There are two popular types of trading techniques: scalping and swing trading. To help you choose which one is better for you, here's a comparison between the two.

Forex trading requires strategy, knowledge, and experience to achieve profitability. There are numerous forex trading techniques, including scalping and swing trading. Each of these techniques has its advantages and disadvantages. Thus, to determine the best trading technique, it is important to understand their unique characteristics and differences.

Getting to Know Scalping and Swing Trading

Scalping and swing trading techniques are commonly used by traders for different purposes and methods. However, the question is, which one is better, scalping and swing trading? Let's discuss each one further.

Scalping

Scalping is a trading technique that involves opening and closing positions quickly, usually within minutes. The goal of scalping is to achieve small profits but multiple times a day. Scalping suits those who like to trade quickly, think fast, and read price movements meticulously.

The advantage of scalping is its short time to make a profit. Traders can take advantage of small price movements that often occur in the market by using high leverage to increase profit potential quickly. Scalping can also provide many trading opportunities because of the fast and frequent price movements.

However, scalping also has its disadvantages. This technique requires high discipline in making trading decisions. In addition, scalping also requires high focus and concentration during trading. Because scalping is done quickly, you must constantly pay attention to price movements and make quick trading decisions.

See Also:

Swing Trading

Swing trading is a technique that involves opening and closing positions for a longer period than scalping, usually from days to weeks. Swing trading aims to achieve large profits from medium-term price movements. This technique suits those who prefer a more relaxed trading approach, with longer analytical thinking and patience in waiting for potential large profits.

The advantage of swing trading is the long time to analyze and make trading decisions. Thus, you can use more time to wait for large price movements and maximize profits from medium-term price movements.

However, swing trading also has its disadvantages. The profit potential obtained from swing trading is usually smaller compared to scalping. Swing trading also requires larger capital because trading positions are opened longer. In addition, you also need to be patient in waiting for large price movements.

See Also:

Comparison Between Scalping vs Swing

As previously mentioned, both trading techniques have advantages and disadvantages. Therefore, choosing the trading technique that suits your trading characteristics and preferences is best. Suppose you like fast, meticulous, and focused trading. Scalping suits you. However, swing trading is the right choice if you prefer relaxed trading, more patience, and paying attention to market movements over a longer period.

To better understand the two, here are some comparisons between scalping and swing trading that can help you choose the right technique according to your needs.

Trading Time

Scalping and swing trading differ in terms of trading time. Scalping requires you to enter and exit the market in a short period, usually within minutes. On the other hand, swing trading allows you to hold trading positions for several days to several weeks.

Risk and Reward

Scalping and swing trading differ in terms of risk and reward. Scalping usually has a lower risk and reward ratio because you are only seeking small profits in a short amount of time. On the other hand, swing trading usually has a higher risk and reward ratio because you hold trading positions for a longer time.

Psychological Factors

Scalping and swing trading also differ in psychological factors. Scalping can make trading stressful because you must always pay attention to market movements and make trading decisions quickly. On the other hand, swing trading allows you to be more relaxed and not rushed in making trading decisions.

Technical and Fundamental Analysis

Scalping and swing trading also require different types of analysis. Scalping focuses more on technical analysis, such as chart patterns and technical indicators, to find trading opportunities. On the other hand, swing trading requires technical and fundamental analysis, such as economic news or government policies, to determine the market's direction in a longer time frame.

Conclusion

You must consider your trading characteristics and preferences when choosing between scalping and swing trading. If you like fast trading and focus on technical analysis, scalping may be your best choice. However, swing trading may be a better option if you prefer a more relaxed trading style and pay attention to fundamental analysis in a longer time frame.

If you prefer scalping, you should know that not all brokers allow scalping for various reasons. That being said, several brokers do. What are the best brokers for scalping?

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

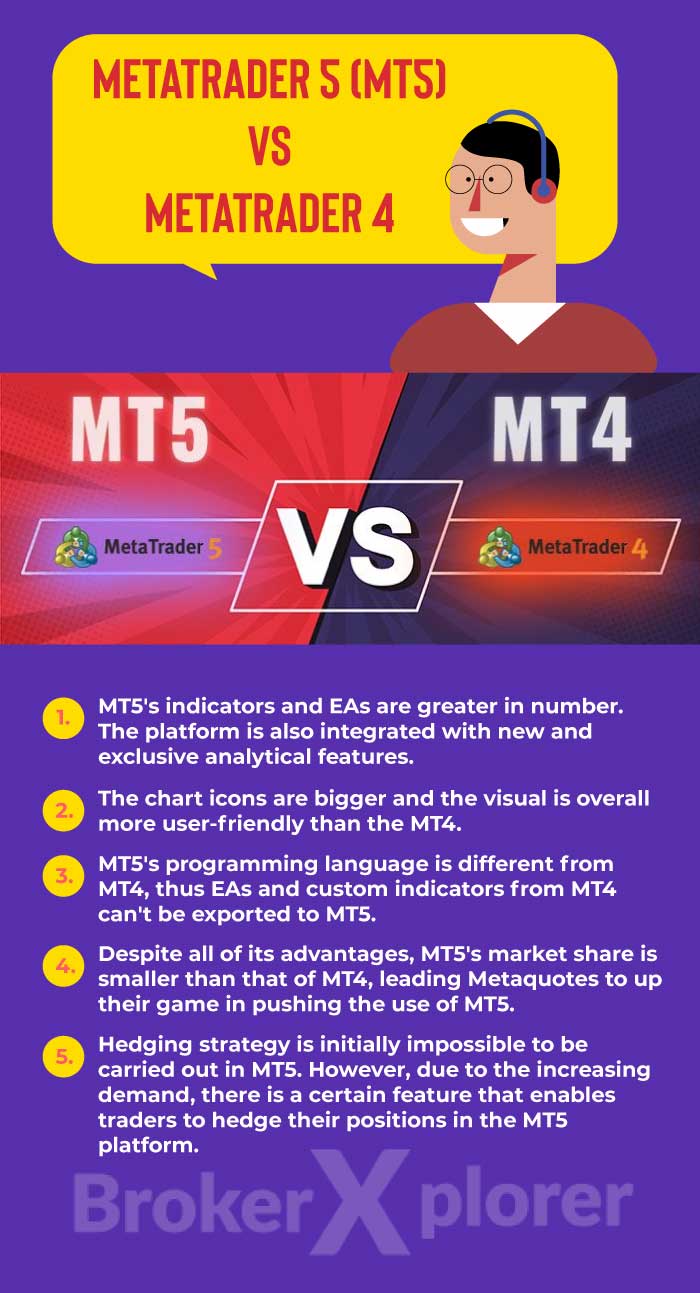

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance