Trading without indicators might seem confusing at first, but you would get clearer trading signals once you master it. Here are the key tips you could follow.

Can you trade without indicators? The answer is yes, it's possible. Also known as "naked trading", trading without indicators is solely based on observing price movements. With this technique, you don't need any technical indicators on your chart.

Advantages of Trading Without Indicators

Trading indicators can be compared to makeup tools that women use to enhance their appearance. Every time there's a new release, we tend to want to try it out, right? Traders are the same way, always wanting to try out every new indicator they come across.

They want to use them to optimize their plan without realizing that the more indicators they use, the potential for profit doesn't necessarily increase. Just like a woman wearing too much makeup, the same goes for using too many indicators. Instead of giving them better signals, many indicators only complicate the look of their charts and decrease their accuracy in viewing the market conditions.

That's why trading without indicators can be a good choice. Instead of being overwhelmed by many indicators to choose from, why not learn about price action and price patterns? Aren't candlestick patterns alone can help you find the price direction and other key information to plan a strategy?

As a matter of fact, bullish or bearish aren't determined by indicators, but rather by price movements. By removing all indicators from your trading chart, you can focus solely on price movements. Not all forex traders can do this, but many are capable of trading without indicators.

How to Trade Without Indicators

If you're interested in trading without indicators, there are a few things you should keep in mind when putting it into practice. What are they?

Identifying Swing Highs and Lows

A swing is a reversal point on a chart that typically consists of high and low levels that appear around support and resistance. There are four categories of swings that you can use as a benchmark, namely:

- Higher Low

- Higher High

- Lower High

- Lower Low

Higher High (HH) and Higher Low (HL) are new high points that are higher than the previous high or low points. Conversely, Lower High (LH) and Lower Low (LL) are new low points that are lower than the previous high or low points.

See Also:

Identifying the Current Market Condition

From identifying Swing Highs and Lows, you will be able to identify the current market condition. There are three types of market conditions, namely:

- Uptrend (bullish): a series of HH and HL.

- Downtrend (bearish): a series of LL and LH.

- Sideways (ranging/consolidation): no specific series that show a direction. They usually form Wedges, Triangles, or Head and Shoulders patterns.

If you can't determine HL, HH, LH, and LL, then it is likely that the market condition is ranging or choppy.

Making Decisions: To Trade or Not to Trade

After being able to read market conditions, you can now determine whether to trade or not. If the market condition is in an uptrend or bullish, then it is easy for you to take a buy position. If it is in a downtrend or bearish, then the decision is clear to sell.

But what if it is sideways?

When the market condition is sideways or choppy, market participants are likely waiting for important news releases. In this situation, it is difficult to determine entry and exit points, so you can choose not to trade if you wish. However, there are several alternatives you can do to trade when the market is sideways if you still want to trade. One of them is by waiting for a breakout.

Identifying Reversal and Breakout Points

When the market is trending, you can try to enter the market when the price experiences a correction from the big trend. It is called "buy the dips and sell the rally". You can also mark support and resistance levels to use as a benchmark for reversal and correction points. If the price moves beyond the levels, you can identify it as a breakout.

Waiting for Trading Signals to Appear

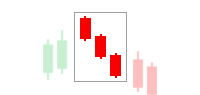

Next step, wait for a tested trading signal to appear. In trading without indicators, these signals often come in the form of candle formations that indicate reversal or breakout.

One of the most widely used candlestick patterns for trading without indicators is Pin Bar. Additionally, there are Shooting Star, Bullish Hammer, and Tweezer Top and Bottom.

Next, to determine the exit point, you can customize it by the principle of Equal Waves, risk-reward ratio, or other setups according to your preferences without using indicators on the chart.

Creating a Trading Plan Without Indicators

Once everything is settled, pour your trading steps into a plan. A trading plan contains notes about trading activities, including strategies and steps to achieve predetermined targets.

You don't need to go overboard; write it on a piece of paper or a notebook, and make sure to keep it safe since it is very personal.

The content of the trading plan can differ from one trader to another. However, the general outline of a trading plan usually includes notes about entry and exit setups, risk management, capital notes, and any changes during the trade.

In the context of trading without indicators, make sure you write down all of your steps neatly and carefully. Start from the entry and exit time to market analysis. Don't forget to write down all the patterns you understand as trading signals. Make sure you follow your own trading plan to avoid being tempted or distracted by destructive emotions.

Self-Control

This step may be challenging to implement because trading without indicators requires challenging psychological control. You will be easily "forcing" illusions about price movements when there is nothing on the chart. Therefore, you must be able to control yourself in all decision-making and not create trading signals out of nothing.

In the forex market, there are undoubtedly many opportunities. However, opportunities don't always come all the time. There are moments when you should avoid the market. So, face everything with a cool head and strong self-control, regardless of the technique used.

Conclusion

Trading without indicators requires you to focus solely on price action. For traders who are used to using indicators, it may feel difficult. However, the opportunities from trading with or without indicators remain the same.

No matter how sophisticated the indicator used is, it will be in vain if you cannot use it correctly. Like a woman with the right makeup, you will be able to see a lot of character and potential from price movements when trading without indicators.

It can be said that price action is the core of trading without indicators. If you feel that your price action knowledge is still lacking, you could always learn from Most Recommended Price Action Books to Read.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance

5 Comments

Ferran

May 17 2023

Is naked trading, you know, the strategy where you trade without using any indicators, considered a type of trend-following approach? It's like comparing indicators to makeup tools that traders just love to try out, always looking for the next best thing. But here's the thing, using too many indicators can mess up your charts and make it harder to see what's really happening in the market. It's like putting on too much makeup and ending up with a complicated look. So, when it comes to naked trading, where you solely rely on price action, I'm curious if it's all about following the trend or if it falls into a different strategy category altogether.

Hendrik

Jun 8 2023

actually trade without using any indicators? It's quite an intriguing concept because indicators are typically considered the backbone of trading analysis. However, I'm curious to explore alternative approaches or strategies that can potentially lead to success without relying on indicators.

I've always believed that trading is a combination of art and science, and while indicators provide valuable insights into market trends and patterns, I wonder if there's another way to approach trading that doesn't rely heavily on them. Perhaps there are techniques or methods that focus more on price action, support and resistance levels, or even market sentiment.

Have you ever come across traders who successfully trade without indicators or have you tried it yourself? I'd love to hear about your experiences or any insights you might have on this fascinating topic.

Johnson

Jun 15 2023

@Hendrik: To be honest, I'm not personally aware of specific traders who have achieved success without using indicators. However, I do know that trading without indicators is a viable approach. This style of trading allows traders to gain a deeper understanding of price movements and develop their intuition. It involves closely observing patterns and conducting thorough analysis of historical price data. Traders who adopt this approach often emphasize the significance of studying market psychology and interpreting real-time price patterns.

Trading without indicators can indeed be challenging, but it provides a unique perspective and can be effective for experienced traders who possess a strong grasp of market dynamics. It requires discipline, patience, and a solid understanding of technical analysis concepts. Ultimately, the decision to use indicators or trade without them depends on the individual trader's preferences, skills, and trading style.

Hector

Jun 23 2023

When establishing your trading plan, it's important to outline the rules for your trading activities, including strategies and steps to reach your predetermined targets. While the content of a trading plan may vary among traders, it typically includes notes on entry and exit setups, risk management, capital allocation, and potential adjustments during trades. In the context of trading without indicators, it is crucial to document your steps systematically. This includes recording entry and exit times, conducting market analysis, and noting any recognized patterns that serve as trading signals. To maintain discipline and avoid succumbing to destructive emotions, it is essential to adhere to your own trading plan diligently. So, what are the key guidelines or considerations to keep in mind when determining the appropriate Stop Loss (SL) and Take Profit (TP) levels in your trading plan?

Foden

Jun 27 2023

@Hector: Let me help you! When it comes to setting your Stop Loss (SL) and Take Profit (TP) levels in your trading plan, here are some key things to keep in mind:

Risk vs. Reward: Decide on a risk-reward ratio that makes sense for you. It's all about balancing the potential profit with the amount you're willing to risk. Maybe you aim for a 1:2 ratio, where you're looking to make twice the profit compared to your risk.

Support and Resistance: Look out for important levels on the chart. These can act as barriers or turning points in the market. Place your SL below a support level and your TP near a resistance level to capture potential price movements.

Volatility: Take into account how crazy the market can get. Higher volatility may require wider SL and TP levels to handle price swings. Look at indicators like Average True Range (ATR) to gauge volatility and adjust accordingly.

Technical Analysis: Pay attention to indicators and patterns that can give you trading signals. Trend lines, moving averages, and chart patterns can be helpful. They guide your entry and exit points and help you determine where to set your SL and TP levels.

Timeframes and Strategy: Consider the timeframe you're trading on and the nature of your strategy. Short-term trades may have tighter levels, while longer-term ones need wider levels to ride out bigger price swings.

Risk Management: Be smart about managing your risk. Set a maximum risk percentage per trade or day, use position sizing techniques, and adjust your SL and TP levels accordingly.

Remember, your specific SL and TP levels depend on your style, preferences, and the market you're trading. Test and evaluate your plan over time, and don't be afraid to make adjustments as needed. Happy trading!