Crypto futures trading is considered one of the most lucrative ways of earning profits from the cryptocurrency market. How to do it in Binance?

Crypto futures provide traders with exposure to digital currencies without having to own the actual coins. It is similar to stock indices or futures contracts that involve commodities in which investors can take risks on the future value of such assets. The value of crypto futures contracts is derived from specific cryptocurrencies like Ethereum or Bitcoin. When the expiration of a crypto futures contract occurs, the trader is meant to use cash rather than dealing physically in crypto.

The major aspect of crypto futures trading is that the trader enjoys protection against adverse price changes and the extremely volatile nature of cryptocurrencies. This high volatility enables them to purchase digital assets when prices are low and then sell when prices rise. Crypto futures can be traded on derivative platforms like Binance Futures.

Similar to spot trading, crypto futures are available for trading 24 hours a day, 7 days a week. Derivatives trading is highly volatile which is why traders need to manage risks wisely and be knowledgeable about the fundamental basics of crypto futures before investing their money in them.

How do Crypto Futures Work?

While digital assets face various and unique challenges which range from high volatility to negative publicity, some traders are smart enough to take advantage of the volatility by trading in crypto futures. The most crucial thing about crypto futures trading is that the trader only takes risks on the price changes without holding the cryptocurrency itself. Let's take a look at this example.

Assuming two traders named James and Ruth entered an Ethereum futures position at $10,000 each. Ruth decides to take a long position while James takes an opposing position. Upon expiration, the Ethereum futures price settles at $17,000. This means that Ruth will be paid a profit of ($17,000 - $10,000 = $7,000) while James that is holding a losing position will have to pay a deficit loss of $7,000.

Basic Concepts of Crypto Futures Trading

As a potential crypto trader, it is advisable to be familiar with certain basic concepts that will make it easier to navigate the complexity of trading crypto futures.

- Leverage: this is one of the major concepts that attract traders to the futures market because leverage makes futures trading very capital-efficient. With leverage, traders can open a BTC futures position at a fraction of the cost. The more leverage the trader has, the lesser the money needed to open a position.

- Margin requirements: there are two major margin requirements namely initial margin and maintenance margin. Initial margin refers to the percentage of the notional value of a futures position that needs to be covered by cash or collateral when using a futures trading account. Maintenance margin is the minimum amount required for investors to keep their trading position(s) open.

- Funding rates: this is a mechanism that ensures that the index prices and futures prices converge regularly on the various crypto exchanges so that the crypto contracts are settled.

How to Trade Futures Contracts on Binance

It is quite straightforward especially if you already have an existing account with Binance. Within a few minutes, you can get started with futures trading, and the process is explained below:

- Open a futures account on Binance site, but prior to that, a 2FA verification should have been enabled to fund the futures account.

- After opening the account, you can deposit funds in USDT, BUSD, or other cryptocurrencies supported by Binance Futures.

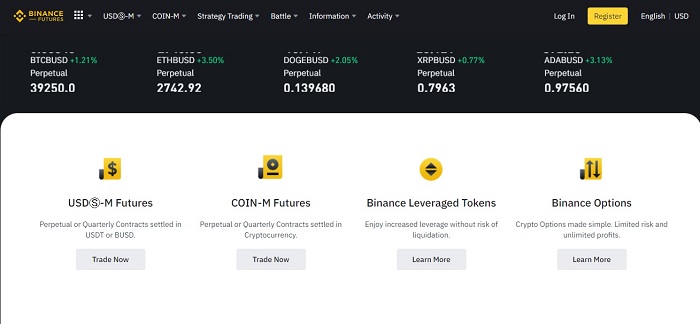

- Choose the preferred futures contract between the USD-M Futures and COIN-M Futures. For instance, if you are interested in BTCUSDT perpetual contracts, then the right choice will be USD-M futures. COIN-M Futures are more suited to BTCUSD coin-margined contracts.

- Choose the suitable leverage for the futures contract.

- Orders can now be placed according to the different order types that Binance Futures offer.

In general, derivatives like futures enable you to speculate on the future prices of digital assets and there are many exchanges today that offer futures trading, including the incredibly well-known Binance. More importantly, understanding how futures trading works and applying the proper risk management techniques will enable you to be profitable and avoid large losses.

Through Binance, crypto futures is not the only alternative means to earn profits from the market. In fact, you can also get crypto loans by utilizing your cryptocurrency as collateral to borrow some cash.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance

Bitcoin

Bitcoin Ethereum

Ethereum Tether

Tether BNB

BNB Solana

Solana USDC

USDC XRP

XRP Dogecoin

Dogecoin Toncoin

Toncoin Cardano

Cardano