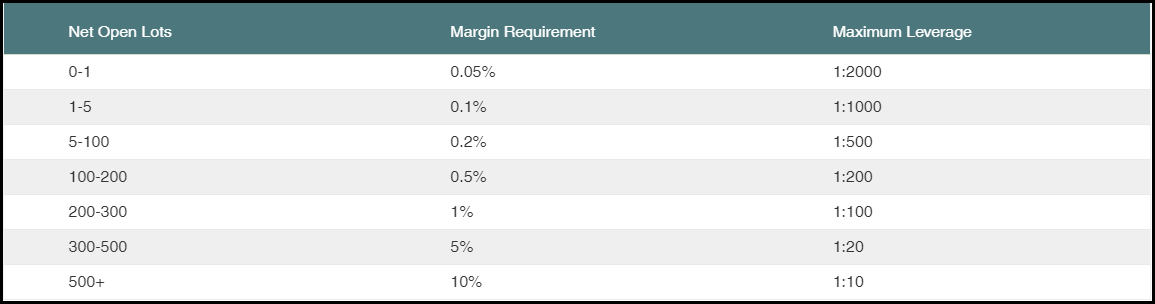

ThinkMarkets has launched a new mini account with dynamic leverage of up to 1:2000. This dynamic leverage adjusts based on the total size of the open transactions.

Forex broker ThinkMarkets introduced a mini account with dynamic leverage. This mini-account offers a maximum leverage of up to 1:2000. To sign up, just deposit a minimum of $10. This mini-account covers forex, gold, stock indices, crude oil, and cryptocurrencies.

This ThinkMarkets news is very important, especially for traders with small capital. Dynamic leverage lets them manage risk and maximize profits.

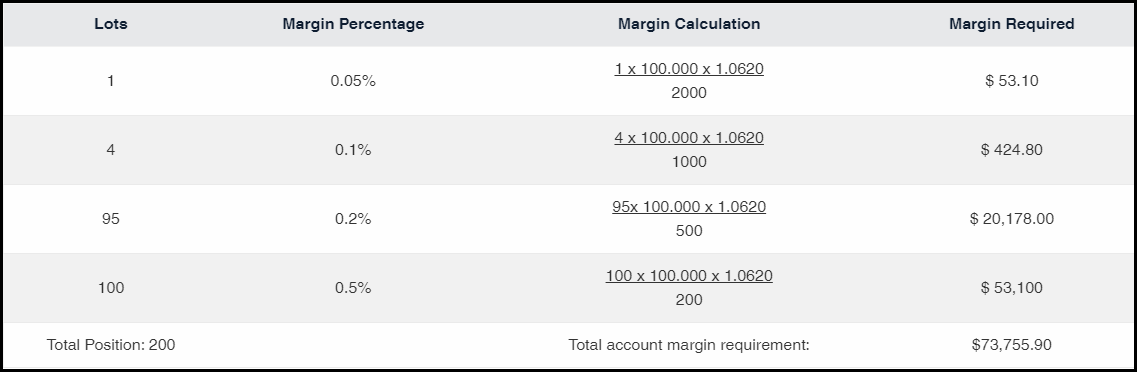

Unlike fixed leverage, dynamic leverage changes based on the size of the trade. To grasp it better, here's a breakdown using a table for different lot sizes and dynamic leverage scenarios.

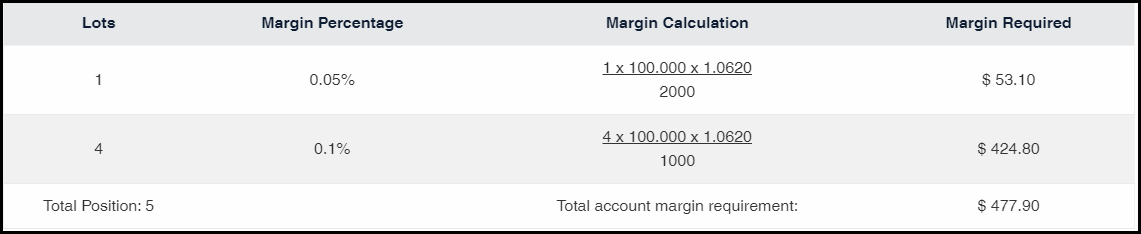

Let's take an example: if you start with a 1-lot position, the leverage is 1:2000, and the needed margin is $53.10.

Now, if you add a new 4-lot position, making the total lots 5, the leverage for this second position becomes 1:1000. The margin to open a 4-lot position with 1:1000 leverage is $424.80. So far, the total margin for these two positions is $477.90.

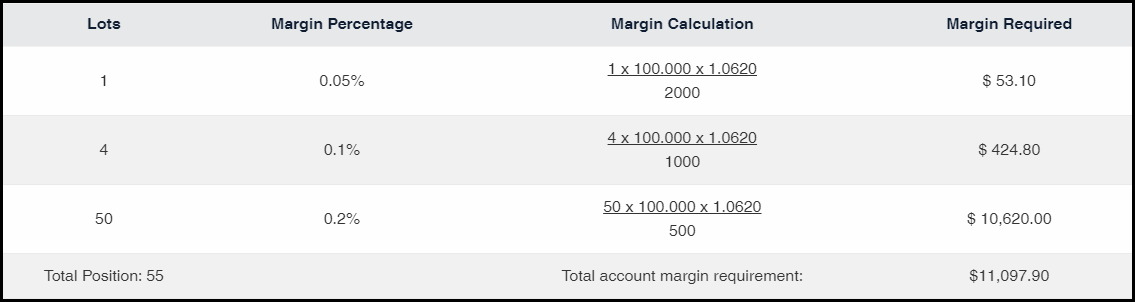

Moving on, if you open a 50-lot position, totaling 55 lots, the leverage becomes 1:500. The margin to open a 50-lot position with 1:500 leverage is $10,620. The total margin for the three positions with 55 lots is $11,097.90.

Then, let's say you add a 100-lot position, bringing the total lots to 200. The leverage for this fourth position is 1:200. The margin to open a 100-lot position with 1:200 leverage is $53,100. Consequently, the total margin for all positions is $73,755.90.

This multi-asset broker offers mini accounts on both MT4 and MT5 platforms. Plus, it's optimized with zero commission and spread-only costs.

Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance