This Binance feature is especially made for crypto traders who wish to earn from their idle digital assets during sideways condition.

Binance is the largest cryptocurrency exchange in the world by trading volume. By the end of 2022, the company had more than 128 million registered users. Binance offers a wide range of promotions and features that are aimed to satisfy clients with various backgrounds and needs. One of the most recent launches is called Range Bound.

Binance Range Bound is a product that offers rewards to users who can successfully predict that the price of a certain asset will stay in a certain range during the subscription period.

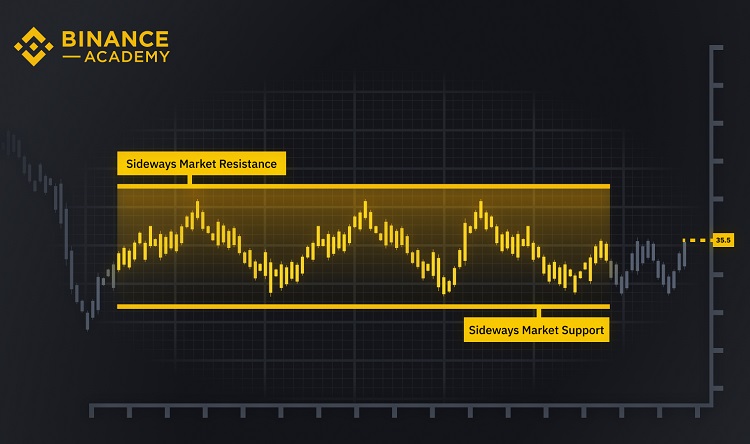

It is based on the range-bound trading strategy, which involves buying an asset when the price is at the lower end of the range (support line) and selling when the price is moving toward the upper end of the range (resistance line). This method is commonly used in sideway markets when the price is more likely to stay within the range than to break out.

