Did you know that apart from trading, you can also use your cryptocurrency as collateral to borrow some cash? Find out how to use crypto loans in one of the largest exchanges in the world, Binance.

Crypto lending and borrowing have become popular recently, indicating the beginning of a new financial era. Several crypto exchanges were quick to notice this and decided to offer crypto loans, including the famous crypto exchange Binance.

Crypto Loan in a Nutshell

A crypto loan or crypto lending is basically the same as a securities-based loan or mortgage, where you use a certain asset as collateral to borrow money. In this case, cryptocurrency is the collateral offered to the lender in exchange for cash that you're going to pay back later on. This means that you won't be able to access or use the crypto before you repay the borrowed money. If you somehow fail to repay the loan, the lender will have the right to liquidate or cash out the crypto coins.

Crypto loans can be a great idea if the borrower has a good amount of crypto and wish to cash it out without having to lose it from selling and possibly pay taxes on it. You can then use the money to purchase or invest in something else, similar to getting a personal loan.

Apart from that, there are also other benefits of getting crypto loans as compared to traditional loans. For instance, crypto lending offers low-interest rates and no credit check required to access modern financing. Both interest rates and rigorous background checking are often seen as deterrents to borrowing money from a centralized firm.

Also, it's worth noting that the process of a crypto loan is definitely quicker than traditional ones. Normally, crypto lending platforms would only take about one business day to process your loan request, whereas banks would need to go through a lengthy step-by-step procedure that could take a few days in total.

There are, however, consequences and risks to crypto loans that you need to put into account. One of the most pressing matters is regarding the fluctuating value of cryptocurrency. High volatility can lead to a margin call, where the borrower must put additional crypto in order to maintain the value of the initial collateral. So if the value of the collateral declines below a certain level set by the lender, you would have to add more crypto in a limited period of time.

Crypto Loan on Binance

Binance is one of the largest crypto exchanges in the world with an estimated number of users around 28 million people. Apart from facilitating the buying and selling of cryptocurrencies, Binance also gives its users access to crypto loans. Binance claims to provide a secure and fast solution for all crypto holders who wish to borrow and lend cryptocurrency.

By depositing some crypto coins as collateral within your trading account, you are allowed to borrow either USDT or BUSD through the Binance Loans platform. You can then transfer those stablecoins and use them as you please.

As for the collateral, Binance supports several cryptocurrencies including BTC and ETH. The amount that you can borrow will be based on your Loan-to-Value (LTV) ratio, which can be calculated by dividing the desired loan value by your collateral value.

In Binance, the loans are fixed at 65% LTV. The interest is calculated hourly (less than one hour is counted as one hour) and the loan can be repaid at any time based on the hours borrowed. Keep in mind that the minimum single loan amount and the borrowing limit for every supported coin are different, so make sure to check and calculate the cost before you decide to take a loan.

How to Borrow Crypto on Binance

First of all, you need to make sure that you're registered on Binance since only Binance users can take crypto loans on Binance. Then, follow the step-by-step guide below to help you get started:

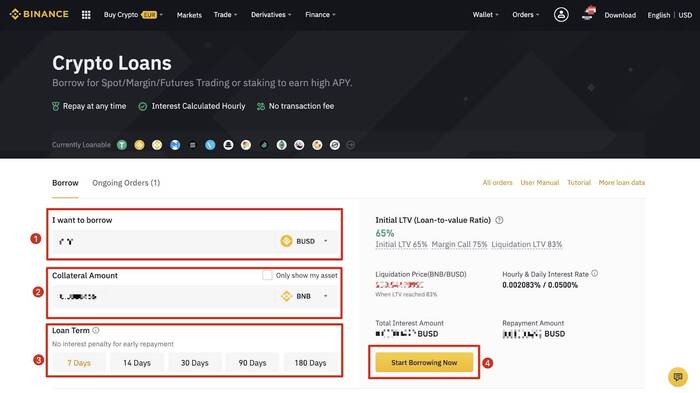

1. Head over to Binance's official website, click "Finance", and click "Crypto Loans" to enter the loan page. Then, the asset that you wish to borrow and enter the borrowing amount. Choose a loan term and once you confirm everything, click "Start Borrowing Now".

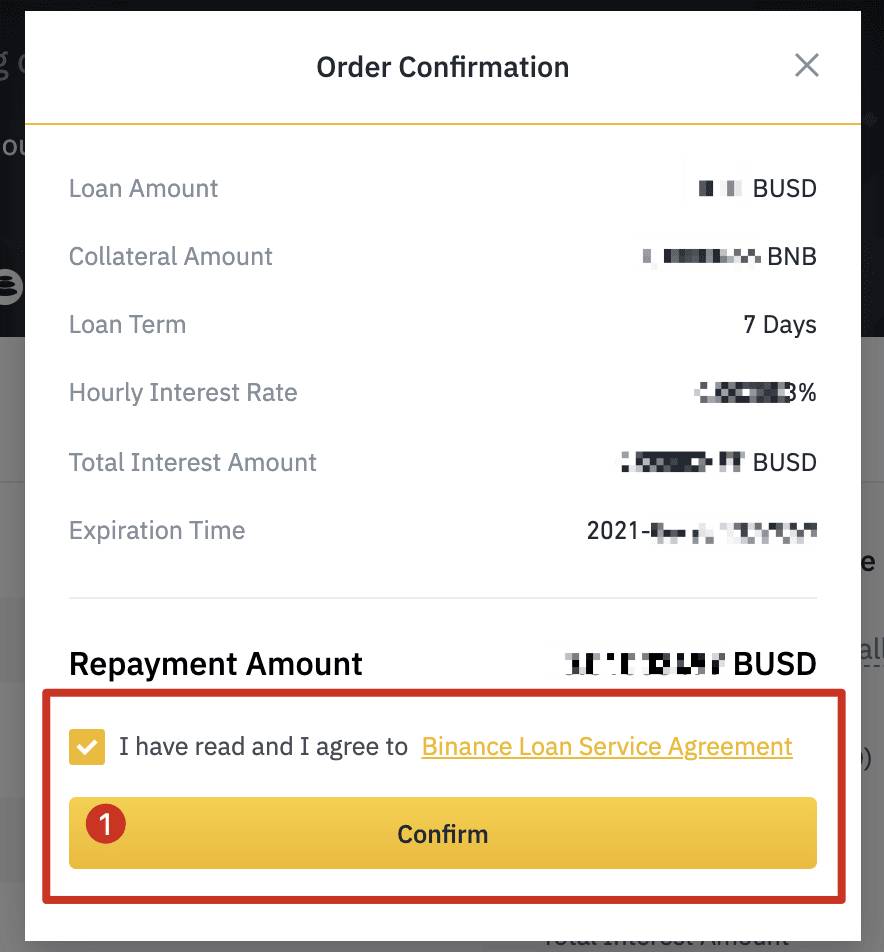

2. Afterwards, you'll see an Order Confirmation pop-up that will ask you to confirm all of the information you entered earlier. Read carefully and if this is your first time, don't forget to read the Binance Loans Service Agreement to help you understand the terms and conditions better. Once you're done, click "Confirm".

After doing all the steps, Binance will remove the collateral from your spot account and replace it with the loan amount according to the agreement. You are now free to withdraw the money to the bank account of your choice and use it for whatever you want. The most important thing is to not forget to repay the loan once the term is over.

How to Repay Crypto Loans on Binance

In Binance, there are several loan terms options to choose from, namely 7, 14, 30, 90, and 180 days. The duration to repay the loan is highly important, so make sure to keep track and make the repayment on time. If the loan repayment is overdue, you will be charged 3 times the hourly interest. And if you still don't repay after the overdue duration, Binance will liquidate your collateral money to repay the loan.

The following are the steps to repay the loan on Binance:

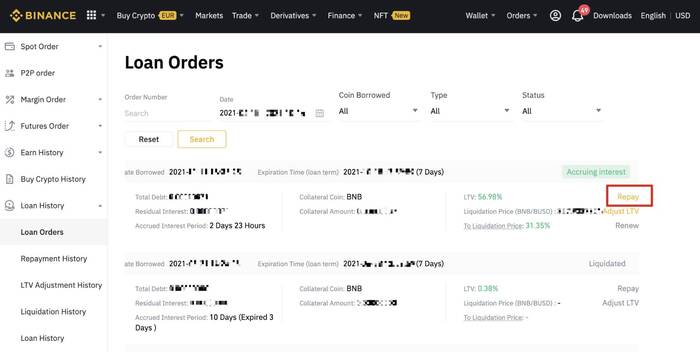

- Select "Ongoing Orders" from the main menu and click "Repay".

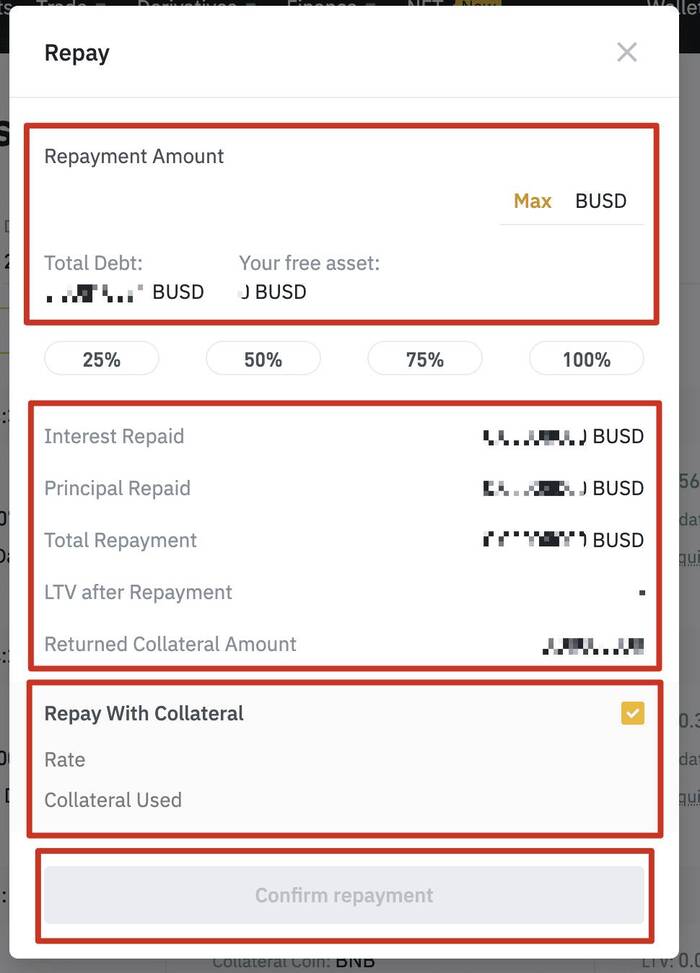

- You can either enter the repayment amount directly or a repayment ratio.

- Review the details and make sure that the data is correct. Then click "Confirm Repayment".

- The screen will display a confirmation message once the repayment process has been completed.

Note that Binance also allows you to repay your loans with collateral. Here's how to do it:

1. Click "Repay" on the Loan Orders page.

2. Enter the repayment amount and "Repay with Collateral".

3. Check the details and click "Confirm Repayment".

Crypto Loans without Collateral

We have mentioned earlier that one of the downsides of crypto loans is the possibility of getting a margin call and having to put extra crypto as collateral. Thankfully, since 2019, Binance has offered a solution to the issue by introducing the Binance Margin, which can be accessed on the main Binance exchange platform.

If you use Binance Margin, Binance as the third party will allow you to multiply your gains on successful trades. This can be incredibly profitable but bear in mind that this also means that you can get greater loss from losing trades.

Unlike crypto loans, using margin allows you to make use of your initial crypto value in a trade, rather than as collateral in exchange for additional funds. In order to avoid a margin call, you should be able to earn a value that doesn't go below the initial investment of the margin trade. It's not mandatory, but typically, margin trades are used in low volatility markets.

The Bottom Line

Crypto loan is one of the many uses of cryptocurrency that probably not many people are aware of just yet. Nevertheless, it is a great alternative for those with a sufficient amount of crypto coins who want to cash it out for other purposes without selling it. Crypto loan also has several advantages in comparison to traditional loan in centralized firms. Some of them are regarding its accessibility, transparency, and ease of use.

Binance is one of the crypto firms that offer a crypto loan service with minimal cost and speedy processing time. What's even more important is that as a leading crypto exchange in the world, Binance is also considered reliable in terms of the safety of the clients' funds. So if you're interested in Binance crypto loan, simply head over to the exchange's main platform and find out more about it in detail.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance

Bitcoin

Bitcoin Ethereum

Ethereum Tether

Tether BNB

BNB Solana

Solana USDC

USDC XRP

XRP Toncoin

Toncoin Dogecoin

Dogecoin Cardano

Cardano