Corvin Codirla has 2 secrets to success in the forex market including understanding interest rates and employing trend following strategies.

Corvin Codirla, a renowned financial expert, has earned a reputation for his straightforward and precise mindset. Drawing inspiration from the legendary investor Warren Buffett, Codirla has honed his investment skills to achieve remarkable success in the forex market.

With an alma mater like the prestigious University of Cambridge and the guidance of Buffett's investment principles, Codirla's aspirations have materialized into a reality. Armed with invaluable lessons learned from the forex tycoon himself, Codirla has discovered the key to triumphant forex investing.

Surprisingly, his approach is refreshingly simple yet highly effective. Codirla focuses on two crucial points when navigating the forex market:

- Understanding the impact of interest rates on price movements.

- Employing the Trend Following strategy.

How do these two factors contribute to the 47-year-old's triumphant forex investments? In this article, we delve into the explanation and unveil the secrets behind Corvin Codirla's remarkable success in the forex market.

Who is Corvin Codirla?

To delve into Corvin Codirla's insightful tips for success in forex investing, we must familiarize ourselves with his background and prominence in the industry.

Born in April 1976, Dr. Corvin Codirla has dedicated nearly three decades of his forex life. His academic journey led him to obtain a Bachelor's, Master's, and ultimately, a Ph.D. in mathematics from the esteemed University of Cambridge in 2001.

Embarking on his finance career, Codirla commenced his professional path in September 2001 as part of the Risk Management team at JPMorgan. Subsequently, he ascended to the position of Head of Global FX Options Strategy at Barclays Capital from 2005 to 2006 and later assumed the role of Director at Deutsche Bank from 2008 to 2011.

Currently, Codirla is the Senior Vice President of Hedging & Portfolio Management at Bladex. Bladex, an acronym for Banco Latinoamericano de Comercio Exterior, operates as a multilateral bank headquartered in Panama. Through trade and investment financing, Bladex is key in boosting economic growth and regional integration in Latin America and the Caribbean.

Before establishing himself as a seasoned forex investor, Dr. Corvin Codirla drew invaluable insights from the legendary Warren Buffett. Known for his astute financial insight, Buffett's success in forex investment can be attributed to three key elements: fundamental analysis, a thorough evaluation of a company's performance before investment, and capitalizing on opportune moments.

Despite Warren Buffett's impressive wealth, he has also faced losses, including some that amounted to 50 percent of his capital. Like novice traders, his setbacks often arose from hasty strategy changes without proper evaluation of trades. To overcome this hurdle, Buffett developed a methodical trading approach.

Corvin Codirla, drawing from Buffett's experiences, has distilled two secret keys to successful forex investment, as mentioned earlier. These keys align seamlessly with his motto, "Simple Is Best," reflecting his inclination towards effective, straightforward strategies.

Corvin Codirla's Secret Formula for Forex Success

Most investors generally prefer stocks, bonds, gold, or property as investment instruments. However, Corvin Codirla has a different opinion. He prefers forex because he believes that currency trends are stable, making forex trading an attractive investment.

Codirla highlights the importance of two key factors in successful forex trading: understanding the impact of interest rates on price movements and using trend following strategies. For more details, read the following sections.

1. Understand the Impact of Interest Rates on Price Movements

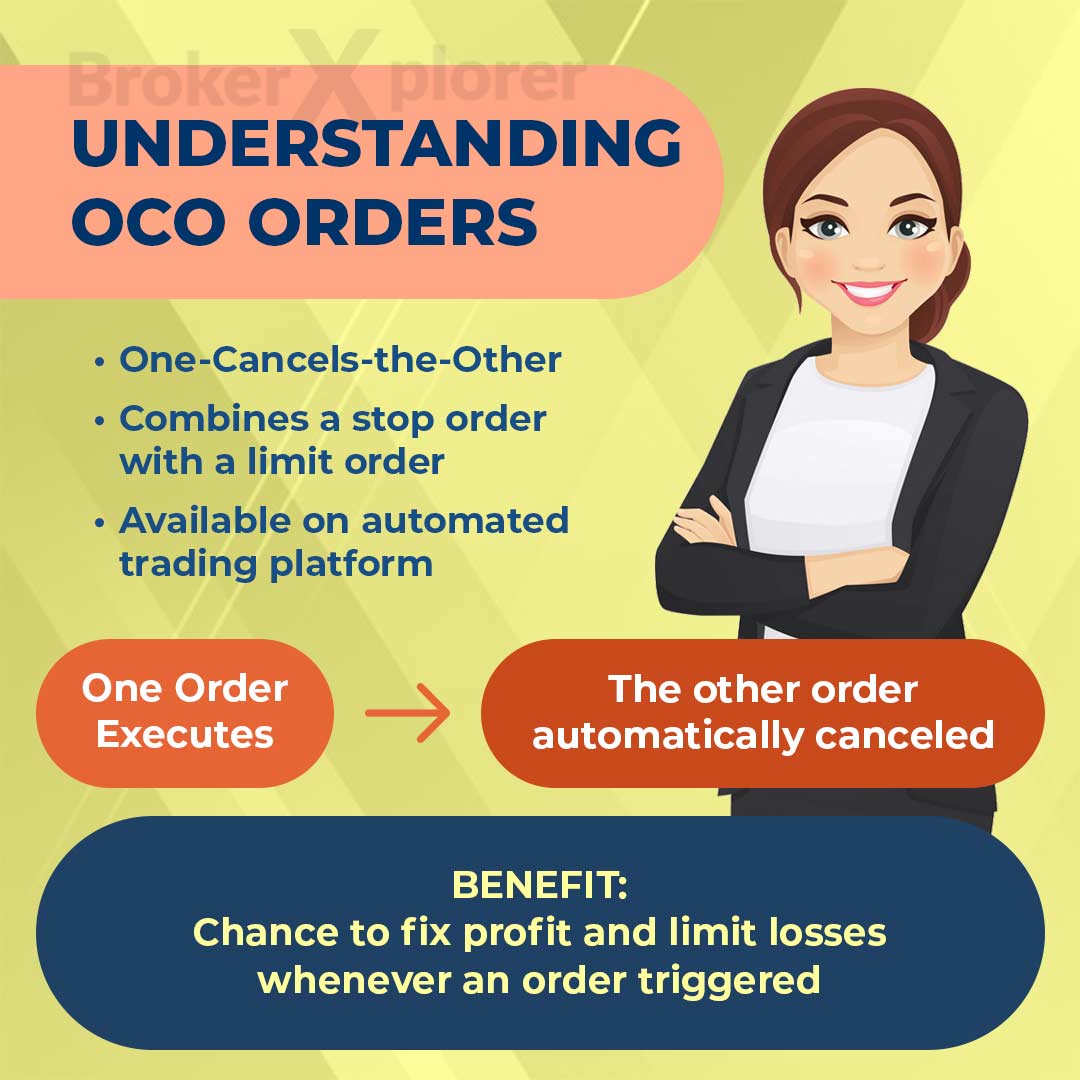

Price movements in the forex market are influenced by various factors, including interest rates. Interest rates are determined by a country's central bank and have a significant impact on the exchange rate of a currency. Understanding the interest rate conditions of the countries involved in a forex pair is crucial before making investments.

When a country's interest rate is high, there is a greater demand for its currency. This leads to an increase in the currency's exchange rate against other currencies. On the other hand, if the central bank decides to lower interest rates, the currency's value may decrease. Therefore, it is important to consider the interest rates of the currencies involved in a forex pair.

According to Corvin Codirla, selecting a forex pair based on the currency with the highest interest rate and the currency with the lowest interest rate is a key point in forex investing.

Example:

Currently, the interest rate on the British Pound (GBP) is 4.50 percent. When compared to other major currencies, the GBP is the largest interest rate currency. Meanwhile, the smallest interest rate is held by the Swiss Franc (CHF) at 1.50 percent.

Based on these data, investors will buy a lot of GBP/CHF. The high interest rate on GBP will attract investors to move their investment assets to Sterling, because they want to take advantage of the high interest rate.

Central bank interest rates have a significant impact on the forex market. Interest rates serve as a benchmark for determining currency strength and influence investor interest in a particular currency as an investment instrument. By keeping an eye on interest rate movements, traders can make informed decisions and potentially capitalize on favorable market conditions.

2. Use Trend Following Strategy

Have you heard of the trend following strategy? It's a method that focuses on investing based on the strength of market trends. But why does Dr. Corvin Codirla consider this strategy as his second key to successful forex investing?

Dr. Corvin suggests utilizing the trend following strategy because it can generate optimal profits when investing in forex, as long as the trader has mastered position management and proper emotional control.

With the trend following strategy, traders and investors enter positions based on the prevailing trend. Buying is the most suitable approach in an uptrend, while selling is preferred in a downtrend.

While this strategy allows entry based on the developing trend, caution is still necessary. Like a double-edged sword, careless implementation can lead to losses. Therefore, it is recommended to employ technical indicators that confirm the strength of the momentum, such as the RSI or MACD indicator. These tools can provide valuable insights and enhance decision-making.

By combining the trend following strategy with effective risk management and appropriate technical analysis, traders can potentially enhance their success in the forex market.

Additional Strategies for Successful Forex Trading

In addition to the Trend Following strategy, another approach that can lead to success in forex investing is the Position Trading strategy. Unlike short-term methods, Position Trading focuses on long-term positions that can be held for weeks or even months.

According to Corvin Codirla, the market's price trends tend to remain relatively stable over time. This makes holding positions aligned with the trend a promising approach for forex investment. Therefore, Position Trading can serve as a valuable complement to the Trend Following strategy.

When combining these strategies, conducting a more comprehensive analysis becomes essential. Relying solely on technical indicators may not be sufficient. It is crucial to consider the impact of news releases and other fundamental factors that can influence the currency you intend to invest in.

Summary

Corvin Codirla emphasizes the significance of two key points for achieving success in forex investing. However, it is crucial to complement these points with effective money management practices. Money management serves as a fundamental aspect that protects funds and ensures long-term profitability.

Furthermore, emotional management plays a vital role in investment decisions. Maintaining control over your emotions and avoiding them dictating your choices is important. Implementing a trading system can greatly assist in this regard, fostering discipline and focus on adhering to pre-established setups.

By incorporating robust money management techniques and maintaining emotional stability through a trading system, investors can enhance their overall performance and increase their chances of long-term success in the forex market.

Discover valuable insights and inspiration from master traders to improve your trading skills and spark a new wave of enthusiasm. Dive into the winning narratives and captivating expertise shared in this special section.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance