Top Forex Indicators - Download for Free

An important instrument to help analyzing the chart, forex technical indicators are somewhat a must to be learned when you first come into this business. Even though you may end up with strategies that don't involve any technical indicator, it's still a good practice to try out some indicators every now and then.

On the other side, for technical traders keen on utilizing indicators as best as possible, exploring various types of indicators can be a necessity. Common indicators provided in the MetaTrader setup are sometimes not enough, hence the search of alternative (hopefully more advanced) indicators from other sources.

For that particular reason, we have compiled a number of top forex indicators that you can't get from your MetaTrader's selection. Don't worry, everything is available for free. You only need to choose what kind of indicator that you want, and click the download button to get it for free.

What are the best indicators for 1-hour trading?

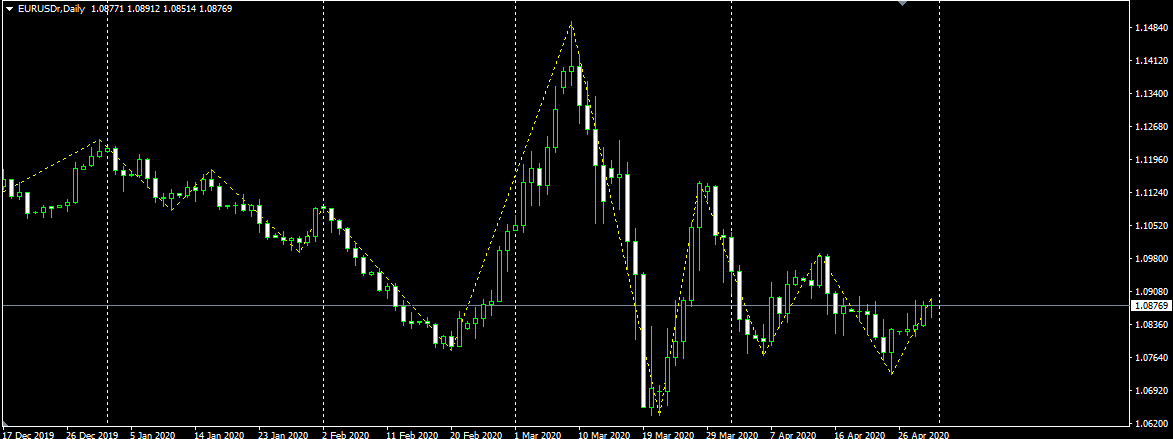

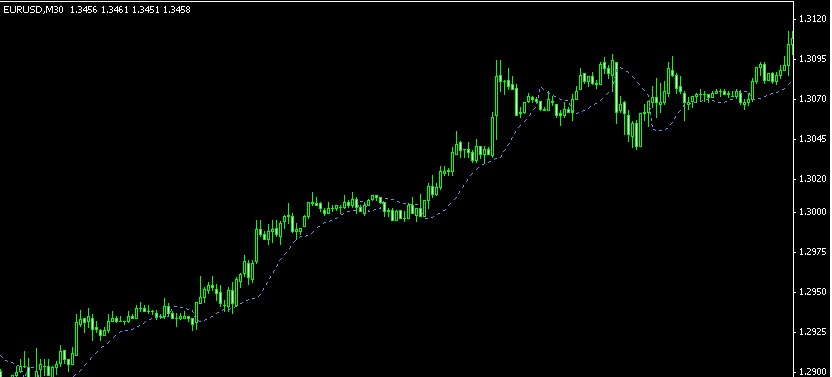

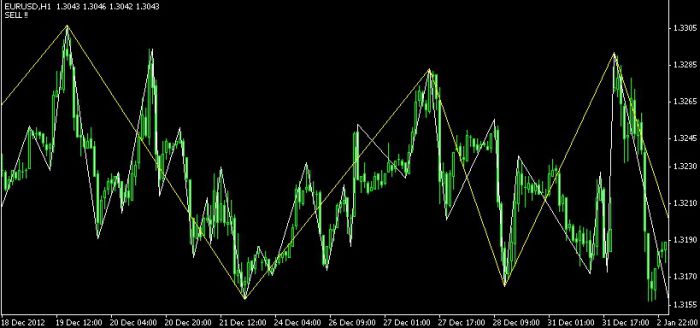

You can combine a 20-period Moving Average and 11-period RSI or mix up Bollinger Bands and simple price action analysis for swing trading strategy.

Continue Reading at 1 Hour Swing Trading Strategy with Simple Price Action

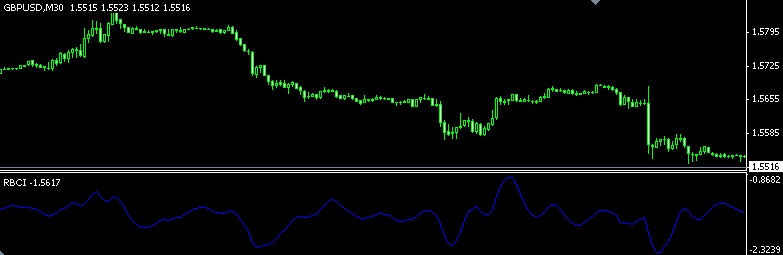

How to use RoC indicator for short-term trading?

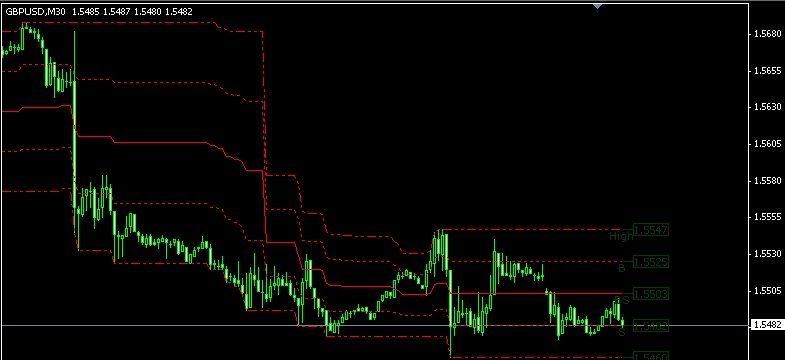

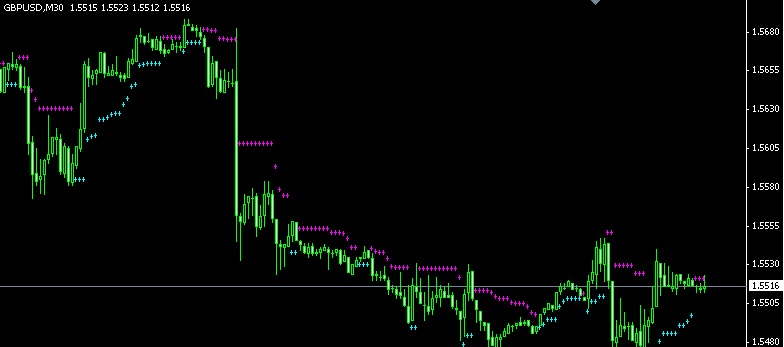

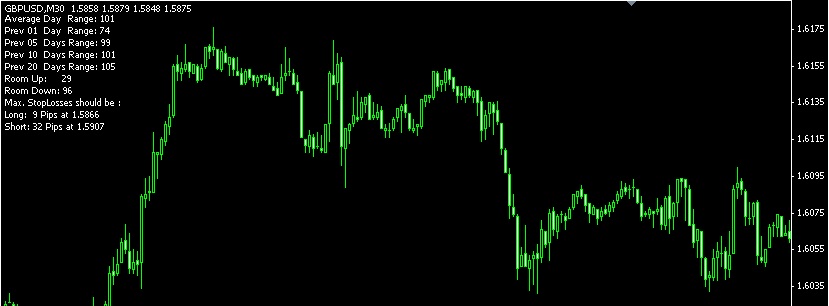

- Select a pair, for example, GBP/USD.

- Determine a short-term time frame (M15 or M30).

- Use the RoC indicator with a period of 10 or 14.

- Wait until the RoC indicator shows a strong Buy or Sell signal.

- If RoC shows a strong decrease, you can open a Sell position on GBP/USD.

- Place a stop loss above the nearest resistance to limit losses.

- Set a profit target following your risk/reward ratio.

- Don't forget to monitor the positions.

