eToro is one of the largest brokers in the world. But, is it really worth checking? Here is an honest review of eToro and what to expect from it.

eToro is a reputable UK-based forex broker that was founded in 2007 by David Ring and the Assia Brothers: Ronen Assia and Yoni Assia. Over the years, the broker has been earning high reputations as one of the top forex brokers worldwide with more than 17 million users in at least 100 countries as of 2018.

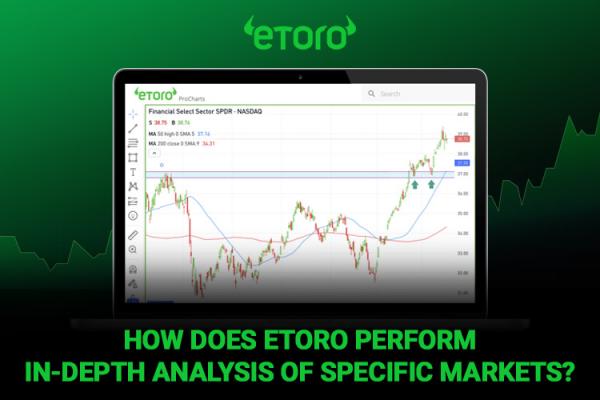

eToro arguably has the best, user-friendly trading platform in the industry, making it suitable for beginners, particularly traders who are interested in social and copy trading. It is a multi-asset platform that offers more than 2,000 tradable assets including stocks, commodities, CFDs, forex, cryptocurrencies, indices, etc.

The top feature offered by eToro is copy trading that allows new investors to copy the strategy and portfolio of professional investors. In return, the experts will receive a reward from the company for being copied. The platform also provides a wide range of educational tools and resources for beginners in need.

Other than that, the broker is also known to be the leading broker in cryptocurrency. eToro offers access to 18 of the world's most popular cryptocurrencies, including the major cryptos such as Bitcoin and Ethereum, as well as smaller ones like Tron Coin and Stellar Lumens.

Contents

Is eToro a Safe Broker?

eToro has no problem with security. The broker has top security measures and regulations, as well as strict money protection features to ensure the safety of your funds. Established in 2007, eToro has built physical offices in many countries around the globe including London, Limassol, New Jersey, Shanghai, and Sidney. The broker has also obtained licenses from several top-tier regulators, namely ASIC (Australia), FCA (UK), and CySEC (Cyprus). Being regulated by these authorities means that the broker won't likely manipulate market prices and comply with the regulator's policies.

In addition to the legal licenses that the broker has obtained, eToro is also ESMA compliant and regulated in almost every country in Europe. For this reason, eToro can offer service to almost every country in the world, even the US. There are, however, some limitations for US traders in terms of trading. So if you're from the US, make sure to check the terms and conditions before you register.

When it comes to money protection, eToro always makes sure that it is their priority. The broker provides two safety measures to help you keep your money as safe as possible.

First, traders' funds are all stored in segregated accounts within top-tier banks like Barclays and Goldman Sachs. This is important to ensure that your funds are kept safely in a separate account and won't be used by the broker for their personal interest. It can also protect your funds if the broker suddenly goes bankrupt or encounters financial difficulty.

The second measure is negative balance protection. With this feature, your account's balance won't be negative or below $0. So if at some point your trade goes downhill and the broker's stop out doesn't work, the negative balance protection will automatically set your balance to $0 despite the exceeding loss you may have.

The Pros: Why Should You Pick eToro?

What are special features that set eToro apart from its competitors? Here is a detailed explanation of why you should choose eToro:

Excellent Trading Platform

eToro is best-known for its user-friendly trading platform available for both mobile and desktop users. Unlike other brokers, eToro only offers one type of platform, which is their own trading platform that has built a high reputation among traders for many years. The best aspect about the platform is that it is very easy to use and navigate, even for those who just started trading.

