Fixed spread and floating spread have their pros and cons. Follow these 5 comparisons between them to choose which one is best for you.

In trading, there are two types of spread: floating and fixed. A fixed spread remains constant despite price fluctuations, although it may be modified during periods of high volatility. Fixed spreads offer lower risk, providing traders with predictability throughout the trading process and enabling them to calculate the necessary profit margin.

On the other hand, floating spreads vary and generally align with market trends. They tend to be lower than fixed spreads during less volatile periods. Floating spreads entail higher risk for traders, as they can surge significantly, resulting in a final execution price that exceeds expectations.

Although floating spreads can be advantageous during periods of market calm, fixed spreads are considered optimal for volatile market conditions. Different spreads will give traders different trading outcomes, which is why traders must consider several things that differentiate fixed spreads and floating spreads, including:

- Bid-ask range: The difference between the highest and lowest prices a seller or buyer is willing to accept.

- Broker type: The tendency at which fixed spreads and floating spreads are offered in forex brokers.

- Execution cost: How the trading commission is charged.

- How it affects the trading style: The way fixed spreads and floating spreads support certain types of strategies.

Let's get to the discussion below to learn more about each aspect.

1. Bid-Ask Range

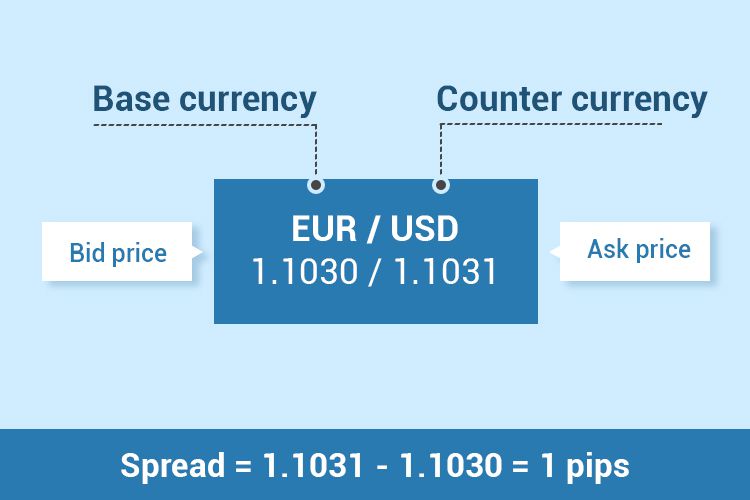

The bid-ask range refers to the difference between the highest price a buyer is willing to pay (bid) and the lowest price a seller is willing to accept (ask) for a particular financial instrument, such as a stock or currency pair. Of course, the condition of the bid-ask range will be affected by the type of spread.

The fixed spread shows that the difference between the bid and the ask prices of security remains the same amidst the changing market conditions. For instance, the spread on the EUR/USD will be fixed as two, even though the market condition fluctuates.

On the contrary, a floating spread shows that the difference between a security's bid and ask prices fluctuates occasionally. Fluctuation of spread depends most on the market circumstances, notably during high-impact news releases in which the spread could widen significantly.

2. Broker Type

When it comes to forex trading, there are various types of forex brokers available. There are several examples of broker types, such as NDD (no Dealing Desk), ECN (Electronic Communication Network), STP (Straight Through Processing), and many more. Broker type can indicate what spread type they are offering because of the conditions related to the broker type.

For example, Market Makers offer fixed spreads in line with their clients' orders to positions. They can offer controlled pricing with fixed spreads because they have already assumed "in-house" via their dealing desk.

Meanwhile, most NDD brokers offer floating spreads because it is a feature with the non-dealing desk brokerages. The bid-ask range is subject to variations in market circumstances, volatility, etc. Many liquidity providers offer different spreads for security at the prime brokers or the interbank market level. Some might offer a low spread, while some don't.

3. Execution Costs

Broker execution cost refers to traders' expenses when executing trades through a brokerage firm. Usually, it consists of two factors: the spread and commission. Execution costs can differ according to the spread the broker offers. Here is the difference:

- Fixed Spreads: Brokers that offer fixed spreads often include the cost of execution within the spread itself. This means that traders do not pay a separate commission per trade. However, fixed spreads are typically slightly wider than variable spreads during normal market conditions. This wider spread compensates the broker for potential market fluctuations and provides them with a built-in profit margin. InstaForex and FBS are some brokers that consistently offer this type of spread.

- Variable Spreads: Brokers offering variable spreads may charge a separate commission per trade in addition to the variable spread. These brokers often provide access to the interbank market or liquidity providers and pass the spread from the market onto the trader with a transparent markup or commission. Variable spreads can be narrower during periods of high liquidity and market stability, resulting in lower execution costs for traders. However, spreads may widen significantly during volatility, increasing the execution cost. IC Markets and Exness are some well-known brokers that provide their traders with variable spreads.

4. Effect on Trading Styles

Trading style refers to the individual approach, strategy, and methodology a trader adopts to participate in financial markets. Each trading style affected how long a trader spent their time in the market. This means the type of spread will heavily influence what is the best trading style used.

- Fixed spreads significantly impact trading style, particularly for traders who prefer a more calculated and long-term approach. One of the primary advantages of fixed spreads is their predictability. Regardless of market conditions, fixed spreads remain consistent. This makes fixed spreads particularly suitable for longer-term trading strategies like position trading.

- On the other hand, floating spreads are for traders who thrive in dynamic and fast-paced markets. As market conditions fluctuate, so does the spread width. During periods of high volatility, spreads tend to widen, impacting the cost of trades. Traders comfortable navigating volatile markets and actively seeking short-term opportunities may find floating spreads more suitable for their trading style. Some good examples are scalping and swing trading.

See Also:

After Words

Based on the abovementioned characteristics of trading styles, the floating spread is usually the most useful for scalping and day trading. Meanwhile, a fixed spread is more suitable for swing trading and position trading since both need spread stability to work in the medium to long term.

Both have their pros and cons, such as:

| Types of Spreads | ✔️Pros | ❌Cons |

| Fixed spreads |

|

|

| Floating spreads |

|

|

Whichever spreads you choose, it is imperative to practice your strategy in a forex demo account before trying it for live trading.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance

2 Comments

Borello

Jan 12 2024

According to the article, fixed spreads are closely associated with brokers that operate as Market Makers or, in other terms, Dealing Desk Brokers. Interestingly, in my experience, I've come across numerous brokers who operate as NDD (No Dealing Desk) because they predominantly provide floating spreads, as detailed in this article. The article explains that floating spreads are closer to the actual market spread price.

Now, I'm keen to delve deeper into how Dealing Desk brokers operate. Specifically, I'm curious about the pros and cons of trading with them. I've checked out the linked article, and it mentions that Dealing Desk brokers are regulated. So, while they offer fixed spreads, which can assist traders in determining fees more accurately, the term "market maker" associated with them might raise some suspicions. I'd like to understand more about the positive and negative aspects of engaging in trading with Dealing Desk brokers.

Zero

Jan 14 2024

Yeah I agree with you! While they offer fixed spreads, aiding in a more precise calculation of fees, there is a degree of skepticism associated with the term "market maker." This term might imply a potential conflict of interest, as it raises questions about whether the broker is on the opposite side of the trade, potentially benefiting from traders' losses.

Positively, Dealing Desk brokers often provide a stable trading environment, and fixed spreads can be advantageous in certain market conditions, especially during high volatility. On the flip side, the concern lies in the potential for the broker to act as a counterparty to trades, leading to suspicions of a conflict of interest. But Dealing Desk brokers are not always bad! As long they are regulated by strong regulator, I think you can trust em. Read : Are Market Maker Brokers Always Bad?