Continue Reading at RoC Indicator for Short-term and Long-term Trading

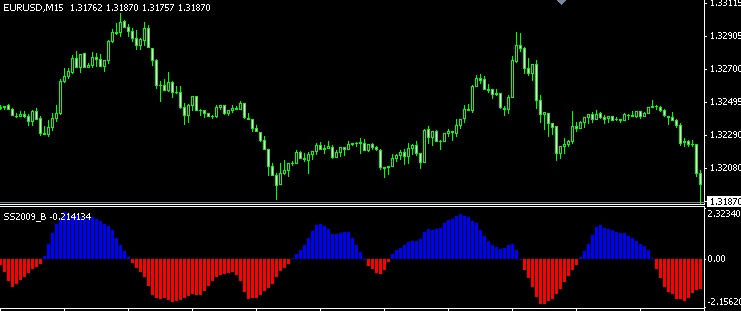

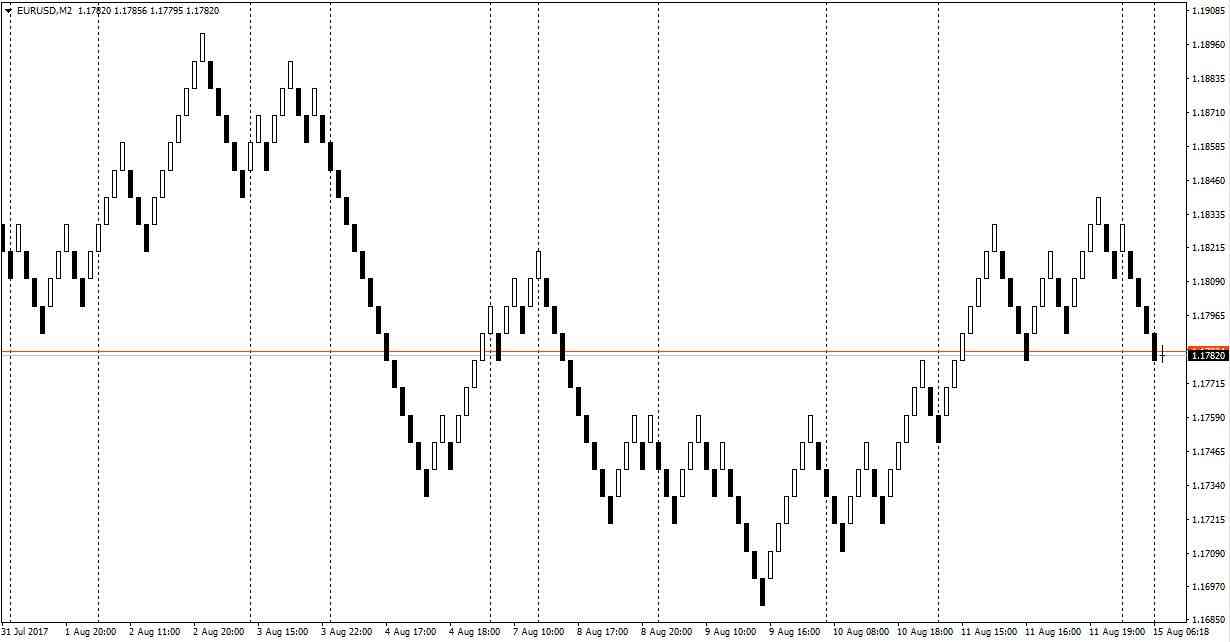

Why should we use volume indicator for scalping?

For some reason, scalpers believe that volume indicator and price action have a very strong short-term connection. The volume indicator is considered leading while the price action acts as a confirmation. It is believed that information retained from the indicator carries what would happen in the next movement, so scalpers referring to the volume indicator can get an earlier signal to act upon. That is one of the key benefits for scalpers as responding to market signals as quickly as possible is the essence of what they do.

