To enjoy the full functionality and higher safety measures in FXTM, you must verify your account. How to do it?

FXTM is one of the industry's top brokerage companies and an expert in providing safe trading services for traders of all expertise levels. The company offers a great deal of trading instruments, trading platforms, as well as research tools that can help you make better, rational decisions when trading in volatile markets. It operates in more than 150 countries and has obtained licenses from several financial authorities, including the top-tier FCA.

At FXTM, opening an account is very easy and requires no prior knowledge. However, as a fully regulated broker, the company must require all clients to verify their accounts. This means you need to upload certain documents and wait for the broker to approve your identity.

At a glance, account verification may sound complicated and time-consuming, but don't worry because FXTM verification process is fast and won't hurt your head.

What Documents Should I Prepare to Verify My FXTM Account?

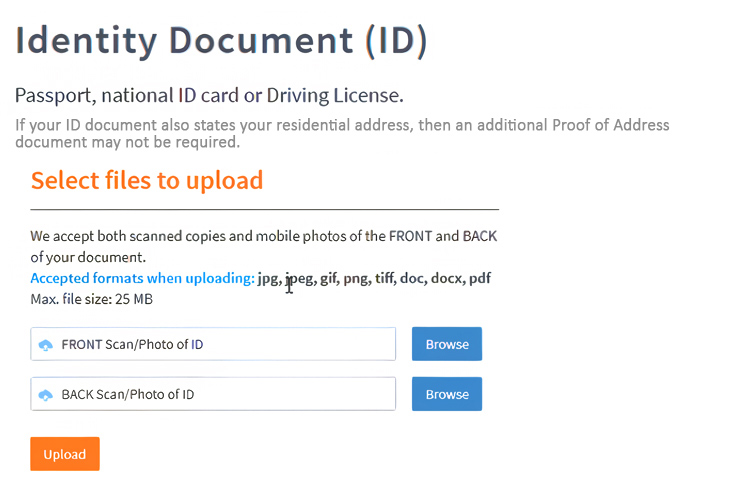

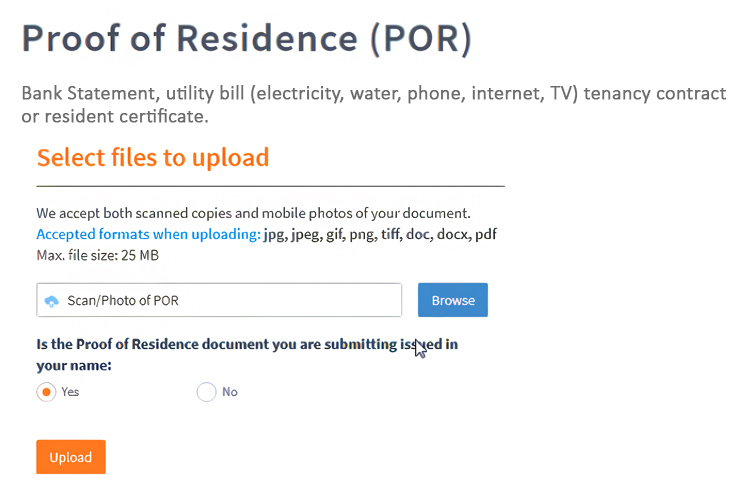

To verify your account, you will be required to upload a clear and colored copy of certain documents. It can either be a scan or mobile photo. The size of the file must be smaller than 25 MB and must be in one of the following formats: GIF, JPG, TIFF, PNG, DOC, DOCX, and PDF. Also, please make sure to provide both sides if it's a two-sided document.

In FXTM, there are two types of documents that you should provide:

- Proof of Identity – passport, national identity card, driving license

- Proof of Address – bank/card statement, utility bill (water, gas, electric, internet, or telephone), residency certificate, tenancy contract

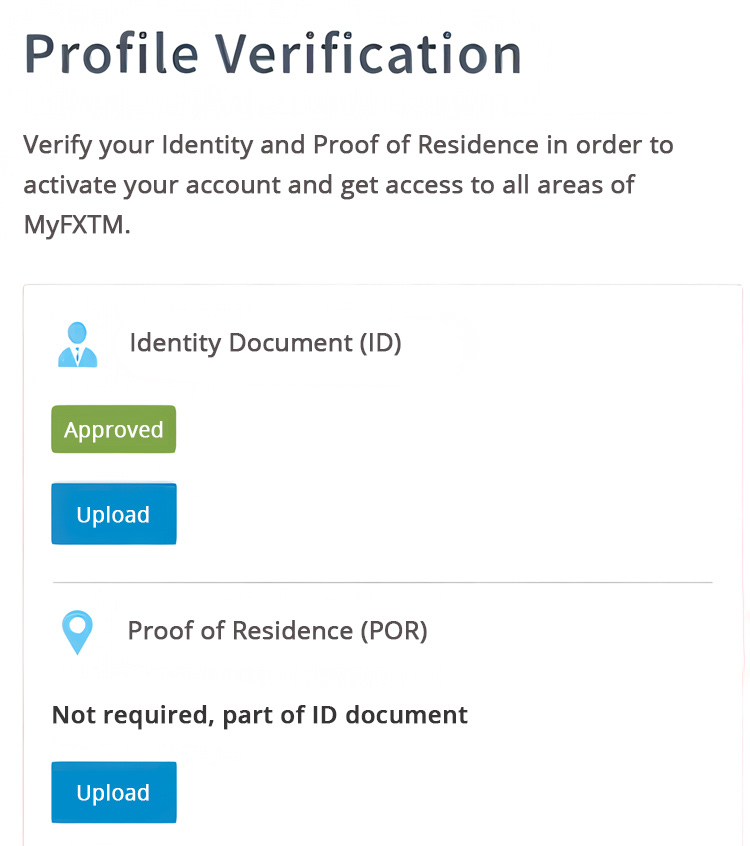

The Proof of Address must not expire and issued within the last 3 months. Your full name and residential address must also be visible. If the document you have provided for Proof of Identity already includes your correct residential address, you will not be required to upload an additional Proof of Address.

FXTM was initially launched in 2011 with a unique vision to provide unparalleled superior trading conditions. Opening an account in FXTM would also bring about access to advanced education and sophisticated trading tools in the forex industry.

Now, FXTM is registered under the Financial Conduct Authority of the UK with the number 600475. The company is also regulated by the Cyprus Securities and Exchange Commission with CIF license number 185/12, and is licensed by the Financial Sector Conduct Authority (FSCA) of South Africa, with FSP No. 46614

FXTM has 1 million registered accounts with more traders joining every day. The company continually tries to improve their performance and have got many awards such as Best Trading Experience 2019 by World Finance Awards, Best Online Forex Trading Company Nigeria 2018 by International Finance Awards, Reputable Investor Education Forex Broker Award 2018 by Hexun.com, Forex Brand Of The Year China 2018 by Fxeye.Com, and many more.

As a responsible broker, they determine leverage (expressed as a ratio of transaction size relative to trader's buying power) according to the trader's level of knowledge and experience in trading, which is evaluated by the Appropriateness Assessment. The company also enables trading with leverage up to 1:1000.

As for spreads, FXTM offers low spreads starting from 0.1 pip, so traders can withdraw profits at the start of trading. The company, which has headquarters in several countries, uses No Dealing Desk (NDD) technology and partners with credible liquidity providers to provide the best bid and ask prices.

For beginners, there is an automatic trading facility called algorithmic trading provided. When trading in FXTM, traders can develop their trading strategy or adopt other traders' strategies. Furthermore, the strategy is applied to automated trading systems, such as Expert Advisors. The purpose of this system is traders do not have to worry about losing opportunities while not observing the market so that profits can still be earned.

Three types of ECN accounts use the MT4 and MT5 trading platforms. There are also mobile and Tablet Apps trading platforms. Aside of providing many account variants, FXTM goes above and beyond to ensure that their client receives excellent support that they deserve, making their trading experience optimal and user-friendly.

FXTM also provides a diverse range of products. In addition to over 50 currency pairs, they provide gold, silver, CFD on commodity futures (oil), CFD on ETFs, and indices.

Education about the basic concepts of the forex industry is also accessible in this broker. Traders can read all the concepts provided in the form of e-books, video tutorials, articles, webinars, and forex seminars. There are 17 languages provided on the FXTM website to make it easier for traders to learn about forex.

Traders are also given various choices for payment methods, including Credit Cards (Visa, Mastercard, Maestro) and E-Wallet (Neteller, Skrill, Western Union). For withdrawing funds, traders are not charged a fee with a length of 2 hours to 2 days. Traders can live chat to ask further questions and contact the admin via email. There is also a question and answer page about forex trading on FXTM.

Steps to Verify Account in FXTM

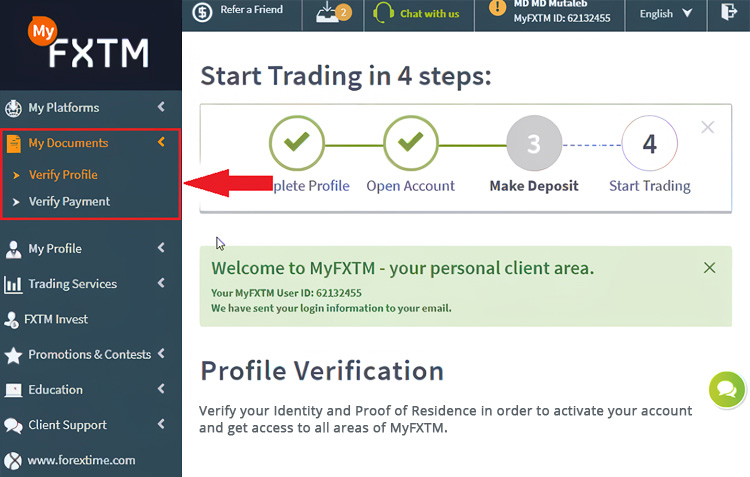

- Open FXTM's official website and log in to your "MyFXTM" personal area.

- Navigate to the left-hand side menu and click "My Documents". Then, select "Verify Profile".

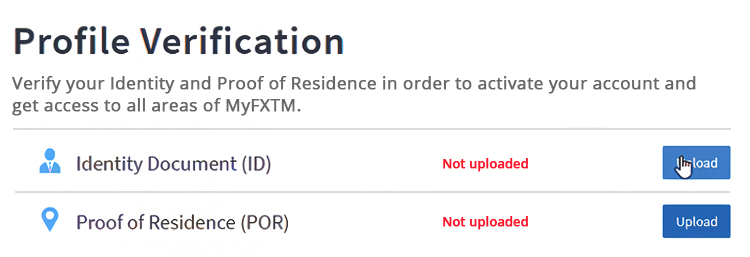

- On the verification page, you will see the types of documents that you must provide. Click the "upload" button for the Identity Documentation (ID).

- You can then select the files from your computer and upload them. Make sure that the document fits all the requirements from FXTM.

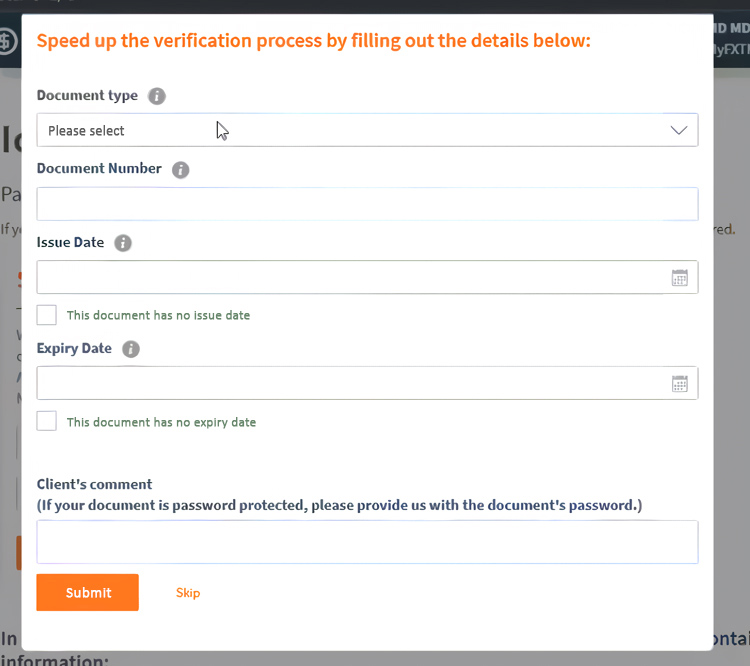

- In addition to uploading the documents, you can also enter the information manually in the application form to make the process faster. This is not mandatory, so if you don't have time to do it, you can just click "skip".

- You can repeat steps 3-5 for uploading the Proof of Residence.

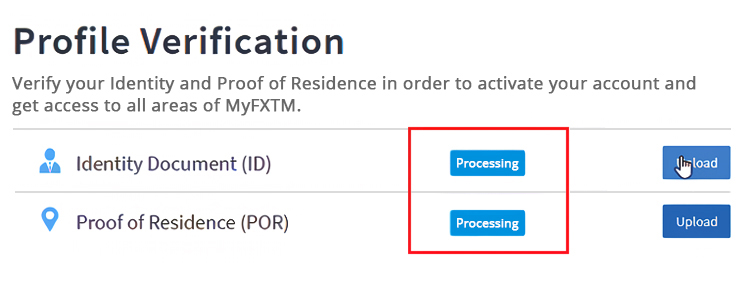

- Next, simply wait for FXTM to approve your documents. At this point, the status of your request is "processing". This might take around 10 minutes up to 24 hours during working hours. For faster response, you can contact the customer service via live chat.