How to Get Started with Binance Range Bound Via Website

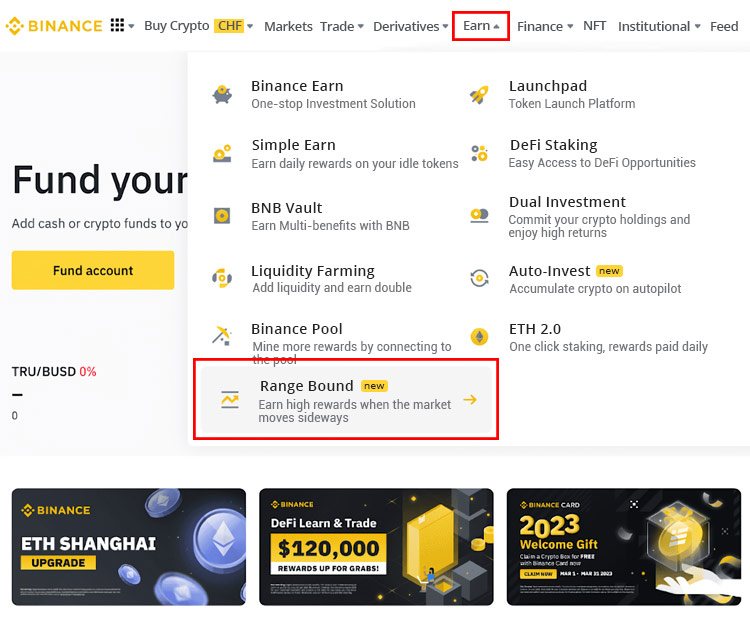

1. Head over to Binance's official website and log in to your Binance account. Click "Earn" and select "Range Bound".

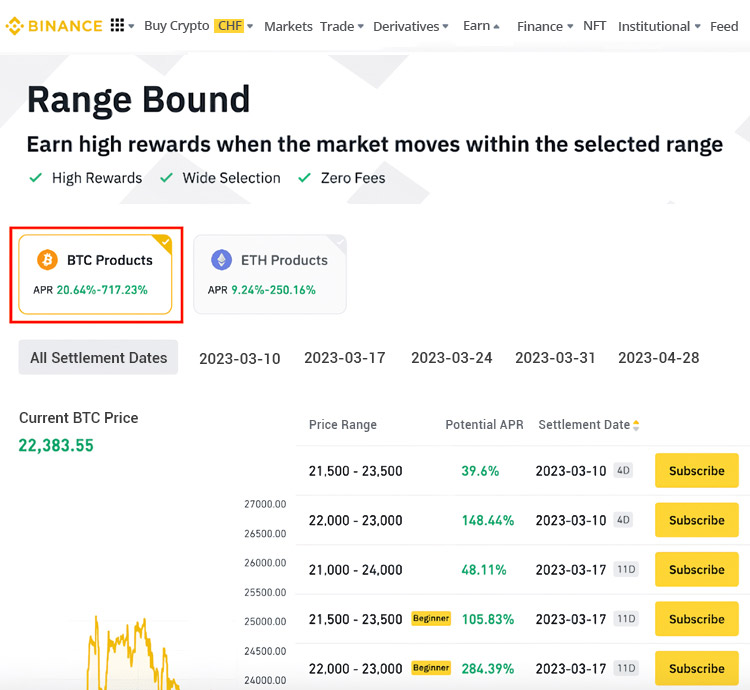

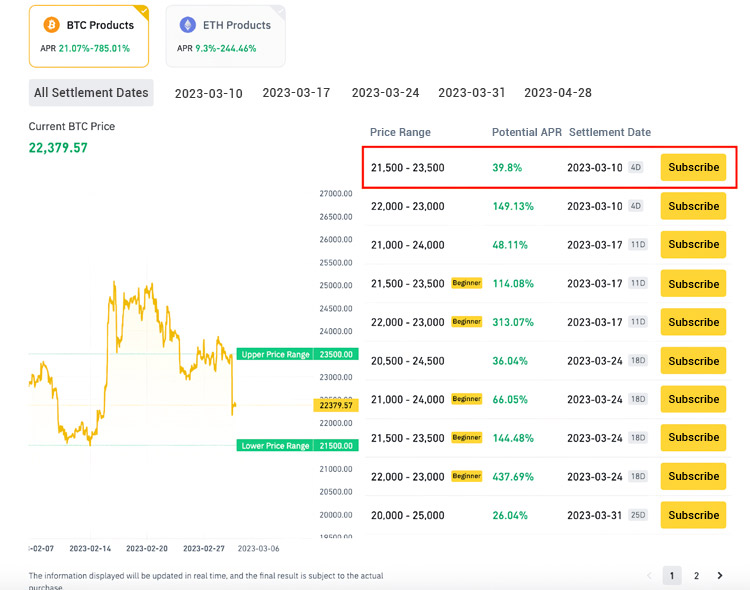

2. Choose your preferred digital asset (BTC or ETH).

3. Select the price range, potential APR, and settlement date that you prefer. Click "Subscribe" to continue.

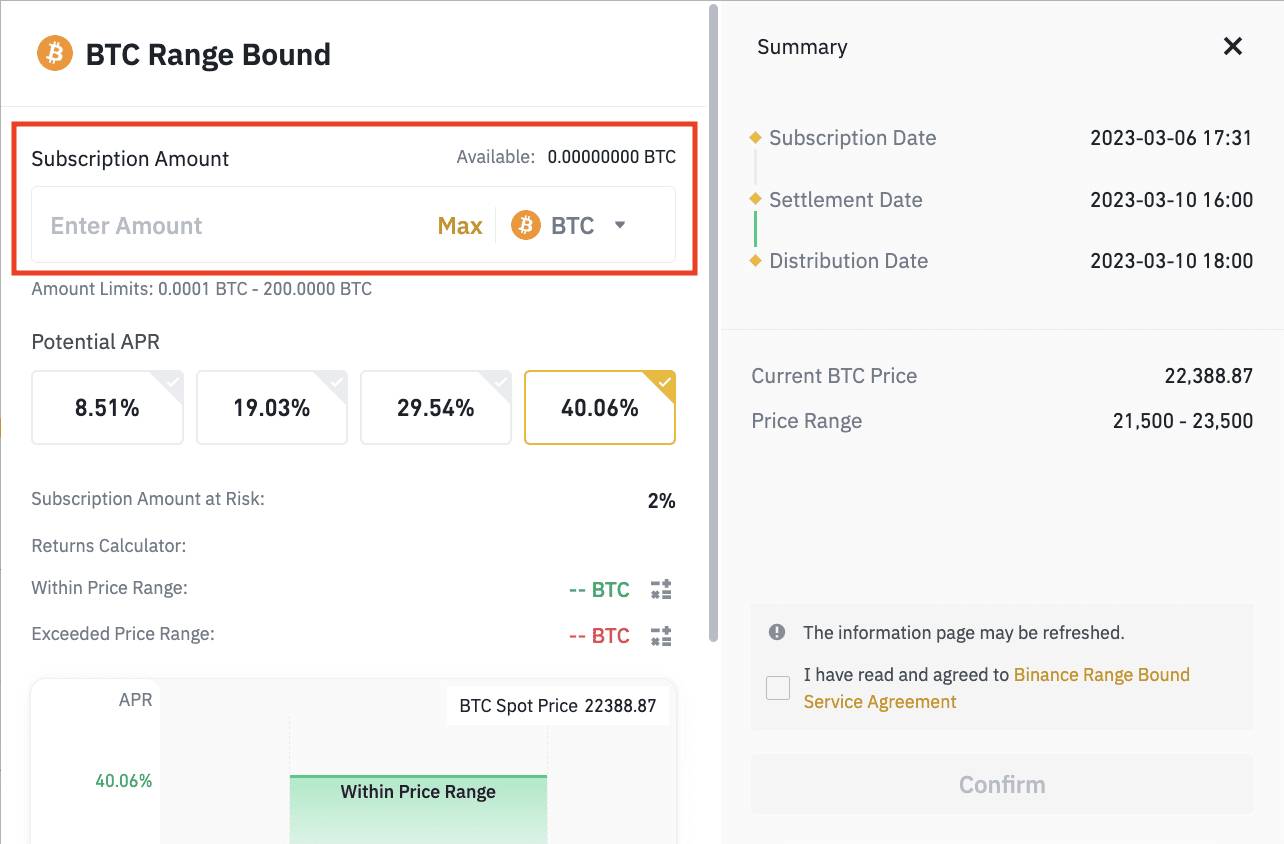

4. Enter the subscription amount. You can subscribe using stablecoin (USDT) or other tokens (BTC or ETH).

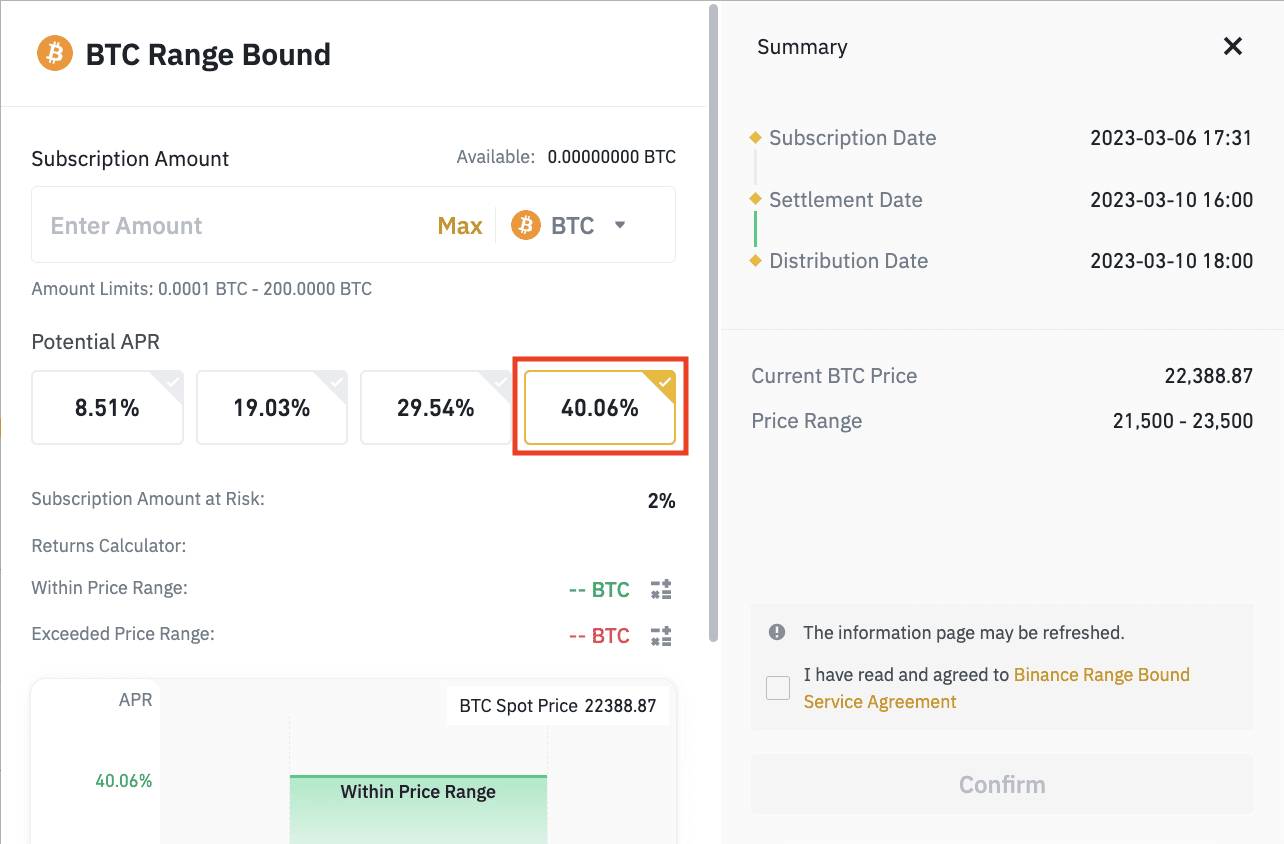

5. Choose the potential APR percentage that you want to earn at the end of the subscription period. Keep in mind that the higher the APR, the higher the subscription amount at risk.

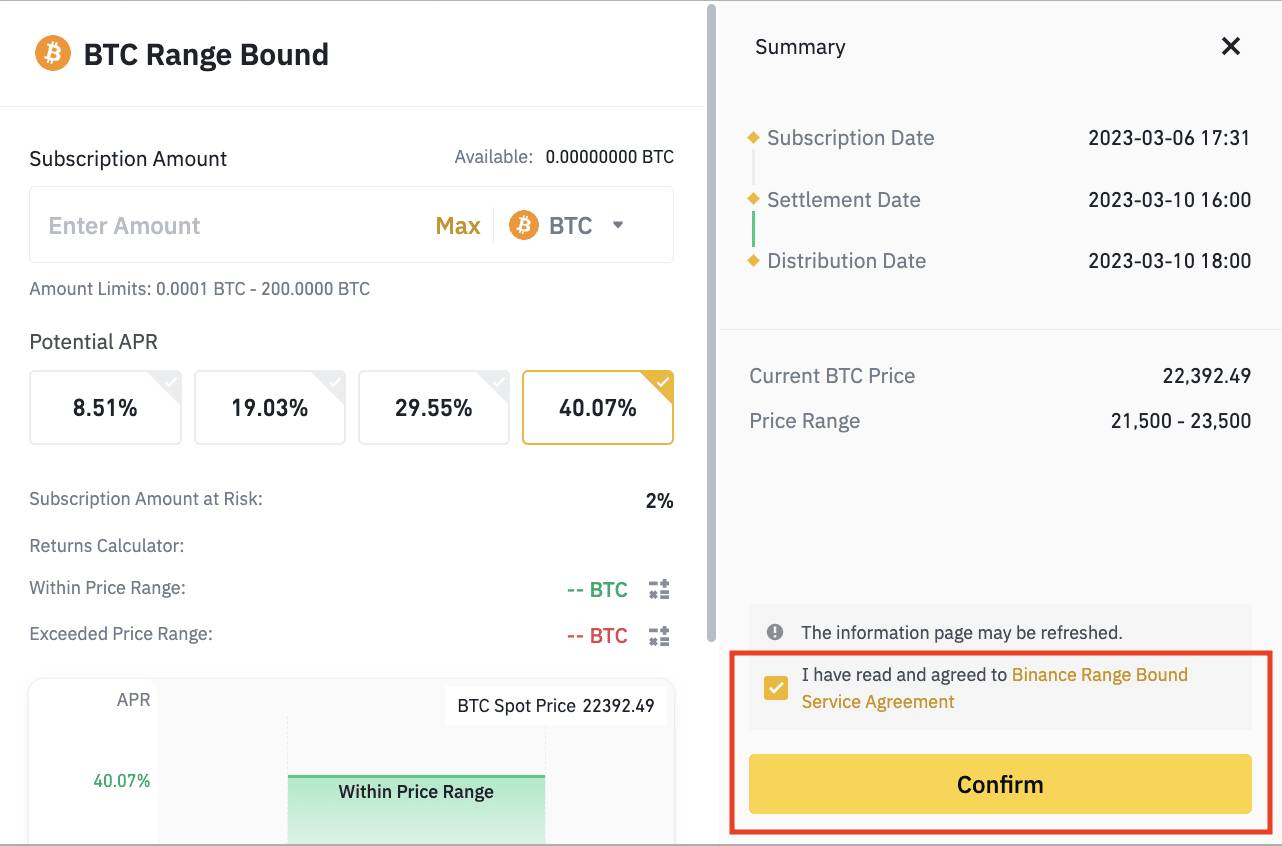

6. Read and agree to the service agreement and check the confirmation box. Click "Confirm" to finish the setup.

How to Get Started with Binance Range Bound Via Mobile App

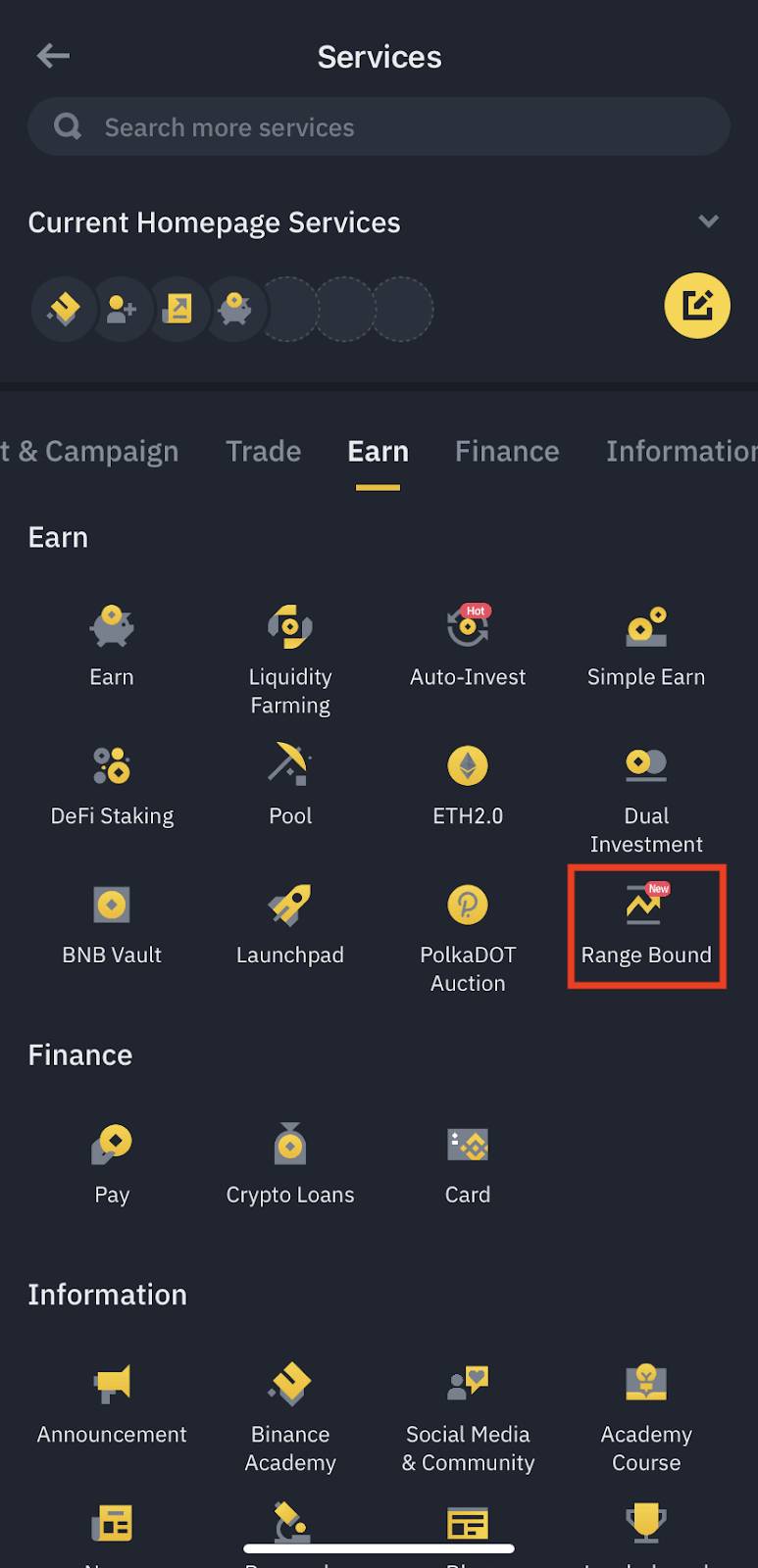

1. Log in to the Binance app and tap "More". Scroll down to find the "Earn" section and tap "Range Bound".

2. Choose your preferred digital asset (BTC or ETH).

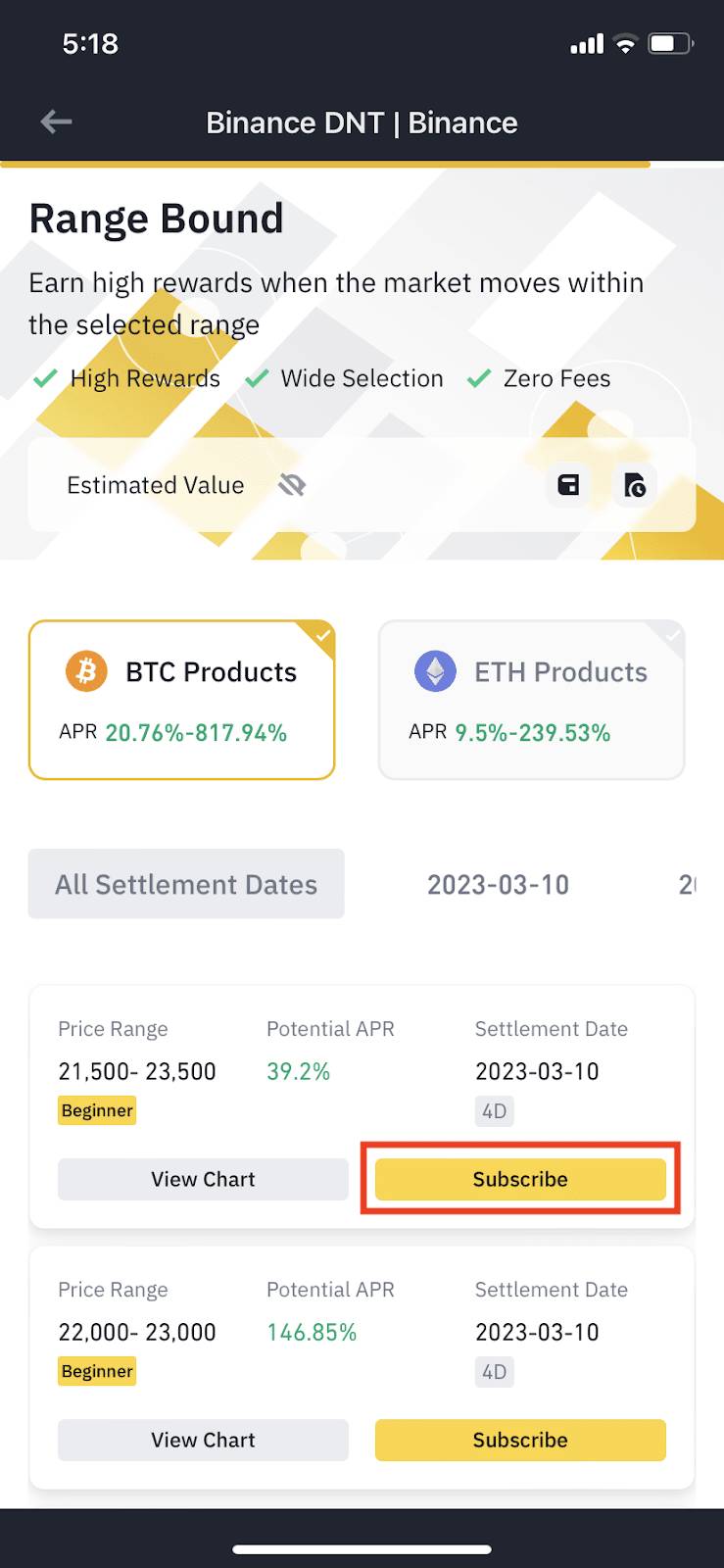

3. Select your preferred price range, potential APR, and settlement date, then click "Subscribe". You can also tap "View Chart" to see the price history of the digital asset before subscribing.

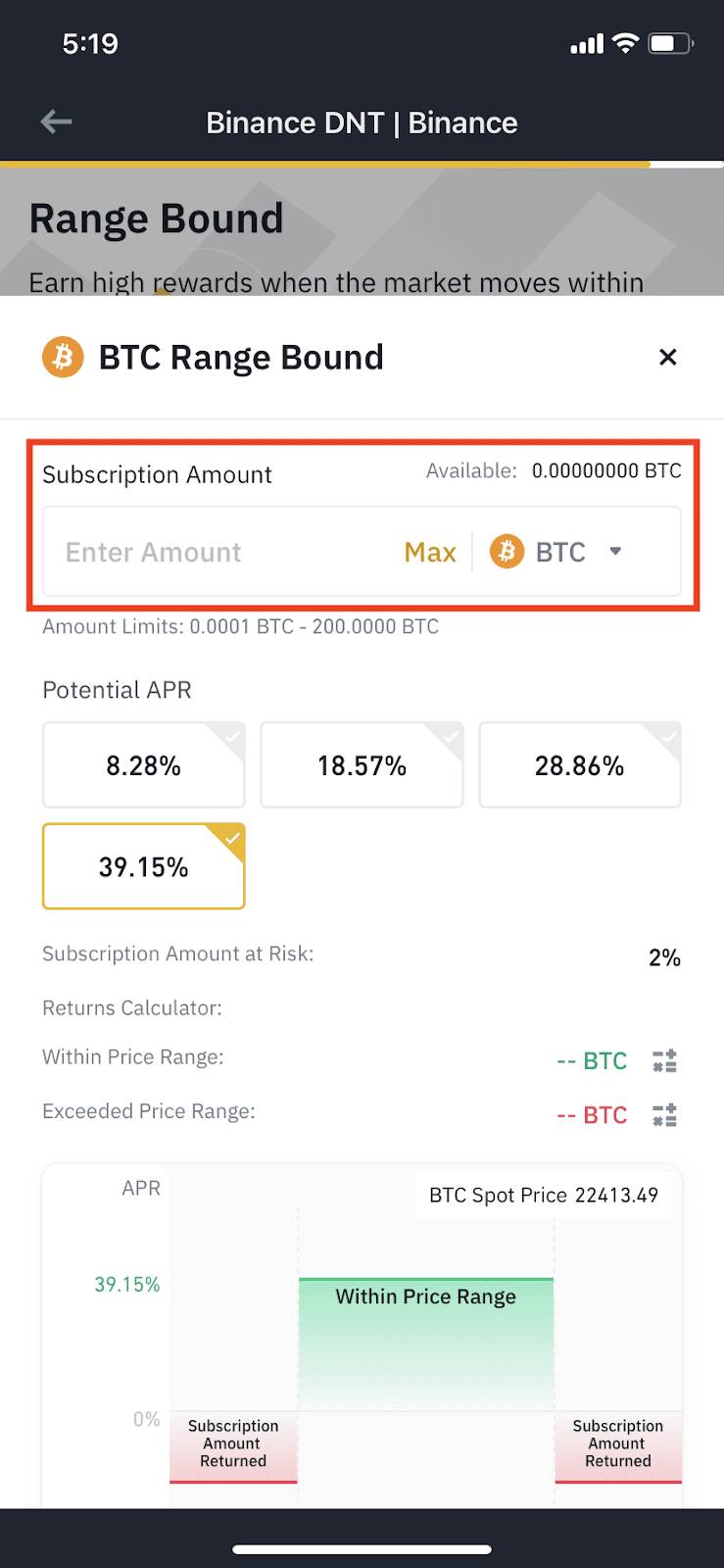

4. Enter the subscription amount.

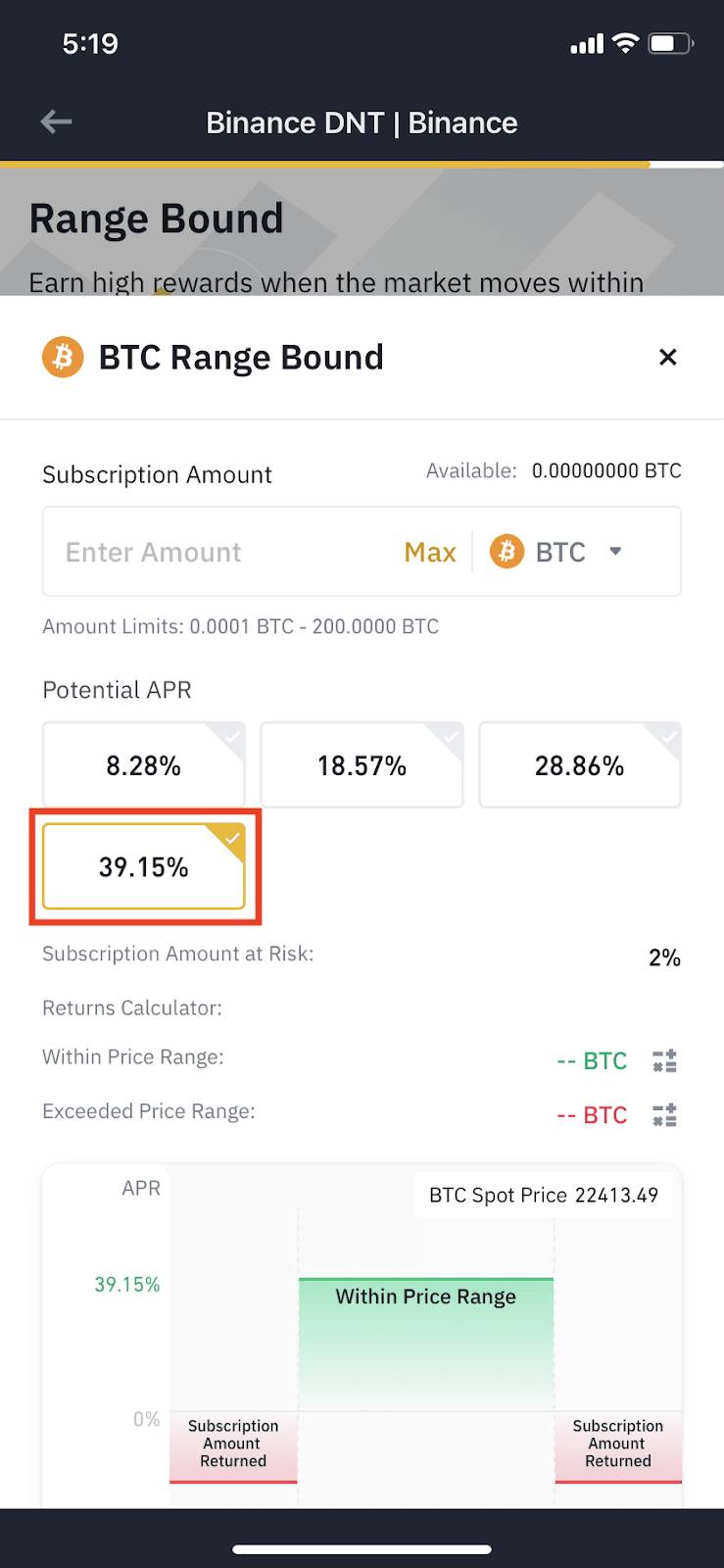

5. Decide the potential APR from the available options.

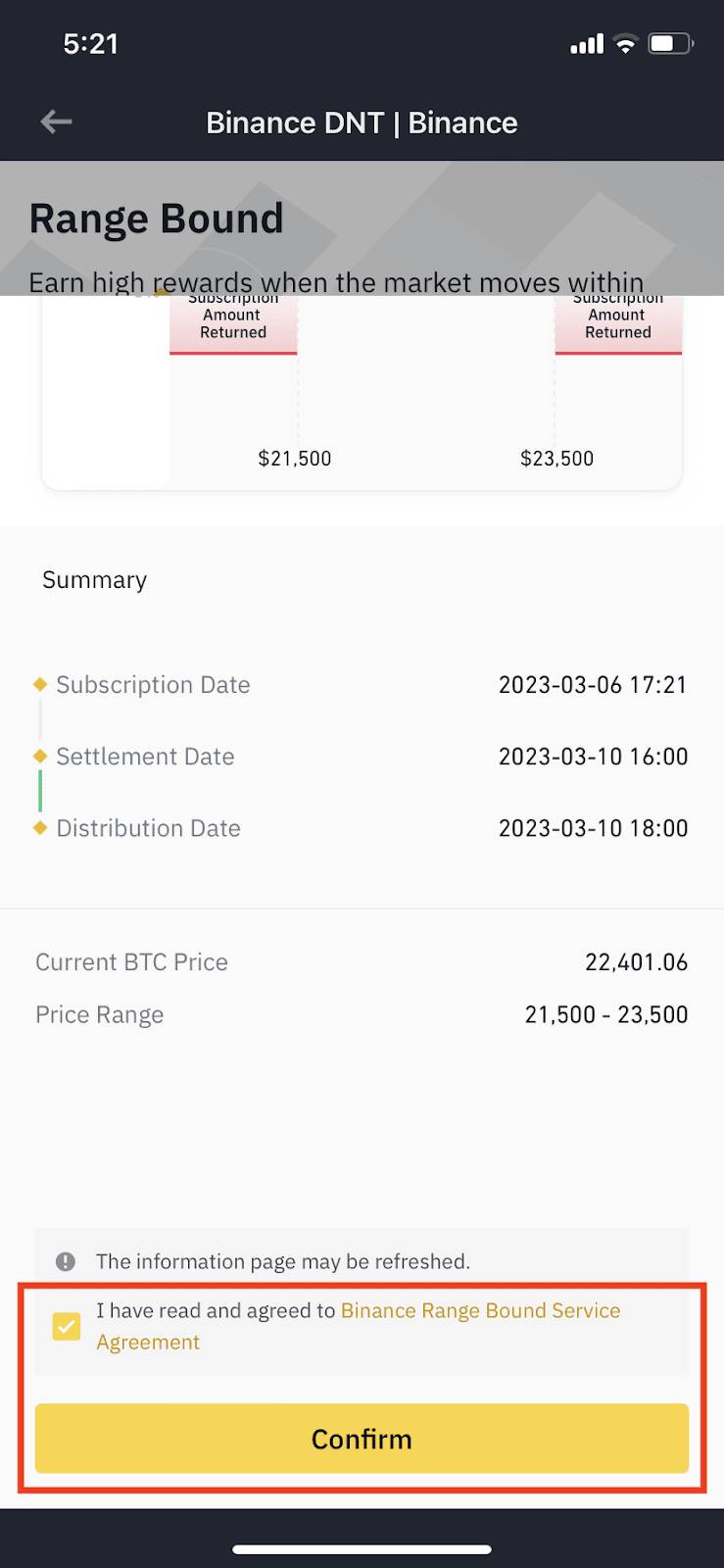

6. Read and agree with the service agreement. Click "Confirm" to subscribe.

How Binance Range Bound Works

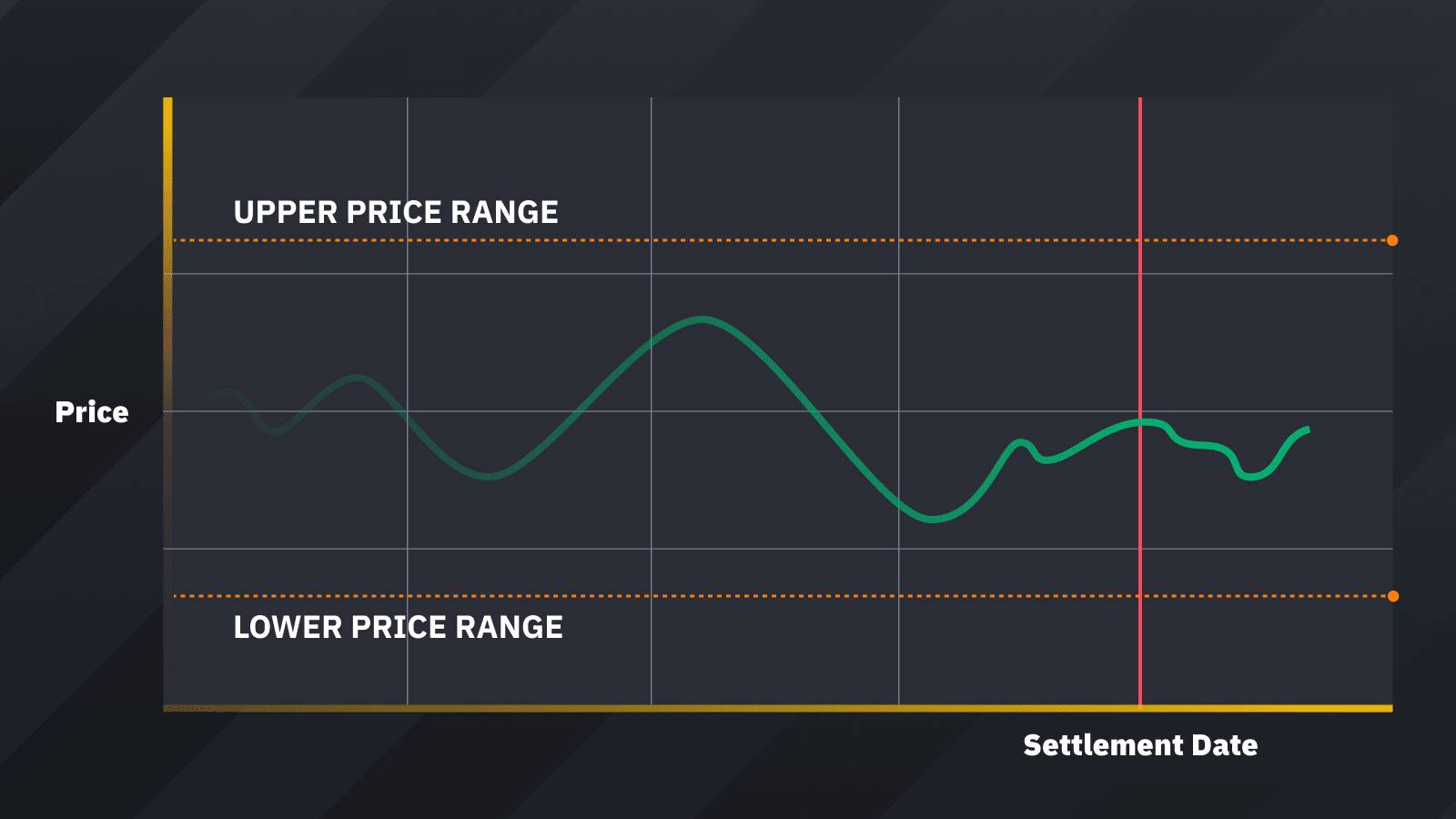

As a product that rewards users for making the correct prediction of a certain asset's price movement during a certain period, Binance Range Bound aims to predict when the reference price of the chosen digital asset stays within the pre-determined price range during the entire subscription period.

Once the subscription period begins, digital assets that you use to subscribe will be immediately transferred from your Spot account to your Range Bound account. Keep in mind that you won't be able to cancel the subscription or withdraw the deposited funds under any condition until the subscription period ends.

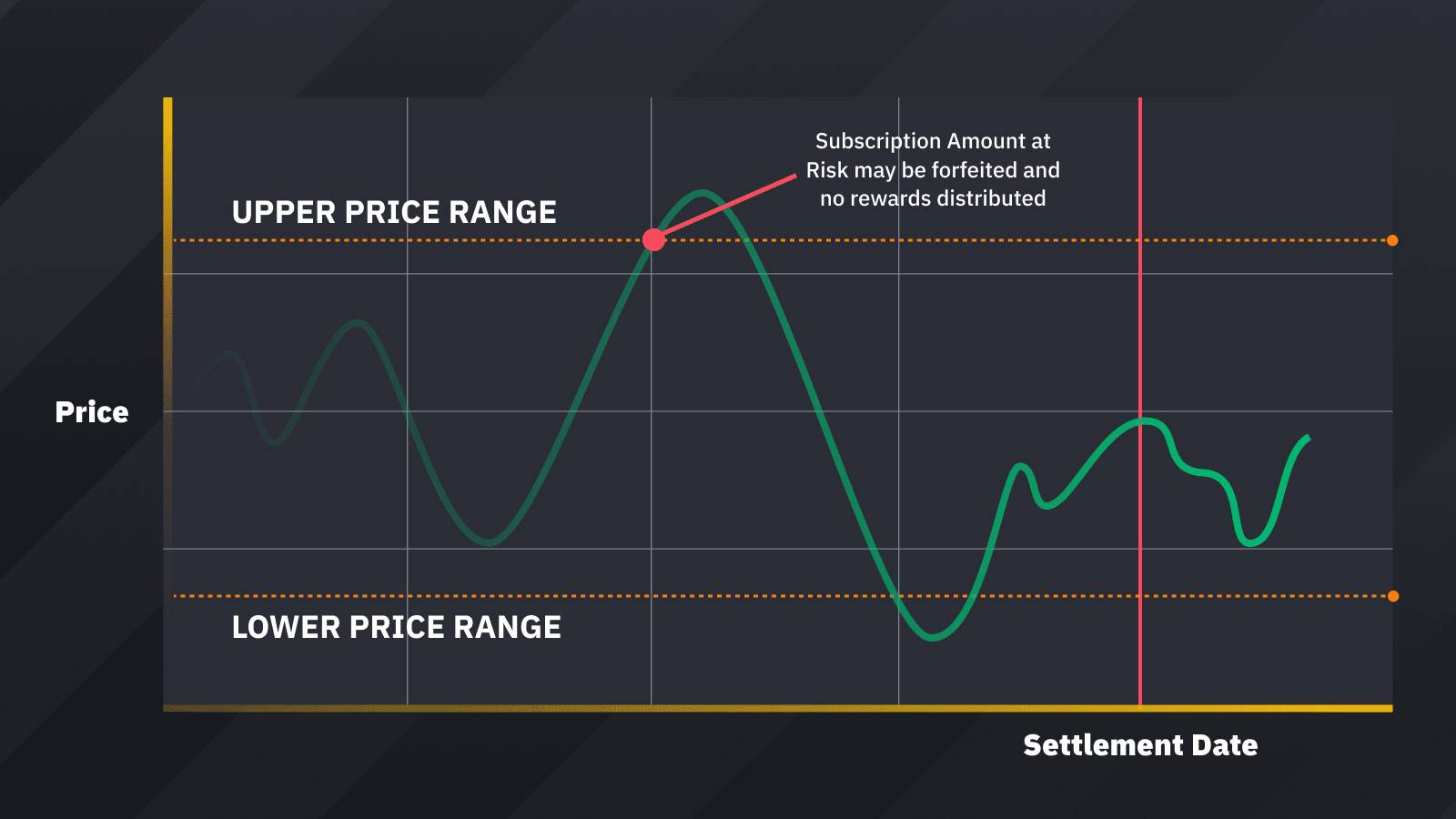

To receive greater rewards, you may decide a certain percentage of the subscription amount to be forfeited if the reference price ends up touching or breaking the upper/lower level of the selected price range during the subscription period. So, the higher the subscription at-risk amount, the higher the potential APR.

There are two possible outcomes that you may get in Binance Range Bound:

- If the reference price stays within the price range during the whole subscription period, then your deposited digital assets will be transferred back to your Spot account and you will receive the corresponding APR within six hours of the settlement date.

- If the reference price touches or breaks the price range at any point during the subscription period, then you will have the subscription amount at risk forfeited and you will not be entitled to any rewards.

The Calculation of Range Bound Rewards

The potential APR in Binance is calculated using the following formula:

Range Bound Digital Assets (Potential APR% Subscription Period / 365)

Let's say that you subscribe to Range Bound with the following conditions:

- The preferred digital assets are BUSD1000

- The subscription period is 10 days

- The underlying digital currency is ABC

- The upper price range is BUSD100 and the lower price range is BUSD 90

- The subscription amount at risk percentage is 2%

- The potential APR is 5%

If the reference price stays within the price range on the settlement date, Binance will transfer back your deposited BUSD1000 along with the rewards of BUSD1000 (5% 10 / 365) = BUSD1.3689

In total, you will receive BUSD1001.3689 on the settlement date at 08:00 UTC. The amount will be reflected in your Spot account approximately within six hours.

If the reference price is equal to or exceeds the price range, you will not get any rewards, but Binance will still transfer your digital assets minus the subscription amount at risk.

In total, you will get BUSD1000 - (BUSD 1000 2%) = BUSD980. In this sense, you've made a loss of BUSD20.

The Bottom Line

Binance Range Bound can be a perfect solution for crypto traders who are aware of their risk tolerance and have a good understanding of technical analysis. It also offers high flexibility because you can decide your own conditions based on your needs and personal preferences.

However, it is important to note that this product is not without risks. Given the volatile nature of crypto markets in general, building a strong range-bound strategy may not be that simple. If you're not careful, you may end up getting less than the amount you deposited during your subscription. This is why you must ensure to read all the terms and conditions before subscribing and learn how to minimize risks.

FAQs on Binance Range Bound

-

What are the benefits of Binance Range Bound?

Firstly, Binance offers a wide variety of digital assets and price ranges that you can choose on the subscription page. Secondly, Binance does not charge any additional fees to participate in Range Bound. Lastly, you can get the chance to earn higher rewards by simply predicting the price movements of a certain asset within a certain period of time. This is a great option for those who want to earn additional returns from idle digital assets without having to sell. -

What are the risks of Binance Range Bound?

The most obvious answer is that you may get a loss if the price touches or breaks the upper/lower ranges at any point during the subscription period. Aside from that, subscribed assets are locked during the subscription period, so you won't be able to use or withdraw them before the settlement date. -

When should I use Range Bound?

Range bound trading typically takes place in a sideways or ranging market because prices tend to move horizontally between high and low prices. As such, choose to use this feature when you're sure that the market would not break out of the current range. -

How to view my subscription?

You can check your subscription either via the Binance website or mobile app. For the former, simply open the website, go to "Orders", choose "Earn History", then click "Range Bound". Meanwhile, if you use the mobile app, you can go to "Wallets" and choose "Earn". Tap "Flexible Savings" and change the settings to "Range Bound". You'll be able to see all of your current subscriptions and settlement items. -

Can I cancel my subscription before the settlement date?

No, you won't be able to modify or cancel your subscription before the period ends. Make sure to pick the most suitable subscription period that works for you before subscribing.

Apart from joining Binance Range Bound, you can also earn additional income from Binance DeFi staking, which allows you to make profit simply by locking your digital assets for a certain period of time.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance

Bitcoin

Bitcoin Ethereum

Ethereum Tether

Tether BNB

BNB Solana

Solana USDC

USDC XRP

XRP Toncoin

Toncoin Dogecoin

Dogecoin Cardano

Cardano

10 Comments

Hania

May 25 2023

I've always admired Binance for keep making new innovations to keep their users active and entertained. The idea of facilitating traders to make profit without having to open real orders is actually brilliant. I want to try it myself, except I don't know how to make a good prediction and increase the odds of winning. I figured that this program is not free of risk, so i want to be prepared before I put my money in it. Any tips on how to succeed in Range Bound?

Rafika

May 25 2023

Totally agreed. As a complete beginner, this program is certainly attractive because obviously everyone's attracted to winning prizes. The problem is that I have no idea how to win. The author of this article mentioned that the range bound strategy is commonly used in sideways markets and works well during low volatility, but as far as I know, the crypto market is highly volatile most of the time. So, is it still relevant in crypto markets? I would appreciate if someone could enlighten me more about this. Thanks

Lewis M.

May 26 2023

I'll do my best to explain this matter. Cryptocurrency prices, like other assets, are typically based on market cycles. Bull markets are characterized by periods of positive growth and the price generally moves upwards. Bear markets are the complete opposite. However, these cycles do not happen all the time. They are mostly separated by periods of stagnant prices and low volatility. This is when the market is said to be moving sideways, perfect for range bound strategies.

Sideways markets occur when the price moves within a narrow range. To identify sideways markets, you can use tools like ADX or the Bollinger Bands. After that, find the key support and resistance levels. And that's it! You can use the information you obtained to participate in Binance Range Bound. Good luck!

Mina

May 26 2023

So, Binance Range Bound is based on the range-bound trading system, right? It's quite interesting because I typically avoid trading in sideways market/low volatility markets and use trend-following strategies instead. Can anyone explain more about how to trade in sideways markets? What is the best approach to use?

Tika Benson

May 26 2023

Hey there. There are several strategies that you can use to generate profit using the range bound strategy, namely:

To help you further, I suggest you use technical indicators like pivot points, bollinger bands, etc. Most brokers provide these tools for free, so please try them out perhaps on a demo account to see how they work.

Jorge joshua

Jun 9 2023

@Mina: Yep, Binance Range Bound is based on a range-bound trading system. It's pretty interesting because it focuses on making profits from price movements within a defined range when the market is not showing a clear trend. I get that you prefer trend-following strategies, but trading in sideways markets can open up additional opportunities.

In sideways markets, where prices are consolidating within a range with low volatility, one common strategy is range trading. You look for key support and resistance levels that define the range and aim to buy near support and sell near resistance. It's all about capitalizing on the price bounces within that range. Using technical indicators like RSI or MACD can help with finding entry and exit points within the range.

Hope it can help!

Yudha

Jun 18 2023

With Binance being the largest cryptocurrency exchange and offering various promotions and features, including the recent launch of Range Bound, I'm curious about the investor sentiment. Considering the recent issues with the founder, are investors still willing to invest in Binance and participate in products like Range Bound? How has the controversy surrounding the founder impacted the trust and confidence of investors in the platform? Are there any additional measures or assurances that Binance has put in place to address these concerns and regain investor trust? Hope there is an answer to the question! Thank you!

Lidya

Jun 28 2023

@Yudha: Dude, I cannot answer your question anymore. It is because the recent controversies surrounding Binance's founder have indeed raised questions about investor sentiment and confidence in the platform.

It's important to note that investor sentiment can vary among individuals and may depend on their level of trust, risk tolerance, and overall perception of the situation.

However, as I know, Binance remains a popular and widely used cryptocurrency exchange, and many investors continue to trade and engage with its offerings.

SO it is depending on your preference to see this Binance is really worth it to try and really safe or not!

Justin

Jun 29 2023

How effective is the Binance Range Bound product in terms of generating rewards for users? Considering that it rewards users for accurately predicting the price movement of a specific digital asset within a predetermined price range during a subscription period, I'm curious to know how successful this product has been in delivering on its promises. When the subscription period begins, users transfer their digital assets from their Spot account to their Range Bound account, and it's important to note that these funds cannot be withdrawn or the subscription canceled until the subscription period ends.

In order to maximize potential rewards, users have the option to forfeit a certain percentage of their subscription amount if the reference price of the chosen asset touches or breaks the upper or lower level of the ed price range during the subscription period. This means that a higher subscription at-risk amount could potentially result in a higher Annual Percentage Rate (APR).

So, I'm interested in understanding the effectiveness of this approach. Are there notable success stories or statistics that demonstrate the potential profitability of participating in Binance Range Bound? How well have users been able to predict price movements within the specified range and earn rewards accordingly? It would be insightful to gain a clearer understanding of the overall effectiveness and user experiences associated with this product.

Harry

Jun 30 2023

@Justin: How well does the Binance Range Bound product actually work in terms of dishing out rewards to users? I mean, they claim you can earn rewards by nailing the price movement of a digital asset within a specific price range during a subscription period. But does it really live up to the hype? Once the subscription period kicks off, you can't withdraw your funds or cancel the subscription until it's over, so it's a bit of a commitment.

To sweeten the deal, you have the option to give up a portion of your subscription amount if the price of your chosen asset touches or goes beyond the upper or lower range levels. It's like a risk-reward trade-off, where more at stake could mean higher potential returns (Annual Percentage Rate, to be precise).

Now, what I'm curious about is how effective this whole setup is. Are there any cool success stories or juicy stats that show how profitable the Binance Range Bound can be? How good have people been at predicting price movements within the designated range and raking in those rewards? It would be awesome to get the lowdown on the real deal and hear about users' experiences with this product.