Stop loss is a useful tool that you can use in various financial markets, including the crypto market. So what makes it important and how do you use stop loss in crypto trading?

Not only popular for traditional traders, stop loss is also used in crypto trading. You may already know that the crypto market is extremely volatile, so it can be hard to avoid getting losses due to the many possible market conditions and rapid price movements. Risk management is probably the most crucial skill that any crypto trader must have.

This is why stop loss is pretty much needed in crypto trading. When used appropriately, stop loss can make a huge difference in your trades. It is also considered simple enough to be used by almost any type of trader including beginners. So how do you exactly use stop loss in crypto trading?

Contents

What is a Stop Loss in Crypto Trading and Why You Need It

In general, the term stop loss refers to the order which is placed to buy or sell an asset when its price reaches a certain level. Once the preset conditions are met, the order will be executed automatically.

So basically, stop loss order is an enhanced version of a basic order because it adds certain rules or limits to the order itself. The goal is to prevent further losses on a running trade.

In crypto trading, the stop loss feature is usually available in the trading platforms of crypto exchanges. Here's an easy example.

Let's say you bought BTC at $20,000 and the trend is going upwards. However, being a volatile asset as it is, the coin started to slide down, putting your positions in more and more losses with each passing time. In such scenario, it would be really helpful to have a safety net like stop loss to save you from further losses. In this case, it's wise to set a stop loss at an amount that is a little less than the buying price. For instance, you can set a stop loss order at $19,000 so when the price reaches that number, the stop loss will be activated and the BTC will be sold at this price.

By looking at that scenario, one might say that even with the stop loss activated, the trade still loses $1,000. But even so, this is way better than not having a safety net and just letting your trade free fall even further.

Imagine ing through the night without setting a stop loss and it turns out that the price is dropping drastically. You will only find regrets in the morning.

Remember that the idea is to minimize the risk that you'll be getting in unpredictable market outcomes, but not necessarily eliminate the risk altogether. After all, in crypto trading, there is no such thing as a holy tool that can fully save you from getting any losses.

Types of Stop Loss

There are several types of stop loss that you can use, such as:

Complete or Full Stop Loss

Complete stop loss lets you put the whole amount that you purchased to be sold in the event of stop loss. It means that when the price suddenly goes down overnight, you will be able to hedge your risk when you are away from your computer by using the stop loss.

While this can mean you may lose on a potential profit, you will avoid a negative balance in your account. This type of stop loss is more suitable in a stable market with a low possibility of sudden price drops.

Partial Stop Loss

In partial stop loss, you can decide to sell only half or some amount of crypto from the amount that you purchased in an event triggering a stop loss order. This type is particularly useful for assets like crypto which is so volatile because it can ensure the trader still has some assets left if the price drops before a surge.

Trailing Stop Loss

Trailing stop loss is a more advanced type of stop loss where the value will be adjusted according to the asset's price fluctuations. So if the crypto price rises, the stop loss value will also rise with it.

In contrast, if the price drops, the stop loss value will not change and the stop order will be activated if the stated value is reached. This is a great way to keep up with price fluctuations without having to manually adjust the stop loss every single time.

Suppose you buy 1 BTC for $10,000 and set a trailing stop order with a distance of $100. That means, the initial order trigger is $10,000-100 = $9,900. If the price fluctuates between $9,900 and $10,000, then nothing will change. But if the price rises outside of that range, the stop loss will adjust itself. Remember that trailing stop loss will always follow the price and adjust the stop loss depending on the price movement. Let's say the price rises to $10,100, then the stop loss will move to $10,000 in order to maintain its $100 distance. If the market rises further to $10,200, then the stop loss will also move up to $10,100.

Though it's very useful in volatile markets such as crypto, trailing stop losses are not easy to find in crypto exchanges. You should use certain tools that can help you trail your stop losses when placing an order in exchanges such as Binance, Bittrex, and Poloniex.

The Risk of Stop Loss in Crypto Trading

While stop loss is helpful in many conditions, when it comes to crypto trading, there's a unique risk that comes with it.

Let's say you purchased 10 ETH at $2,000 and set a full stop loss order at $1,900 and you on it. The price suddenly drops until it reaches the preset price, thus activating the stop loss and you sell your asset automatically. In this case, you end up losing $1,000 (10 x (2,000 - 1,900)), which is fine if the price keeps going down afterwards.

But due to high volatility, the price may surge up again in a matter of hours. Say the price goes up to $2,100 per ETH, then that means you will be forced to buy again at an even higher price than before. This situation is called an indirect loss and it can happen if you use stop loss in crypto trading.

The example proves that partial stop loss can be a great tool for damage control in a highly volatile market such as crypto. Yet, it still can't guarantee full protection due to unpredictable price movements. It must therefore be understood that the risk still exists in any condition.

How to Place Stop Loss in Crypto Trading

The exact steps may vary in different exchanges or platforms, but here are the general steps that you usually need to follow when placing a stop loss order:

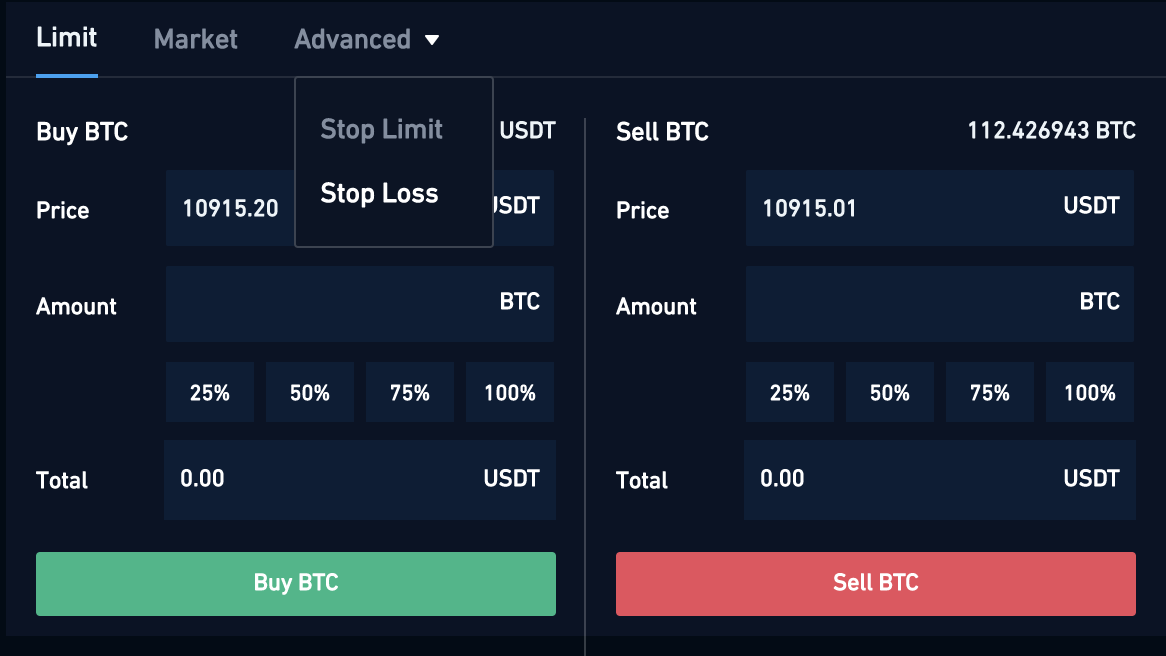

1. Pick an instrument and "Stop Loss" under the "Advanced" dropdown menu.

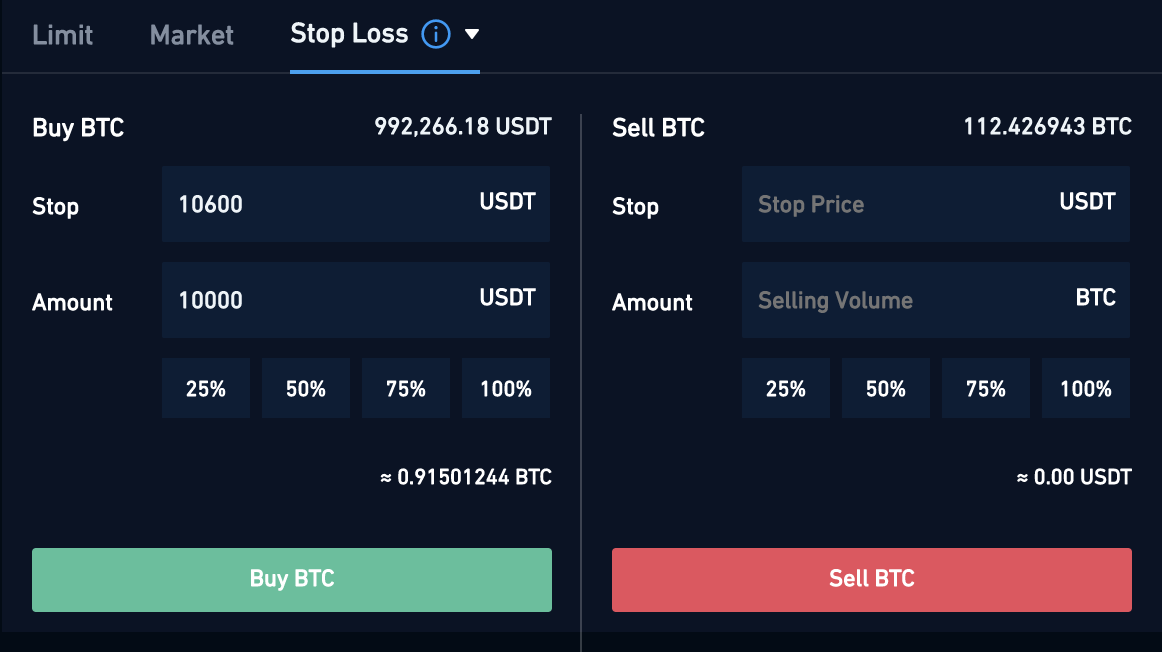

2. Input the amount of stop loss that you want. The "Stop" is the level where the stop loss will be triggered and the "Amount" is the number of volumes that will be executed with the stop loss order. Depending on whether the stop price is greater or lower than the market price, the system will either create a stop loss or take profit market order.

4. The stop loss or take profit market order will be created, and the screen will show you the order details along with the trigger condition under "Open Orders".

5. Once the price reaches the trigger condition, a market order will be placed immediately.

Conclusion

Stop loss order is a simple yet powerful tool that can be used by various types of traders. By using the order, you can prevent your trades from further losses as well as lock in profits.

Therefore, it can give a huge impact on your trade if you know how to properly use it. When it comes to crypto trading, risk management is extremely important due to the high volatility nature of the market. So, it would be great to choose a crypto exchange that offers stop loss order in their service.

However, keep in mind that stop loss is just a tool and it is not free of risk. The ultimate decision to use it is based on your analysis of the market and the outcome of the trade depends on how well that analysis is carried out. So before trading, make sure to consider the risk-to-reward ratio and prepare a well-thought trading strategy.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance

Bitcoin

Bitcoin Ethereum

Ethereum Tether

Tether BNB

BNB Solana

Solana USDC

USDC XRP

XRP Dogecoin

Dogecoin Toncoin

Toncoin Cardano

Cardano

1 Comment

Jennifer

Nov 26 2022