Learn everything you need to know about verifying your account in AvaTrade. The purpose is to confirm your identity and protect your funds from malicious activities.

Online trading has become significantly more popular than ever among any group of traders. The problem is that there are risks of getting scammed or hacked without you knowing. You need a protection layer to keep your fortune safe from malicious intent.

This is where account verification comes in: to confirm the person's identity. This helps to avoid scam accounts and reduce the rate of spam, impersonation, abuse, and fraudulent activity on the trading platform. By conducting the KYC verification procedure, your broker can be sure that only legitimate and verified users can make transactions with them.

Account verification is usually mandatory in regulated brokers such as AvaTrade. Whether you are a new or seasoned trader, AvaTrade broker is recommended because it provides user-friendly trading conditions on top of reliable services. It also operates under the strict regulation of a few authorities including the famous ASIC in Australia and FSCA in South Africa.

Avatrade can be called one of the most well-rounded brokers that support almost all trading styles. Not only allowing hedging, scalping, and expert advisor (EA), Avatrade also completes their service with One-cancels-the-other order (OCO) and AutoTrading in many variants of automated trading systems.

AvaTrade was founded in 2006, with the primary mission to empower people to trade with confidence. If traders are still confused about what is the best broker for supporting trader's trading, AvaTrade perchance option of traders, because it has been evaluated and honored for some of the industry's most remarkable financial and technological achievements that it provided to clients.

In 2019, the Dublin-based broker got achievement from Daytrading.com as The Best Forex Broker 2019. Besides, the company is honored as Best Forex Broker, Best Bitcoin CFD Trading Provider of the year, and Best Affiliation Programme in the European area.

Furthermore, for traders who have high mobility, AvaTrade provides many platforms that allow traders to trade using laptops and mobile phones. The availability of the free Autochartist tool in the platforms is the best support for both novice and experienced traders because it makes it easier for them to find trading opportunities without the need to glance at charts all day.

The Autochartist free signal is provided in Gold Account, Platinum Account, and AVA Select. By opening an account in AvaTrade, traders don't have to pay for getting a full Autochartist service. Autochartist itself is a market scanner tool that can detect trading signals from various technical perspectives.

Traders can access AvaTrade in many variants of platforms, such as AvaTradeGO, MetaTrader 4, MetaTrader 5, Automated Trading, Mac Trading, Web Trading, Mobile Trading, and AvaOptions.

In terms of regulation, AvaTrade is regarded as a superior broker because it has a lot of credible licenses. That way, even with deposits of up to ten thousand dollars, security can be guaranteed. Applying the Segregated Account system, AvaTrade is regulated by the Central Bank of Ireland (No.C53877), ASIC Australia (No.406684), JFSA Japan (No.1662), and South Africa (FSP 45984).

Can traders lose more than their deposit abruptly in the event of high volatility? AvaTrade explicitly answers no, as traders have negative balance protection.

With a minimum deposit of USD100, AvaTrade offers various leverage depending on the trading instruments; whether it is forex (starts from 30:1), indices (starts from 20:1), commodities (starts from 5:1), ETFs (starts from 5:1), or cryptocurrencies (starts from 2:1).

AvaTrade has committed to a set of values in relation to customers. Therefore, the company provides the best trading experience, offering multilingual customer service and the most sophisticated and user-friendly trading platform.

New traders can also learn forex trading in the Education tab on AvaTrade's official website. Traders will find a wide collection of articles, video tutorials, and more tools that will assist them every step of the way. It is an important requirement as the forex market might be a bit overwhelming and even scary at times, so traders need to make sure that they are fully prepared to begin trading in the real account.

There are many types of account types provided by AvaTrade. There is also an Islamic Trading Account, which is uniquely provided for Muslim Traders. Islamic account type is similar to a regular one with one key difference; it is not subject to any special fees or interests (swap-free), which sits well with the finance principles of Sharia Law.

If traders have felt confident for forex trading, traders can choose AvaTrade as an ideal choice. The minimum deposit and various platforms offered to make it a suitable destination for even beginners who would like to try forex trading for the first time.

Verifying Your AvaTrade Account

AvaTrade verification is a very easy and straightforward process. You simply need to submit a copy of required documents that contain information about yourself using your computer or smartphone. Then, the broker will inspect your submission. Your account will be verified once the broker approves the validity of the documents.

Bear in mind that if you fail to complete the AvaTrade verification requirement within 14 days after making your first deposit, your account will be blocked.

