Binance offers many opportunities to make use of your idle crypto assets, such as staking and savings. Here's what you need to know about them and find out which one's better.

As one of the leading crypto exchanges in the world, Binance also decided to join the party and launched its own savings program.

Apart from facilitating the buying and selling of crypto assets, Binance offers a savings option that allows traders to earn interest on cryptocurrency.

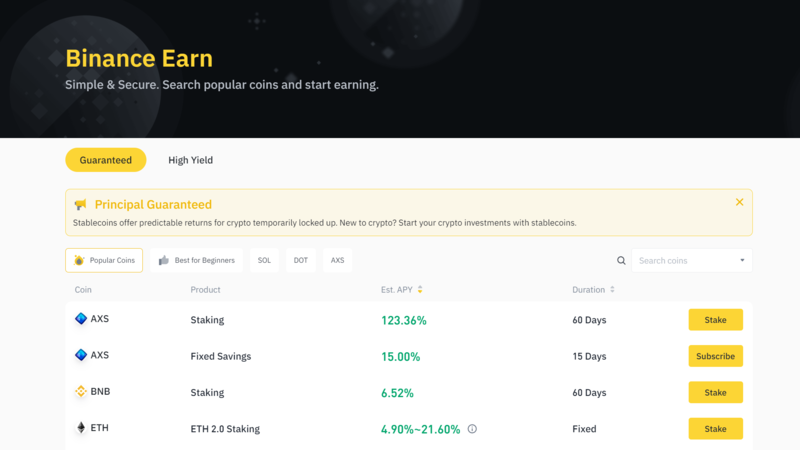

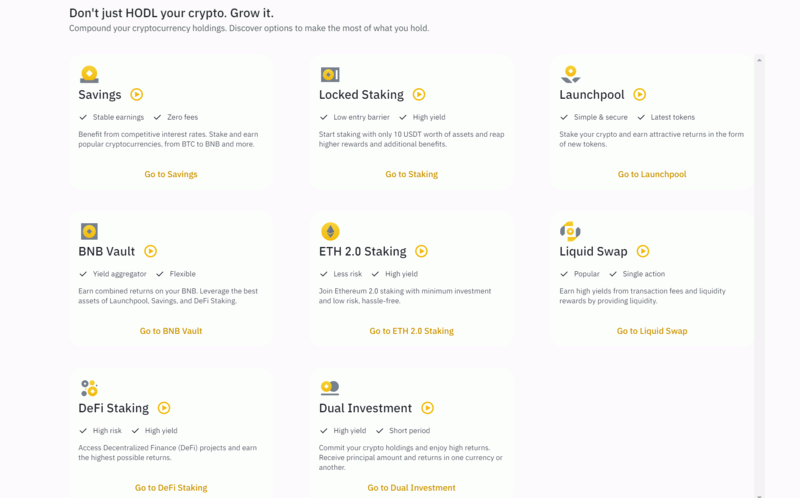

Under the Binance Earn feature, there are several different choices that you can use to generate passive income from your idle cryptocurrency, but most traders are torn between the staking and savings options.

Today, we shed some light on the differences between staking and savings in Binance so that you can decide which methods work best for you.

Binance Crypto Staking

To increase users' income, there are several types of staking offered by Binance:

1. Locked Staking

Locked staking requires you to lock funds in a crypto wallet for a certain period to earn rewards. Currently, Binance supports several coins to stack, including QTUM, VET, ALGO, EOS, ONE, XTZ, and ATOM.

During the staking period, your crypto coins will be locked and you wouldn't be able to access them until the period is over. The staking essentially starts at 0:00 AM (UTC) until the end of the period and during that time, the staking interest will be distributed daily.

At the time of writing, Binance offers four timeframes to choose from, namely 15, 30, 60, and 90 days long. Each coin also has a specific minimum account, which you can check on the platform.

Moreover, you can then take back your locked coins and store them in your account the day after the redemption process is complete. Alternatively, you can also choose to redeem in advance by using the "early redemption" option.

But keep in mind that early redemption will deduct all of your interest-based income. Also, the interest that has been distributed will be deducted from the principal, thus reducing the principal payout number.

Due to differences in the global time zone, the transfer process can take around 48-72 hours.

If you're interested in locked staking, here are the step-by-step guide you should follow:

1. Head over to the front page of the Binance website, choose "Finance", and click "Binance Earn".

2. Navigate to "Locked Staking" and click "Go to Staking".

3. See the coins available for staking and choose the crypto that you own. Click "Stake Now".

4. Fill in the information needed. You can determine the details, such as duration, lock amount, redemption period, and more. Once you're finished, click "Confirm".

2. DeFi Staking

Binance also offers a DeFi staking option to give users access to participate in certain decentralized projects. In DeFi staking, there's no need to manage private keys, make trades, or do other complicated tasks.

Instead, Binance offers a one-stop service so that you can get generous rewards without having to keep an on-chain wallet. Another advantage is that the fees required are low compared to other platforms.

It's worth mentioning that while Binance claims that they only provide the best DeFi projects out there, there's still no guarantee of the security of investing in these projects.

Remember that Binance only serves as the platform to showcase the projects and give access for users to participate, but they won't take the responsibility for any losses incurred due to the project's security issues.

For this reason, you need to protect yourself and be extra ive when it comes to choosing which DeFi project to invest in.

3. ETH 2.0 Staking

Another thing you can do is staking in the new Ethereum network ETH 2.0, which is an upgrade that consists of three phases and allows users to stake their ETH on the blockchain. Staking in ETH 2.0 is a great option if you want to stake it in the long term.

There are several things that you need to understand before choosing this staking option. Firstly, you cannot redeem your stake during the first phase of the upgrade and this might take around two years.

Another thing is that since you are staking your ETH on the Binance smart chain network, the coin will be converted into Beacon ETH (BETH), which is a tokenized proof of your stake.

This means, your rewards will also be given in the form of BETH. You can redeem the rewards once the first phase is completed and ETH 2.0 starts implementing shard chains. When that happens, you can swap your BETH to ETH with a ratio of 1:1.

Binance Crypto Savings

Apart from staking, you can also choose to use the savings service in Binance. To put it simply, you can think of it as a regular bank saving account.

You just have to store and keep your funds in Binance and earn interest from the idle asset based on the number of days your funds remain locked. The number of interests you'll earn varies for each cryptocurrency.

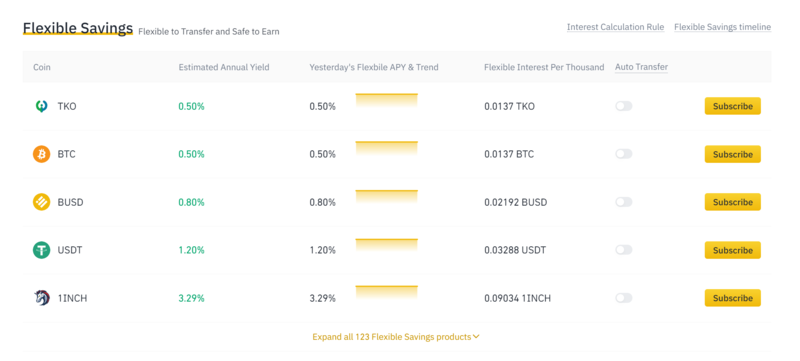

1. Flexible Savings

In flexible savings, you can earn interest from the cryptocurrency you keep on the exchange. It is considered flexible because you are free to deposit and withdraw your holdings at any time. The rewards will be distributed on a daily basis.

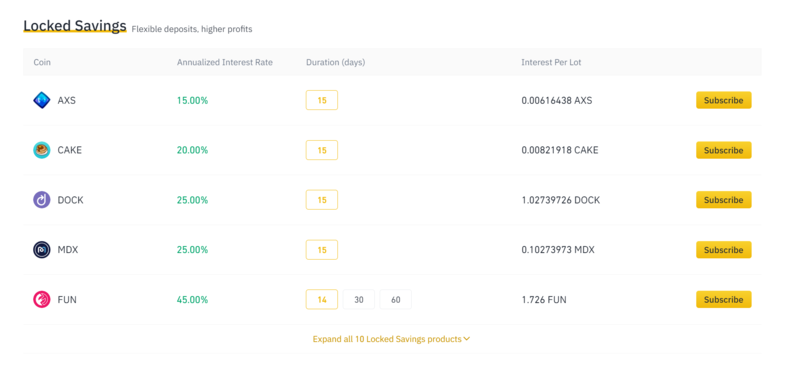

2. Locked Savings

In the locked savings feature, you need to keep your cryptocurrency for a certain period of time. This means, when the period starts, your funds will be "locked up" and cannot be used for other purposes. Once the period is over, you will be rewarded with interest.

Before you place your coins in a locked savings account, make sure that you won't need to use the money during the duration. If you really need to use the money though, you can switch to flexible savings, but this action will make you lose any interest you've accumulated during that time.

Conclusion

In conclusion, Binance offers many attractive options to earn extra income from your idle cryptocurrency, either by staking or saving. Staking and savings are actually quite similar as both require the crypto holder to lock their coins in order to gain rewards.

The main difference is that in staking, the coins are locked on the protocol and the staking rewards are generated from validating transactions on the blockchain. On the other hand, in savings, the coins are locked in the exchange, and the exchange uses it to reward the savers.

In the end, whatever option you choose, it's important to analyze each service and consider the level of risks that comes with it. The ones that offer high returns usually come with higher risks, while the ones with low interest are mostly considered low-risk. So make sure to do your research beforehand and find out which option is best for your investment plan.

Recently, the popularity of NFTs soared as so many artworks sold at high prices. This phenomenon encourages Binance to launch its own NFT marketplace last year. Now, apart from staking and saving, Binance NFT Marketplace can be another way for you to earn money by selling and buying NFTs.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance

Bitcoin

Bitcoin Ethereum

Ethereum Tether

Tether BNB

BNB Solana

Solana USDC

USDC XRP

XRP Dogecoin

Dogecoin Toncoin

Toncoin Cardano

Cardano