Combining Bollinger Bands and simple price action analysis might work wonders for your 1-hour swing trading strategy.

As intraday strategies become increasingly favored among FX and CFD traders, more people are looking for a 1-hour swing trading strategy. Swing trading tends to be more flexible than scalping while offering short-term profits that cannot be fulfilled by longer-term strategies.

How should we arrange a 1-hour swing trading strategy? All trading strategies begin with market analysis. Following the result of the analysis, we will create an executable trading plan, which will then be the beacon of our future entry and exit decisions.

Market Analysis for a 1-Hour Swing Trading Strategy

We can conduct analysis on a 1-hour time frame for any forex pair. The variety of ways a currency pair can be analyzed in the 1-hour timeframe is one of the reasons why the intraday trading approach is growing in popularity.

Every trade you make should be based on sound analysis—your own analysis, as opposed to someone else's tweets. The effort might involve looking at some technical and/or fundamental elements. There are a variety of techniques for technical analysis, such as price action or a set of technical indicators (Moving Averages, Bollinger Bands, RSI, etc.). You can also pay attention to the release of significant economic data, such as interest rates, the CPI, or labor statistics, to anticipate extraordinary price movements.

At this point, you might wonder, "What is the best indicator for 1-hour trading?" In a previous article, we talked about combining a 20-period Moving Average and 11-period RSI. You can refer to the article to learn more about it.

Of course, there are also other popular default indicators in our trading platforms that function equally well. In particular, mixing up Bollinger Bands and simple price action analysis might work wonders for your 1-hour swing trading strategy.

Price Action and Bollinger Bands

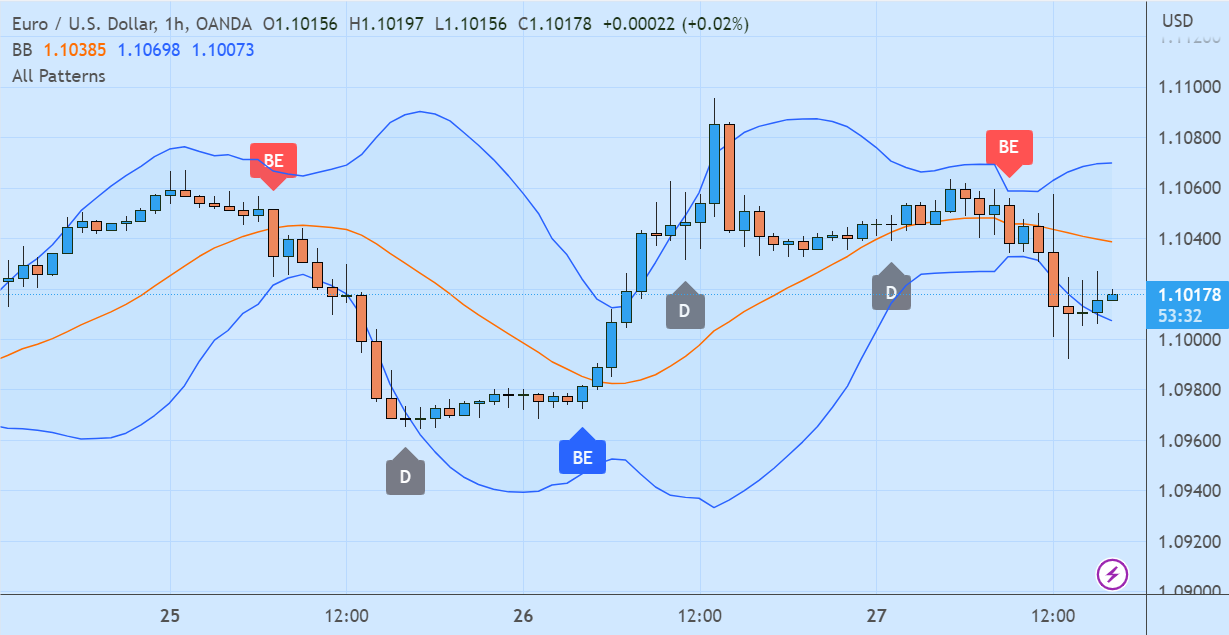

We might have to work meticulously for a period of time in order to master advanced skills related to price action. However, a simple price action strategy can be done by applying the All Candlestick Pattern indicator to a TradingView chart. Here is an example of a EUR/USD in a 1-hour chart with the aforementioned indicator and Bollinger Bands applied together.

The chart shows two sell opportunities and one buy opportunity based on several Engulfing candle patterns. Engulfing is a well-known reversal trading signal. Red BE marks a Bearish Engulfing, while blue BE marks a Bullish Engulfing signal.

You can see increasingly intense selling pressure just before the first red BE. Then a Bearish Engulfing pattern appears at exactly the same time as the candle crosses Bollinger's middle band downward. It means the bulls have lost control of the market and the bears are taking over. A similar scenario explains the second red BE.

The blue BE marks the end of a downtrend and the beginning of an uptrend. You might hesitate to take action as soon as the signal appears due to the prevalence of fake signals in shorter time frames. However, the fact that the next candle crosses Bollinger's middle band upward confirms the buy signal.

What about the D mark? D refers to the Doji candle pattern. Doji reflects indecision in the market. It usually appears during a sideways or ranging market and is not a good buy or sell signal. If you find it in your favorite chart, then let go and look for trading signals by applying the same indicator combination on other forex pairs.

Conclusion

So, is a 1-hour time frame good for a swing trading strategy? Yes, it is. In fact, the best time frames for swing trading strategies are 1-hour, 4-hour, daily, and weekly—sorted from the most efficient to the most relaxed approach.

Any time frame lower than 1-hour is unlikely to be useful for a swing trader because they demand a considerably more 'hands-on' approach. On the other side, we run the risk of missing important trading signals if we were to swing trade on time frames higher than 1 hour.

The 1-hour swing trading strategy is also ideal for those who are new to trading. Try it out on either Trading View's paper trading feature or your preferred broker's demo account, and then trade for real after gaining the necessary understanding.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance

5 Comments

Justin

Jun 1 2023

Hey there! I'm a beginner in trading too, and I recently came across this article that mentioned using a 1-hour time frame for analyzing forex pairs, especially for intraday trading. I found it quite fascinating, and I'd love to learn more about why the 1-hour time frame is popular for intraday trading.

Could you explain to me the advantages of using the 1-hour time frame compared to other time frames? How does analyzing forex pairs on a 1-hour basis help beginner traders like me? I'm also curious about the simple price action indicator mentioned in the article. Does it work differently depending on the time frame you're using? I'd love to understand how to effectively use price action indicators on the 1-hour time frame.

As a beginner, I'm eager to explore different strategies and find the right approach for my trading journey. Any insights you can provide on the 1-hour time frame and its relationship with price action indicators would be greatly appreciated. Thanks in advance for your guidance!

Bruno

Jun 2 2023

@Justin: Hey there! In my opinion, using the 1-hour time frame for analyzing forex pairs in intraday trading is popular for several reasons. It offers a good balance between capturing meaningful price movements and providing a clear view of overall market trends. For beginner traders, the 1-hour time frame allows for better analysis of support and resistance levels, price patterns, and market sentiment without overwhelming noise.

When it comes to price action indicators, using the raw price data on the 1-hour chart can be effective. Candlestick patterns and key levels become more reliable on this time frame, aiding in spotting trends, breakouts, and potential reversals.

As a beginner, it's essential to practice and develop your skills with demo trading, implement proper risk management, and stay aware of market conditions and news events. Remember to explore different strategies and seek additional resources as you embark on your trading journey. Good luck!

Witan

Jun 21 2023

Why is the Doji candle pattern considered a signal that is not ideal for entering the market? I came across the term "D mark," which refers to the Doji pattern, known for indicating market indecision. It's often observed in sideways or ranging markets. However, I'm curious to understand why the Doji pattern is not considered a reliable buy or sell signal. Does it lack the necessary clarity or direction for traders to make informed decisions? If the Doji pattern appears on a chart, why is it recommended to let go of that particular trade and instead seek trading signals using the same indicator combination on different forex pairs? I'm interested in learning more about the limitations of the Doji pattern as a market entry signal and the reasoning behind avoiding it in trading strategies.

Surya

Jun 23 2023

Hey there! After reading the article, I'm intrigued by the idea of using the 1-hour timeframe for swing trading. It seems like a promising approach, so I have a few questions. What advantages does the 1-hour timeframe offer in swing trading strategies? How does it strike a balance between active trade management and capturing important market signals? And why do many swing traders prefer the 1-hour timeframe? Let's dive deeper into these aspects and explore the significance of the 1-hour timeframe in swing trading. I'm eager to hear your insights and learn more about this fascinating topic.

Mckennie

Jun 27 2023

@Surya: Hey there! So, you're curious about swing trading with the 1-hour timeframe, huh? Well, let me tell you, it's got some sweet advantages. This timeframe strikes a cool balance between active trade management and catching important market signals. You see, with hourly candles, swing traders can keep tabs on their trades without getting overwhelmed by every little price blip. They can spot patterns, support/resistance levels, and key indicators without all the noise of shorter timeframes.

But wait, there's more! The 1-hour timeframe gives swing traders a wider view than super short intervals. They can jump in on price moves that last a few hours to days, aiming for bigger profits. And the best part? They don't have to be glued to the charts all day. They can analyze the markets, make smart decisions, and still have a life!

That's why many swing traders dig the 1-hour timeframe. It dishes out meaningful market signals, keeps trade management manageable, and gives traders the flexibility to do their thing. It's like the Goldilocks of timeframes—not too short, not too long, but just right for swing trading success!