Document Requirements

In AvaTrade, there are two types of documents that you need to provide:

- Proof of Identity: Passport, ID Card, Driver's License

- Proof of Address: Bank/Credit Card Statement, Utility Bill, Council Tax Bill, Phone Bill, Local Authority Waste Disposal, Affidavit, Letter from Your Local Municipality, Internet Bill

All documents must be clear and readable. For the Proof of Address, the document must be valid and the issue date is not older than 6 months after the time of registration. Please check carefully before submitting to avoid rejection.

If you don't have the scanner feature on your device, you can submit a scanned file or photo of the document. Screenshots, PO addresses, and cropped documents are not allowed. Don't forget to save the file in the correct format and make sure that the file name contains letters and numbers only. Any other characters will be invalid.

The Step-by-step Guide

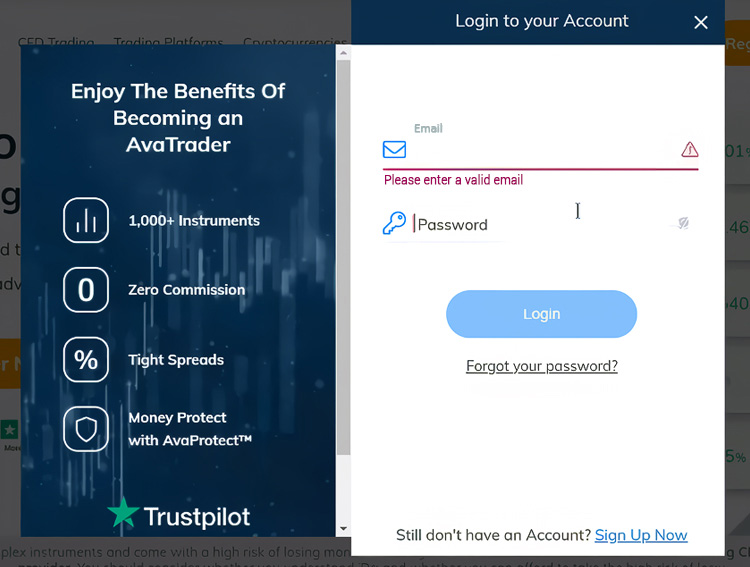

- Open AvaTrade's official website and log into your account using your email and password.

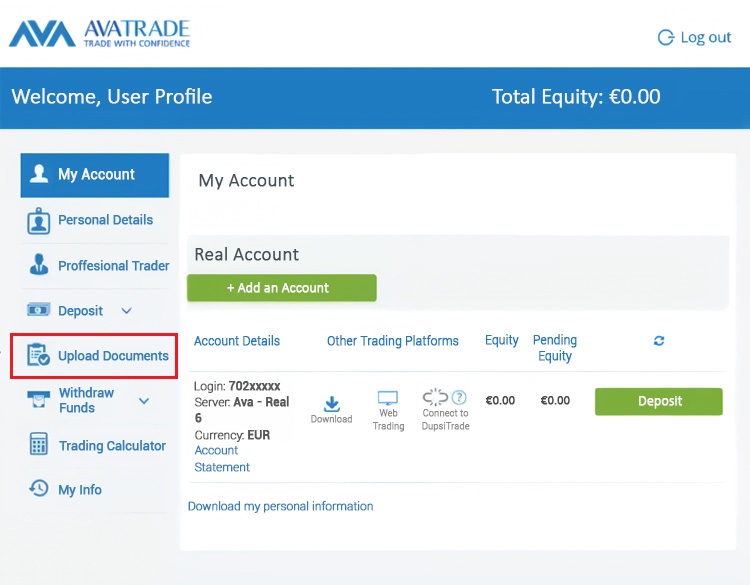

- In the My Account area, click "Upload Documents" on the left-side bar.

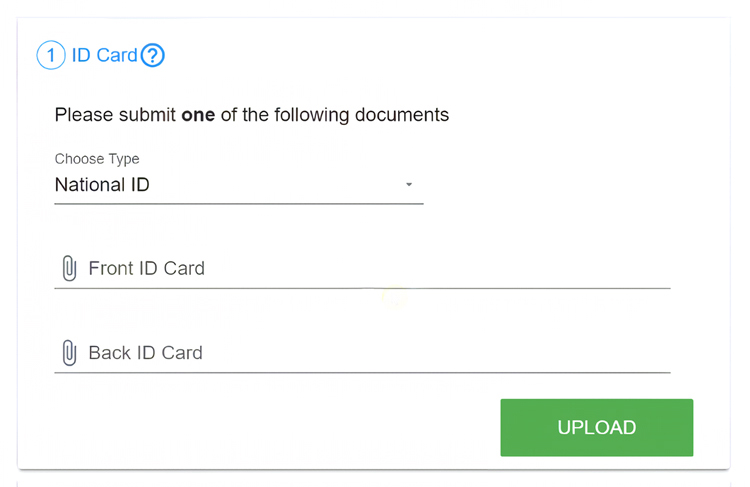

- Select the type of document that you'd like to upload, then browse through your computer and select the document. Hit "Open" and finish off by clicking the green "Upload" button.

- As soon as you upload the documents, you will immediately see their status. You will need to wait for about 1 business day for the document review from AvaTrade.

- Within the next day, you will be able to see if the document is approved or rejected. If it's the former, you'll see a green check mark next to the document.

But if they are rejected, you'll see that the status change to "Rejected" and details of what you are required to upload instead next to it.

What Are the Benefits of Account Verification?

Now that you get this AvaTrade guide, you will be able to enjoy the following perks and advantages as a verified user:

- Enhanced Security: Verification helps to create a safe community to trade in, so your account and funds will be protected from malicious actors. You can also easily confirm that it's you, preventing other people from getting access to impersonate you and use your identity for frauds.

- Unlimited Access to Trading: AvaTrade will block accounts that are not verified within 14 days after the first deposit. This means, your trading activities will be very limited. Verifying your account will free you from such restrictions completely.

- Deposit and Withdrawal: Without the verified status, you won't be allowed to cash out any of your funds.

AvaTrade is an innovative global forex and CFD broker that offers a diverse range of trading services as well as instruments with some of the most competitive commissions in the industry. It is known as a trustworthy brokerage firm, suitable for beginners and professional traders alike. Some other defining points include easy deposits and withdrawals, an intuitive mobile app, and fast execution.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance

5 Comments

Maharani

Nov 27 2023

Hi, just to be clear. Verification is completely safe if it's done with a regulated broker right? From what I've read, regulated brokers will keep our funds and information safe, at least as long as we're active. Well, it makes me wonder what might happen to my account if I suddenly just stop opening it for a few months and come back later to make new trades. Is that possible? I'm pretty sure there are people like me who trade probably only a few times a year, sometimes even random and not regularly.

Joshua

Dec 5 2023

Verifying your account will enhance the security of your account, so yes it is perfectly safe. You just need to make sure that the broker is trustworthy and have obtained permission from the official authority to operate in your country. It is also true that to keep your account up and running, you need to be active. Otherwise, you will be charged with inactivity fee. In AvaTrade, you must pay $50 after 3 months of inactivity. Then, after 12 straight months of non-use, you'll be charged with an additional $100 annual administration fee. The amount will be deducted from your trading account.

That being said, the situation is not necessarily the most ideal for buy-and-hold traders or long-term investors. Therefore you need to be strategic with your trade to avoid being charged with inactivity fee.

kamala

Nov 28 2023

I understand why it is mandatory for clients, but what does the business gain from verification really? Is it purely to safeguard their clients' money and no other intentions? One of my friends just got scammed recently by an offshore stock broker. She trusted the company, so she signed up and deposited some money to trade. She gained some profits, but when she tried to withdraw, the request got rejected a few times. It's devastating to hear and obviously I don't want to repeat the same mistake. Is AvaTrade safe and trustworthy?

Lili_12

Nov 30 2023

First of all, I'm sorry for what happened to your friend. Forex scams do exist and it's hard to get out once you've got yourself tangled in their traps. But that doesn't mean it can't be avoided/prevented. The first rule is to trade ONLY with regulated brokers. Do not trust companies that don't have official licenses in their pockets. Never. Regulated brokers must comply with strict regulations all the time and they must maintain their compliance rate to keep their status. AvaTrade operates under the regulation of a couple of watchdogs in various countries including Ireland, Australia, Japan, South Africa, the UAE, and British Virgin Islands. Therefore, the broker is considered safe to trade with.

Bara

Dec 2 2023

In my opinion, account verification benefits both the client and the broker. How so? Well on one hand, the client gets protection by verifying their accounts and access to various features offered by the broker. On the other hand, the broker complies with the regulator and gets high reputation of providing a safe platform. It's a win-win situation for all.

Think of it like this. The broker has proven that they're safe by following the law. Now it's the client's turn to prove that they are not frauds and trustworthy to make transactions in financial markets. Trust me, completing the verification process will give you a peace of mind, knowing that you are trading with a good broker and knowing that your account is safe from unnecessary threats.