Axi's UK unit doubled FY23 revenue to $27.5M, achieved stellar growth, and expanded into prop trading with live accounts.

The UK subsidiary of Axi forex broker has grown by the end of the fiscal year, June 30, 2023, doubling its annual client revenue to $27.5 million. These figures represent a massive leap of 110 percent and were revealed in a Companies House filing.

However, the main line of the UK office still is to provide trading in forex (foreign exchange) and CFDs (contracts for difference) to individuals and legal entities. Axi forex broker demonstrates a solid financial performance with the year-end client funds balance at $21.3 million, clearly far above the past annual balance of $10.2 million.

There needs to be more than the rise in operating costs in line with increased revenue to stifle the 37.1% increase in profit to $2.2 million from over $2 million the previous fiscal year. Apart from the income from the endowment, which was $121,804, another source of income was interest at $297,089, which resulted in a pre-tax profit of $2.5 million.

The incursion of this low-spread broker into proprietary trading with a profit split of up to 90 percent has also attracted investor attention. Trying to distance itself from its rivals, this fast-execution broker will give its clients a live account prop trading function, facilitating them to directly interact and trade in this flourishing industry segment.

This no-commission broker's stellar financial results show the business's resilience and progress as a forex and CFD brokerage company. It is only a glimpse of what the future holds for this strategy.

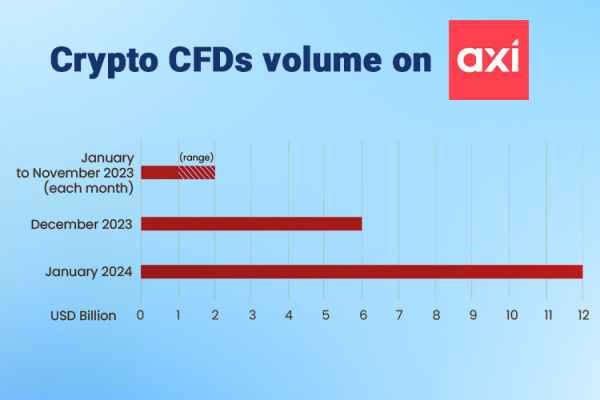

In recent forex broker news, Axi reports near $12 billion in crypto CFDs volume for January, reflecting growing demand among traders.

See Also:

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance