The forex market is open 24/5, but that doesn't mean you can expect the same trading outcome from whenever you place a trade. Here's why.

Forex trading is not an easy investment. It is widely known that forex traders lose money and a lot of them end up quitting the market. There are various factors that might cause a trade to fail such as poor money management, misuse of leverage, and uncertain market conditions. In order to be successful, forex traders must know exactly what they're doing and make the right decisions. This includes understanding how the market works, what strategy to use, and which broker to trust.

But apart from all that, a trader also needs to know when to open trade. While the forex market is open most of the time, it's not always active and offers the same amount of opportunities every time. Let's dive deeper and see how you can use it to improve your trading performance.

Contents

Understanding Forex Market Sessions

Before we go any further, it's important to understand that the forex market is divided into four trading sessions. Here's the brief explanation for each of them (in EST):

- London: 3 a.m. to 12 p.m. (noon)

- New York: 8 a.m. to 5 p.m.

- Sydney: 5 p.m. to 2 a.m.

- Tokyo: 7 p.m. to 4 a.m.

It's worth mentioning that these sessions can overlap, and when it happens, the market is naturally busier since more people are active.

Does Timing Matter in Forex Trading?

The answer is yes, timing is indeed very significant in forex trading. In order to truly understand the importance of timing, let's see the following example.

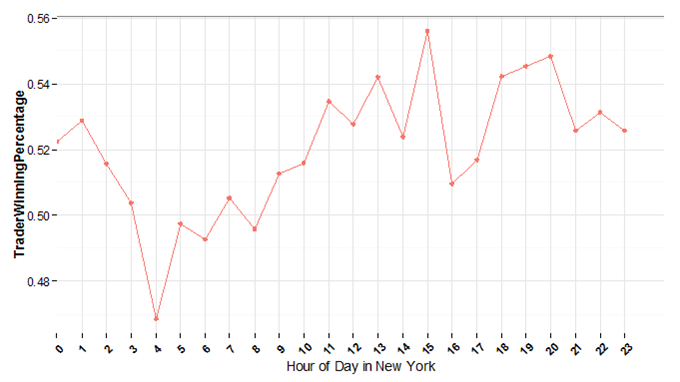

This time, we're using the data of approximately 24 million real trades that were placed across the GBP/USD currency pair in the 12 months ending in Q1, 2015. The following chart shows the likelihood of trader profitability in hours.

Based on the chart above, we can see that if a trader opened GBP/USD trades between the hours of 04:00 and 05:00 EST, then they could've gained a profit 47% of the time. Meanwhile, on the opposite end, if a trader opened GBP/USD trades between the hours of 20:00 and 21:00 EST, then they could've gained a profit 55% of the time.

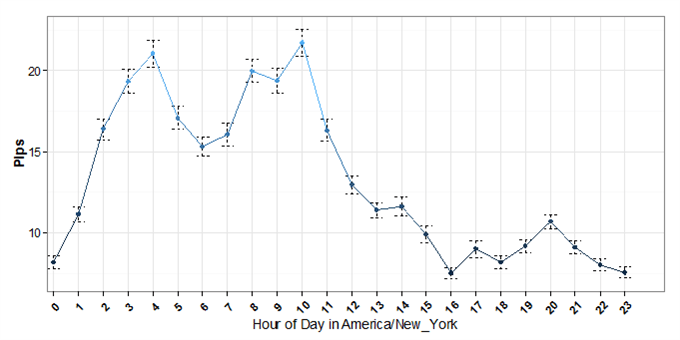

Now, let's take a look at the average rate of hourly price changes in GBP/USD from 2005-2015.

The chart indicates that the hour-to-hour price changes vary at different times of the day. On average, the Sterling moved 22 pips from 04:00 to 05:00 EST. In contrast, it moved less than 4 pips from 23:00 to 00:00 EST. So, volatility is highly different throughout the day.

If we compare the two charts, we can see that there's a clear negative correlation between volatility and trader's profitability. They're less profitable when the market is highly volatile and more profitable when the market is less volatile. The reason lies in the trader's behaviors. Most traders tend to use range trading strategy which basically involves buying an asset when the price is low and selling it when the price is high. This type of trading method can work if the price is not breaking key price levels and continues to move in relatively narrow ranges, which typically occurs in quieter markets.

So, in order to make a profit, traders with range trading strategy should simply avoid trading during the most volatile hours.

Please note that the above scenario is only an example. The truth is that different strategy is best used at different times. This is why traders need to know exactly what they need in order to win the trade and generate significant profit.

When is the Best Time to Trade Forex?

Many traders believe that the best time to trade is when the market is most active. This occurs when two or more sessions open simultaneously, particularly between 8 a.m. and noon, or the overlap of the New York and London sessions. It's worth noting that these two trading sessions account for more than half of the whole forex trades, so the market is typically very volatile and liquid during the period.

Other traders prefer to trade when the market is quiet. In this case, the Asian session is a great choice because it has low liquidity and low volatility. It is also less risky because the prices tend to move slower. In the previous example, we've mentioned that this method is suitable for traders that use range trading or mean reversion strategy.

Please note that there are some exceptions. Firstly, the market can be extremely volatile (even during slow hours) after a major economic or political news release. Secondly, the market can also suddenly be quiet and less active when there's a huge global event like the World Cup because people are distracted.

The Bottom Line

We can conclude that timing is highly important to consider in forex trading. Trading at the right hour can make you generate significantly more profit, so it's unwise to just wing it and trade whenever you want without thinking about the market conditions.

When looking for the best time to trade, you should choose based on the strategy that you use. If you're a day trader, it's better to trade when the market is volatile. You can get more trading opportunities and take profits from extreme price movements. But if you're a range trader, it's better to trade when the market is quiet and less volatile. Also, please make sure to monitor the release of big economic events and news releases as they can affect the market and increase market uncertainty.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance

7 Comments

Enzo Galtier

Sep 28 2022

According to this article, many traders believe that the New York and London trading sessions offer the best trading opportunities due to their high market activity. The article mentions that these sessions, especially during the overlap from 8 a.m. to noon, account for over half of all forex trades and are characterized by increased volatility and liquidity. Based on this article, I'm curious to know more about the advantages and differences between the New York and London sessions. How does the heightened market activity and liquidity during this period impact traders' strategies and decision-making? Are there any specific trading techniques or approaches that tend to work well in these sessions? Furthermore, does the article provide any insights into the potential profit opportunities or risks associated with trading during the New York and London sessions? I'd appreciate any further details or perspectives you can share based on the information in the article.

Ferran

Jun 10 2023

@Enzo Galtier: Definitely! The New York and London trading sessions are like the hotspots for trading action. They have high market activity, and that means plenty of opportunities for traders. The article says that during the overlap from 8 a.m. to noon, more than half of all forex trades happen! That's crazy!

Because of all the action, traders have to adjust their strategies. Some go for quick trades, taking advantage of the rapid price movements. Others focus on breakouts, looking for big moves when news hits. It's all about riding those market waves!

But remember, with great activity comes great risk. So, if you're into fast-paced trading and love volatility, these sessions can be your playground. Just keep an eye on the news and market trends. The possibilities for profits are there, but always be mindful of the risks that come with it. Happy trading!

Bosh

Sep 28 2022

The article mentions that the market can experience periods of quietness and reduced activity during significant global events like the World Cup due to people being distracted. Could you explain why such events can have an impact on the market and lead to decreased trading activity? Are there specific factors related to human behavior and market psychology that contribute to this phenomenon? Additionally, how does this temporary decline in market activity during major events affect traders and their trading strategies? Are there any precautions or adjustments that traders should consider during these periods to navigate potential market volatility or reduced liquidity?

Hagai

May 31 2023

@Bosh: Sure thing, mate! In short, major events like the World Cup can actually put a damper on the financial markets and lead to less trading action. It's all because people get caught up in the excitement and their attention shifts away from trading. Plus, human behavior and market psychology play a role too. Traders might become more cautious during these times, fearing potential volatility or uncertainties. As a result, trading activity drops, and market liquidity takes a hit. If you find yourself trading during these events, remember to manage your risk, be flexible with your strategies, and stay informed. Keep your head in the game, mate!

Victor

Feb 9 2023

Given that many traders believe that the best time to trade is when the market is most active, which typically occurs during the overlap of the New York and London trading sessions between 8 a.m. and noon, and considering that these sessions account for more than half of the overall forex trades, it is known that the market becomes highly volatile and liquid during this period. In light of this, what is the anticipated impact on spreads during the overlap of the New York and London sessions? Are spreads expected to tighten, resulting in narrower bid-ask spreads, or are they more likely to widen due to the heightened trading activity and market volatility?

Bruno

May 18 2023

I completely agree that market sessions are of utmost importance for forex traders. The level of volatility within a session can greatly impact the potential for profit.

It is true that many traders actively participate in the US Market Session, especially when it overlaps with the European Market Session. During this overlap, the EUR/USD pair tends to exhibit high volatility, providing traders with favorable opportunities.

However, as an Asian trader, it can be challenging to find suitable trading times during overlaps. Therefore, I would like to inquire about the specific Asian overlap occurrence and which currency pairs are recommended during the Asian overlap market session?

Enzo Galtier

May 25 2023

@Bruno: You're absolutely right about the significance of market sessions in forex trading. The timing of your trades can greatly influence your potential for profit due to variations in volatility.

While the European and US market session overlap is well-known for its trading opportunities, as an Asian trader, you may be interested in exploring the Asian overlap market session. The Asian overlap occurs when the Asian market session and the European market session overlap, typically during the early hours of the European session.

During this time, currency pairs involving the Asian currencies, such as the Japanese Yen (JPY), Australian Dollar (AUD), and New Zealand Dollar (NZD), can experience increased activity and volatility. Some popular currency pairs to consider during the Asian overlap session include USD/JPY, AUD/JPY, and NZD/JPY.