Using PrimeXBT Covesting is often said to be a great way to gain easy profits for both rookies and expert traders. So what is it and how does it work?

Many people are interested in participating in online trading because of the huge potential of profit they can get. There's a bunch of success stories coming from investors across the world, making it more attractive to many people. The popularity of online trading has spiked high in recent years, especially due to faster internet and sophisticated technology. However, not all traders realize that trading for the first time can be quite a challenge and is most definitely not free of risk.

PrimeXBT is one of the leading crypto trading exchanges offering various services for both beginners and professional traders. The exchange was established in 2018 and has served clients in more than 150 countries. As a derivative exchange, PrimeXBT offers many interesting products to trade such as cryptocurrencies as well as various traditional financial instruments that include forex, commodities, etc.

The exchange has been trying to attract investors by offering high leverages (100x) and, most recently, partnering with Covesting and creating the Covesting Module, which can be accessed on the exchange's website or trading platform.

Contents

What is Covesting?

Covesting is a special module offered by PrimeXBT that is guaranteed to favor both rookies and experienced traders. The platform basically offers the same idea of copy trading, where traders can follow other traders and copy their strategy to their own portfolios. In other words, this method can be used as an easy way to earn passive income for both sides.

Experienced traders can earn fees from other traders copying their strategies, while those who just started trading or don't have much time to build a proper strategy themselves can follow the professionals to learn, use their strategy, and make profits.

Covesting is indeed attractive to many investors as there are several great things about it such as no experience required to copy other traders' strategies, no limit on the number of strategies to follow, and no mandatory KYC process. Besides, the platform's interface is simple enough to navigate and already covers all the basics needed for copy trading.

The platform's security is also guaranteed because PrimeXBT has a sophisticated system that has never been hacked before and uses Google 2-factor authentication to secure your account.

Important Terms on PrimeXBT Covesting

Before we continue, there are several specific terms that you should be aware of in the trading platform:

- Strategy is a set of all the rules and plans that a trader uses. So this is what you will be copying in order to start trading.

- Strategy Manager refers to traders providing strategies to follow. They usually consist of experienced traders with reliable track records in online trading.

- Strategy Follower is the term given to traders who choose to follow other traders and use their strategies to trade. Hence, these traders don't have their own strategies.

- Total Profit % is the indicator that reflects the percentage of change in the Manager's Equity, but only in cases where the Manager did not deposit or withdraw funds from their Strategy accounts. If so, the amount will be calculated as a compound percentage between each deposit/withdrawal and the next one.

- Today's Profit % is the change in Equity in a single day.

- Manager's Equity shows the funds that a manager has in a certain Strategy. Keep in mind that this is not necessarily an indicator of the Strategy's success rate because the number changes with each deposit and withdrawals.

- Trade Fees means precisely as the name implies, but it will change every once in a while depending on the current Followers' Equity of the Strategy in question.

- COV is the ERC-20 utility token used to unlock utility options such as reduced trade fees, entry fees, and success fees. All of them lasts 30 days since activation.

Covesting Fees

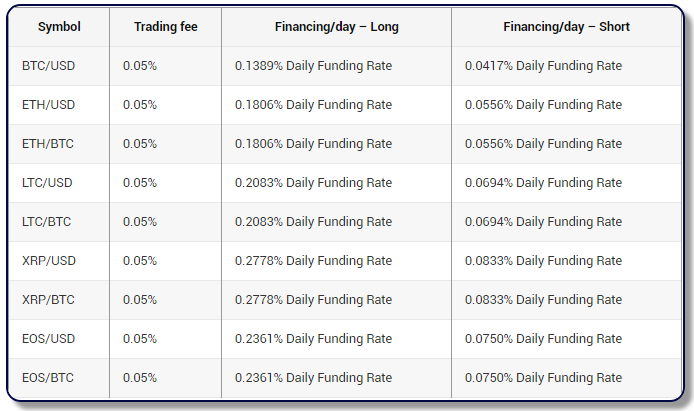

In PrimeXBT, there are trading and non-trading fees (overnight financing) that should be considered. In this case, overnight fees will depend on the liquidity of the asset you trade. You can see the complete list of costs on the table below:

However, when it comes to margin and leverage, the fees are not equal for regular and PrimeXBT Covesting trading accounts. Regular tradings have their own margin trading ranges, whereas Covesting accounts can do a 2% maximum leverage or 1:50.

Compared to other exchanges, the fees in PrimeXBT are relatively low and quite advantageous because some of the services are completely free, including no deposit fees and 0.0005 BTC for withdrawals that cover the Bitcoin transaction cost.

Also, PrimeXBT has built a strong partnership with the instant cryptocurrency exchange Changelly. This allows you to buy Bitcoin instantly with your credit card, although it is not exactly the best way to do it because Changelly is known to be charging high fees on these transactions.

How to Invest in Covesting?

Before you start Covesting, you need to create an account at PrimeXBT. It is a straightforward process and takes very little time than other exchanges because there are no KYC requirements. Once you make the account, you should log in and then deposit some BTC.

If you intend to copy other traders' strategies, all you need to do is navigate to Covesting and choose the Strategy or trader you would like to follow. By clicking on the Strategy, the platform will show you more information about it including how long it has been active, how many followers it has, and how profitable the strategy has been in a handy chart.

The platform offers hundreds of interesting trading strategies to choose from, so you only have to browse through them, review the performances, and choose the most suitable one. Once you pick, you will have to set the amount that you are willing to invest in the ed strategy. After that, you have to click the "follow" button and that's it!

On the other end, if you're a professional trader and want to share your strategy with the rookies, you will have a different set of rules to obey. One of them is not to have more than one active Strategy. You can find all the essentials you need in Covesting's Help Center and if you have any questions, you can always contact the support team for help.

Is Covesting Really Profitable?

Realistically speaking, you can get profit from Covesting. However, you can also lose it all the same. That is why we recommend you to test the system first by investing small amounts of money and see how it goes from there. Once you're more comfortable with the platform and strategy, you can always gradually increase the amount of capital and trade bigger.

See Also:

Covesting provides a lot of trusted traders with a good reputation in managing their strategies along with their historical performances, so you can judge for yourself whether they are worth your money or not. However, that still doesn't guarantee success every single time because your chosen manager can fail in the future after you follow him. But if we take a hypothetical scenario where the manager successfully carries the strategy and earns a considerable profit, you will have to split it into three parts: 70% for you, 20% for the manager, and 10% for the platform.

The COV Token

COV is a utility token that only members can use within the Covesting environment. Investors can use COV tokens to get various benefits and discounts, improve success rates, and many more. Apart from that, there is also a chance of a buyback and burn program that reduces COV token supply on the market.

See also: The Best Performing Crypto Tokens

COV tokens' main aim is to help strategy managers slash their trading fees by up to 75%. This can be achieved by buying and staking, ranging from $250 to $750 of COV. On the other hand, followers can remove the new 1% entry fee to hold more fees obtained through successful trades and episodic burning of the Covesting team's fees.

The Pros and Cons of Covesting in PrimeXBT

In general, PrimeXBT Covesting has its own advantages and disadvantages. You can consider the following points before joining the Covesting program:

1. The Pros

- Covesting lets you diversify your portfolios with cryptocurrencies, commodities, indices, and forex.

- You can get access to higher ROI while reducing the risks within the market by letting the professionals do the hard job for you.

- By using strategies from experienced traders, there's a lot of learning opportunities that you can make use of. In fact, this is an equally important aspect in copy trading other than getting passive income.

2. The Cons

- The fees offered by PrimeXBT aren't exactly the lowest on the market so it can burden investors with low deposits.

- PrimeXBT only offers five crypto coins, so the choices are still quite limited for many traders.

Conclusion

Covesting is a great common ground for both novice and professional traders as it provides a win-win situation for both groups. The platform is easy to use and offers a wide range of tools that can help you improve your trading. For a follower, choosing the right strategy can potentially give huge profits.

Still, it is also quite risky especially if you add high leverage to your trade. Therefore, always treat Covesting with caution. You should perform a thorough review of the managers' performances in the past and diversify your portfolio to minimize risks.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance

Bitcoin

Bitcoin Ethereum

Ethereum Tether

Tether BNB

BNB Solana

Solana USDC

USDC XRP

XRP Dogecoin

Dogecoin Toncoin

Toncoin Cardano

Cardano