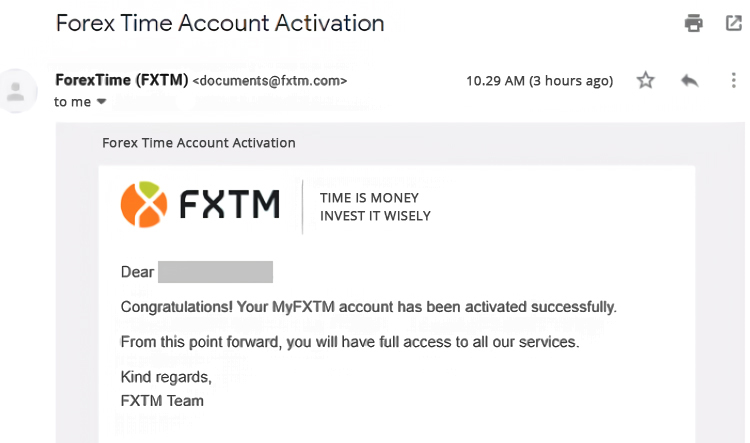

- The broker will inform you via email once the verification is done.

- The status of your submitted documents will also change to "Approved". You can now use the account to start trading and access full features of FXTM as a verified user such as making withdrawals.

To avoid any issues, it is highly recommended to prepare your documents in advance and make sure that they're valid. However, if you still have any trouble while uploading the documents, you can provide your submission to [email protected] instead.

Is Verifying My Account Really Important?

If you still think that verifying your FXTM account trading is a hassle, you need to remember that account verification is required as part of the international AML policy, which is mandatory for all regulated brokers to follow. Otherwise, the company would have to face consequences from the authorities such as warnings and/or penalties.

The idea is to make sure that all applicants are legitimate so that the broker and its clients are protected from dangerous individuals such as thieves, hackers, frauds, and so on. So long story short, FXTM account verification is part of the broker's security measures to ensure that their clients are real and trustworthy.

In addition to higher safety, verification also unlocks all features offered by the broker. In FXTM, unverified clients won't be able to access certain features and make withdrawals. They can still make deposits but with certain amount restrictions and limited payment methods. Thus, we highly recommend completing the verification process before making any trades to avoid any issues and restrictions in the future.

FXTM broker is a leading trading service provider that strives to support forex traders with 3 focuses on Trust, Access, and Value. Over the years, they managed to gather more than 4 million clients worldwide and 45+ awards that prove their competitive edge in the brokerage industry.

Forex trading signals straight to your inbox

Forex trading signals straight to your inbox Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus

5 Comments

Fatima

Nov 17 2023

Wow, I used to think that verification is just an optional thing because in some brokers you can still make trades without uploading KYC documents, but apparently it goes way deeper than that. I also just noticed that it is part of the regulator's policy, so the broker basically has no choice but to comply. Does that mean that my account is safer once I completed the verification process? Also, when is the best time to submit the documents? Can I do it on weekends?

Eddy

Nov 20 2023

To a certain extent, yes. By uploading the documents, you basically confirm your identity and help making a better, safer environment for everyone including yourself. So it's not just going to affect the broker, but the entire community! Think of it as a protection layer that can safeguard your account (and money) from shady business and fraudulent people. On top of that, it will also make the broker trusts you more. Aside from being able to withdraw freely, you might also get more exclusive promos and bonus deals.

As for the ideal time, I suggest you complete the verification step right after you open your trading account. Working days are preferable, but you can do it any time. I just think it's better to get it out of your way as soon as possible so that it won't disturb your trading activities.

Clara

Nov 19 2023

Hi, I need your help. So I'm currently pursuing my degree in a foreign country, far away from my birth country. I've been interested in trading for a while and I just registered in FXTM earlier today. Thanks to this article, now I know that I must upload several documents to verify my identity and that it is important to access all the tools. I'm a bit worried about that though. The problem is, none of my bills are in my name right now. I'm also going to move in a couple of days, so I still don't have a fixed residential address. What do you suggest I should do in this situation?

Yanti

Nov 21 2023

Hello there! As someone who just got verified last month, I can assure you that verification in FXTM is very easy. No need to be worried at all! If none of the documents are in your name, then you have several options:

Icha_12

Nov 25 2023

I want to add that as stated in this article, if your ID card already states your residential address, then you don't have to upload another document for POR. So you can use a single document for both categories. But I see your issue and I suggest you contact the customer service via email or live chat. As far as I know, FXTM has one of the best customer support team in the industry. They're very responsive and actually helpful. You won't be greeted with some bots that answer in templates. Good luck