Aside from offering favorable trading conditions, ThinkMarkets also offers the ease of deposit and withdrawal. Here's everything you need to know about it.

As a trader, you might need to fund your account quickly or move your money a lot across trading accounts. This is why the ease of deposit and withdrawal is one of the top qualities that you should consider in a broker.

With over 10 years of experience, ThinkMarkets clearly knows how to satisfy their clients. Not only offering a wide variety of trading instruments, the broker accepts different payment methods to ensure that traders can manage their funds with ease.

| 💳Payment Method | 💲Available Currencies | ⏳Estimated Processing Time |

| Bank Wire | AUD, EUR, CHF, GBP and USD | 1-3 business days |

| SEPA | EUR | 1 business day |

| Credit/Debit Cards | AUD, EUR, CHF, GBP and USD | Instant |

| Neteller | USD, EUR, GBP, JPY and AUD | Instant |

| Skrill | AUD, EUR, CHF, GBP and USD | Instant |

| Cryptocurrency | Bitcoin (BTC), Ether (ETH), Tether (USDT ERC-20 & TRC-20), Bitcoin Cash (BCH), Stellar (XLM), Litecoin (LTC), EOS (EOS), DASH (DASH), USDC (USDC ERC-20), XRP (XRP), Tron (TRX), Binance Coin (BUSD (ETH only) | Instant |

| Perfect Money | USD, EUR, Bitcoin (BTC) | Instant |

| Apple Pay | AUD, EUR, CHF, GBP and USD | Instant |

| Google Pay | AUD, EUR, CHF, GBP and USD | Instant |

As you can see, most of the methods support instant payment so every deposit request using that method will be processed instantly and the funds will be reflected in your balance in a matter of minutes. Remember that timing is very crucial in forex trading, so being able to fund your account quickly is undoubtedly a huge advantage.

Making a Deposit in ThinkMarkets

Any in or out transaction can be made from the ThinkPortal (Member Area) on your PC or mobile phone. There is no minimum deposit for Standard account holders, so you can start out with any amount. However, if you are a Mini or ThinkZero account holder, you'll need to deposit at least $10 and $500 respectively.

Here's the step-by-step guide to make a deposit in ThinkMarkets.

- Visit ThinkMarkets' website to register a new account or simply log in to an existing account.

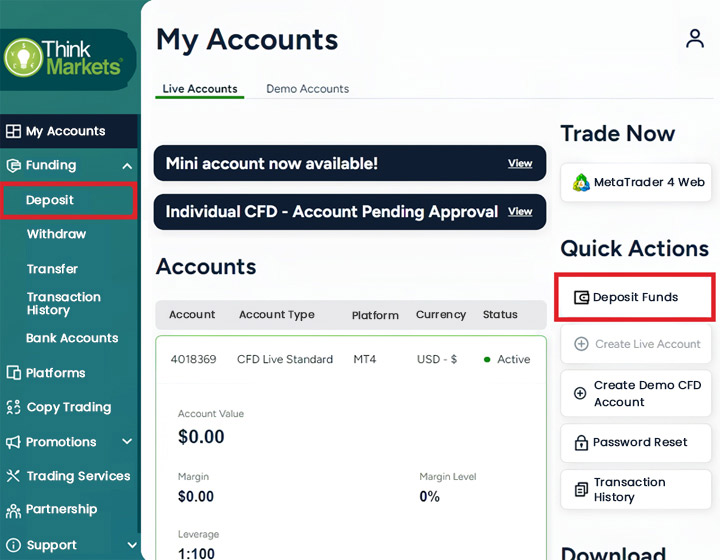

- Once you're logged in, click "Funding" on the left-side menu and select "Deposit or click "Deposit Funds" on the right for a faster access.

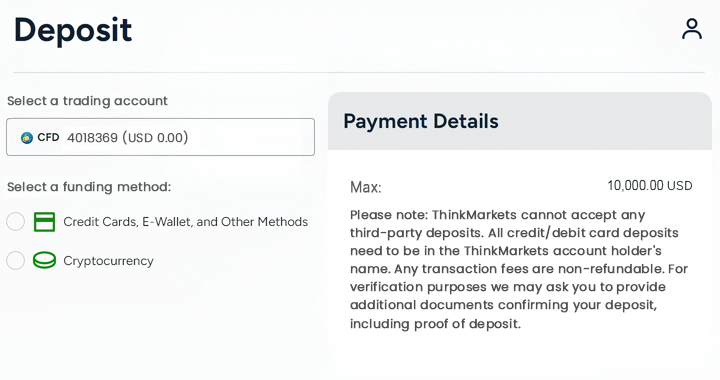

- On the deposit page, select the trading account and payment method of your choice.

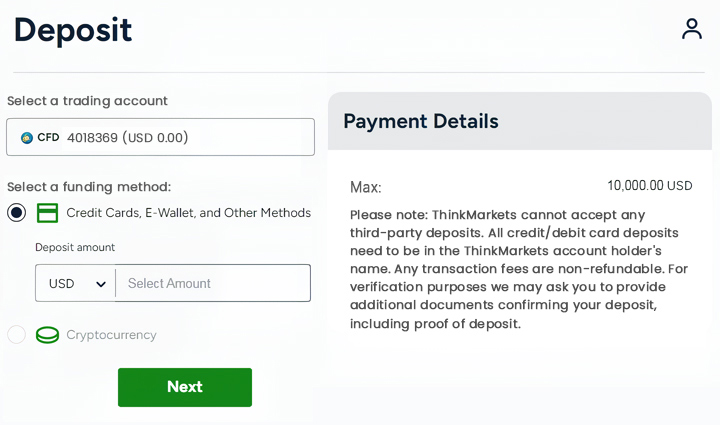

- Enter the amount that you'd like to deposit to your ThinkMarkets' account. Click "Next" to move to the next step.

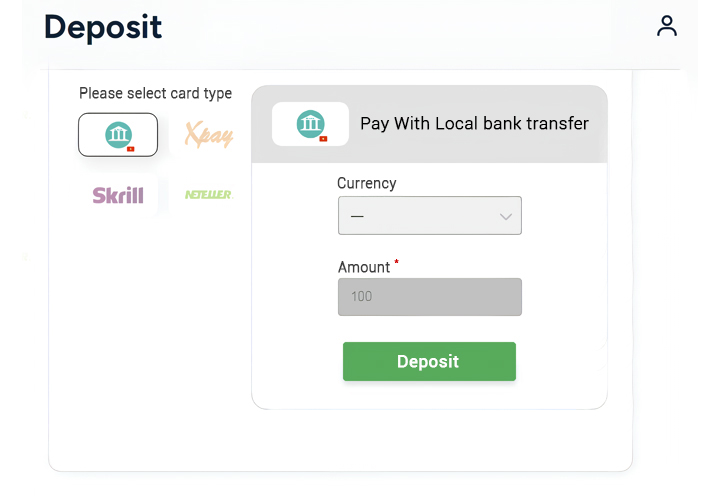

- You'll be asked to specify the method and the currency. Click "Deposit" to complete the transaction.

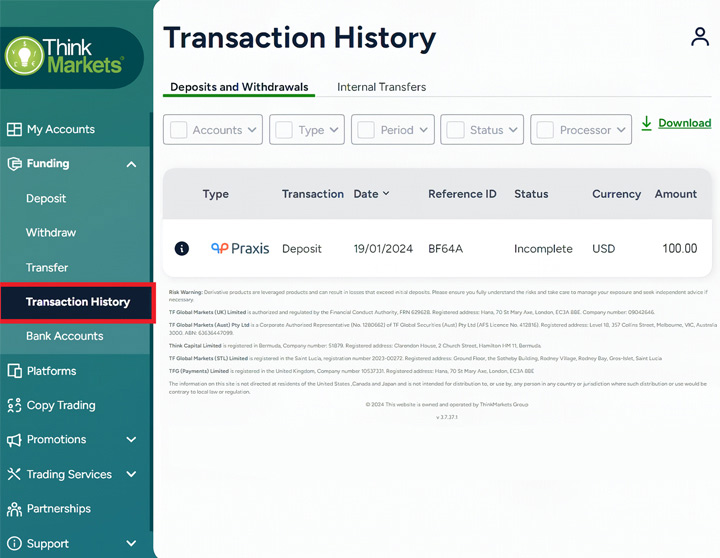

- To check the status of your transaction in ThinkMarkets, select "Transaction History" from the side menu.

How to Withdraw from ThinkMarkets

The goal of a trader is to make money. When you decide to realize you money from your ThinkMarkets trading account, here are the steps that you should follow:

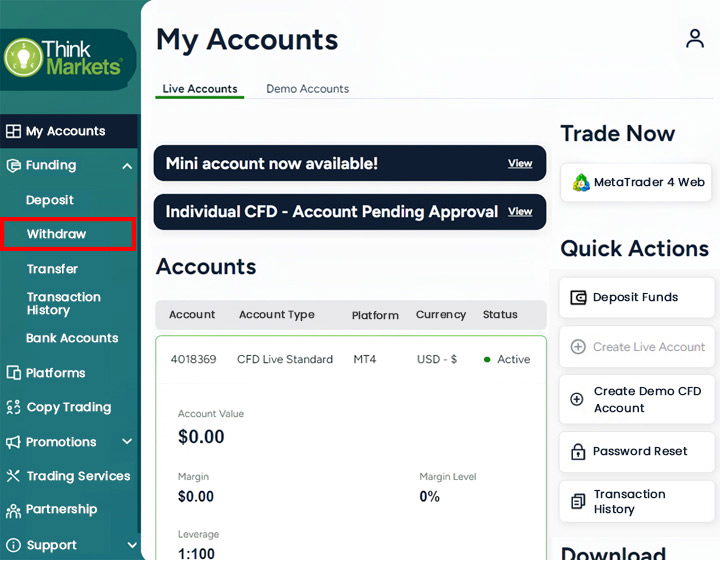

- Log in to your ThinkPortal and click "Withdraw" under the "Funding" menu on the left.

- Complete the rest of the procedure by selecting the trading account, withdrawal method, and amount.

- Your withdrawal request will be processed by ThinkMarkets within 24 hours in the same week, but the actual time needed for the funds to reflect in your bank account might take longer (1-7 business days) depending on the method you choose.

Note that Withdrawal is only available to verified users. If your identity is still unverified, we strongly suggest finishing the verification steps as soon as possible to eliminate any restrictions and potential issues in the future.

Moreover, ThinkMarkets uses the "return to source" policy, so you can only withdraw using the same method as your deposit. For instance, if you deposited funds using a credit card, then you should withdraw to the same credit card. Any profits that exceed the initial deposit amount will be sent preferably via Bank Wire in the name of the trading account holder or e-wallet with a maximum of 10,000 units of currency.

As a multi-asset online brokerage, ThinkMarkets present a wide range of trading assets starting from Forex to Precious Metals, Commodities, Indices, Shares, and Cryptocurrencies. The Australian-based broker is established in 2010 and has since opened additional headquarters in London and regional offices throughout Asia-Pacific, Middle East, North Africa, Europe, and South America.

Along with its history operation, ThinkMarkets has been awarded and recognized many times in various aspects. Most recently, they won the Best Value Broker in Asia at the 2020 Global Forex Awards.

Average FX spreads for traders opening an account in ThinkMarkets start from 1.2 pips for the standard account, while ThinkZero provides the best trading experience with 0.1 pips spread. Still, traders may need to consider that ThinkZero applies commission from $3.5 per side for every 1000,000 trading volumes.

As a global online brokerage, ThinkMarkets operates under various financial regulatory institutions. For example, ThinkMarkets Australia is managed by TF Global Markets (Aust) Limited and is licensed by the Australian Financial Services as well as the Australian Securities and Investment Commission (ASIC) with ABN: 69158361561. ThinkMarkets UK is registered under the Financial Conduct Authority (FCA) by the company name of TF Global Markets (UK) Limited (number: 09042646).

ThinkMarkets consistently try to improve their trading environments with various advanced products. Automatic trading fans are provided with free VPS Hosting, while passionate traders who'd like to experience beyond MetaQuote platforms can try ThinkMarkets' proprietary platform called ThinkTrader.

The trading platform is available on 3 different interfaces specifically designed for Web Desktop, Tablet, and Mobile displays. Furthermore, customized tools such as 80+ drawing tools and more than 125 indicators for technical analysis accessible even through Mobile screens would certainly provide a brand new trading on-the-go experience.

As far as market updates go, trading in ThinkMarkets would be accompanied with news from FX Wire Pro that is known for its strict policy toward upholding objective journalism and delivering critical, trusted information in real-time. Information segments covered by FX Wire Pro include Economic Commentary, Technical-level Reports, Currency and Commodities, Central Bank Bulletins, Energies and metals, together with Event-driven Flashes.

For payment methods, ThinkMarkets offer the gateway via bank transfer, credit card (Visa and MasterCard), Skrill, Neteller, POLi internet banking, BPay, and Bitcoin wallet.

All in all, it is safe to say that for a company that started business since 2010, ThinkMarkets is an accomplished broker in terms of legal standing and innovation in trading technology. As an additional safety assurance for traders, this broker underlines its commitment to provide a $1 million insurance protection program which is made possible by ThinkMarkets' insurance policy with Lloyd's of London that protects clients' funds for up to $1 million in the unlikely event of insolvency.

FAQs on ThinkMarkets Deposit and Withdrawal

- Can I transfer money between trading accounts?

Yes, you can do so by clicking the "Funding" drop-down menu on the left and selecting "Transfer". Then, choose the trading account that you'd like to send the money to along with the amount. Note that you can only make up to 2 inter-transfer transactions within 24 hours. - Can I make a deposit/withdrawal using third-party payments?

Third-party payments are prohibited by ThinkMarkets. In other words, you can only make deposits/withdrawals using a bank account under your real name. This also applies to e-wallets and credit cards. How much are the deposit and withdrawal fees?

ThinkMarkets does not charge fees for deposits and withdrawals. However, some third party providers like banks do charge additional payments according to their fee structure. Thus, don't forget to find out the detailed conditions with your service provider before making any transaction.- What if my favorite payment method is not available in ThinkMarkets?

The list of available payment methods may vary in different regions. Check on the ThinkMarkets' website in your jurisdiction to confirm the availability of your preferred choice.

ThinkMarkets is a multi-awarded broker for online trading. Since 2010, they have become a highly regulated brand with a global presence that keeps striving to empower traders with access to a wide range of financial markets on their sophisticated platform, ThinkTrader.

Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance