Forex broker types can be confusing at times. Your choice can either make or break you. If you want to be successful in your forex trading stories, you'll seriously need a good broker.

Like a party dress, picking forex broker types can either make or break your first impression. I mean, if you want to hit up some ladies with your forex trading success stories, you'll seriously need a good broker.

Why forex Broker Types Matter?

It's no secret that forex brokers come in many shapes and stories, from top quality dealers to bucket shops. As a beginner, you may not get all the nook and crannies, but knowing which is which at first glance is essential nevertheless.

Choosing suitable forex broker types boosts your trading performance, or at least reduces the risk of margin loss

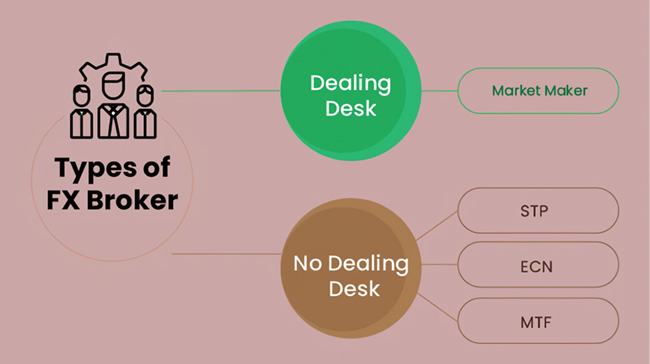

Let's put it this way: You want to buy a tray of eggs. The first thing you'll do is looking for a shop that sells it. Next, you got to choose either you'll shop at farmer markets or at retailers. Now, the most important part, do you get the best deal out of it? Is that the cheapest quality egg you can get? Is all the egg in good condition or is there any spoiled one? The same thing applies to forex trading. In order to trade, the first agency you need is a forex broker. Next, you may choose either one of these forex broker Types:

- Dealing Desk: It's more or less the equivalent of farmer markets. All the asset and product comes from the producer themselves

- Non-Dealing Desk: This type of broker doesn't produce its own products, so they'll need other parties to keep supply flowing.

Depending on your capital strength and trading style, either one of the forex broker types can greatly affect your trading performance while the remaining one will undermine it. So, which one suits you?

See also: Comparing Forex Brokers Side by Side

Dealing Desk Vs Non-Dealing Desk

Here's the part you'll end up arguing other traders with. That's because the other party will always argue that other forex broker types are scams. Instead of discriminating or picking aside, I'll break down each available forex broker types so you can consider which one suits you better:

a. Dealing Desk

If there's any bloke insisting his statement that 100% of dealing desk brokers are bucket shops, leave him. Essentially, bucket shop brokers are only interested in draining their client money. That's not the case with actual dealing desk brokers! In fact, they may take the other side of your market order to provide added liquidity. Meaning that they also have to shoulder the risk of loss if the liquidity is scarce (often during news release).

Dealing Desk forex broker directly manages their price quotes as they transmit both buy and sell quotes at the same time to the clients.

Dealing desk forex broker types directly manages their price quotes. In other words, they transmit both buy and sell quotes at the same time to your trading terminal. So, you can rest easy and be assured if your dealing desk broker plays fair by displaying the price quotes without frequent re-quotes or bad slippage.

See Also:

Second, these forex broker types won't always take the opposite end of your order. They may occasionally pass client's orders to other clients or liquidity providers. More or less, anyone can still have chances of winning in this market environment.

Lastly, due to flexible market order traffics, dealing-desk broker does not need a commission or spread markup to run their business. That's why dealing desk broker may offer their clients with zero-spread, no-commission, or even no-swap accounts.

b. Non-Dealing Desk

Most of the pros would say this is where all the good meat is. I'd say yes to that, but it'd be for the pros only. But why pros only? First and foremost, non-dealing desk forex broker type DOES NOT pass their clients' orders to their own dealing desk. This means if you are a buyer with specific buy order, this broker will have to match it with an actual seller. That seller (or buyer) can be either other clients or liquidity providers. That sounds fair and good, yeah? But unfortunately, it comes with a downside.

Non-dealing desk broker does not take order to a dealing desk.

Instead, they build a network where your market order gets filled with actual counter-trade

NDD brokers network relies heavily on its external liquidity providers, which means they have to build a structure to sustain it. In the doing, they will have to slightly markup their spread or charge commission to run their business. Ultimately, it adds up to your trading cost. So, in essence, you can get the best transparency and fair prices from NDD brokers.

However, due to the nature of the network, slight slippage or commission is rather unavoidable. This is why non-dealing desk brokers are ideal for veteran traders, because they wouldn't mind the lofty trading costs as long as their trades run in transparent network.

Conclusion

Choosing the right forex broker type determines your trading experience. This is a factor that you cannot ignore if you wish to learn forex trading without unnecessary losses. If you are a beginner, consider trading with a dealing-desk broker as your trading cost is very low compared to non-dealing desk one. Also, don't be afraid to trade with dealing-desk brokers, not all of them are cheap bucket shops. The most important thing is how transparent they run their market quotes. Pick ones that don't "slip" too often.

To help you pick the most ideal broker, we provide a special tool called Broker Finder. What is it and what it can do? Find out here.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance