Oil Price Today - Brent and WTI Charts

This page presents the world oil price updates in a simple but informative table and a real-time chart. Find out how Brent crude oil and WTI crude oil are moving daily, weekly, monthly, and so on. Price changes are also available for oil traders to figure out the volatility of the market.

Oil Price in Real Time

Oil Price FAQ

Brent (Brent Crude) is the name for oil produced from the North Sea (Europe), with the name Brent derived from mining fields in the North Sea. Brent crude is considered a high-quality crude oil with a relatively low sulfur content, making it less polluting and easier to refine into various petroleum products, including gasoline and diesel fuel.

Key features of Brent crude oil include:

- Comes from the North Sea, specifically from four major oil fields: Brent, Forties, Oseberg, and Ekofisk (often referred to as the BFOE complex). These fields are located in the waters between the United Kingdom and Norway.

- Classified as "sweet" because it has a low sulfur content, typically below 0.5%. Lower sulfur content makes it less environmentally harmful and easier to refine into cleaner fuels.

- Widely used as a benchmark for pricing crude oil around the world. The price of Brent crude is often referenced in financial markets and serves as a basis for pricing many international crude oil contracts.

- Changes in the price of Brent crude can have a significant impact on energy markets, including the cost of gasoline and diesel fuel. It is also a key reference point for governments, oil companies, and traders when making decisions related to the energy sector.

The price of Brent oil today is $89.12 per barrel as of Apr 26, 2024. It records a change of 0.12% if compared to yesterday's price

WTI (West Texas Intermediate) is petroleum produced in North America and in most applications used for gasoline products. The characteristics of WTI oil are lighter and easier to process, so it is in great demand, especially in the US and China.

Here are some key features of WTI crude oil:

- Primarily produced in the United States, specifically in the Permian Basin in West Texas and parts of New Mexico. It is extracted from land-based oil fields.

- Considered a high-quality crude oil with a low sulfur content, typically below 0.5%. Like Brent crude, its low sulfur content makes it desirable for refining into various petroleum products, including gasoline and diesel fuel.

- Serves as a benchmark for pricing crude oil in the United States and is used as a reference point for domestic oil prices. The price of WTI is often quoted in financial markets and is used in the pricing of many oil contracts in North America.

- The delivery point for WTI crude oil futures contracts is in Cushing, Oklahoma. This location is a major oil storage and distribution hub in the United States, making it a critical point for the physical delivery of WTI crude oil.

- Can be subject to volatility due to various factors, including changes in supply and demand, geopolitical events, and economic conditions. This volatility can have significant implications for energy markets and the broader economy.

- Closely watched by traders, investors, and policymakers, as its price movements can impact energy prices, inflation, and the overall economic outlook in the United States.

- Often compared to Brent crude oil, another major benchmark, to assess global oil market trends and price differentials.

The price of WTI today is $83.64 per barrel as of Apr 26, 2024. It records a change of 0.08% if compared to yesterday's price

Which Crude Oil Price is the Main Oil Price?

The price of Brent oil has been the basis for price formation since 1971 for nearly 40% of oil worldwide and continues to be used today. However, in its development, the oil production of the United States has increased and contributed greatly to the world market share, so the price of WTI oil has been used as a major reference too since around 2007.

Brent vs. WTI Crude Oil, What Are the Differences?

The existence of two main references for oil prices, namely Brent crude and WTI crude, is primarily due to geographical and other market factors. Here are their comparisons:

| Aspects | 🇬🇧 Brent Crude Oil | 🇺🇸 WTI Crude Oil |

| 🌎 Geographic Origin | Primarily from the North Sea, which is located between the United Kingdom and Norway. | Produced in the United States, specifically in the Permian Basin in West Texas and parts of New Mexico. |

| ⚖ Qualities | Have a slightly higher sulfur content | Known for its very low sulfur content, making it an even "sweeter" crude oil. |

| Refining and Transportation Infrastructure | Cushing, Oklahoma | Can occur at various locations, including but not limited to the Sullom Voe terminal in the Shetland Islands and Rotterdam in the Netherlands. |

| 🔍Regional Focus | Stronger connection to the European and global markets, hence the key to European and global benchmarks. | Closely tied to the US market. |

| International vs. Domestic Pricing | Used as a reference for international oil prices. It has a broader global impact on oil prices. | Primarily used to price crude oil in the United States and has a more domestic focus. Market players consider them as a major reference only due to the US economic influence in the global market. |

See also: List of Brokers for Commodity Trading

What are the Key Drivers of Oil Price?

- Supply and Demand

The fundamental principle of supply and demand is a primary driver of oil prices. When global oil demand exceeds supply, prices tend to rise, and when supply outpaces demand, prices tend to fall. Factors influencing supply and demand include economic growth, industrial activity, transportation demand, and energy efficiency. - Geopolitical Events

Geopolitical instability in major oil-producing regions can lead to supply disruptions and cause oil prices to spike. Conflicts, sanctions, political unrest, and changes in leadership in oil-producing countries can all have significant impacts. - OPEC and OPEC+ Actions

The Organization of the Petroleum Exporting Countries (OPEC) and its allies, collectively known as OPEC+, have a substantial influence on oil prices. They can adjust production levels and quotas, affecting global oil supply. Decisions made during OPEC+ meetings can lead to price increases or decreases. - Production Levels

The level of oil production in key oil-producing countries and regions, such as the United States, Saudi Arabia, Russia, and others, directly affects the global supply of oil. Changes in production can have a direct impact on prices. - Technological Advances

Advancements in drilling and extraction technologies can increase oil production and influence prices. Innovations in shale oil extraction, for example, have significantly impacted global oil markets. - Currency Exchange Rates

Oil is typically priced in US dollars. Fluctuations in currency exchange rates can affect the purchasing power of countries with other currencies, influencing oil demand. A stronger US dollar can make oil more expensive for buyers in other currencies, potentially reducing demand and prices. - Natural Disasters

Events like hurricanes, earthquakes, and wildfires can disrupt oil production, refining, and transportation infrastructure, leading to supply shortages and price increases, especially in regions prone to such events. - Energy Transition

Efforts to transition to renewable energy sources and reduce greenhouse gas emissions can impact long-term oil demand. Policies promoting energy efficiency, electric vehicles, and alternative fuels can affect the growth prospects for oil consumption. - Inventory Levels

The amount of oil held in storage can impact prices. High inventory levels can indicate an oversupplied market and put downward pressure on prices, while declining inventories may support prices. - Speculative Trading

Financial speculation in oil futures markets can lead to short-term price volatility. Traders and investors often respond to news and market sentiment, which can lead to price swings. - Global Economic Conditions

Economic conditions, such as economic growth, inflation, and interest rates, can impact oil demand. A strong economy tends to increase demand for oil, while economic downturns can reduce it. - Regulatory Changes

Changes in regulations and government policies related to energy production, environmental standards, and carbon emissions can impact the cost of oil production and consumption, influencing prices.

How to Choose Brokers to Trade Crude Oil?

A good broker for oil does not only constitute good regulation, platform, and other general services but is also excellent in offering oil-related products. As such, make sure your broker has these qualities if you aim for oil trading:

- Provides at least Brent and WTI as CFD products, futures, or spots.

- Ensures low spreads in oil trading.

- Offers competitive leverage for oil instruments; make sure that your desired leverage is not limited to Forex CFDs.

- Presents education materials, analysis, and market tools for commodity and oil trading.

Additional FAQ

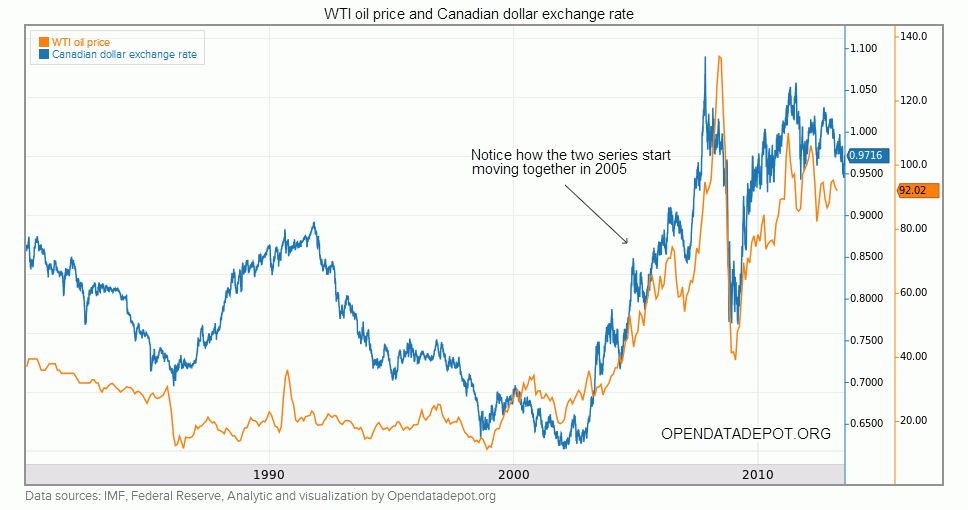

Is oil price still an important driver of the Canadian Dollar today?

Yes, oil prices are still seen as one of the Canadian dollar movers to this day. The reason undoubtedly is that oil production and refinery is accounted as one of Canada's major industries. Canada is the sixth largest world oil producer after Saudi Arabia, the United States, Russia, and China. The country holds 4.54% of the world oil market share.

Continue Reading at How World Oil Prices Affect Forex, Before And After US Shale Fracking

What is the effect of Russia-Ukraine war in the market?

The Russia-Ukraine war had several effects, including a significant spike in crude oil prices and supply uncertainties in various locations. In early March, crude oil prices reached a 13-year high, hitting $125 per barrel.

Continue Reading at What Can We Learn from Market Trends in 2022?

How does oil price influence currency?

International Energy Agency mentioned that high oil prices generally have a large negative impact on global economic growth. Countries with high oil consumption will suffer from the high price, and in the long term, the burden will take shape in a deficit in their trade balance. That's why, a higher oil price will weaken USD, as the US is a major oil consumer. On the other hand, countries that export oil like Canada and Norwegia will experience surges in their exchange rate.

For example, the chart below shows how the oil moves against the USD/CAD. That is because when the oil price rises, the CAD also rises. This causes the value to rise and causes the USD to fall against CAD.

Continue Reading at Understanding the Effect of Commodity and Stock in Forex

How does oil price affect Dollar?

Two famous examples are the Canadian Dollar and the US Dollar. Canada is a net oil exporter, which means it will gain more as oil prices soar. Unsurprisingly, the Canadian dollar tends to go up along with oil prices. On the other hand, the US needed to import oil to fulfill around half of its industrial and household energy needs, whose portion of which is catered by Canada. Consequently, CAD/USD tended to move in the same direction as oil prices.

Continue Reading at How World Oil Prices Affect Forex, Before And After US Shale Fracking

Articles About Oil

-

US Dollar in Turmoil, NFP Signs are Alarming

-

FBS Reduces Spreads for Oil and Gas

-

Limited Market Turmoil, Dollar Weakens and Euro Rises

-

Swiss' Support to Credit Suisse Eases European Banking Turmoil

-

Free ICMarkets Webinar on How to Trade Oil

-

Low Spread Brokers to Trade Crude Oil

-

Stocks Mixed as Oil Prices Fall

-

Stocks Rise Following Ban on Russian Oil Import

-

Stocks Plummet, Pushed Down by Rising Oil Prices

-

Oil Prices Continue Rising, Stocks on the Dip

- More