This list would take you to forex withdrawable bonuses of up to 1000 dollars with easily understandable terms and no other restrictions.

Forex withdrawable bonuses are few and far between. Many forex brokers offer bonuses, but they do not allow them to be easily withdrawn. Most forex bonus T&Cs mention that traders can use the bonus money to trade, but the bonus itself is usually not withdrawable. However, "rare" does not mean "none".

Here are several forex brokers with withdrawable bonuses in 2023:

- AGEA No Deposit Bonus: $5

- Dukascopy Live Trader Contest: $10-$500

- FXTM Refer a Friend: $50-$500

- OctaFX MT4 Demo Contest: $40-$500

- Tickmill Trader of the Month: $1000

So, are you interested? Let's dig each of them deeper to learn whether you are eligible to get them today.

Where to Find the Information on the Official Broker Site?

- This information is reported per Oct 31 2023.

- We can not ensure if this offering is still available or remain the same in future.

- The broker announcement page may or may not exist anymore, You may explore each broker's website and try to find "Promotion" section on the menu, footer, etc, to ensure the availability and validity of this promotion.

1. AGEA No Deposit Bonus

- Bonus amount: $5

- Eligibility: The no deposit bonus is automatically available for all new account registrations upon confirmation.

- Withdrawal: Bonus and profits can be withdrawn anytime, provided that you can pay the required withdrawal fee on the first withdrawal ($7 for non-wire options, or $10 for bank wire transfer).

- How to get it: Simply open a new account with AGEA, and you will see $5 ready to be traded on your account.

There is no more reason for traders to consider deposit conditions as an obstacle when opening a trading account, at least in AGEA. This broker provides a No Deposit program for new traders, so they no longer need to prepare any money as a deposit. The amount of free funds is $5 and is specifically given to Streamster clients. Besides, AGEA also provides $10,000 as virtual money. The purpose of these funds is to practice trading.

Another advantage traders can receive from AGEA is low spreads. The lower the spreads set by the broker, the higher the chance for traders to earn more profits. AGEA also provides a trading facility in the form of swap-free. All trading accounts registered with AGEA are free from swap fees. This facility is certainly very suitable for beginners and professional traders.

Facilities offered by AGEA to help clients make the company one of the most trusted brokers among traders from all over the world. This broker is registered with the company name of AGEA International AD. Since founded in 2005, AGEA has its headquarters in Montenegro, Southeast Europe.

The head office's position in Montenegro helps AGEA to be regulated by the Market in Financial Instruments Directive (MiFID). To ensure its service quality, AGEA is working continuously with legal and compliance experts so that they are fully compliant with relevant local and international laws and regulations.

Traders' convenience also increases with the security of funds AGEA. Clients' funds held by AGEA are maintained in separate bank accounts at local and international banks, in line with relevant laws and regulations.

AGEA provides its services through several trading platforms. One example is AGEA's proprietary platform, Streamster. In this platform, traders will get a comfortable and simple trading experience. Streamster is also a powerful platform that has its API for algorithmic trading. The interface of Streamster is considered as user-friendly and easy to use. On a Streamster account, traders can trade with a leverage of 1:100.

Besides the Streamster platform, AGEA also provides MetaTrader 4. It is a programmable trading platform intended for use by traders who understands how to code. It provides the necessary tools and resources to analyze the price dynamics of financial instruments and is integrated into Expert Advisors. Besides currency pairs, traders can trade with other instruments, such as CFDs, Gold, and Silver.

The process of opening an account at AGEA is easy and fast. Traders only need to fill out a registration form online. It takes 5 minutes to fill out the form, then provides due diligence documents before trading.

Processing speed can be found when depositing and withdrawing. AGEA is known as the broker that has the most smooth system in the payment process. They provide various methods of deposit and withdrawal, including Credit Cards, Skrill, Neteller, FasaPay, WebMoney, Wire Transfers, and many more.

When joining AGEA, traders can also find unique partnership programs while receiving additional benefits. The program is called the Affiliate Program. AGEA's partners can refer clients to AGEA via the website or by sending them coupons in an e-mail. For each live position client closes on the Streamster trading platform, partners will receive a commission in value of 15 points.

For instance, if partners have clients who sometimes close about 15-20 positions per day, they can earn hundreds or even thousands for each month by simply referring clients to AGEA. Besides, there is no charge for participation in the program.

There is also the Assistant program. It provides an opportunity for current members of their affiliate program to work more closely with AGEA. To apply for the AGEA assistant program, partners need to have a regular client account. If traders still feel confused, traders can contact AGEA team support by e-mail and Live Chat.

Based on the review above, it can be concluded that AGEA provides so many special programs for their clients. Both beginners and professional traders have a big chance to optimize their earnings. For novice traders, they can benefit immensely from AGEA's no deposit bonus.

2. Dukascopy Live Trader Contest

- Bonus amount: $10-$500

- Eligibility: The bonus is available as a tiered contest prize for 20 winners of Dukascopy's Live Trader Contest. It is a weekly trading competition on real accounts with no minimum or maximum account balance.

- Withdrawal: As Dukascopy said, the prizes won are free from any limitations. Winners are not obliged to meet turnover requirements nor take part in broadcasts.

- How to get it: Open a live account with Dukascopy, trade using the JForex platforms powered by Dukascopy Bank, then be the winner by obtaining the highest profitability.

Founded in 2004, Geneva-based Dukascopy Bank offers trading spots, including forex, metals, binary options, CFDs on bonds, commodities, indices, stocks, ETFs, and cryptocurrencies through the same platforms. After the development of the Swiss FX Marketplace, Dukascopy acquired a Swiss banking license in 2010 and launched Dukascopy Bank.

They try to provide trading services based on the following main principles: equal trading rights and a transparent pricing environment. Dukascopy is licensed in Switzerland through the Swiss Financial Market Supervisory Authority (FINMA) and in the EU through the Financial and Capital Market Commission of Latvia (FCMC).

This ECN-Marketplace represents the advanced generation of liquidity aggregators in the industry. Dukascopy has a unique technology to hedge instantly any clients' trades directly with other liquidity providers. The company is currently connected to Bank of America, Commerzbank, Nomura, Barclays, Currenex, Deutsche Bank, JP Morgan, and other liquidity providers.

All trades are usually executed in milliseconds. Dukascopy offers the deepest source of liquidity in the industry resulting in tight spreads.

Opening an account in Dukascopy would allow you to trade in its proprietary platform called JForex, which can be accessed by desktop and mobile. In desktop experience, traders can get several features including hundreds of indicators, advanced charting, historical testing, real-time news, and embedded customer support.

On the other hand, customization is weak as there are no pop-out charts or built-in complex desktops and watchlists. The web version of the Java-based software triggers security warnings in Chrome and other browsers, while JForex mobile versions allow easy syncing between platforms.

Not only JForex, trading in Dukascopy also offers access to MetaTrader 4 platform that is appreciated by many traders around the world. It has main features such as expert advisors and customizable templates.

Furthermore, Dukascopy provides two types of accounts including Mobile Current Account (MCA) and Standard Current Account (SCA). For private use, traders can choose both account types. But for business use, SCA is more suitable. The minimum acceptable order size is 1,000 units of the primary currency.

Depending on Dukascopy services used by the clients, commissions may apply. Commissions and spreads are calculated through a declining tier system, with clients categorized by monthly trading volume and net deposit.

Dukascopy has won several awards including Best Forex Trading Apps 2019, Best Platform & Tools 2018, and Best Mobile Trading. Besides, the company also gets awarded as Best Forex Bank 2018 by China (Shenzhen) Forex Expo, Best Forex ECN/STP Broker 2018 by London Forex Show, and Best Provider of Liquidity 2017 by IAFT Awards.

Traders will get multiple ways of funding account, including credit and debit cards, wire transfers, and bank transfers. Each client is protected up to CHF100,000 against the insolvency risk of Dukascopy Bank. However, Dukascopy charges a $20 fee in addition to possible bank or credit card charges for withdrawals.

Dukascopy's clients have the opportunity to get more profit through bonus programs, including Equity Bonus, Discount Program, Experience Sharing, and Anniversary Bonus.

The minimal deposit size of the account with Dukascopy Europe is $100, while the minimum for Dukascopy Bank SA is $1,000. Deposits accepted in 23 currencies. Several additional features are available depending on the clients' profile and the type of account.

Dukascopy Bank provides a wide range of free financial information and other attractive resources through its website, Dukascopy TV online television, Freeserv products, and its active online Dukascopy community that hosts over 130,000 members. Based on the review of their clients, product sections and trading platforms point to limited "how-to" articles and videos about forex, CFD, indices, and cryptocurrency trading venues.

The members of Dukascopy may exchange in several languages on trading experiences, market views, trading strategies, may win prizes in various contests, and freely communicate through advanced and secure chat and video conference systems developed by Dukascopy.

The company provides a 24/6 support team through phone and live chat. Traders also can send questions via email. They maintain active social media portals as well as a dedicated support forum for JForex and automated trading.

Overall, Dukascopy is suitable for the highly experienced and high-volume traders. Higher than average trading costs could undermine beginner and retail accounts, who may have to look elsewhere for building skill levels due to weak educational resources.

3. FXTM Refer a Friend

- Bonus amount: $50-$500

- Eligibility: The bonus is available as a reward when you refer your friend to FXTM and the referral meets all requirements. Each referrer can refer up to 10 referrals and get $50 for each referral. Each referral can also get $50 separately in their account.

- Withdrawal: The reward will be withdrawable after 30 days following the transfer of the reward funds, provided the referrer/referral does not withdraw funds during this period.

- How to get it: Open a live account with FXTM, refer your friend, then let them deposit and trade at least 10 standard lots in any account. The reward will be transferred based on the weekly payment cycle.

FXTM was initially launched in 2011 with a unique vision to provide unparalleled superior trading conditions. Opening an account in FXTM would also bring about access to advanced education and sophisticated trading tools in the forex industry.

Now, FXTM is registered under the Financial Conduct Authority of the UK with the number 600475. The company is also regulated by the Cyprus Securities and Exchange Commission with CIF license number 185/12, and is licensed by the Financial Sector Conduct Authority (FSCA) of South Africa, with FSP No. 46614

FXTM has 1 million registered accounts with more traders joining every day. The company continually tries to improve their performance and have got many awards such as Best Trading Experience 2019 by World Finance Awards, Best Online Forex Trading Company Nigeria 2018 by International Finance Awards, Reputable Investor Education Forex Broker Award 2018 by Hexun.com, Forex Brand Of The Year China 2018 by Fxeye.Com, and many more.

As a responsible broker, they determine leverage (expressed as a ratio of transaction size relative to trader's buying power) according to the trader's level of knowledge and experience in trading, which is evaluated by the Appropriateness Assessment. The company also enables trading with leverage up to 1:1000.

As for spreads, FXTM offers low spreads starting from 0.1 pip, so traders can withdraw profits at the start of trading. The company, which has headquarters in several countries, uses No Dealing Desk (NDD) technology and partners with credible liquidity providers to provide the best bid and ask prices.

For beginners, there is an automatic trading facility called algorithmic trading provided. When trading in FXTM, traders can develop their trading strategy or adopt other traders' strategies. Furthermore, the strategy is applied to automated trading systems, such as Expert Advisors. The purpose of this system is traders do not have to worry about losing opportunities while not observing the market so that profits can still be earned.

Three types of ECN accounts use the MT4 and MT5 trading platforms. There are also mobile and Tablet Apps trading platforms. Aside of providing many account variants, FXTM goes above and beyond to ensure that their client receives excellent support that they deserve, making their trading experience optimal and user-friendly.

FXTM also provides a diverse range of products. In addition to over 50 currency pairs, they provide gold, silver, CFD on commodity futures (oil), CFD on ETFs, and indices.

Education about the basic concepts of the forex industry is also accessible in this broker. Traders can read all the concepts provided in the form of e-books, video tutorials, articles, webinars, and forex seminars. There are 17 languages provided on the FXTM website to make it easier for traders to learn about forex.

Traders are also given various choices for payment methods, including Credit Cards (Visa, Mastercard, Maestro) and E-Wallet (Neteller, Skrill, Western Union). For withdrawing funds, traders are not charged a fee with a length of 2 hours to 2 days. Traders can live chat to ask further questions and contact the admin via email. There is also a question and answer page about forex trading on FXTM.

4. OctaFX MT4 Demo Contest

- Bonus amount: $40-$500

- Eligibility: The bonus is available as a tiered contest prize for five winners of OctaFX MT4 Demo Contest. It is a monthly trading competition on demo accounts that are open to all OctaFX clients.

- Withdrawal: The Winner can use the fund for trading on OctaFX's live account, invest it in OctaFX Copytrading, or withdraw it at any time.

- How to get it: Open an account with OctaFX, join the next round of the demo contest, and win it. See the detailed instructions here.

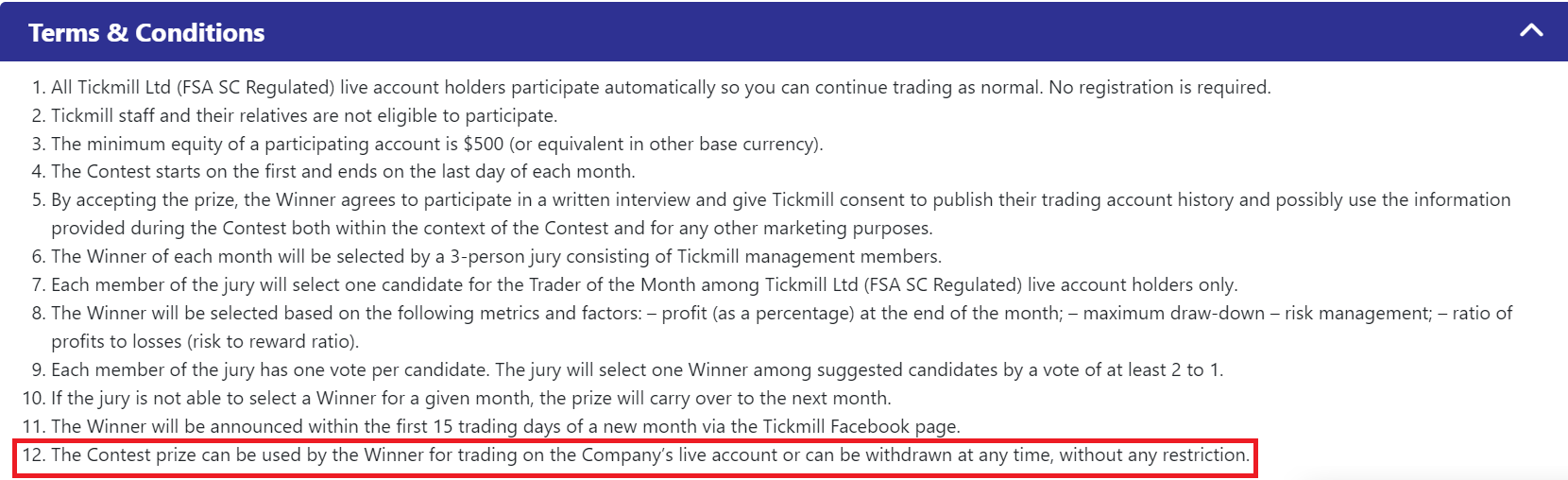

5. Tickmill Trader of the Month

- Bonus amount: $1000

- Eligibility: The bonus is available as a contest prize for the winner of Tickmill's Trader of the Month contest. It is a monthly trading competition on real accounts which requires a minimum equity of $500.

- Withdrawal: The Winner can use the fund for trading on Tickmill's live account or withdraw it at any time, without any restriction.

- How to get it: Open a real account with Tickmill, have a minimum of $500 in your account, then win the competition.

Tickmill is an award-winning global ECN broker, authorized and regulated by the Financial Conduct Authority (FCA) in the UK, CySEC in Cyprus, and the FSA of Seychelles. Founded in 2014, it offers its retail and institutional clients various trading services with a prime focus on forex, stock, commodities, CFDs, and metals.

For traders who prioritize the value of spreads in broker selection, Tickmill provides excellent services with low spreads, starting from 0.0 pips.

The London-based company has a mission to provide clients with the best possible trading environment, so clients can focus on trading and become successful traders. One way to reach its mission is to offer a fast-execution of 0.15s. With this facility, it's no wonder that Tickmill gets the 2019 Best Forex Execution Broker award by the CFI.co Awards. Also, Tickmill received the achievement as Best CFD Broker Asia 2019 by International Business Magazine, the Best Forex Broker Asia, and the Most Transparent Broker 2019 by Forex Awards.

After registering in Tickmill, traders can choose the most ideal asset among 60 currency pairs that they can trade. If traders aren't sure yet to open a real account, Tickmill recommends learning to trade through a demo account.

There are also educational features such as Webinars, Seminars, Ebooks, and Video Tutorials. All of these facilities can be used by traders to increase knowledge about trading and the financial market as a whole. If traders already have enough knowledge, they have a greater opportunity for earning profit consistently.

For traders registered in real accounts, they can choose between provides three types of accounts, including Pro Account, Classic Account, and VIP Account. Traders can open positions with a minimum order of 0.01 Lots. This applies to all types of accounts.

The company provides recommendations for traders who are still confused when choosing an account. For example, for novice traders, Tickmill encourages clients to choose a Classic Account. It offers optimal conditions with fast order execution while enabling traders to use virtually any trading strategy. Additionally, the account is trade commission-free so traders only pay the bid/ask spread. Other than the 3 main accounts above, Tickmill also provides an Islamic account (swap-free).

The downside is, trading with Tickmill will only enable traders to use MetaTrader 4 as their offered trading platform. Although not much if compared to other brokers, the Tickmill platform provides a user-friendly and highly customizable interface, accompanied by sophisticated order management tools to help traders control positions quickly and efficiently.

The convenience of trading on Tickmill is enhanced by the existence of One-Click EA integrated on MT4. Traders will get Stop Loss and Take Profit calculations automatically. On top of that, Tickmill provides a VPS hosting for automated traders that can't be bothered with technical problems such as troublesome internet connection.

They offer several third-party research solutions, including Autochartist, which is a popular pattern-recognition software that uses automated technical analysis to make forecasts and generate trading signals. Autochartist is available both in Tickmill's web portal and as a platform plugin for MetaTrader 4.

As a Tickmill client, a trader can deposit and withdraw with a variety of payment methods, including Visa, Mastercard, bank transfer, and Skrill. Tickmill accepts deposits and withdrawals in 4 currencies, which include USD, EUR, GBP, and PLN.

Overall, Tickmill is a competitive broker in spreads and provides a safe trading environment with its regulated entities in three different jurisdictions. Although their trading platform is not outstanding, the analytical tools they present to equip traders' needs are considered by retail broker standards.

Key Tips to Find Forex Withdrawable Bonus

Forex withdrawable bonus can be an opportunity to jumpstart your trading career. But it can also be the one that gives you a traumatic experience due to the complexity of the procedures to cash out the bonus and/or the profits you gained by trading with the bonus.

Most forex brokers will not give out tens or hundreds of dollars in cash bonuses for nothing. Bonuses usually hold important roles in forex brokers' marketing efforts to attract new clients, then encourage them to deposit and "start trading with us". Forex bonuses may also incentivize clients to refer their friends and families. As such, you have to meet certain conditions to withdraw the bonuses and/or the profits you gained from the bonus.

Still, it doesn't necessarily mean that there are no forex bonuses that can be withdrawn. You can still find forex withdrawable bonus by following these tips:

- Read the fine print and do not trust any "withdrawable bonus" tag easily. Anyone can attach such a label to any promotion and then define a complicated withdrawal procedure in the promotion's T&C. The T&Cs are held in higher regard legally than mere marketing lingo, and so, you have to read them carefully before joining any promotions.

- Be ready to trade with your best strategy and do not expect to withdraw bonuses without any effort at all. At the very least, you have to trade for some time with the brokers to fulfill their requirements.

- Beware of any forex bonus offer that seems too good to be true, particularly the ones advertised by unlicensed brokers. Oftentimes, such an offer is disguised fraud that wants you to deposit more money but won't give you the funds later.

How to Distinguish Real vs. Misleading "Withdrawable Bonus" Ads

Decades ago, DeBeers created a series of diamond adverts that made it into an overpriced jewelry item for eternity. One of the reasons why people were misled by De Beers' ads: they did not have the necessary knowledge to determine the real value of diamonds. The other reasons related to the De Beers' superbly attractive marketing jargons.

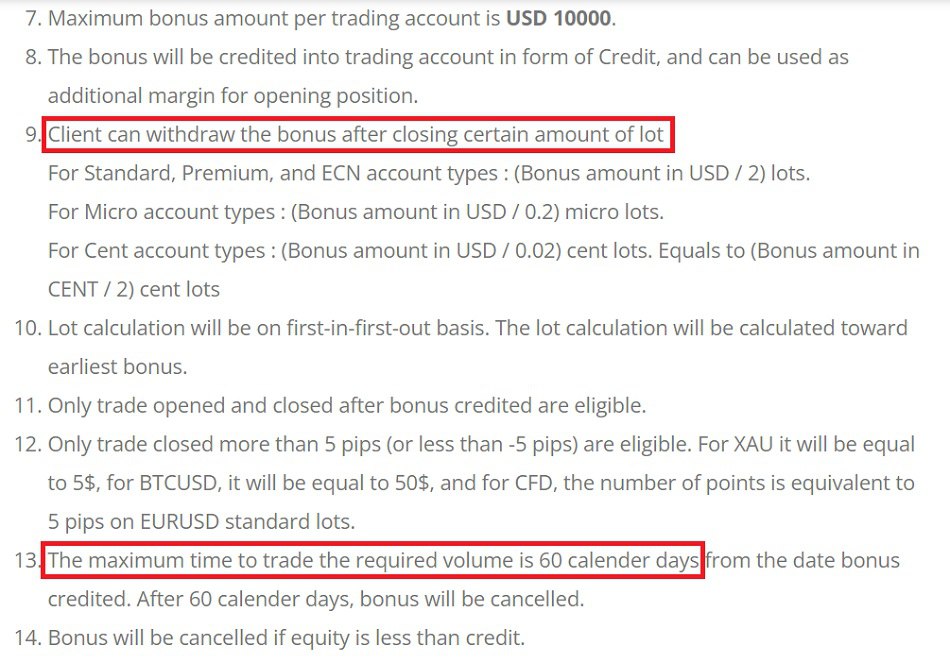

Many people nowadays are still easily caught by the web of ads spun by marketing experts. In the forex industry, some of these include terms such as "withdrawable bonus", "withdrawable cash", and "withdrawable prizes". But the facts are not so rich. Lots of "withdrawable bonus" ads are followed by complicated procedures that are nearly impossible to fulfill during the predetermined promotional period.

A real withdrawable bonus offer should be straightforward without any tricky formula. Here is a positive example:

On the other hand, a misleading "withdrawable bonus" offer will most likely look like this:

The first example is a real withdrawable bonus. It has a simple headline and an equally straightforward T&C.

The second example is a somewhat misleading ad. The headline said "bonus can be withdrawn", but the T&C detailed various requirements that may trip you anytime.

This is the reason why you should be careful before accepting any bonus offer. If it seems too good to be true, then it probably is. Dig the offer's terms & conditions first, and see whether you could actually fulfill them. If you are not sure, then do not accept the offer.

Alternatively, there are easier and fraud-free ways to get fresh funds from your forex broker through rebate or loyalty programs. They are fairly straightforward, and you can cash out your bonuses regularly in accordance with your trading sizes and frequency.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance