Binance Visa Card is a crypto debit card that allows you to make payments with crypto assets. Here's how it works and how to get it.

One of the goals of cryptocurrency is to become a modern mainstream payment of method, but in reality, spending digital tokens still remains a huge challenge in the real world. There aren't many shops and sellers that accept cryptocurrency these days because of several reasons. They might be worried about volatile exchange rates, think that the technology is too hard to understand, or find that the demand for crypto transactions is low. To solve the issue, many developers and exchanges decided to release crypto debit cards, which basically allow you to make transactions with crypto tokens.

In 2020, the leading crypto exchange Binance also released its own crypto debit card called Binance Visa Card. The product was launched in the hope to take a further step toward making crypto tokens more usable in our day-to-day lives. Users can expect to get many unique features as well as benefits.

Contents

Introduction to Binance Visa Card

As the name suggests, Binance Visa Card is a crypto debit card that can be used in various merchants all around the world. Launched in July 2020, Binance Visa Card allows its holder to spend their cryptos just like they were fiat currencies. The card basically converts the crypto that you've stored in your debit card account to fiat currencies that are universally accepted everywhere. Since the card was issued by Visa, you can simply use it in practically online and offline merchants that accept Visa. You can also use it at regular ATMs and link your card virtually with Google Pay and Samsung Pay.

Binance Visa Card is currently available for residents living in the following countries: Austria, Belgium, Bulgaria, Croatia, Republic of Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Gibraltar, Greece, Hungary, Iceland, Ireland, Italy, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, Netherlands, Norway, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, and Sweden.

Moreover, Binance Visa Card supports the conversion and spending of 12 cryptocurrencies, which are BNB, BTC, ETH, BUSD, USDT, SXP, EUR, ADA, DOT, LASIO, PORTO, and SANTOS. It's important to know that the card is denominated in EUR, so all related transactions are processed in EUR. This also means that all refunds will always be given in EUR.

How Does the Card Work?

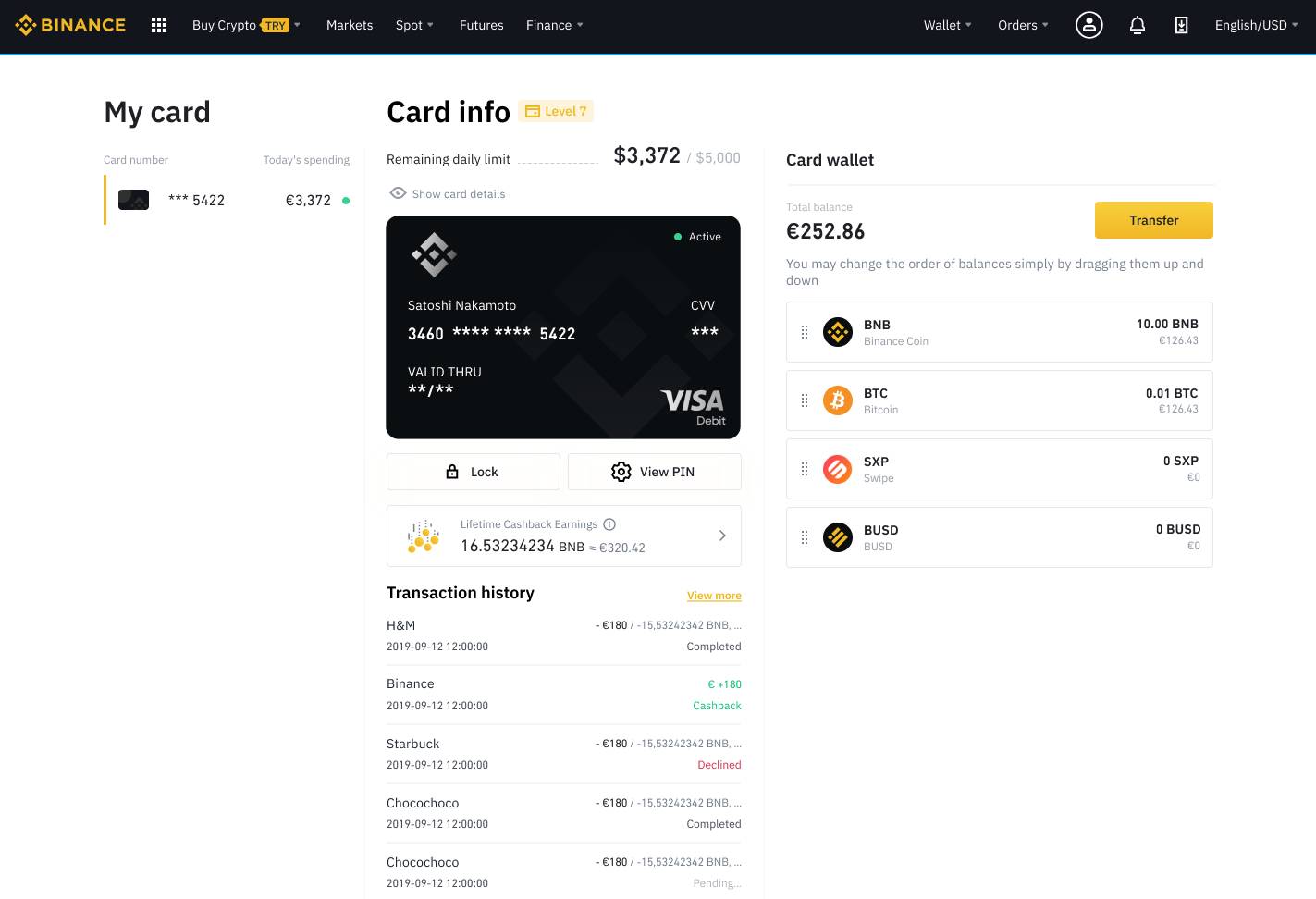

Powered by Swipe, Binance Visa Card essentially works like a traditional debit card, except it holds cryptocurrency instead of fiat currency. The card is linked to your Card Wallet within your Binance account. You can make deposits in this wallet by using the funds stored in your Spot Wallet.

When you use Binance Visa Card to make a payment, the card automatically converts your crypto into fiat currency. This is made possible by the Swipe technology, which powers the conversion and allows users to pay in both online and offline merchants. In addition, you'll have the option to get both the virtual and physical forms of the card.

Fees, Cashbacks, and Card Limits

One of the main draws of Binance Visa Card is regarding the fees and cashback system. First of all, the card has zero fees, so you won't have to worry about monthly or yearly maintenance fees. However, there are third-party services and network fees of up to 0.9%. There's also a fee for physical card reissue that amounts to EUR25.

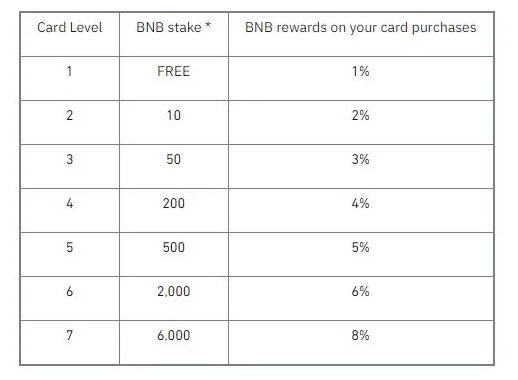

You can get up to 8% cashback for every payment you make with the card, which is quite high compared to other card issuers. The reward will be given in the form of Binance's cryptocurrency, BNB, and the amount will depend on your card level and how much BNB you're currently holding in your debit card account.

That being said, the more BNB tokens you have in your account, the higher the rewards will be. You can refer to the table below to see the breakdown of the cashback rewards:

It's worth pointing out that the cashback is rewarded to your card wallet on a weekly basis and the percentage is based on your average holdings of BNB over a 30-day period. Also, note that transactions on digital wallets, digital banking services, crypto exchanges, stored value products, money remittance services, and some other categories are excluded from the BNB cashback program.

Another thing to mention is card limits regarding cashback and your daily spending. The monthly cap for your cashback limit is calculated based on your card level:

If you reach the cashback threshold at the moment of the cashback calculation, you will only be rewarded with partial cashback within the cap for the card level. Any other purchases you make within the month will not be rewarded any cashback. For your information, the cashback is calculated from the 1st day of the month at 00:00:00 UTC and the cashback limit will be reset every month.

As for the spending limit, you can refer to the following list:

- Virtual Binance Visa Card has a daily spending limit of EUR870

- Physical Binance Visa Card has a limit of EUR8,700

- The daily ATM limit is EUR290

- Contactless transaction across Europe's limit is EUR50

- The accumulated amount of contactless payment is 150

You can view your card's limit in the Cardholder Agreement or from the Card Dashboard. "Today's Spendings" refers to the spending you made today and "Today's Withdrawals" refers to ATM withdrawals you made today.

How to Get Binance Visa Card?

1. After signing up for an account and funding it, go to Binance's card section on their official page.

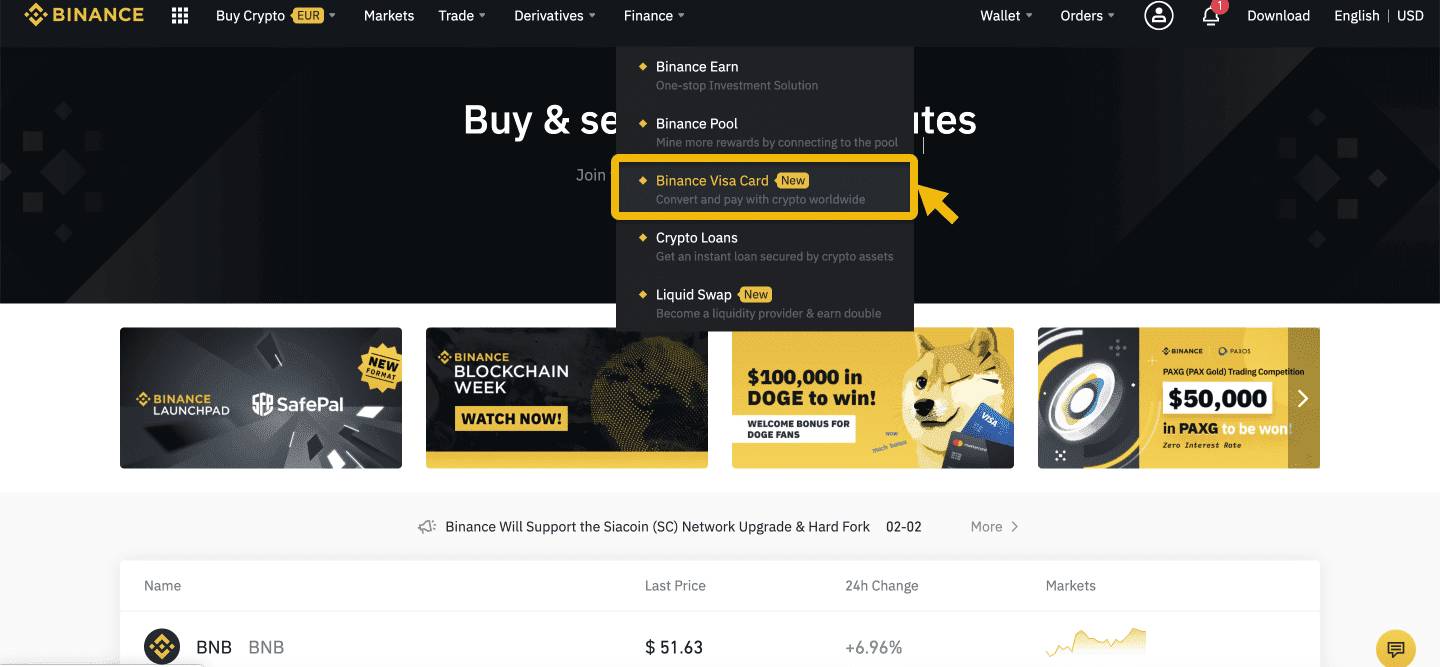

2. Head over to "Finance" and click "Binance Visa Card" in the Binance homepage header.

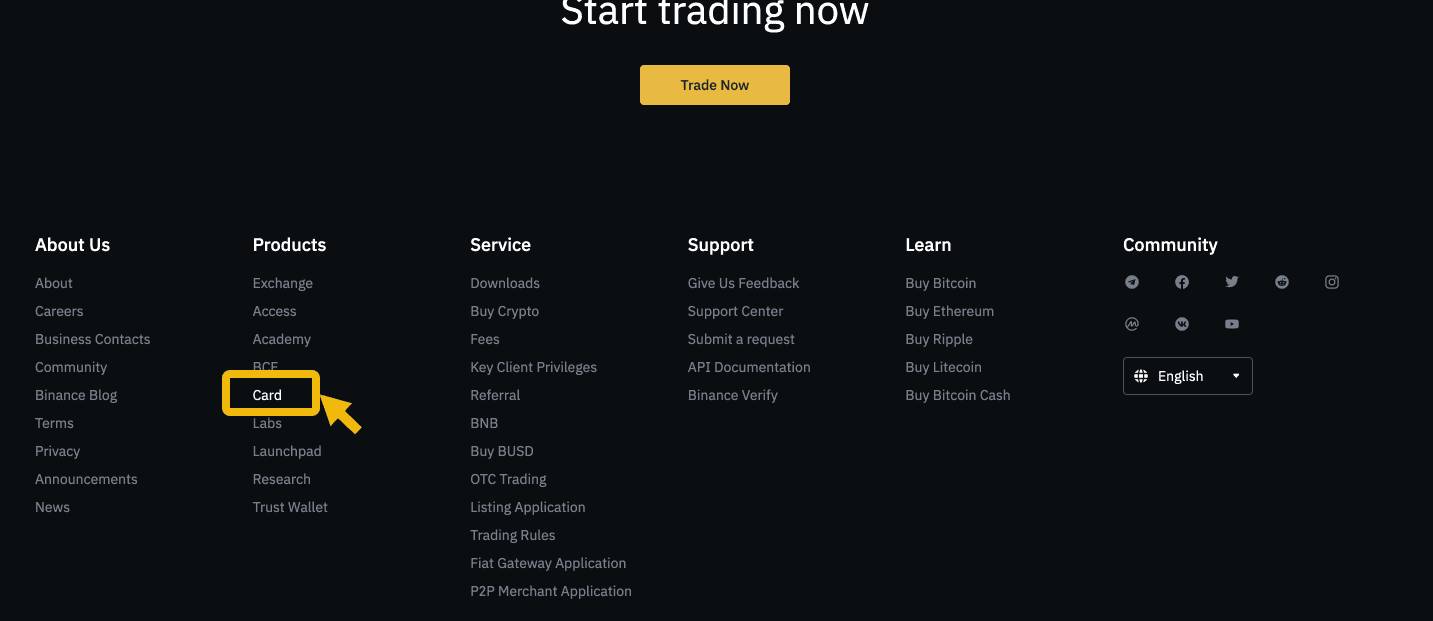

3. Alternatively, you can also click "Card" in the footer of the homepage.

To complete the order, you'll need to verify your identity first. Make sure that you live in the region where Binance Card is available.

The Application Process

1. Navigate to the Binance Card page as described above and click "Get Started".

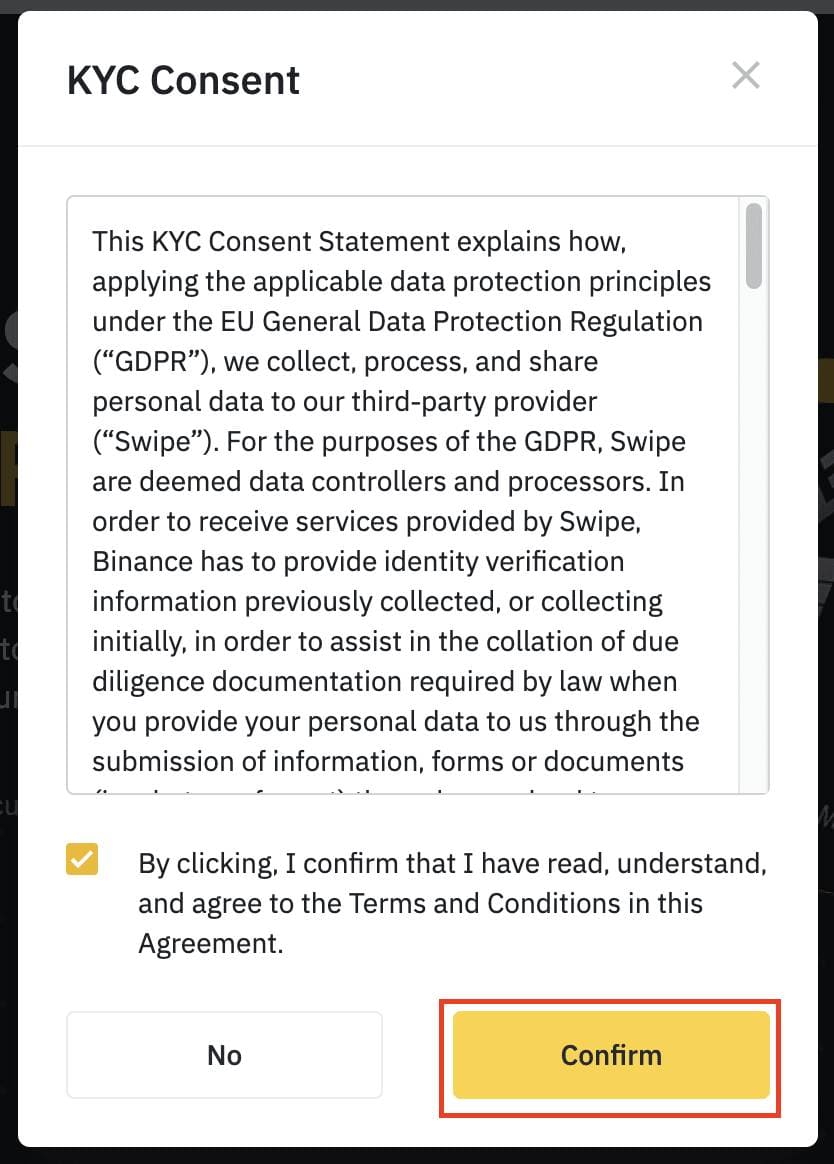

2. Carefully read the KYC Consent information and click "Confirm" once you're ready.

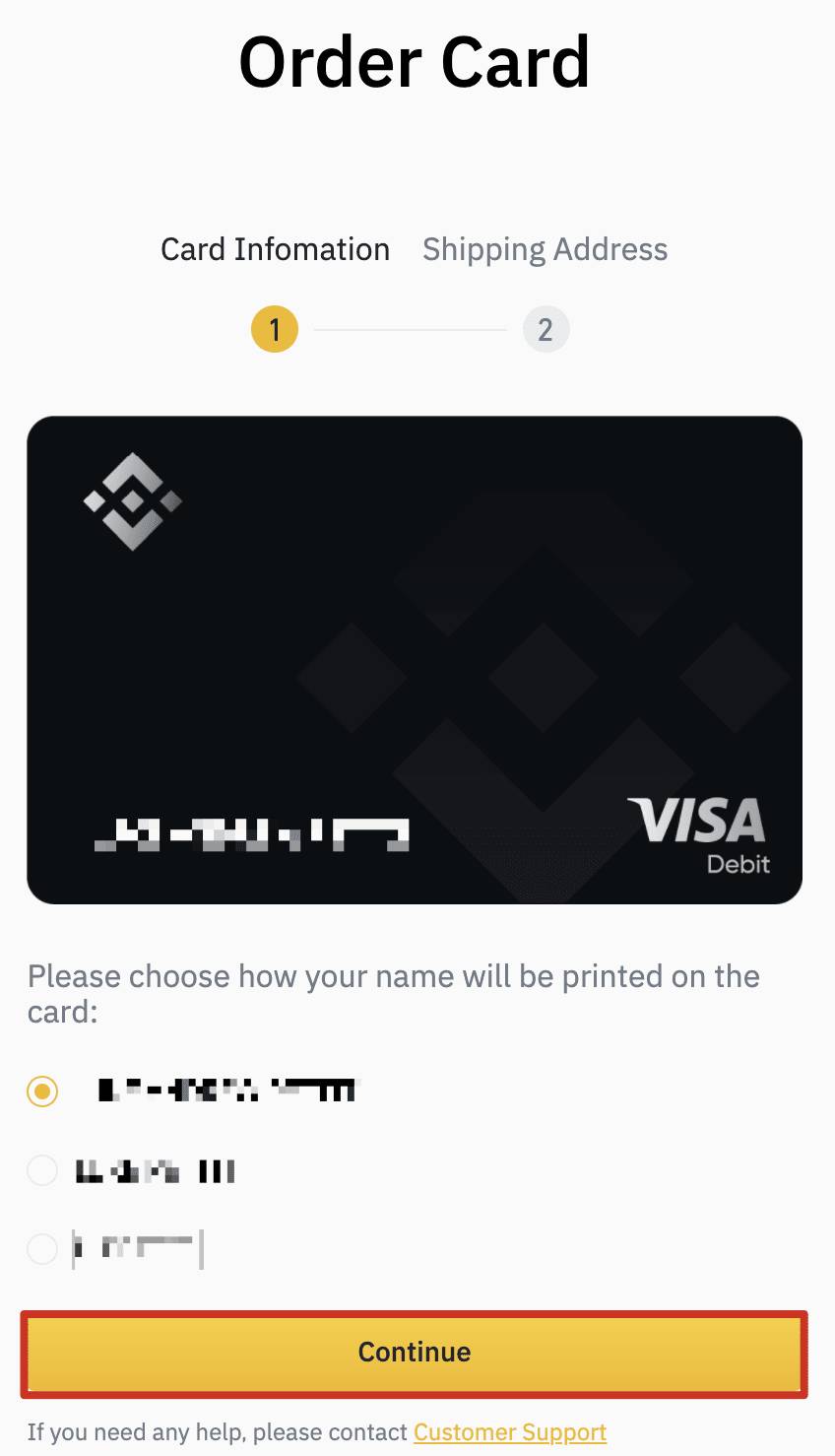

3. You will be redirected to the Order Card page. You can then choose a name that will be written on the card. Once you're done, click "Continue".

4. After all the details are confirmed, please agree to the Terms of Use, Privacy Policy, and Cardholder Agreement by clicking the "Order Your Binance Card" button. Upon completion, your virtual Binance Visa Card will be issued instantly and will remain valid until the physical card is activated.

Keep in mind that you might have to confirm some details beforehand (pre-filled). Some information like phone number and passport/driver's license issue date might be missing, so you'll need to provide them. If your details are incorrect, you can contact Binance's Support Team.

See Also:

Activating the Physical Card

- Log in to your Binance account and head over to the Card Dashboard. You can activate your physical card once the card status has changed from "Pending" to "Shipped".

- There is an activation button at the bottom of the page. Click "Activate" to start the activation process.

- You will be asked to enter the four digits of your physical Binance Card and enter the CVV located on the back of the card.

- Once you verify the details, your card will be activated. Note that you'll need the four-digit PIN code for ATM access, so please save it in a secure place and don't share it with anyone.

Please note that card delivery might take up to 45 days depending on where you live. If you haven't received the card within 45 days after you placed an order, then your card might be lost in the delivery process. When this happens, you can simply reorder the card. Here are the steps:

- Go to Binance Card Dashboard

- Click "Manage my Card", and choose "My Card".

- You'll see the message that says "If you have not received your card, please reorder here".

- Click "Order New Card". This action will be free of charge.

However, keep in mind that if you have terminated or lost your physical card, you'll need to pay a replacement fee of EUR25. You can use fiat or crypto tokens from your Spot and Fiat Wallet to make the payment. If you choose to pay with crypto, the system will automatically convert it to EUR based on the current conversion rate price.

The Bottom Line

In summary, crypto debit cards are an excellent option if you wish to use your digital assets as a regular payment method. Binance Visa Card in particular can be used in over 60 million merchants that accept Visa worldwide, so it is certainly useful and highly accessible.

As mentioned above, the main benefits of Binance Visa Card are the zero fees and cashback system. However, remember that the cashback will only be given in BNB tokens and only based on the amount of BNB tokens in your account. This means you won't earn any rewards for holding any token other than BNB. In the end, Binance Card is great but it is more recommended for Binance exchange users who are heavily invested in BNB tokens and want to pocket a lot of cashback rewards.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance

Bitcoin

Bitcoin Ethereum

Ethereum Tether

Tether BNB

BNB Solana

Solana USDC

USDC XRP

XRP Dogecoin

Dogecoin Toncoin

Toncoin Cardano

Cardano