The amount of forex trading capital is intensely diverse, ranging from zero to thousands of dollars. How much is the ideal number? Can you actually achieve something from trading with small money?

The amount of capital invested in forex trading varies greatly from trader to trader. Some traders invest below $100, while some choose to invest above $10,000. But, is it possible to start even smaller than $100? The answer is yes, if you have proper risk management, know how to control your emotion, and trade with a broker that allows low deposit trading.

As a matter of fact, if you are a beginner, you should start "warming up" with a small capital first. There are many brokers with various capital requirements to pick from. With small to zero capital, you can start your journey into the world of trading with small money.

Do This If You Want to Succeed in Trading with Small Money

They say that money is not everything. Not in life, not in love, and apparently, not in forex trading too. There is an even more important factor than money that will seal the fate of a forex trader.

Risk management and emotion control also play important roles. No matter how big or small your money is, you should always trade with rational considerations and planned management.

If you trade with zero capital, you may tend to underestimate the risk. You may think that it's okay to lose big, after all, the amount lost is not your money.

However, if you trade your own money, you will certainly tend to be more careful before opening positions. This kind of psychological difference should never happen.

A trader with experience should be able to address potential gains and losses in the same way, regardless of the amount of money put into the trade.

The key is to use a clear risk and money management calculation and measure the success not by how much the money is made, but how many pips of profit have been accumulated.

Risk and money management have various variations. What are they?

Anti-Martingale

Anti-Martingale means that you will not double your position when you experience losses, because additional transactions will only be made if the position is in profit.

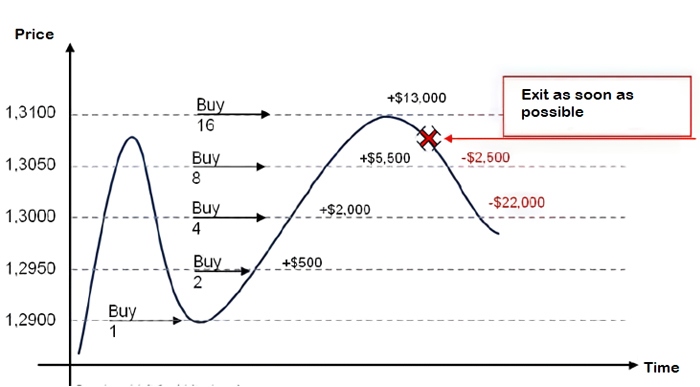

The Anti-Martingale method has the advantage of creating a rolling profit that gets bigger and bigger, like a snowball. The further the journey, the greater the benefits. Below is the perfect example of Anti Martingale method:

However, it is very important to limit the amount in the transaction, because the failure of one trade can result in a large loss as well.

So, the risk will increase along with the profits. This will appear usually when the price consolidates or reverses. If it is not immediately anticipated, the benefits accumulated by the Anti-Martingale method will be quickly reverted into losses.

Pyramiding

The Pyramiding strategy is almost like Anti-Martingale as it is basically "adding when a position is profitable". The difference is that you don't modify the transaction size. Take a look at the scenario below:

The logic behind this strategy is, if the market moves as expected, it is likely that a trend is continuing for some time. Therefore, additional positions need to be executed to capitalize on the potential trend continuation.

This strategy can be very powerful to create substantial profits if applied successfully. If you fail, however, you will be caught in a damaging loss from several losing positions.

Fixed Fractional Position Sizing

This type of management and its variations is the method most recommended by professional traders. Whether you realize it or not, you have been using this method as a simple strategy to manage the risk.

To put it simply, fixed fractional position sizing is setting a fixed position size based on a certain percentage of the total capital.

For example, let's say a trader has a capital of $10,000 and uses a portion of 5% of his capital for each position. It means he uses the fixed fractional sizing at 5 percent. He will not use more than $500 ($10,000 x 0.05) in each transaction.

