Stellar Lumens (XLM) is a cryptocurrency with great potential. To trade it successfully, there's a swing strategy with DBLHC that you might need to try. Why so and how to do it?

Cryptocurrency is becoming increasingly popular worldwide, and one of the digital currencies that is gaining more recognition is Stellar Lumens (XLM). As one of the top altcoins, XLM's potentials are quite attractive for traders and investors.

However, as with all types of investments, crypto trading also involves significant risks. Therefore, it is important for traders to have an effective trading strategy to optimize their profits and manage risks. In this approach, we would learn to trade Stellar Lumens (XLM) in a swing strategy with Double Bar Low Higher Close (DBLHC) that consist of the following steps:

- Find a bullish trend of a swing low.

- Wait for a valid DBLHC.

- Open buy at the opening of the next candle.

- Set a Stop Loss.

- Take profit on a breakout.

But before describing each step thoroughly, let's get more details on Stellar Lumens and its potential as a cryptocurrency.

Why is Stellar Lumens (XLM) Considered Special?

Stellar Lumens (XLM) is a cryptocurrency on the Stellar blockchain, a decentralized payment network that allows its users to send money with small to no fees and fast transactions.

Stellar has been around for a long time since Jed McCaleb and Joyce Kim started the Stellar Foundation in 2014. Initially, it was just a fork of the Ripple protocol. The creator of Stellar was also one of the founders of Ripple. When Stellar separated itself from Ripple, the developer changed Ripple's basic code in the blockchain.

Here are some factors that make Stellar Lumens highly regarded among investors:

- The blockchain only takes 3 to 5 seconds to confirm transactions.

- Stellar is able to process thousands of transactions at the same time.

- Stellar is considered the future of banking because it has great potential in the financial industry.

- The crypto coin, XLM, has become very popular among investors as a long-term investment.

- The uniqueness of XLM lies in its ability to quickly complete cross-border transactions with very low fees.

- The number of users switching to Stellar to send money keeps increasing in recent years.

- The use of Lumens is integrated into global P2P lending platforms and services such as Bitbond.

- Although the price of Stellar Lumens is below $1, the coin is included in the top 25 cryptocurrencies with the largest market cap.

DBLHC Trading Strategy for Stellar Lumens (XLM)

Each individual has a different trading approach. Some traders are impatient to HODL, so swing trading can be a good strategy to choose. With swing trading, you can hold a trading position for at least one day to three weeks.

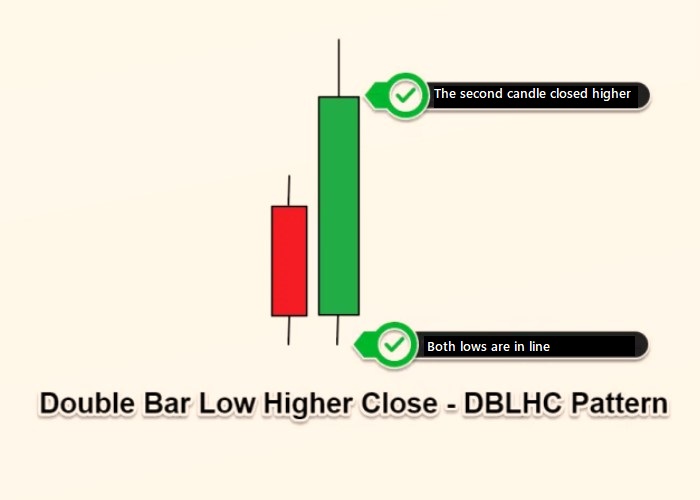

To start swing trading with Stellar XLM, there are several price patterns that need to be considered. One pattern that can be used is the Double Bar Low Higher Close (DBLHC), which is better known as the double bar chart pattern.

This pattern is easily recognizable because it consists of two bars with the lowest price levels that are parallel or almost the same, and the second candle must close higher than the first candle. Usually, the candle wick will be very small while the body is more dominant.

Without further ado, here are some steps that you need to follow when trading Stellar Lumens with DBLHC:

Step 1: Find a Bullish Trend or Wait for the Market to Form a Swing Low

The first step in this Stellar Lumens trading strategy is to find a bullish trend or wait for a swing low to appear in the market. To profit from Stellar Lumens' swing trading, pay attention closely to DBLHC. You can find this pattern at the end of a bearish trend as a bullish reversal pattern.

However, DBLHC can also appear as a trend continuation pattern. The pattern's reliability will increase if it is used on a previously established trend. That way, DBLHC can also provide the same results even if the market is in the process of developing a swing low.

The appearance of the DBLHC pattern immediately after the swing low indicates confirmation that institutional money is buying at low prices. This can also be seen on the Stellar XLM chart that develops a swing low.

Step 2: Wait for a Valid DBLHC Pattern to Form

In general, the first and second candle of the DBLHC pattern should be different. However, in certain cases, the first candle can also be as bullish as the second candle. As long as the lowest price is parallel and the closing price of the second candle is closed higher, the DBLHC pattern is still considered valid. To enter the market, remember that both conditions of the DBLHC pattern must be met.

Step 3: Buy at the Opening of the Next Candle

The third step in the Stellar Lumens swing trading strategy is to enter a buy position at the opening of the candle after DBLHC. It is important to remember that the second candle must close much higher than the first candle and have two parallel lows. To not miss the moment, you can place a buy limit order above the highest price of DBLHC's second candle.

Step 4: Place a Stop Loss Below the DBLHC Pattern

For the stop loss, you can place it below the low of the DBLHC pattern. Stop loss is an automatic order to close a trading position when the price reverses to an undesirable level.

Step 5: Take Profit When the Price Breaks the Trendline

To determine the take profit level, you can draw a trendline from the swing point to the lowest price of the DBLHC pattern. Once you have a view of the upward trendline, you just have to wait for the price to break below the trendline.

After the price breaks and closes below the upward trendline, you can immediately take a profit. This breakout strategy will help maximize your profit while the bullish momentum is still strong.

It should be noted that the above strategy is just an example for buy positions. As for sell positions, you can apply the same rules but just reverse them. The example for entry sell positions is provided below.

To conclude, XLM is one of the favorite and prominent cryptocurrencies compared to other coins. It has great potential with some serious partnerships serving a number of large transactions. Trading Stellar Lumens with DBLHC provides a good approach to swing strategy. It combines momentum and chart patterns, giving you the best opportunity to take profits in the cryptocurrency market.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance

Bitcoin

Bitcoin Ethereum

Ethereum Tether

Tether BNB

BNB Solana

Solana USDC

USDC XRP

XRP Dogecoin

Dogecoin Toncoin

Toncoin Cardano

Cardano

5 Comments

Peter

Apr 29 2023

Could you shed some light on why XLM stands out among other cryptocurrencies? I know that it operates on the Stellar blockchain, which enables fast and low-cost transactions. But what makes Stellar Lumens unique in terms of safety and regulation? Are there any special features or protocols in place that ensure the security of transactions conducted using XLM? Additionally, I'm curious to know about the regulatory framework surrounding Stellar Lumens. Are there specific regulations or oversight measures in place that provide confidence to users and investors? Understanding the safety and regulatory aspects of Stellar Lumens would be helpful in grasping its significance in the cryptocurrency landscape.

Johnson

Jun 15 2023

@Peter: When it comes to XLM (Stellar Lumens), it's got some cool stuff going on. One thing that makes it stand out is its use of the Stellar blockchain, which makes transactions fast and cheap. That means you can move your XLM coins around without breaking the bank or waiting forever.

Now, let's talk safety. Stellar Lumens benefits from the Stellar blockchain's security features. They've got this thing called Stellar Consensus Protocol (SCP) that keeps transactions legit and prevents any sneaky attacks. It's all about maintaining the integrity of the network and making sure your transactions are secure.

As for regulations, the Stellar Development Foundation (SDF), which takes care of Stellar Lumens, has been working with regulators to play by the rules. They want to make sure they're on the right side of the law and provide peace of mind to users and investors.

Hayashi

Jun 4 2023

How effective is the DBLHC (Double Bar Low Higher Close) strategy for swing trading with Stellar Lumens (XLM)? I've come across this trading strategy that involves identifying a specific price pattern, namely the DBLHC pattern, characterized by two bars with parallel or nearly equal low price levels, where the second candle closes higher than the first candle. It's intriguing to see how this pattern emphasizes a small wick and a dominant body. However, I'm curious to know about the track record and effectiveness of this strategy in swing trading with Stellar Lumens. Have traders found success using the DBLHC pattern to make profitable trades, and how reliable is it as a signal for potential price reversals or trend continuation? Understanding the effectiveness of this strategy would provide valuable insights for swing traders looking to trade XLM.

Theo

Jun 23 2023

Hey there! I'm really intrigued by Stellar Lumens and its ability to confirm transactions in such a lightning-fast manner, taking just 3 to 5 seconds. I'd love to understand the nitty-gritty details behind this impressive feat. Could you walk me through the inner workings of the blockchain technology employed by Stellar Lumens that enables such remarkable transaction speed?

I'm particularly curious about the underlying mechanisms, protocols, or unique features that contribute to this swift processing time. How does Stellar Lumens manage to outshine other blockchain platforms in terms of transaction speed? Are there any specific optimizations or innovations that play a role in achieving such impressive confirmation times?

Stevano

Jun 27 2023

@Theo: Hey there! let's simplify it!

Stellar Lumens achieves its fast transaction speed through a few key factors. It uses a consensus protocol called the Stellar Consensus Protocol (SCP) instead of traditional mining, allowing for quick transaction confirmation. Stellar Lumens also has a decentralized network structure with validators called Stellar Core nodes, which reach consensus on transactions in a distributed way, further speeding up the process. The blockchain design is lightweight and efficient, focusing on fast and secure value transfers. Additionally, Stellar Lumens benefits from a network of anchors that bridge the gap between the Stellar network and traditional financial systems, facilitating smooth asset movement. By combining these factors, Stellar Lumens stands out in terms of transaction speed by using innovative consensus algorithms, optimizing network architecture, and prioritizing efficient value transfer.