Throughout history, there have been 3 bubbles that have had massive impacts on the global market. Those are Roaring Twenties, Dotcom Bubble, and the Housing Bubble.

The term 'bubble' here should not be confused with a children's soap liquid toy that can be blown. In economics, a bubble refers to a sudden price decline, also known as a crash or a bursting bubble.

Throughout history, there have been three sensational bubbles that have occurred. The impact of all three was strongly felt because of their large scale. The three examples of bubbles are the Roaring Twenties, the Dotcom Bubble, and the US Housing Bubble. The causes varied. Let's thoroughly discuss all of them in the article below.

What is a Bubble?

In economics, a bubble refers to high-volume trading that drives prices far beyond their true value. Thus, a bubble phenomenon can occur when a product or asset is traded at a price higher than its fundamental value.

The term "bubble" was first used between 1711-1720 to describe a financial crisis at the South Sea Company. The company inflated the value of its stock above its fair value with the hope of future price increases but without fundamental support. As a result, the opposite occurred, and the price plummeted.

Economic experts at the time called it the "South Sea Bubble". Like a child's toy bubble, the commodity prices of the South Sea Company soared too high but easily burst and crashed instantly.

The Roaring Twenties (1929-1939)

The decade after 1929 was a dark and unforgettable time for Americans and the world. This was because a severe depression, known as "The Great Depression," occurred, which dragged the world's economy into decline for the next ten years.

Initially, the US economy has been showing rapid development since 1920. Even the total wealth of the US doubled. These times were known as the "Roaring Twenties."

This condition eventually caused Americans from various backgrounds to flock to buy stocks on Wall Street. From businessmen, millionaires, cooks, lawyers, and even janitors, they all poured their money into buying stocks. As a result, Wall Street soared high, and its peak occurred in August 1929.

However, it resulted in a decline in US productivity and unemployment. The stock prices were now far from their actual values. At that time, wages and salaries in the US were very low, leading to a surge in consumer debt. In addition, the agricultural sector suffered from droughts. The banking system was also affected, with many loans being unable to be withdrawn.

Eventually, the US economy experienced a mild recession during the summer of 1929. Consumption growth slowed, production piled up, but stock prices remained high.

On October 24, 1929, investors began to panic and sell their shares en masse. 12.9 million shares were traded that day. Eventually, the moment became known as "Black Thursday." A week later, panic hit Wall Street, causing 16 million shares to be sold off, known as "Black Tuesday."

Millions of shares eventually became worthless. Investors who had bought stocks with borrowed money had to close their businesses. Consumer and investor confidence vanished. Eventually, investment plummeted, and those still had jobs experienced wage cuts. Purchasing power was also eroded.

Many Americans were forced to shop on credit and ended up in debt. The lowest point of this event occurred in 1933 when 15 million Americans were unemployed and nearly half of the banks in the United States went bankrupt. The Roaring Twenties' impact was felt in the United States and countries that adhered to the Gold Standard and relied on the Dollar exchange rate, especially in Europe.

Dotcom Bubble (1994-2000)

After that, the most famous bubble in the world was the Dotcom Bubble, which shook the internet world throughout history. At that time, internet growth was very fast, but it was not proportional to the success of digital startup companies. Many companies were successful but failed quickly. For example, Pets.com only survived for nine months before going bankrupt, followed by Boo.com, Webvan, and other telecommunications companies.

The Dotcom Bubble began with technology's rapid development, attracting many investors to invest in internet-based (dotcom) companies. At that time, the internet was treated as an innovation that benefited many parties.

One internet company that was very confident in releasing shares to the public was Netscape, a browser on par with Internet Explorer. Netscape's IPO closed at USD 58.25 billion, with a company valuation of USD 2.9 billion. Excite, Lycos, and Yahoo followed this.

However, because the fundamentals of these companies did not match their high stock values, the bubble eventually burst. Over 100,000 employees of dotcom companies lost their jobs since 2000. Two years later, the NASDAQ index fell by 75 percent. By the end of 2002, investors had estimated to have lost as much as $5 trillion due to this bubble phenomenon.

During that time, internet company stocks fell by as much as 75 percent. However, some still survived, such as Amazon, Oracle, Cisco, eBay, and Intel.

Housing Bubble (2000-2007)

Sometime after the Dotcom Bubble, The Fed began lowering US interest rates, followed by loosening loans, triggering the Housing Bubble in the US. Many flooded the real estate market because of cheap and easy-to-get mortgage rates. Housing prices reached record highs, and the Housing Bubble was formed.

This was also supported by government policies that encouraged credit to the housing sector through deregulating the financial sector. Financial institutions created new "products" of home loans, including subprime loans to creditors with poor credit risks. Large banks and hedge funds repackaged these high-risk loans into mortgage-backed securities (MBS) and derivatives, which were then traded speculatively in the financial market.

The Housing Bubble, later known as the subprime mortgage market, burst in 2007 due to rising interest rates. Some homebuyers failed to pay, leading to the collapse of the global financial market in 2008. The size of bad debt became increasingly clear. The resulting severe recession caused millions of people to lose their jobs and assets worth $14 trillion.

What Caused These Bubbles?

From the three cases above, it is clear that factors that accelerate bubble phenomena are wild speculation, irrational investor behavior, and FOMO behavior. Investors tend to ignore safe margins and buy assets without thorough research. When the bubble bursts, asset prices will drop dramatically. If broken down, here are the signs of a bubble that you need to be aware of to avoid falling into the risk of the next bubble.

Excessive Liquidity

Excessive liquidity can cause lending requirements to become loose, resulting in many short-term speculations that make the market vulnerable to volatile asset price inflation.

Simply put, a bubble phenomenon can occur when there is too much money but too few assets. This triggers an excessive increase in the value of an asset beyond its reasonable limits. After the bubble "bursts," the value will collapse, stopping the investment scheme and leading to a consumer and investor confidence crisis. This is where the role of the central bank comes in for stabilization.

Some economists consider economic bubbles to be the same as credit bubbles. They calculate the debt-to-GDP ratio, and if it collapses, it will result in an economic contraction called a recession or, worse, a depression.

Social and Psychological Factors

In addition to monetary factors, the causes of economic bubbles can also be attributed to the social and psychological factors of investors. Some of them are:

- Wild speculation refers to excessive and irrational speculation by investors or market players in buying assets to make big profits in the short term.

- Herd behavior is following the crowd or trend by a large group of investors, causing the asset price to continue to rise. Herd behavior is sometimes referred to as the "theory of stupidity." Although not yet empirically studied, the Chinese public has agreed that this theory is the cause of economic bubbles in their country.

- Irrational exuberance is when the market is too optimistic about an asset's economic performance or profit potential, causing the price to soar significantly without any clear reason.

When the above factors overlap, an economic bubble can form. Over time, asset prices will increase disproportionately to their real value. However, when the bubble bursts, prices will plummet drastically and cause a widespread economic crisis.

Conclusion

In addition to the three examples of bubbles mentioned above, other bubble phenomena have occurred. For example, Tulip Mania (1637), the South Sea Bubble (1720), the Mississippi Bubble (1720), the speculation of British railway stocks (1840), the speculation of Florida land (1925), Nifty Fifty (late 1960s-early 1970s), the speculation of Poseidon stocks (1970), the Japanese asset bubble (1986-1990), and the Asian financial crisis (1997). FOMO behavior that causes many investors to flock to the market can be a warning sign of the risk of a downturn, as seen in the three most talked-about bubbles above.

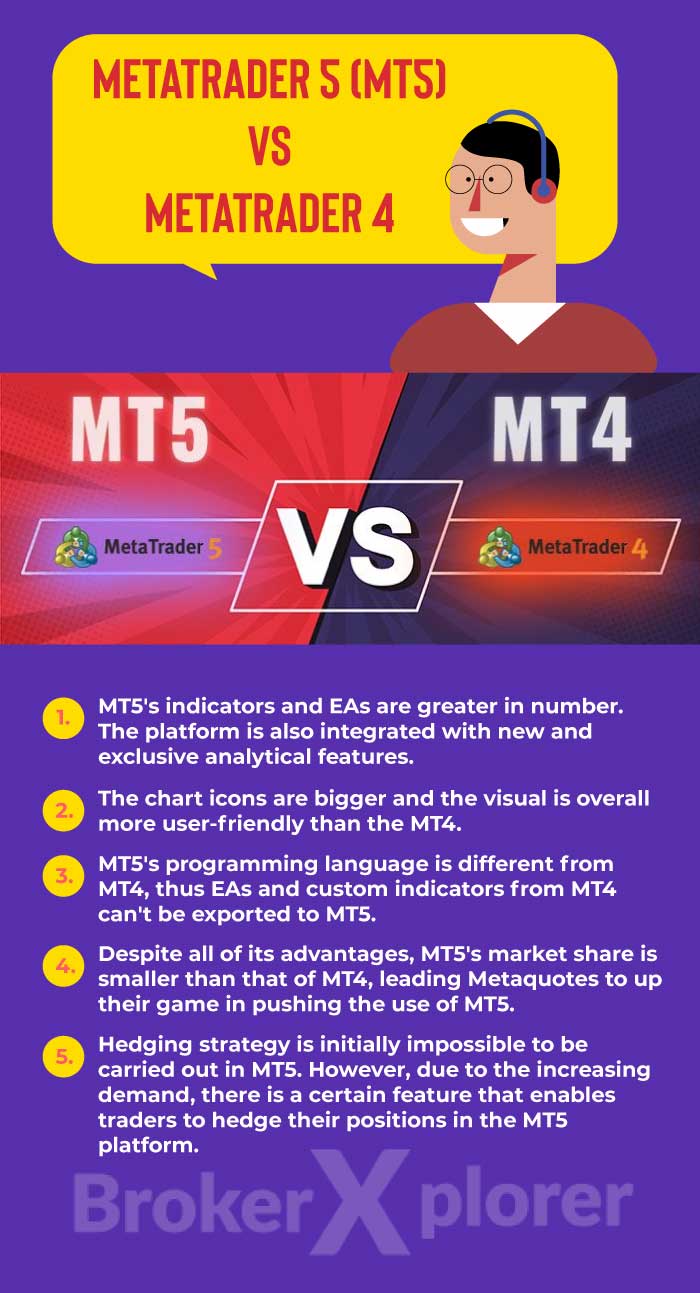

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance