If you are not a big reader, consider watching a few great financial movies or documentaries. Sitting on your couch and watching these movies on your laptop will inspire and help you learn the financial market with interesting conflicts and storylines.

Do you want to learn how to invest in the stock market and make money? Do you, on the other hand, find college textbooks or investing novels to be too tedious to read? There's no need to be concerned. There's another way to learn about the financial world that's interesting, entertaining, and informative without having to read a thousand pages of financial books. Then let's talk about financial movies.

The financial industry, in all of its aspects, provides excellent filming. Tragic events, satire, imagination, crisis, and redemption have all appeared in Hollywood's financial films over the years. While the majority of the films depict financial professionals in a negative light, the incredible tales of excess, risk-taking, and, of course, greed all make a compelling cinema needed for anyone considering or currently involved in the industry.

Learn, be impressed, and angered by the money-hungry wannabe and elites' actions. Real stories will obviously shock you, and the film industry will definitely entertain you. Here, we provide the top 5 recommended financial movies:

Contents

1. The Big Short (2015)

The Big Short is a nonfiction comedy-drama film directed by Adam McKay that was released in 2015. It was written by McKay and Charles Randolph based on Michael Lewis' 2010 book "The Big Short: Inside the Doomsday Machine", which revealed how the US housing bubble triggered the financial crisis of 2007–2008. Christian Bale, Steve Carell, Ryan Gosling, and Brad Pitt starred in the film, which also highlighted Melissa Leo, Hamish Linklater, John Magaro, Rafe Spall, Jeremy Strong, Finn Wittrock, and Marisa Tomei.

It tells the story of three different communities of traders who wanted to sell mortgage-backed securities. Previously, the film depicted that such an instrument did not exist; however, in response to a request from a customer, the major banks agreed to develop it to allow such a trade. The majority of investment bankers laughed at the idea of shorting MBAs at first, but they still support their clients because they would expect insurance premiums unless the housing market crashed, as seen in the film.

The film highlighted several mortgage companies' reckless accounting practices. Some people could receive five mortgages at the same time, while others' requests for loans were approved despite having no occupation or source of income. Although it initially seemed unbelievable among most investors and traders, the crash of the entire market happened. Eventually, and the traders shorting the MBAs earned massive gains, with one of them making a 489% return.

The Big Short is a must-watch financial movie as it offers a number of valuable lessons. The major point seems to be for traders and investors to trust their own analysis rather than simply accepting the market and public perception. The movie also demonstrated that contrarian trades can be very rewarding if executed at the right time.

The Big Short was nominated for several Academy Awards, including "Best Picture", "Best Adapted Screenplay", and "Best Director, and won for "Best Adapted Screenplay". Some critics, including Nobel Laureate Paul Krugman, have said that the film refused to acknowledge that many people other than the characters featured in the film raised concerns about subprime mortgages. Others suggested that the film downplayed the Federal Reserve's role in enabling the crisis to flourish.

2. Black Wednesday (1997)

Black Wednesday told the story about forex trading. It covered the circumstances leading up to and during the "Black Wednesday" in the United Kingdom in 1992, as the name indicated.

After a failed effort to hold the pound sterling above the ERM's lower currency exchange cap on September 16, 1992, the British government was forced to remove the pound sterling from the European Exchange Rate Mechanism (ERM). The United Kingdom was the European Communities' Presidency at the time.

As the British pound was then pegged to the German mark under the terms of the European Exchange Rate Mechanism, the German Bundesbank demanded a meeting with the British government to discuss the exchange rate at which the pound would be weighted to the mark.

Nevertheless, the UK government favored a pegged rate of 2.95 for the GBP/DEM without consulting the Bundesbank. The rate was deemed too high by German officials, and the British government could have problems accessing it in the long run. However, UK policymakers had already confirmed the new approach and exchange rate, so both sides could only hope for the best now.

As the film depicted, this was the British government's first huge mistake, and it was just one link in the chain of events that led to the infamous "Black Wednesday". However, choosing an incredibly high exchange rate was not the only factor that contributed to the pound's exit from the ERM.

