Binance has added a feature that allows users to use their crypto assets as collateral to fund their trades. Here's a guide to use Binance Cross Collateral.

At some point in your business career, you may need to borrow some money. Whether you want to expand your business, make a new product, or grab a quick opportunity, learning how to borrow money is always useful just in case you need it. If you're a crypto holder, you can use your crypto assets to get crypto loans.

In crypto loans, you need to put a certain amount of cryptocurrency as collateral to borrow some cash that you will have to pay back at the end of the loan period, which usually ranges from seven days to more than a year. As long as you haven't repaid the borrowed money, you won't be able to access or use the collateral. And if you fail to repay the loan, the lender will take over your holdings.

Binance introduced a new type of crypto loan called Cross Collateral. It is an innovative feature that was first released in early 2020 and is said to be a much-anticipated feature that could give users more flexibility and choices to open positions. Let's find out how it works.

Contents

What is Cross Collateral?

Generally speaking, cross-collateralization is a method used by lenders to use the collateral of one loan to secure another loan with the same lender. In other words, it uses the same piece of collateral to secure two or more loans at the same time. This system is quite common in regular lending, but it's still pretty new in the crypto world.

Now, Binance Cross Collateral refers to the feature that allows users to use their crypto asset as collateral in exchange for another crypto asset. It offers flexibility for users to borrow crypto assets at zero interest rates and use the borrowed asset to open contracts on the Binance platform. This is certainly a more appealing choice than having to convert crypto coins to stablecoins before trading. Users can now keep their holdings in BTC and other cryptocurrencies while using the borrowed asset to participate in the market.

How Does It Work?

On the Binance Futures platform, users can easily collateralize their BTC, BUSD, ETH, or EUR in order to borrow USDT. There are four important matters to consider:

- The total amount of borrowed funds in USDT.

- The total amount of collateral in BTC, BUSD, ETH, or EUR.

- The market value of the collateral in USDT.

- The Loan to Value Ratio.

Loan-to-value (LTV) ratio is a type of measurement used to evaluate lending risk. It essentially measures the nominal value of a loan against the market value of its collateral. So, a high LTV indicates high financial risk and vice versa.

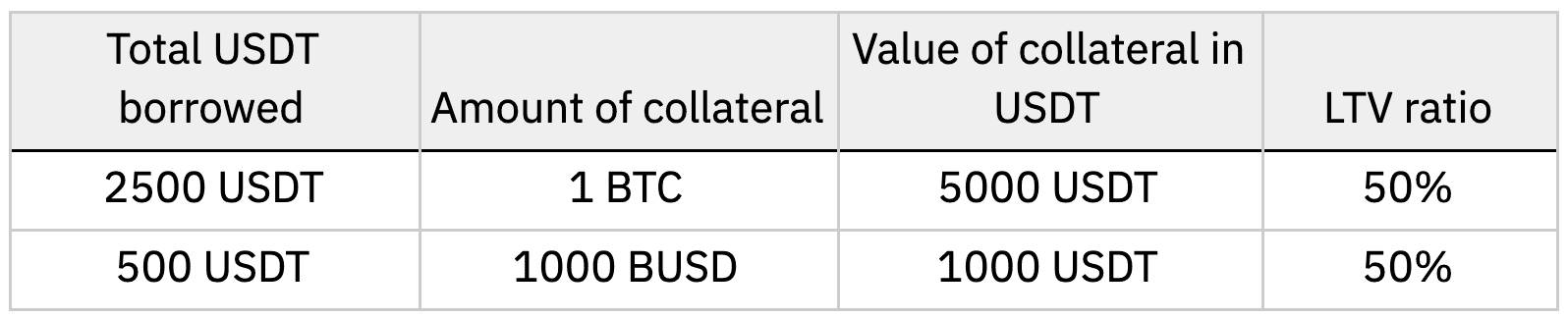

Supposed a trader collateralized BTC and BUSD to borrow USDT at a 0% interest rate, with the assumption that the price of BTC/USDT is at $5,000 and the price of BUSD/USDT is at $1. Here is the first possible scenario.

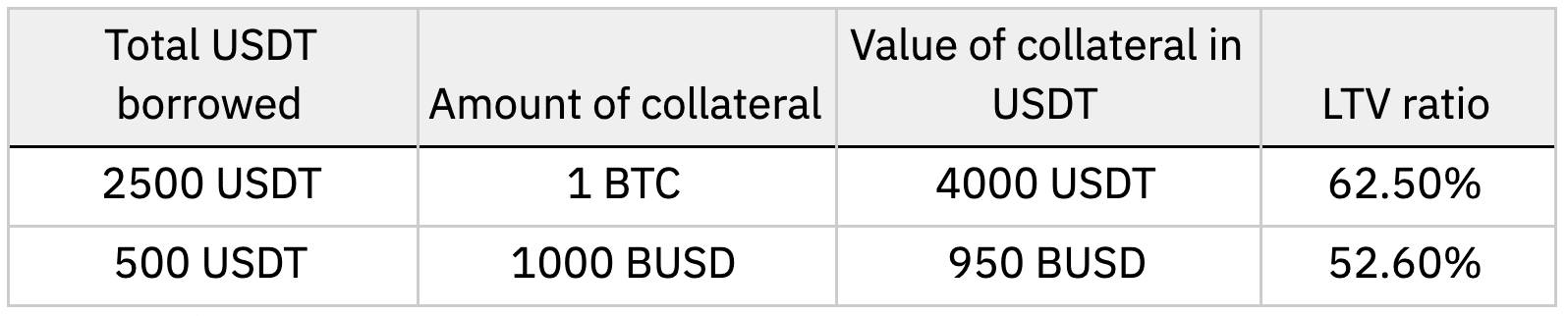

In this next scenario, let's assume that the market value of both assets drops, so the price of BTC/USDT declines by 20% to $4,000 and the price of BUSD/USDT falls by 5% to $0.95. The LTV ratios will change as follows:

We can conclude that the collateral is the key factor that affects the LTV ratio. If the value of the collateral prices declines, the value of the LTV ratio increases and vice versa. This also means that the LTV ratio is more likely to fluctuate for collaterals with high volatility. Please note that extreme price movements may cause your collaterals to be liquidated if the LTV ratio reaches a certain level (the Margin Call level).

Possible Risks and How to Manage Them

While Cross Collateral sounds attractive for traders who want to trade in an easy way, it's also important to understand that the system is certainly not free of risk. The biggest threat is that the system might liquidate your collateral if the value of the LTV ratio hits a certain level.

When the LTV ratio hits the Margin Call level, you will be notified to add more collateral to prevent the liquidation of your assets. If you fail to follow that up and the LTV ratio reaches the Liquidation Call level, your assets will be automatically liquidated to cover the losses. You will receive a liquidation call notification a while later.

In order to reduce the chance of experiencing such an unfortunate condition, here are some tips to help you get started:

- Monitor the LTV Ratio Closely

As explained before, the LTV ratio is a great tool to measure the level of risk that you take in a loan. If the LTV ratio is too high, there's a chance that your collateralized assets will be liquidated by the system. This is why it's important to always check on your LTV ratio and ensure that it doesn't reach the Margin Call level.

In addition, you can avoid liquidation by adjusting the LTV ratio and adding more collateral. If you have a tight schedule, you can simply enable the auto top-up function that will automatically add more collateral from your spot account if needed. Remember that a lower LTV ratio represents a lower risk, so you need to monitor it regularly, especially during extreme market movements. - Ensure the Amount of Collateral

Having some extra assets as collateral is somewhat necessary to avoid liquidation in case the price of the asset falls unpredictably. This can keep the LTV ratio low and reduce the risk of losing your collateral due to forced liquidation. Apart from that, this can give you a sense of comfort. - Be Aware of Liquidation Fees

Aside from liquidation itself, there's also a liquidation fee that users need to pay. The fee is determined based on 1% of the loan amount. However, keep in mind that this fee is different from the liquidation fee of your futures price contracts. So, during extreme price movements, you might be charged with both the liquidation fee of your collateral as well as the fee of your futures position. - Do Not Over Leverage the Futures Contracts

You must know that leverage is a double-edged sword. While it can amplify your position and generate more profit, it can also make you lose a lot of money if the trade goes wrong. Besides, some futures markets are pretty volatile in nature, so leverage can be a dangerous addition to your trade if you don't know how to use it well. This is why leverage is often recommended for experts only. - Read the Terms and Conditions

Last but not least, don't forget to read the Cross Collateral Service Agreement on the Binance website before you start borrowing money with the cross collateral system. Make sure to consider whether Cross Collateral suits your trading style, experience level, and risk tolerance.

How to Borrow Funds with Cross Collateral on Binance

In order to borrow funds using Binance Cross Collateral, here are the steps that you should follow:

- Head over to the Binance website and log in to your account. Go to "Wallet" and click "Futures".

- You'll see the "Cross Collateral" function on the screen. Make sure to understand the terms and policies before starting.

- Choose the type of asset that you want as collateral. This can be BTC, BUSD, ETH, or EUR.

- Enter the amount of USDT that you would like to borrow from the exchange. The system will automatically calculate the LTV as well as the daily interest rate. Afterward, click "Start Borrowing" to proceed.

- Once your order is complete, the USDT will be transferred to your Futures wallet and the collateral amount will be deducted from your Spot wallet. You can then use the borrowed USDT to trade futures contracts.

Summary

Cross collateral is an interesting feature for crypto holders who believe that the asset price will increase. It is a highly accessible way to get USDT and trade futures contracts without having to convert crypto coins. By simply putting some assets as collateral, you can borrow USDT and make profits in the futures market. However, just like any kind of loan, Cross Collateral comes with risk.

As a responsible trader and borrower, it is your job to make sure that you understand the risks and know how to manage them before taking any debt. Remember that while collateral allows you trade in the futures market with a lower interest rate, it can also destroy your hard-earned money in no time.

Apart from Cross Collateral as a borrowing facility, Binance has launched many other features related to cryptocurrency. One interesting tool to talk about is the NFT marketplace. Find out all about it in "Is Binance NFT Markeptlace Worth a Try?"

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance

Bitcoin

Bitcoin Ethereum

Ethereum Tether

Tether BNB

BNB Solana

Solana USDC

USDC XRP

XRP Dogecoin

Dogecoin Toncoin

Toncoin Cardano

Cardano