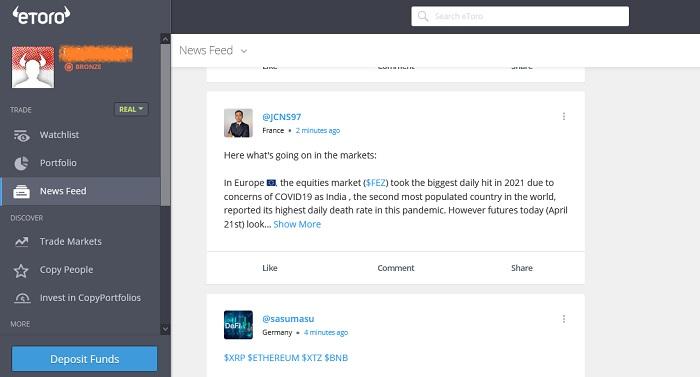

Because social trading is a huge part of eToro, the platform provides many features that can help traders to connect and build a strong community. For example, the "feeds" section will allow you to share any information, strategy, news, and images for everyone to see. You can also follow other traders and participate in various discussions.

Commission-free Trading

One of the best features from eToro is that you can trade with no commission in stocks and ETFs. This is very convenient for many traders, as it can reduce the trading cost. However, keep in mind that the broker still may retain a percentage of the dividend based on the country you are based in. For example, in the US, the amount would be 30% of the dividend.

Unlimited Demo Account

Starting off with a demo account is always a good idea for beginners. In eToro, the demo account is entirely unlimited and can be opened with the most basic personal information. You will only need an email address, username, and telephone number. With eToro's demo account, you can get access to practice with a $100,000 virtual balance that functions exactly like real money. What's great about it is that it is free of risk and definitely suitable for trying out different strategies or trading tools.

Copy Trading and Popular Investor Program

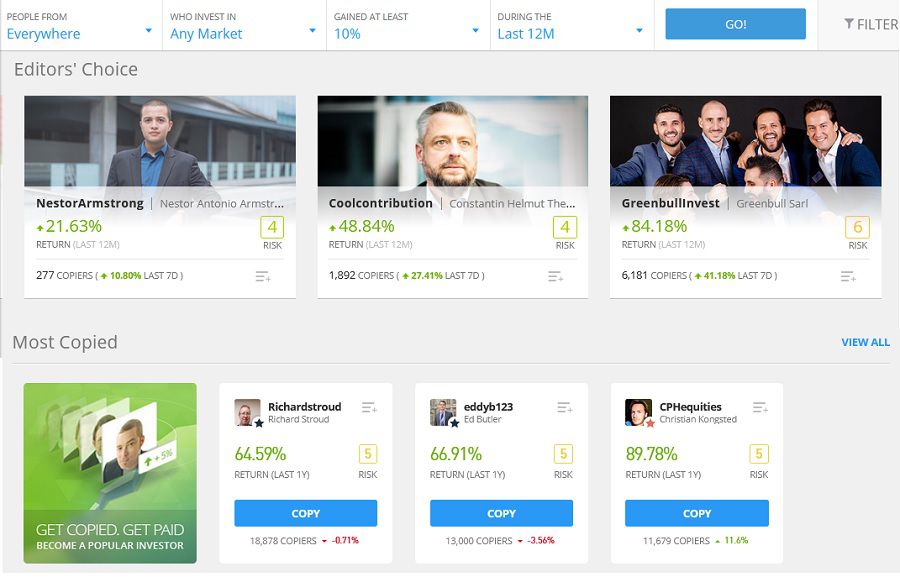

If we talk about social and copy trading, eToro is undoubtedly the best platform to start with. With this feature, traders are able to copy other traders' portfolios and strategies. It is a great advantage for beginners with limited knowledge and experience in trading. You can earn profit while simultaneously learn to build an effective trading strategy. Eventually, you'll be able to figure out the best strategy that suits you and trade on your own.

On the other hand, eToro also provides a program for expert traders, namely the popular investor program. By joining the program, you basically let other people copy you and in return, you'll receive payments from eToro. Before you can join the program, you will have to contact eToro so they can confirm your order and decide whether your profile is eligible to become a popular investor. The number of rewards given will be based on the level you're on (higher levels get more rewards). Therefore, these programs offer a win-win solution to both beginners and professionals.

The Cons: What to Consider

Despite offering various advantages for both new and seasoned traders, eToro has its drawbacks. Are they still tolerable or just downright unacceptable? You may conclude after reading the full explanation below:

Relatively High Spreads and Non-Trading Fees

While there aren't commissions charged, each trade should be executed with specific spreads that vary from one asset to another because eToro only offers variable spreads. Although it is still considered competitive, it's relatively higher than those of other brokers. In cryptocurrency trading, the spread for popular cryptos such as Bitcoin starts at around 0.75% but it can rise up to 5% on others depending on the volatility. Also, the minimum purchase for any cryptocurrency is $25, which makes it difficult for small traders to spread their balances over more than a small number of coins.

Another con is regarding the non-trading fees. There are several charges that you may get including withdrawal fee, inactivity fee, and overnight fee. Typically, these fees are used to compensate for the commission-free trading model that they offer.

Trading Accounts

There are several trading accounts offered by eToro, namely:

- Demo account: as mentioned before, demo account is one of the top features offered by eToro. It is a great way to practice your trading as it offers free and unlimited access to a virtual balance that functions exactly like real money. You can open it only by providing basic personal information including username, email address, and telephone number.

- Standard account: this is a typical account suitable for any traders. To get started, you will need to provide several documents for a fast verification process. The documents needed are ID/passport and proof of residence (utility, bill, or bank statement). Once you submit the requirements, eToro will check the documents and verify the account. Other than that, a minimum deposit of $200 is required to open this account type.

- Islamic account: if you're an Islamic trader, it is possible to have an Islamic account on eToro, but you have to request it specifically. The account will not apply any swap fee as it is considered haram under Sharia law. To open this account, you will need to deposit at least $1,000.

Deposit and Withdrawal

Deposit and withdrawal can be really important for traders. As we have mentioned before, your first eToro deposit would have to be at least $200. After that, a deposit of at least $50 is required. The payment methods offered will vary depending on your country, but typically wire transfer, major credit/debit cards, crypto payments, and e-wallets are available. EUR, USD, GBP, AUD, and RUB are generally accepted but again, it depends on your local area.

As for the fee, it is generally limited if you are depositing in USD. If you happen to deposit in another currency, you will need to pay a conversion fee. Other than that, it depends on the payment method you choose.

Payment methods for withdrawal are essentially the same as deposits. In fact, keep in mind that due to anti-money laundering regulations, your withdrawal method should be the same as your deposit method. The broker will require you to pay a flat $5 fee for withdrawing or the equivalent amount in your currency. Also, the minimum withdrawal amount is $30.

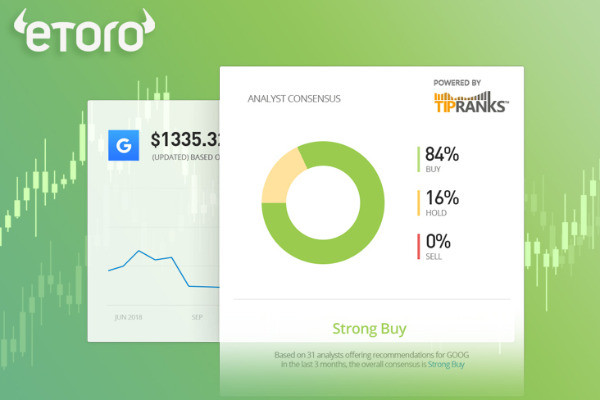

Education and Support

Being a beginner-friendly broker, it's only natural for eToro to provide various educational materials and resources for its traders. The platform itself is available in 19 different languages, which include English, Italian, Spanish, French, Russian, Arabic, and Chinese. When it comes to research, eToro also provides sophisticated market research and daily updates. There are many live webinars and trading videos available for beginners and access to a detailed fintech guide. Furthermore, you can find more information on the eToro blog, which is updated daily and provides a useful economic calendar to keep track of current events.