The German Mark became more appealing to investors and traders as a result of this move. In order to keep the GBP/DEM exchange rate from declining, the UK government had to match the German Bundesbank's inflationary pressures. The challenge was that the United Kingdom still had extremely high interest rates at the time. Any further rise in the rate would likely escalate the problem in the UK economy.

As George Soros said in his interview for this film, the overvaluation of the pound represented a tremendously undervalued opportunity. As the GBP/DEM exchange rate began to fall, the European Exchange Rate Mechanism allowed for a 6% rate fluctuation. This means that the GBP/DEM rate's lower bound was about 2.77. Indeed, the ERM has been labeled the "Eternal Recession Mechanism" by one of the former UK Treasury Secretaries.

The fact that it contained interviews with former UK cabinet members, politicians from the Bundesbank, and George Soros, the hedge fund manager who profited from the event, made Black Wednesday the movie one of the best financial documenter films.

It is one of the most educational films for beginners because it illustrates how interest rates influence the foreign exchange market. A variety of critical lessons are provided, including how fundamental analysis played a big role in forex trading.

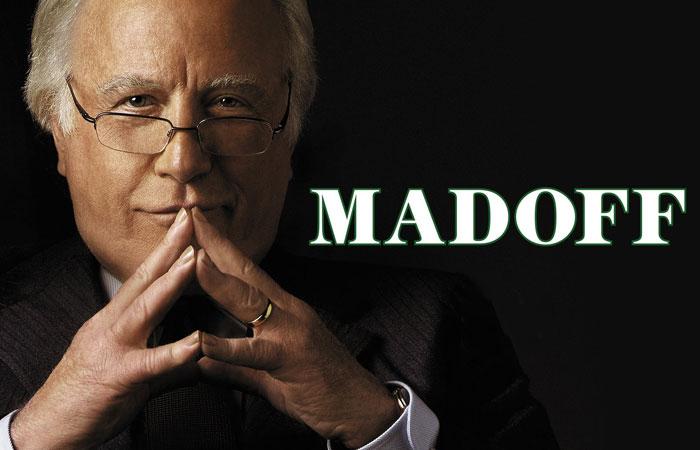

3. Madoff (2016)

The film depicted how the main character managed to convince billionaires to invest billions of dollars in a dubious scheme. As a result, he could afford luxury properties, cars, and just about everything else money can purchase.

The organization of Madoff's company was also depicted in the film. Barnard's sons worked in the trading department, where they conducted transactions in order for the company to make a profit, much like every other investment bank. However, this is all a disguise to hide the true nature of the company. This is where the notorious Room 17 came in, where the company's CFO lived and managed the company's activities for collecting and sending money to clients' accounts.

In particular, Room 17's level of organization was very impressive. Madoff had an employee whose sole responsibility was to keep track of the fund's shifting balance at all times. It's also worth noting that the firm's CEO used the employees in Room 17 to misrepresent some information, with the employees smearing cups of hot coffee on the records to make them appear old.

Bernard Madoff's company's basic scheme was to provide a consistent 10-12 percent annual return on investment to its investors, regardless of economic conditions. It's not shocking that many investors were drawn to this level of stability. As a result, his fund attracted a large number of prosperous clients

The issue was that Madoff did not invest in the equity, bond, or real estate markets in order to generate a profit for his investors. Instead, he deposited the funds in banks' 2% savings accounts. Clearly, this was insufficient to cover the costs of paying investors a 10% annual return.

Following the crash of the housing market and the advent of the 2008 Financial Crisis, the situation changed drastically. Major clients of the company began withdrawing their funds, causing the fund's balance to plummet. Madoff initially managed to calm the situation by requesting additional funds from some of his older clients. He also took his own secretary's deposit when she got her inheritance.

Those interventions, however, only served to postpone the inevitable. Madoff knew it was all over when the fund's balance plunged below $1 billion. Just like what he told his wife and two sons, his company was a Ponzi scheme. His sons ended up betraying him and went to the FBI to report him. Madoff was arrested as a result, and the scheme was discovered.

Bernard was finally sentenced to 150 years in jail, which was effectively a whole life in prison. Surprisingly, when Madoff entered the prison, he was welcomed by his fellow prisoners as a hero who had robbed the prosperous.

This series serves as a reminder that, as the phrase goes, if anything seems too authentic, it most likely is. It also demonstrates the value of diversification in investing and trading, rather than placing all one's eggs inside one basket.

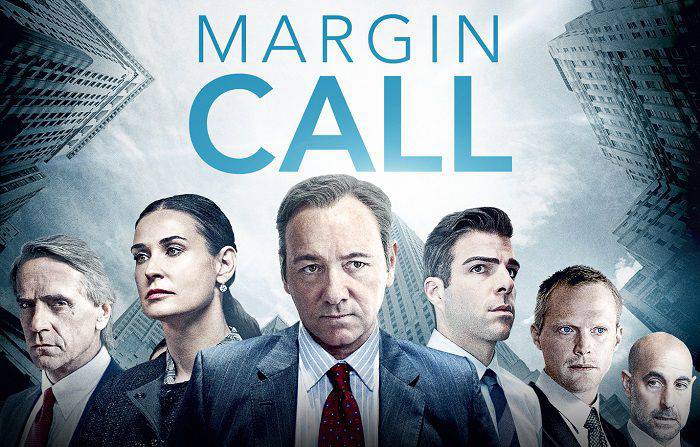

4. Margin Call (2011)

J. C. Chandor made his feature directorial debut with Margin Call, a 2011 American financial thriller he directed and produced. In the earlier stages of the financial crisis in 2007–2008, the main story took place over the course of 24 hours at a major Wall Street investment bank.

The activities of a group of workers during the financial crisis are the topic of the documentary. Kevin Spacey, Paul Bettany, Jeremy Irons, Zachary Quinto, Penn Badgley, Simon Baker, Mary McDonnell, Demi Moore, and Stanley Tucci starred in the film, with Mary McDonnell, Demi Moore, and Stanley Tucci came as supporting actors.

Alongside a round of consultations and review, the firm's Chief Financial Officer planned to conduct a fire sale at a certain future date in order to maintain the company's financial stability. The obvious issue here was that the firm's employees had spent years cultivating relationships and confidence with representatives from various investment banks. As a result, throwing all of the toxic assets into the market would potentially wreck their personal image in the industry, and they would almost certainly become unable to exist in the same place later.

To make up for the loss, the company's CEO set certain targets for workers to meet during the fire sale and promised that anyone who met those goals would receive a $1 million bonus in a single day. This risky operation ended up being a huge success. However, this outcome came at a cost: the CEO had to fire hundreds of workers who took part in the fire sale because it was apparent that nobody would ever do business with them in this area of work.

The audience will learn important lessons from this film. To begin with, it demonstrates that despite the high potential earnings in the industry, people in investment banks can easily lose their careers due to high competition and, in some cases, the harsh nature of the market. It also reveals that an individual's integrity, especially in the financial industry, is much more important than having millions of dollars. Obviously, by engaging in years of constant work, one can have both. However, sacrificing one's reputation for any price could signal the end of one's career.

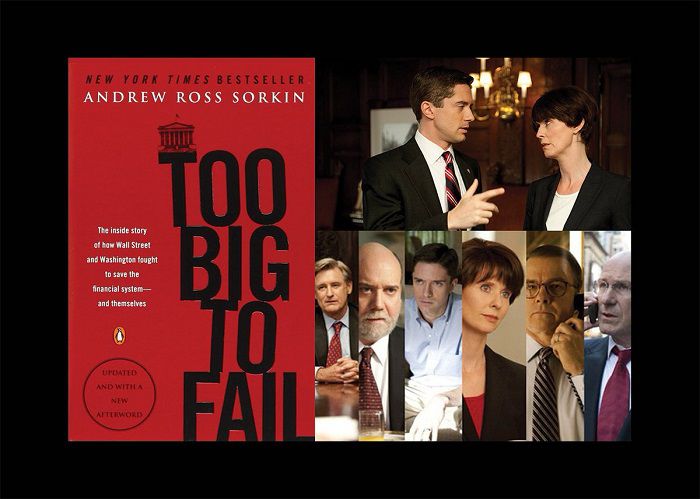

5. Too Big To Fail (2011)

Too Big to Fail is a 2011 American biographical film based on Andrew Ross Sorkin's non-fiction book: "Too Big to Fail: The Inside Story of How Wall Street and Washington Fought to Save the Financial System and Themselves". The movie premiered on HBO on May 23, 2011, with Curtis Hanson as the director. It received 11 nominations at the 63rd Primetime Emmy Awards and won Paul Giamatti the Screen Actors Guild Award for Outstanding Performance by a Male Actor in a Miniseries or Television Movie for his portrayal of Ben Bernanke.

Too Big to Fail refers to a company or industry that has become so deeply embedded in a financial system or economy that its collapse will be catastrophic. As a result, the government would consider bailing out the company or even the entire industry, such as Wall Street banks or American manufacturers, in order to avoid economic catastrophe.

The movie started with Richard Fuld, the CEO of Lehman Brothers, struggling to deal with the company's stock price decline. Investors lost faith in this investment bank as a result of its overleveraging and substantial exposure to the housing market and began to sell their shares, leading to a drop in the stock price.

Despite these massive obstacles, Fuld had many chances to stabilize the situation and save the company from bankruptcy. However, he made some major mistakes along the way, which ultimately sealed the firm's fate.

One of them is turning down Warren Buffet's investment proposal. According to the terms of the agreement, the billionaire was willing to spend several billions of dollars by purchasing a stake in the company for $40 per share. Buffet proposed a 9% annual dividend in exchange. The CEO of Lehman Brothers declined this bid because the stock price of his company was $66 in February 2008, so the price of $40 was too low for him. He didn't want to shell out millions of dividends either.

This turned out to be a tremendous strategic error, but it wasn't the only one. Lehman Brothers eventually went bankrupt after a last-ditch effort to reach an agreement with Barclays failed. The US Treasury Secretary was adamant that no public funds would be used to bail out the investment bank. "If we keep covering their losses, they will never learn anything," he said.

As panic selling took control of the sector, Henry Paulson and the New York Fed's Chairmen, including future Treasury Secretary Timothy Geithner, negotiated with the remaining investment banks to prevent the possibility of the Lehman Brothers situation.

The financial crisis pressured Henry Paulson to be more flexible in his bailout principles, and he went to Congress to request authorization for an $800 billion troubled asset relief program, commonly recognized as TARP.

One of Paulson's former employees recommended that the US Treasury Secretary nationalize some banks as a temporary measure to inject the capital needed for ensuring their survival. The US Treasury staff reacted with hostility and disagreement. Paulson finally agreed to this proposal after the alternative solutions were proven to be impractical or too slow.

The US government will become a shareholder of all such financial institutions under the terms of the agreement. In exchange, they will inject billions of dollars into those companies, effectively lending them money. Following that, the banks would pay the US government 5% interest on the loans, followed by 9% interest.

The banks had the opportunity to recreate their TARP money at a later date in order to escape interest payments and buy back shares from the government. The film ended with Ben Bernanke, the US Treasury Secretary, and Chairman of the Federal Reserve expressing their confidence that banks can use the TARP funds to lend to their investors.

Too Big to Fail demonstrates that during the 2008 Financial Crisis, many US banks and insurance firms have grown massively to the point that they became practically too big to fail. This is because the failure or bankruptcy of either of them would almost certainly have a domino effect on the rest of the industry, bringing the entire US economy down with them.

It also causes a condition in which the CEOs and managers of certain financial institutions realize that if they take any substantial risks and things go badly wrong, the government will be forced to intervene to keep them afloat and prevent the economy from collapsing.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance