Axi reports near $12 billion in crypto CFDs volume for January, reflecting growing demand among traders.

A leading retail forex broker, Axi, has announced an increase in the trading volume of CFDs connected to crypto by almost $12 billion, which was attained within January. This Australian broker was processing close to 70,000 trades per week, meaning active investors demanded more cryptocurrency trading.

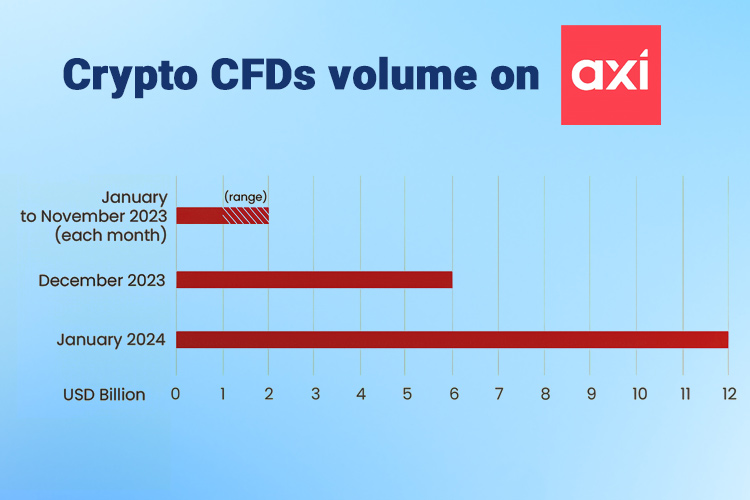

For most of 2023, this ASIC-regulated broker posted crypto volumes between $1 billion and $ 2 billion. But December witnessed a drastic spurt, which peaked at $6 billion, and the same trend has persisted even into the new year.

The increasing volumes in crypto are a mirrored increase of growing anticipations and eventual approval over the spot Bitcoin exchange-traded funds (ETFs) set for US retail.

Despite Bitcoin's price fluctuations sparked by ETF approval news, Axi Crypto traded in what was described as a crypto contract for difference (CFD) had rushed popularity among traders thanks to the chance of trading popular cryptocurrencies, which included Bitcoin, Ethereum, Litecoin, Ripple, and so on.

This broker provides crypto Contracts for Difference through entities regulated in St Vincent and The Grenadines with various leverage options. This offshore entity has a relatively high leverage of up to 200:1.

While the trading volumes in crypto CFDs have skyrocketed on these platforms, this fast-execution broker still represents a small portion of affluence displayed by dedicated exchange venues. For example, the leading exchanges of Binance, Bybit, and OKX process many times larger volumes in derivatives and spot trading.

Despite the increasing demand for crypto CFDs, especially among retail traders, this MT4-only broker's report shows interest in other investment instruments with a dynamic digital asset trading landscape.

In other forex broker news, Axi signs an extended trade deal with football stars Manchester City FC to introduce a 'Select Your Edge' campaign promoting Axi Select program.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance