Trend followers can be a good strategy for all kinds of traders. To make sure your success, answer these trend follower checklists first.

If you have been in the trading industry for some time, you must be familiar with trend trading. It is one of the most commonly used methods to trade assets. The reason behind its popularity is that trends have the potential to generate profits until they come to an end. Therefore, traders devote significant time to perfecting their trend-trading abilities.

If you are also a trend trader, you may know the importance of minimizing risks and maximizing opportunities that trends offer. The question is, how can you accomplish this? Before you start, here is a list of five questions you should ask yourself before and during applying a trend following strategy. By doing so, you can evaluate your trading strategies and ensure you make informed decisions.

1. Are You Using the Right Tools and Indicators?

Although it may be tempting to overload your chart with numerous indicators, focusing only on those that aid in trading a trend is crucial. This involves utilizing trend indicators such as moving averages to determine the general price direction or momentum indicators like ADX and CCI to assess whether a trend is depleted or just beginning. Even for price action traders, it's important to exercise caution and only plot clear trend lines rather than drawing lines around evidently fractured or undeveloped trends with fewer than three highs or lows.

2. Should You Buy on Pullback?

Typically, a trend is more sustainable when it experiences pullbacks. These retracements offer opportunities to either enter a trend or augment position size. Nonetheless, it's not necessary to act on every pullback.

Firstly, entering or expanding a position elevates the psychological pressure to close the trade at a profit. This could result in errors that could have been avoidable if the focus wasn't on the profit or loss. You should only move on a pullback if it aligns with your trading strategy. If it doesn't change how you handle your trade and you don't surpass your maximum risk per trade, then you can proceed.

3. Have You Scaled Positions Accordingly?

When adding positions, pullbacks are not the only opportunities to do so. Alternatively, traders can increase their trades through a method known as "scaling in" at different points in the trend as long as the price action confirms their biases.

However, it's crucial to remember that scaling in is not just about adding units whenever you feel like it; it requires a well-thought-out approach. To scale in effectively, traders must first identify the precise price conditions for when they will add to their positions. This requires carefully monitoring the trend and evaluating the likelihood of its continuation or reversal.

Moreover, traders must determine the amount they will add each time, depending on their risk tolerance, account size, and trading strategy. This requires careful consideration of the potential risks and rewards of each position.

4. Is the Trend Still in Your Favor?

The old saying "the trend is your friend" is well-known among traders. However, it's worth noting that, like any other popular culture trend, all good things must end, and trends are no exception.

To make the most out of a trend trade, traders must remain aware that the trend is their friend only until it bends. This entails being prepared for when the trend concludes, which requires ongoing evaluation of its momentum and the identification of fundamental and technical catalysts that may cause it to falter.

By comprehending the structure and potential of a trend, traders can position their entries and exit more strategically to maximize their profits and minimize their losses. Keeping a watchful eye on the trend's status and potential allows traders to make well-informed decisions and adapt their strategies to changing market conditions, ultimately increasing their chances of success in trend trading.

5. Have You Considered Reversal?

If you're looking to generate profits from the markets, you may want to consider countertrend trading. This approach involves taking positions against the established trend to capitalize on its eventual reversal.

However, it's important to note that countertrend trading requires a high degree of discipline, patience, and experience. Successfully trading against a well-defined trend can be challenging and often requires thorough analysis, careful consideration, and effective risk management strategies.

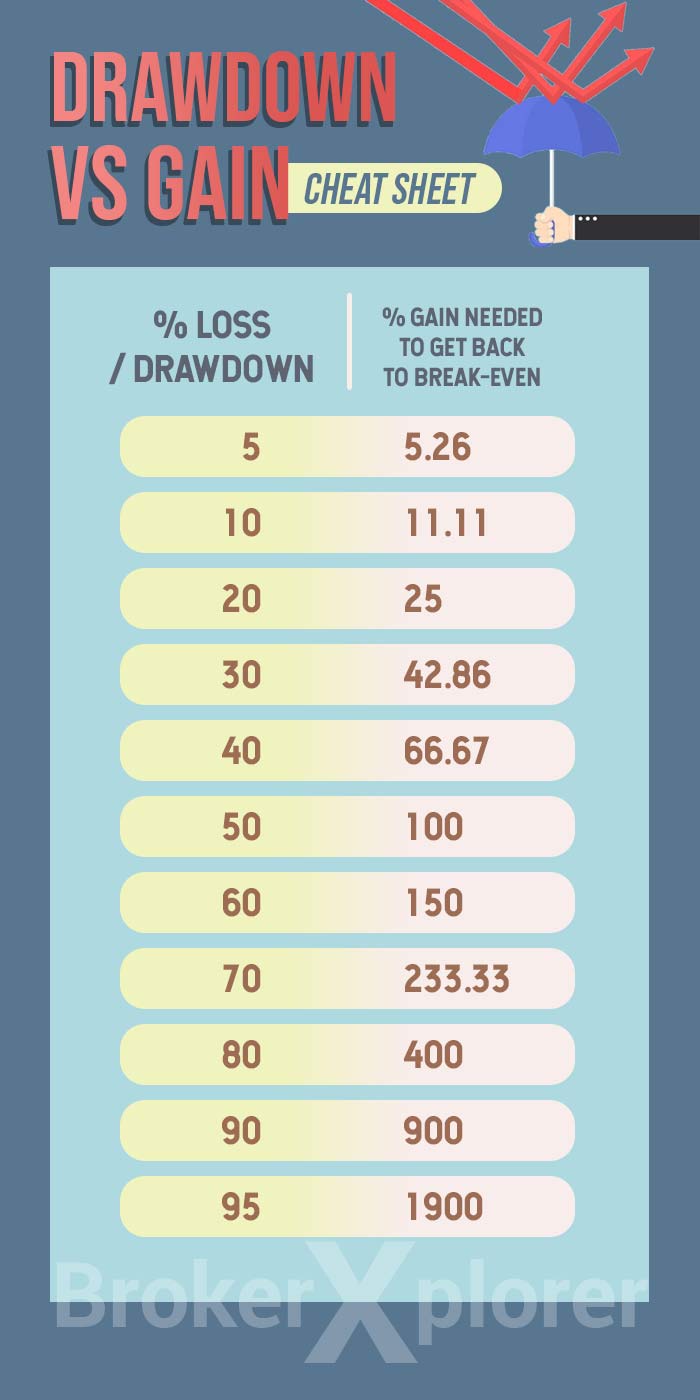

Picking tops and bottoms can be as effective as any other trading technique with the right knowledge and approach. Prioritizing proper risk management is crucial, regardless of your specific trading strategy.

By remaining vigilant and staying informed about market trends and conditions, you can increase your chances of success and maximize your profits through countertrend trading. Whether you're a seasoned trader or just starting out, take the time to carefully evaluate your options and develop a solid plan before entering any trades.

See Also:

Conclusions

In conclusion, trading checklists are valuable tools for trend followers to optimize their trading strategies and increase their chances of success. By following a systematic approach incorporating indicators and techniques tailored to trend trading, traders can effectively identify potential trades, manage risk, and capitalize on profit opportunities. When developing a trading checklist, it's important to consider your trading style's specific needs, preferences, market conditions, and trends. Overall, trading checklists can be valuable for trend followers looking to improve their trading outcomes.

Trend following trading can be a good option for many traders. But beginners might find it a little bit tricky. So, what to expect from trend following if you are a novice trader?

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance