Each broker has a different set of rules regarding their commission fees. This article will discuss how to measure forex broker commissions and see if their conditions are reasonable enough for traders.

The currency market is a vast and highly dynamic market unlike any other, which could open many opportunities for you to be a successful trader. To begin with, you need to find a forex broker to facilitate your trading. A broker has a role in connecting traders to the currency market and provides tools needed to do online transactions and execute the orders.

But using the broker's facilities can't be completely free of charge because the broker needs money for their further existence too. So in exchange for their services, traders must pay commission fees for every transaction depends on the term and conditions that each broker has.

Essentially, there are three sources of income for a broker.

- Spread, whose values are determined by the difference between the ask and the bid price so it is obviously distinct for every currency pair. It can be offered as a fixed or variable spread.

- Trading against the client. This income only works for DD brokers or market maker brokers that create their own market for the customers and, at certain conditions, could trade on the opposite side against their clients. So the clients' losses would mean direct profit for the broker.

- Commissions. Brokers would charge a certain amount of commission fee for every transaction. In this article, we will focus more on this subject.

Every broker has a unique set of rules and requirements to make a profit; some could take more advantage of their clients than the others. Brokers would create their rules by bouncing around with those three sources of income mentioned above. For example, some brokers would have a free commission but higher spreads, or vice versa.

However, the different regulations in every broker are sometimes confusing. Indeed, there are pros and cons to every option. Which one is the most profitable? Here, we will discuss how to measure the fairness of forex broker commissions and see if their conditions are reasonable enough for traders.

The Commission in Forex Trading

Forex broker commission is essentially the amount of transaction fee that a trader must pay, sometimes for each lot traded. As a trader, you should regard this charge as part of your regular expense. The money will be used by the broker as a part of their income, as well as to pay their trading partners, namely liquidity or technology providers. After all, brokers are not charity groups that are willing to work for free, and their clients are the main, if not the only source of income that they could get.

To optimize their services, brokers should collaborate and cooperate with many forms of institutions. The first one is the banks. Technically, the banks are in a higher position than the brokers because they could provide liquidity to the market. These multinational banks are associated with the interbank network where the prices of forex pairs are formed. In return for giving access to the banks' price, the liquidity providers should charge a commission. Therefore, the money obtained from traders is partly used to pay commission to the banks.

Not only for the bank, brokers also need to pay the technology providers if they decided to partner with one. Technology provider companies are needed to facilitate online forex trading and provide the latest technology to give traders a better experience. That is why many brokers then include this service fee in the commission.

Reasonable Range of Commission Based on Broker Types

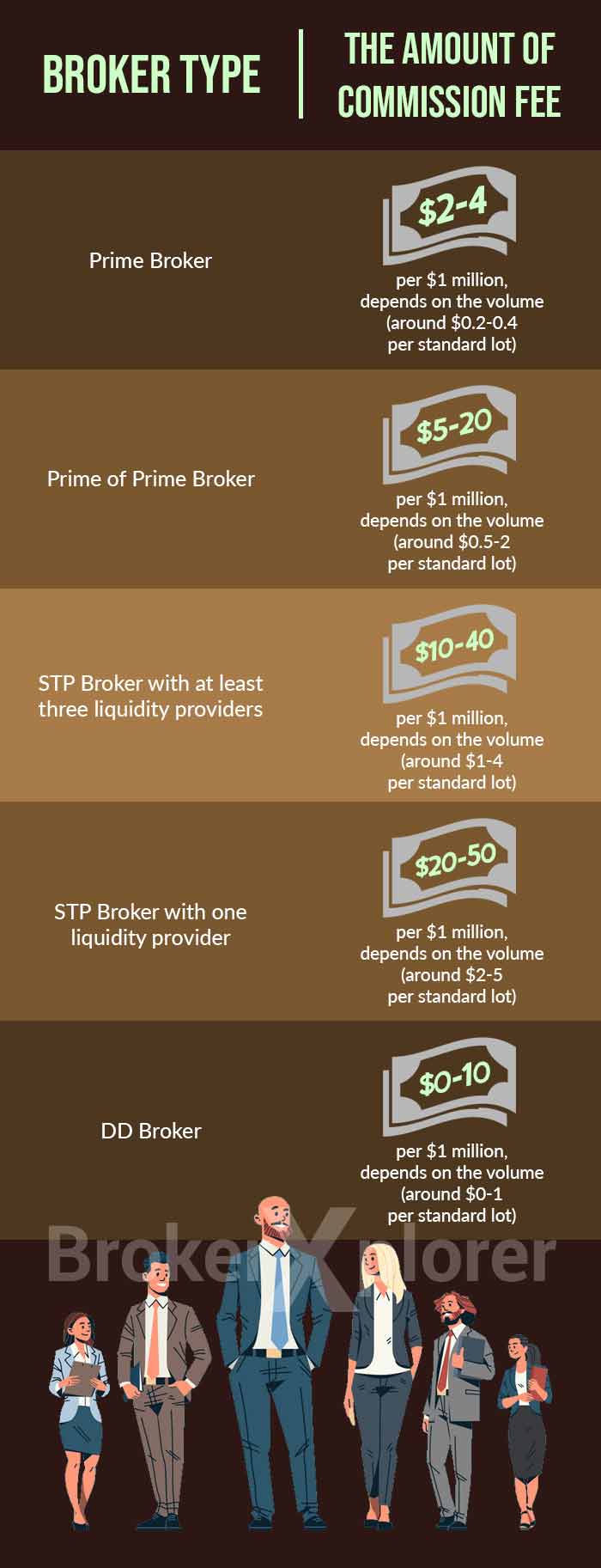

One of the most challenging parts of finding the right broker is calculating the total cost of trading and making sure that the commission fee is still affordable, but not too cheap either that it feels like it could be a scam. The team from Boston Technologies (one of the leading online trading technology providers) made a list of some reasonable ranges of forex trading commission fees based on the types of brokers:

To better understand the categorization of forex brokers in the picture, read the description below:

- Prime brokers are often used by professional and experienced traders such as Goldman Sachs and Morgan Stanley, and also provide services for institutional traders like Hedge Funds.

- PoP (Prime of Prime) brokers mostly serve retail traders by dealing directly with liquidity providers. Many of them promote themselves as ECN or STP or DMA brokers. To name a few, there are IG Markets, Pepperstone, Dukascopy, Varengold, IC Markets, and Saxo Bank categorized as PoP.

- STP (Straight Through Processing) brokers are basically the same as PoP brokers, and it can be a little bit confusing for novice traders to distinguish between the two without knowing more about the business aspect, especially since many STP brokers also like to call themselves ECN or STP model brokers.

- DD (Dealing Desk) brokers operate by creating the market and act as the liquidity provider themselves, so they're not merely liaisons that connect the traders with the market, but they deal in their own market.

Prime brokers' transaction fees tend to be low due to the high volume of daily trades and their large deposit requirements. Apart from that, the smaller broker's deposit requirements and trading volume, the higher the commission fee. Still, it does not apply to DD brokers. This happens because DD brokers don't have to pass orders to liquidity providers, so according to Boston Technologies, there shouldn't be any commission charges incurred.

For some types of brokers like DD and STP brokers, commission fees can be eliminated, which seems like a very profitable option for traders. But keep in mind that brokers should obtain their income from the traders to keep going in one way or another. So in these cases, instead of charging commission fees, they would shift the commission to the spread (mark-up). Some brokers offer a fixed spread, others offer a variable spread, or they could charge a commission based on a percentage of the initial spread.

Different Broker, Different Quality

Apart from the number of charges that you might have to add to your total trading cost, remember that each broker has different service levels. Not all brokers are able to make the market equally. Forex market is an over-the-counter market, which means the banks should cooperate with other banks and price aggregators to create a comprehensive condition based on each organization's capitalization and creditworthiness. It shows that a broker's effectiveness depends on their relationships with these institutions and how much the value is traded between them.

In this case, you might want to find a broker that could offer you high liquidity with a reasonable spread. Slippage, which occurs when there is a gap between the expected price and the execution price, is something that you want to stay away from. If the broker has a significant and robust relationship with the liquidity providers and the aggregators, their prices won't be far off and more likely to be accurate for execution. Even with the widening spread, they would be able to offer a more competitive spread than other brokers that are not well-capitalized.

Regarding the broker's commission fee, whether you should pay a certain amount of money actually depends on what the broker offers to you. Supposed a broker charges you a little extra commission than other brokers about $2-3 per 100,000 unit trade. In exchange, you can access a sophisticated platform and analytical tools that are considered new in the forex trading industry. If this is the case, it may be worth the extra commission.

The Bottom Line

Today, the competition between brokers is getting more intense. Many brokers are trying to attract clients by reducing the commission fee and spread to be as low as possible. This trend is definitely beneficial for traders. However, the total cost of trading isn't the only aspect that you need to consider. That being said, the goal is not supposed to be about finding the cheapest broker, but the right broker. Even though you might think that you're getting the best deal at the lowest price, you might not realize that you're sacrificing other benefits.

Think of it this way: the price you have to pay is equivalent to the services you will get. So sometimes paying more means getting more. Make sure that you check all of the broker specifications (not just the commission fee) and compare them with other brokers'. That way, you could really see which broker suits you the most and could help you reach your trading goals.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance