Retail sales data fell short of expectations, but their performance remains positive and supports the strength of the US dollar.

The US Dollar Index (DXY) briefly slipped to around 102.20 during the European session but rebounded to 102.50 after releasing US retail sales data during the New York session on May 16th. Although the retail sales data fell short of expectations, their performance remains positive and supports the strength of the US dollar. Additionally, the market is eagerly awaiting government debt ceiling negotiations this week.

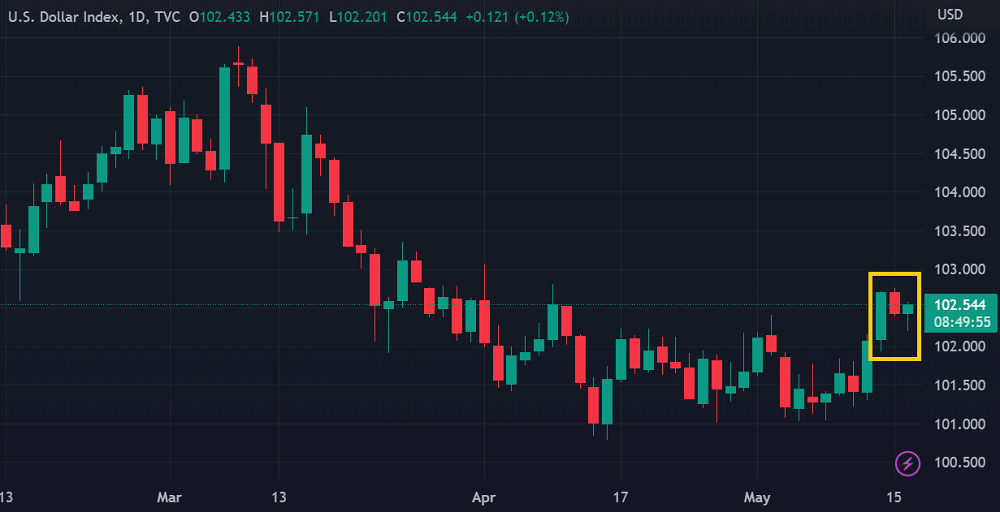

DXY Daily chart via TradingView

DXY Daily chart via TradingView

US retail sales rose by 0.4% in April 2023, only half of the expected 0.8% increase according to consensus estimates. The annual growth rate of retail sales was recorded at just 1.60%, weaker than the consensus expectation of 4.20%.

While the figures are disappointing, the market responded more positively due to the downward revision of March 2023 data, which showed a more dismal picture. The retail sales data for March 2023 was revised from -0.6% to -0.7% (month-over-month) and from 2.94% to 2.42% (year-over-year).

"It was a rebound after two soft months, which suggests that consumer spending is still holding up," said Vassili Serebriakov, FX strategist at UBS. "Consumer spending is the strongest component of the current economy, and we have anticipated that business confidence indicators would be weaker than consumer indicators, and this report is consistent with that forecast."

The majority of the US GDP is derived from consumer spending, making the resilience of this sector positively impact the US dollar. At the same time, the market is concerned about the negotiations regarding the US debt ceiling.

Market participants eagerly await a meeting between US President Joe Biden, Speaker of the House Kevin McCarthy, and several key Congressional leaders to address the issue of raising the government's debt ceiling today. As this news is being written, there are no signs of any breakthrough, even though the US is at risk of default if the debt ceiling is not raised by June 1st.

"There is maybe some potential news on the debt ceiling today. Chances are that this is going to be pushed closer to the deadline, which is early next month," added Vassili. "So the market should remain in a range. I don't really see any directional impulse here."

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance