frequently released monthly GDP data are only issued two or three months later.

See the following story to learn the impact of recent UK GDP data releases on the GBP/USD pair.

🔍Case Study

The most recent UK GDP data was released on 13 March 2024. It showed the UK economy grew by 0.2% (m/m) in January 2024 following a 0.1% decline in December 2023, matching market expectations.

This recovery came after the country plunged into a technical recession in the second half of 2023, so it was a good news.

However, the impacts were indescribable. GBP/USD merely stopped its descent for a while, then went down further in the following days. Its overall impact was less than 50 pips.

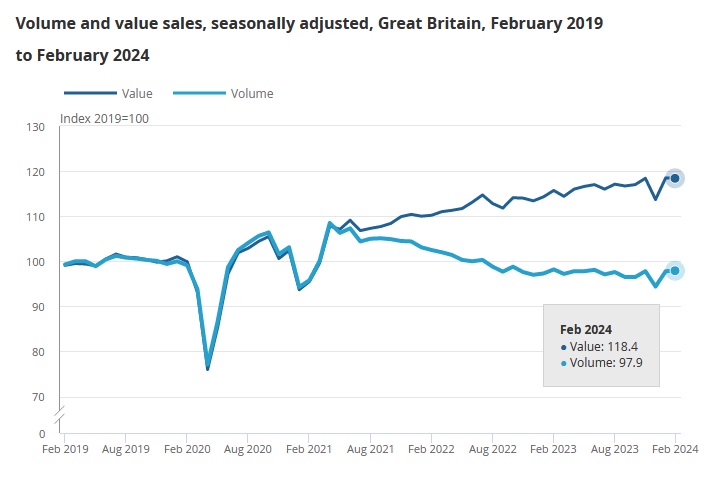

Retail Sales Data Releases

The retail industry in the United Kingdom plays a significant role in the country's economy both as an employer and as a source of income, with over 235,000 businesses employing three million people on average. As such, traders and investors closely watched the monthly retail sales data releases from the ONS.

Source: ons.gov.uk

Source: ons.gov.uk

Higher retail sales growth implies higher consumer spending and better economic health for the country, while lower retail sales growth might be bad for the economy. However, retail sales data is highly seasonal. The figures often surge during the holiday season and drop during bad weather.

💡Retail sales data releases usually have a positive correlation with the pound in the short term. |

See the following story to learn about the recent UK retail sales impact on the GBP/USD pair.

🔍Case Study

The most recent retail sales data was released on 22 March 2024. Retail sales volumes in the United Kingdom stayed flat in February 2024, following an upwardly revised 3.6% growth in January and defying market expectations of a 0.3% fall.

It was a mixed data bringing both bad and good news, where:

👍retail sales growth in February was higher than market expectation, while

👎retail sales growth in February was lower than January.The GBP/USD stopped its descent. The next key economic events supported the pounds moderately in the following days, but its movements were limited as the market lacks more significant catalyst.

Are you interested in trading the UK's currency? To optimize your returns, you can choose to trade with brokers that provide low spreads on GBP/USD.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance