Although USDT still dominates the market share, there are other stablecoins that are worth checking out. One of them is HUSD, a stablecoin from Huobi exchange.

Presently, cryptocurrencies like Bitcoin and Ethereum are often seen as highly risky investments in the long term because of the extremely high volatility and unpredictable market behavior. As a result, stablecoins were created to provide a solution to this matter.

Basically, stablecoins aim to bridge digital and traditional assets in order to maintain a more stable price. Each stablecoin is linked to another asset like gold or the US dollar so that the price of the stablecoin is relative to the price of the pegged asset. This makes the value more stable and allows investors to generate money more safely. Some examples are Tether (USDT), USD Coin (USDC), and Binance USD (BUSD). Many people have invested in these stablecoins and some have gained significant profit from their trades.

But apart from those, there are actually loads of other stablecoins that are trying to prove that they are backed by safer assets and able to provide better conditions. Today, we're going to focus on the HUSD token. Let's find out more about it and why you should check it out.

Contents

What is HUSD Stablecoin?

HUSD is a secure and reliable stablecoin that is designed to be easily redeemable and presents a solution for its holders to reduce volatility and trading risks when participating in the crypto market. HUSD is a fiat-pegged stablecoin, so each token is backed at a 1:1 ratio with the US dollar.

The HUSD token was first released back in October 2018 and it was listed on Huobi Global Exchange. However, developers in Huobi soon figured out that customers were hesitant to trade using HUSD due to the lack of price transparency. For this reason, Huobi decided that the stablecoin must be independent of the exchange. In July 2019, a Huobi Capital-backed startup called Stable Universal announced the start of the HUSD Project and immediately launched a brand new ERC-20, HECO, or TRC-20 HUSD. The project is also supported by the Paxos Trust Company as the custody partner.

Since then, the old stablecoin has transformed into the new Stable Universal-backed HUSD in compliance with all legal requirements in the United States. All of the reserves are held by the Paxos Trust Company in US bank accounts. Every month, a US auditing firm must conduct a test to ensure that the USD reserves matched the number of HUSD supply.

How HUSD Works

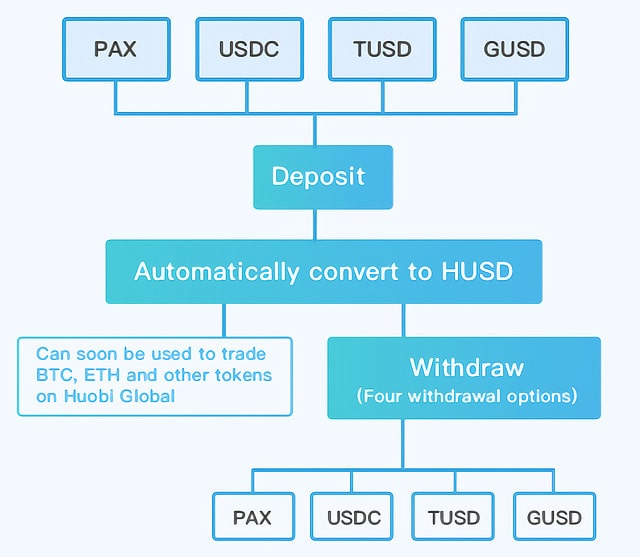

HUSD is a stablecoin provided as a solution that enables users to switch between multiple fiat-pegged stablecoins in events of market fluctuations. There are four stablecoins supported by the HUSD, namely Paxos Standard (PAX), True USD (TUSD), Gemini Dollar (GUSD), and USD Coin (USDC). The basic concept is that users can deposit one of the four stablecoins and convert the coins into HUSD. Then, they can choose to trade with the HUSD or withdraw the tokens in one of the four stablecoins of their choice.

To make it clearer, you can refer to the following illustration:

In other words, HUSD acts as the medium that facilitates the exchange between different stablecoins. For instance, if a user deposits 100 PAX to the exchange, 100 HUSD will immediately be transferred into the user's trading account. Then, the user is free to use the HUSD to trade or withdraw it in a different coin. The user can choose to withdraw, let's say, 50 GUSD, which will be taken from the GUSD pool that other users have deposited to the exchange.

Stablecoins Supported by HUSD

Paxos Standard (PAX)

Paxos Standard (PAX) is an ERC-20 stablecoin that was released by a New York-based blockchain company, Paxos, in 2018. The stablecoin is backed by the US dollar with full regulation and authorization by the New York State Department of Financial Services (NYDFS). This means the security of PAX is guaranteed as it is constantly monitored by trusted authorities. Another benefit is that PAX also allows users to trade with zero fees.

Furthermore, users can buy and withdraw PAX tokens at any time directly from the Paxos website with a 1:1 USD peg. Once PAX tokens have been withdrawn, the tokens are quickly burned through a smart contract and removed from the market circulation. Currently, PAX is listed in a number of well-known crypto exchanges, including Binance, Kucoin, Gate.io, and OKEx.

True USD (TUSD)

True USD is one of the top USD-pegged stablecoins that was launched by TrustToken. According to the company's website, True USD is an ERC-20 stablecoin that is fully collateralized, legally protected, and transparently verified by third-party entities.

The main feature of True USD is the token's secure transaction system. First of all, users need to complete KYC and AML requirements as a part of independent verification before they can purchase the stablecoin. Users then need to wire some USD into an escrow account and at the same time, use them to mint the equivalent amount of TUSD. When other tokens become available, the user can then decide which tokens they like to buy. This system makes the coin appealing to both small and large investors who wish to reduce trading risks.

Gemini Dollar (GUSD)

Gemini Dollar is an ERC-20 stablecoin that is backed on a 1:1 peg with the US dollar and allows users to transact via the Ethereum network. Users can easily redeem GUSD straight from Gemini.

Moreover, the coin is considered safe as it is fully authorized by the New York Department of Financial Services (NYDFS). All USD holdings are insured through the Federal Deposit Insurance Corporation (FDIC), but unlike other stablecoins, Gemini only stores the USD deposits in one bank – State Street. Apart from that, the company employs an independent auditor BPM accounting to perform monthly audits.

USD Coin (USDC)

Launched in 2018, USD Coin is a stablecoin that was developed by the Circle group and the CENTRE open source consortium. The stablecoin is USD-pegged, so the value of one USDC must always equal in the value of one USD.

In terms of safety, the Centre claims to work with auditors and comply with government regulation in providing a transparent description of the reserves available to back the peg to the USD. Users can see the monthly reports of such balance, including how much USDT is in circulation and how much is the equivalent value to the US dollar. The coin is currently supported in several exchanges, amongst them are Poloniex and OKEx.

The Benefits of Investing in HUSD

There are several notable advantages that you can get from investing in HUSD, namely:

Higher security

Compared to other cryptocurrencies, stablecoins like HUSD are considered more secure because they are pegged to more stable assets such as the US dollar. By combining the two environments, users can get both the transparent nature of cryptocurrency while at the same time enjoying the credibility of fiat currency.

Quick and Easy Global Transfer

Users can buy and sell cryptocurrencies without having to move fiat currency in and out of the crypto exchange. Apart from that, HUSD can be transferred 24/7 way faster than transacting with traditional currencies. Thus, users can transfer capital across various jurisdictions in just a few clicks.

Less Costly

Stablecoins offer lower transaction fees compared to regular cryptocurrencies. Also, investing in HUSD can help users save capital even more as they can easily switch between different stablecoins without having to pay extra conversion fees.

Highly Accessible

HUSD is supported for trading and swapping in a number of well-known exchanges, such as Huobi Global, HotBit, FTX, SimpleSwap, VirgoX, SwapSpace, and more. Therefore, users can easily find and access HUSD.

Final Thoughts

From the explanation above, we can conclude that there is more than one good reason to invest in HUSD. You can trade stablecoins easily and securely, while at the same time saving costs from switching between multiple different stablecoins. It can give you considerable flexibility that you might not be able to find in other options. However, keep in mind that investing in stablecoins is not without risks.

Despite the claim that stablecoins can reduce trading risks and maintain a stable price, some of them have proven to be failures. The dramatic collapse of Terra and its sister coin Luna, for instance, has caused massive turmoil in the crypto market and has made many investors skeptical of stablecoins. Therefore, it's important to make sure that you choose the right stablecoin that you could rely on in the long term. Don't forget to also diversify your investment portfolio and manage your risks wisely.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance

Bitcoin

Bitcoin Ethereum

Ethereum Tether

Tether BNB

BNB Solana

Solana USDC

USDC XRP

XRP Dogecoin

Dogecoin Toncoin

Toncoin Cardano

Cardano