We could obtain information about major banks' FX positions through the convenience of our living room by visiting this browser-based FX newsfeed.

Do you know who are the movers in the forex market? Most forex players are retail traders. However, the largest funds are in the hands of the government, central banks, and big banks. Knowing where and when they will move would benefit us greatly.

Government and central banks' moves are usually announced publicly. But, how do we know major banks' FX trade positions? Even top US forex brokers are not commonly providing such information.

In the days of old, we should register an account with each major bank in order to receive their newsletters. Nowadays you can access eFXdata to get various insights about major bank FX.

What is eFXdata?

eFXdata (previously known as eFXnews) started as a Dow Jones newswire subscription, then transformed into a premium FX newsfeed offering priceless insights into the thinking of major banks about the macroeconomic landscape and the developing trends on the Forex market. The Boston-based fintech company is run by a team of economists, scientists, data analysts, and developers.

In 2014, they introduced eFXplus which aggregates insights from sell-side research on 26 currency pairs at FX trading desks in:

- Goldman Sachs

- Credit Agricole

- Bank of America Merill Lynch

- Morgan Stanley

- Commerzbank

- Credit Suisse

- Citibank

- Barclays

- BNP Paribas

- JP Morgan Chase, and many others.

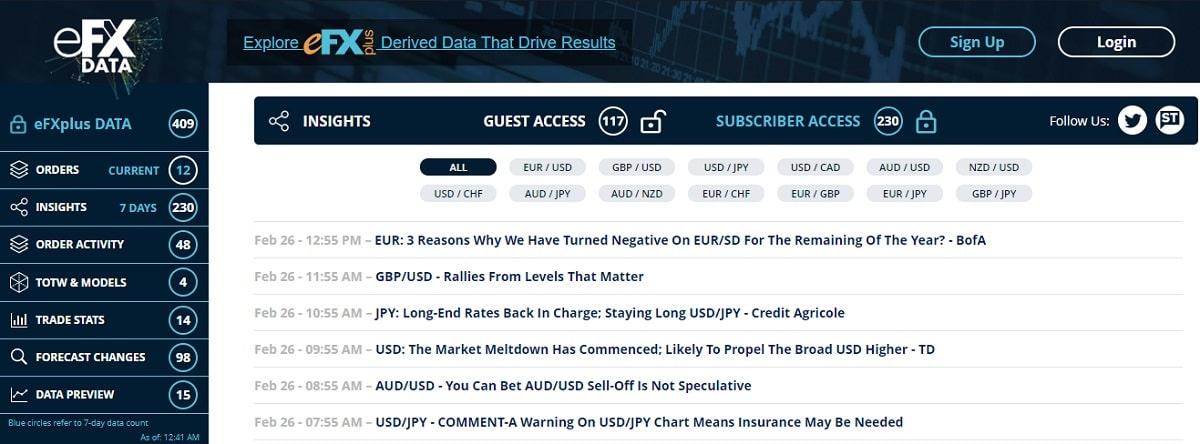

The browser-based service displayed lists of major banks' FX position changes, equipped with desktop and email alerts for premium subscribers.

You could also enjoy the service for free on the web (without auto-refresh, customized notifications, and alerts). See the following screencap for a sneak peek into their insights.

Next, follow these steps:

- Click on any news ticker, then you would see a brief explanation for each analysis.

- In the following screenshot, a research team from Bank of America (BofA) spoke about how they revised down EUR/USD forecast for the rest of the year from 1.20-1.25 to 1.15-1.20 (from 1.25 to 1.15 year-end).

- As EUR/USD currently traded around 1.21, we could respond by selling the pair. Alternatively, we could check other major banks' research briefs for the same pair.

Be aware that guests could not access eFXdata full services. What we could see here are the ones available for guests. But even the bits and pieces shown could give us ideas on whether major banks will buy or sell certain FX pairs, and at which levels.

Basic subscription for eFXPlus premium newsfeed started from USD99 per month (7-day trial available for USD19) for full web-based access, auto-refresh every minute, and in-app notifications. Or, you could also register for the premium plan at USD199 per month to get all basic features plus instant and daily email notifications.

Is It Important to Know Major Banks' FX Positions?

Looking at the precious information on eFXdata, you might be tempted to register for the premium services A.S.A.P. However, we should warn you that this service might not benefit everyone. Do consider it carefully beforehand.

One of the key factors to reach success in forex trading is proper market timing: the ability to identify continuing trends, reversals, and bounces in advance before they happen. It is also the ability to identify where market prices will go before they go there. It's also important to keep watch of the economic calendar.

The primary reason you would want to know major banks' FX positions is to obtain the lowest risk, highest reward, and highest probability of entry into a position in the market. Nevertheless, copying major banks' actions does not guarantee rich results.

The law of uncertainty in the forex market makes sure that even major banks may lose at times. So do you. Meanwhile, registering for a premium FX newsfeed would hike your trading costs. If you could afford it, then it may boost your profitability. But if you are a beginner or someone who started trading with low capital, it might not be so profitable.

Relying on your own fundamental research and technical analysis could also provide you with high probability entry, as long as you could do your homework well enough.

With trend-following strategies, you could still profit from riding the trend a few moments after it happened instead of insisting on catching the trend before it happened. You could also use contrarian strategies to identify trend reversals scientifically before they occur.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance

4 Comments

Gordon

Jan 26 2024

Hey! I'm curious about eFXdata, which seems to provide a valuable FX newsfeed with insights into major banks' perspectives on the macroeconomic scene and emerging trends in the Forex market.

I'm wondering, does eFXdata function similarly to an ECN (Electronic Communication Network) feature? In ECN, we get to see the positions of Forex traders, and it sounds like eFXData might operate in a somewhat comparable way. Could you explain the differences if they aren't the same? Sorry for the newbie questions, but I'm still getting the hang of things here.

Tandra

Feb 1 2024

Hello! Let's dive into the distinction between ECN (Electronic Communication Network) and eFXdata – two valuable tools in the world of Forex trading. Picture eFXdata as your reliable news companion in the Forex market, acting as a source of insights curated from major banks. It keeps you in the loop about economic trends and the overall state of the Forex market.

Now, onto ECN – it's a whole different ball game. ECN acts as a direct connection hub for Forex traders, offering real-time price displays and enabling them to witness the ongoing offers from fellow traders. In essence, while eFXdata is like your go-to news channel, ECN functions more like a live chat room where traders can observe and snag the best deals as they unfold in real-time.

So, to sum it up, eFXdata is your informative buddy, delivering updates on market events, whereas ECN is akin to a dynamic live chat, providing traders with a direct link to the ongoing action in the Forex market. Although they serve distinct purposes, both can be incredibly useful in navigating the complexities of Forex trading. Don't hesitate to shoot more questions our way as you continue to navigate the learning curve!

Ternier

Feb 27 2024

Greetings, I'm intrigued by the feature offered by FX that provides insight into the trading positions of major banks. I'm eager to delve deeper into this aspect. I'm particularly interested in understanding the role of banks in forex trading—are they actively engaged in the market? Additionally, I'm curious about whether banks utilize the funds of their customers for trading purposes. Any additional information on these topics would be greatly appreciated.

Ramos

Feb 29 2024

Banks do indeed play a significant role in the forex market. They participate in trading activities both on behalf of their clients and for their own accounts. Many large banks have dedicated teams of traders who execute forex trades to manage various aspects of their business, including hedging currency exposure, facilitating international trade, and generating profits.

Regarding the use of customers' funds for trading, banks typically operate within regulatory frameworks that dictate how they handle client funds. Banks are required to segregate client funds from their own operational funds to ensure customer protection and prevent misuse. However, it's essential for individuals to verify the policies and regulations governing their specific bank to understand how their funds are managed.