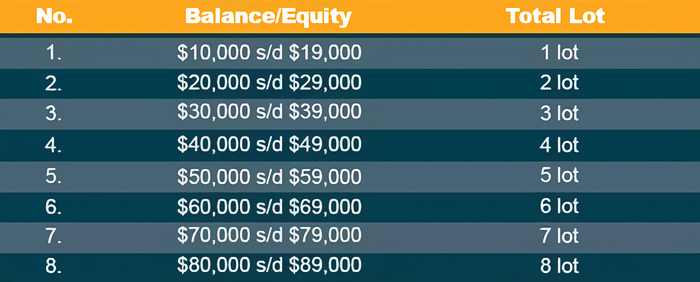

Based on that calculation, he will only open 1 lot when his total capital is $10,000 USD. However, if his total capital increases to 20,000 USD, then he can double the number of lots per transaction because 5% of $20,000 USD is $1,000. As an example, here is the full scenario:

The higher the capital, the more lots that can be used in transactions. This strategy allocates risk according to a predetermined percentage that is ideal according to each trader's tolerance of risk and profit.

7 Go-to Forex Brokers If You Start Small

If you are a beginner, you should not immediately start with big money. Do a trial run on the broker you choose, then observe how their trading condition works.

When you first started trading, it's better if you can choose a good forex broker with small capital requirements, so you have a proper warm-up before trading with a bigger sum of money.

To find out which forex broker is most suitable for you, you should take a quick look at the explanation below:

- FBS

FBS is a forex broker that provides many account options for trading and investment needs. With flexible choices of fixed and variable spread, traders can start small with this broker to open an account with an initial deposit as low as $1. - Exness

You can open an account with this broker with a minimum deposit of $1. The spread is variable and competitive, with leverage that can go up to 1:2000. As a matter of fact, Exness is quite well-known among forex traders as a broker with reliable trading conditions even for beginners. However, this broker rarely holds promotions, trading contests, or other events to attract new clients. - LiteFinance

With a minimum deposit of $50 and leverage up to 1:500, LiteFinance is one of the most popular brokers for newbies. This forex broker pioneered the cent account and is also known to always keep up with the trends among retail traders. It offers interactive features, including a 3-minute registration process via Facebook, Google+, or regular email accounts. - InstaForex

InstaForex is one of the most popular forex brokers since 2009. As the name implies, InstaForex prioritizes ease of administration to instantly jump-start your trade. With a minimum deposit limit of $1 and maximum leverage of 1:1000, as well as a fixed spread from 3 pips, Instaforex earned its right on this list. - FXOpen

FXOpen is a forex broker pioneering micro account and swap-free (interest-free) option. With a minimum deposit starting from $1, leverage up to 1:500, and competitive spreads, FXOpen has survived for 15 years (as of 2020) as a forex broker that novice traders should look at. - JustMarkets

JustMarkets enables their clients to deposit as small as $1 with a maximum leverage of 1:3000. This small capital forex broker can be an ideal option if you are just starting as it also provides an education center for newbies. - XM

Providing a micro account with a minimum deposit of $5 and competitive spread on major pairs, XM aims to present the best service for all types of traders, including the novice ones. Supported by leverage features ranging from 1:1 to 1:888, XM is also quite experienced as this broker has been established since 2009.

Final Thoughts

Stay realistic and keep learning. With small money, of course, the profits you get will not be significant at first. The most important thing is that you know how to manage your money and trade with the right broker.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance

2 Comments

george

Oct 28 2022

See all the list of brokers that give us opportunity to trade with lower capital so much remained me to stay calm and do my best for financial freedom. Unlike the old days before 2000, when forex was limited to a few businesses and individuals who had a lot of money to start trading. There are many ways to achieve financial freedom.

One of them is mentioned in this article. I am amazed that you can start trading with $0 and make a profit! Brokers will give you the free money if we join competition or we can start it with only minimum dollars! I believe we all have at least a dollar in our wallets that we can use to trade.

In other words, look at all the opportunities our parents and grandparents don't get. You can even mine some money on your computer and trade on your smartphone! Only with single click we can start trading without calling brokers to open position. Not the hard-traditional way anymore!

Kennedy Wong

Nov 15 2022

george: I think it may take some capital to achieve financial freedom with forex, no judgement or disagree with your respective views, I think to start making more profit, we must have at least $100 and open in standard account. The size of the contract will be larger, and you can make a really “profitable” profit. So in my opinion, if you start with just 1 dollar for example, you can sign up for a cent account where the profits are only earned in cent which is very small profit or micro account that can earn in cent too. I am not saying it is not profitable at all, but in fact many traders use this account to learn forex before or to the next level after a demo account. I agree with your point about how easy it is for us to trade, but I disagree if a little money can create financial freedom. It is possible to trade forex with little money, but you need at least $100 like the article listed to make real profit in forex.