As for customer support, eToro is known to have a satisfying service through three different platforms: email, telephone, and web-based live chat. The first two are available in almost all 19 languages provided, and the live chat is available in the major ones. Another great feature is that once you open an account, you will be assisted by an account manager whom you can contact and reach out to if needed.

eToro established in early 2007, with a mission to make trading accessible to anyone, anywhere, and reduce dependency on traditional financial institutions. The company has head offices in the United Kingdom, Cyprus, USA, and Australia.

eToro (Europe) Ltd operates as a Financial Services Company authorized and regulated by the Cyprus Securities Exchange Commission (CySEC) under license no. #109/10. Meanwhile, eToro (UK) Ltd is authorized and regulated by the Financial Conduct Authority (FCA) under the license FRN 583263.

As for eToro AUS Capital Pty Ltd, the legal standing is acknowledged by the Australian Securities and Investments Commission (ASIC) to provide financial services under Australian Financial Services License 491139.

A broker that belongs to the 4-digit type, eToro offers both short-term options for day traders and long-term options for investors, such as their innovative Smart Portfolios, a fully managed thematic portfolio.

Since 2007, eToro has been at the forefront of the Fintech revolution. The most recent was launched in 2017, which is Smart Portfolios powered by Machine learning Al. Beyond developing Smart Portfolios, the company integrated Microsoft's machine learning technology into Momentum DD.

The new Smart Portfolios investment strategy uses artificial intelligence to find the steadiest traders who are most likely to generate a double-digit return and bundle traders into one fully-managed portfolio. eToro has hundreds of financial assets for trading across several categories including stocks, commodities, crypto assets, currencies, indices, and ETFs. Each asset class has characteristics and can be traded using a variety of investment strategies.

Some positions on eToro involve ownership of underlying assets, such as non-leveraged positions on stocks and cryptos. Employing CFDs will enable a variety of options, such as leveraged trades, short (sell) positions, fractional ownership, and more. For example, traders can invest as little as USD100 in gold, even if a single unit of gold cost USD1,000. Some of eToro's most popular CFD commodities include gold, oil, natural gas, silver, and platinum.

Currencies are traded on eToro only as CFDs. Also, CFDs enable Sell (short) positions and leveraged trade, even for assets that don't offer the option in traditional trading. Some of the popular currencies include EUR/USD, GBP/USD, AUD/USD, USD/JPY, and USD/CAD.

Furthermore, An Exchange-Traded Fund (ETF) is a financial instrument comprising several assets grouped to serve as one tradable fund. After opening an account in eToro, traders can invest as little as USD250 in an ETF that costs USD500. Some of the popular ETFs on eToro include SPY, VXXB, TLT, and HMMJ.

However, eToro also offers additional functions using CFD trading. All leveraged ETF positions in the UK are under FCA regulations. Meanwhile, all CFD positions executed by eToro Australia are under ASIC regulations.

The company has other advantages. In all financial assets that can be traded, eToro does not charge any deposit or trading frees other than spreads.

eToro charges a USD25 fee for withdrawals and the minimum withdrawal amount is USD50. Long (Buy), non-leveraged crypto, stock, and ETF positions are not executed as CFDs and do not incur any fees. eToro does charge overnight or weekend fees for CFDs positions, such as leveraged positions and short (sell) orders.

Fee updates always apply to open positions. Fees are subject to change at any given time and could change daily, without prior notice, depending on market conditions.

As a beginner, trader can use CopyTrading eToro. Different from the features of other brokers, traders can copy the strategies of professional traders without fee or profit-sharing. Therefore, 100% profit is fully owned by traders. For example, while trader A who is copied by trader B, produces a profit of 10% this month, then trader B also gets a profit of 10%.

The company is the world's leading social trading network. Since eToro operates in complete transparency, each trader has valuable information on their eToro profiles, so other traders that are interested to copy their trades can have assistance in creating their best portfolios.

Another feature that is unique to eToro is the personalized, social News Feed. Just like on any social media, traders can post their updates on feed, comment on other's posts, and gradually create a feed that is tailor-fitted to trader's trading and investing interests. On eToro social trading platform, traders will also get notifications when a trader writes a new post and many other important updates.

Conclusion

It's safe to say that eToro is an excellent choice of broker and trading platform, especially for those who are interested in social and copy trading. eToro's main strength is the simple yet sophisticated platform, which is equally beneficial for novice and expert traders. Beginners can sign up for a demo account very easily and get access to various educational materials. Whereas professional traders can earn extra income by becoming popular investors. Best of all, eToro doesn't charge any additional commission for these features apart from the standard spread and cost for buying and selling assets.

Nonetheless, there are several areas that eToro can improve, such as the number of cryptocurrency options and a more affordable spread. With only 18 cryptocurrencies to choose from, investors looking for a wider opportunity in the cryptocurrency market may find it slightly disappointing. The current spread system may also be a little costly for small-cap traders who wish to build a broad and balanced portfolio. But considering the aforementioned qualities, the overall package offered by eToro is definitely recommended and worth checking out.

eToro stands out as an exceptional option for individuals seeking cost-effective stock, CFD, forex, and crypto trading through its impressive mobile app. With an active user community, eToro provides social features dedicated to supporting the needs of traders and investors across the globe.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance

5 Comments

Terry

Jan 3 2023

The article's cons of e Toro stated there are 3 charges that could gather on this broker that's withdrawal fee, inactivity fee, and the overnight fee. what's this price besides, I don't know if another broker also has an additional fee. But when you additionally get a fee from the spread and commission there, I suppose a number of the charges is ridiculous and what's the benefit of the use of eToro besides the pros that are stated in the article? I suppose this additional fee is too costly.

Palmer

Jan 3 2023

Terry: Actually other brokers also have that fee but not at all. Withdrawal fees are the most broker will charge because some trader is from other region or country so, so when you withdraw you need some process fees and of course, eToro will charge you. And the second one is inactivity fees which means when the account of the trader does have funds but doesn`t trade for some period, the broker will charge that inactivity fee to the trader because it can be the guarantee that your account will not be erased by the server. The danger is when your account doesn't have funds, you will get erased. All because they want to keep their server in the best performance. Meanwhile, the overnight fee is the most trader-charged fee because the rate sometimes rises sometimes down or the other name of this situation is the swap rate.

Yetty

Jan 3 2023

Terry: what makes me impressed about eToro is their mobile app. so advanced and can help us to trade with our phones. Also like the article said, it has social trading which we can get knowledge of trading and copying trading. With that many facilities and trading conditions that not many brokers can provide, a trader may pay more fees but for the feedback, it actually creates a good trading condition.

Clarissa

Jan 3 2023

I want to ask whether eToro provides some different accounts with different leverage and trading condition. Look, I am trying to learn and want to become a swing trader and of course, I am also trying to become a scalper as well. In my case I mean some brokers provide different conditions for traders if the traders open a different account, for example, a cent account, mini account, standard account, etc. Also, the minimum deposit is really starting from $200?

Wallie

Jan 3 2023

Clarissa: unfortunately the minimum deposit is starting from $200 and as you can read in the article above, it only gives you 3 different trading accounts + 1 account for a pro which is a demo, Islamic, and standard account with the same leverage 1:400. For the pro account, you need to fulfill the term and condition such as pass the test that proves you are a pro trader, have more than $500.000 without counting the cash and your assets. So, if you are not a pro, just focus on the 3 accounts that I mention. For the trading condition at eToro actually unique. The spread that eToro offers is a floating spread but you don't have to pay the commission. So, it is perfect for day trading and swing trading but for scalpers, eToro is not a good broker to trade with.