Continue Reading at Easy Scalping with Volume and Price Action Analysis

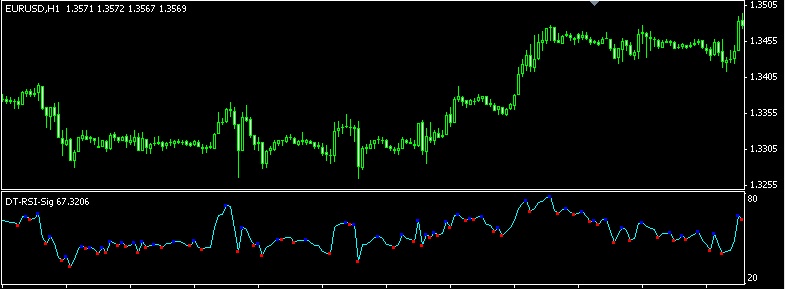

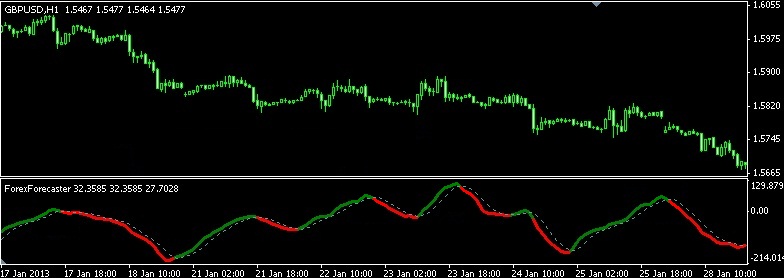

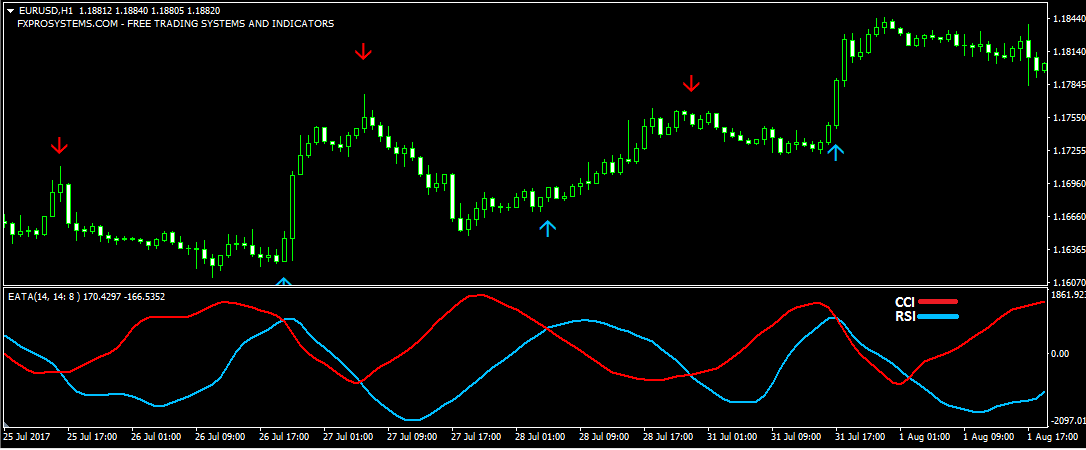

How to use the divergence signal from momentum indicator?

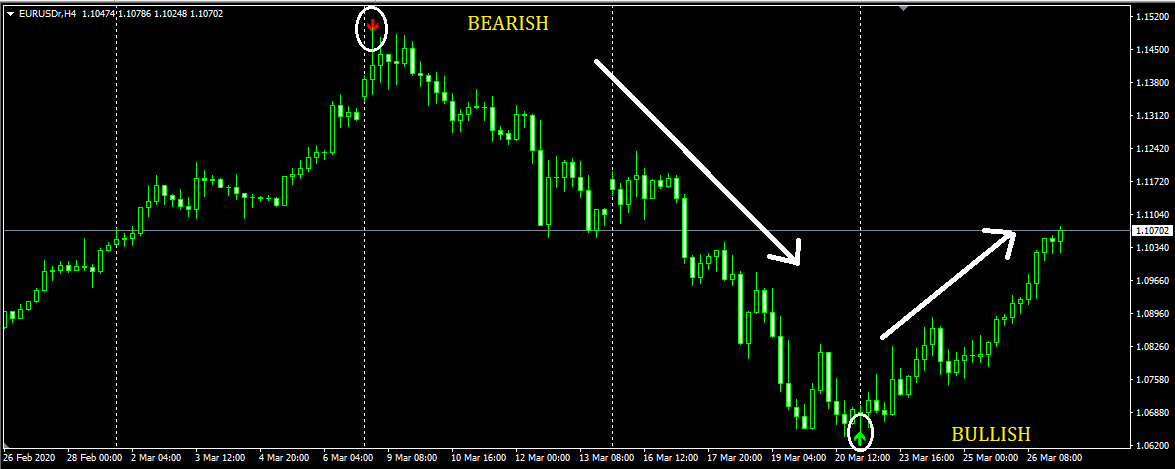

A bullish divergence occurs when the price is going lower, but the momentum indicator is moving higher. This shows that the price is dropping, but the momentum behind the selling is weakening, so it can confirm a buy signal for you.

Meanwhile, a bearish divergence occurs when the price is going higher, but the momentum indicator is going lower. This indicates that the price is rising, but the momentum behind the buying is weakening, so it basically gives you a sell signal.

Continue Reading at Best Trading Strategies with Momentum Indicators

Technical Analysis

-

Triple Bottom Pattern in Trading Explained

-

Your Definitive Guide to Trading without Indicators

-

How to Spot a Downtrend with Candle Patterns

-

How to Use Double Bottom and Double Top Strategy

-

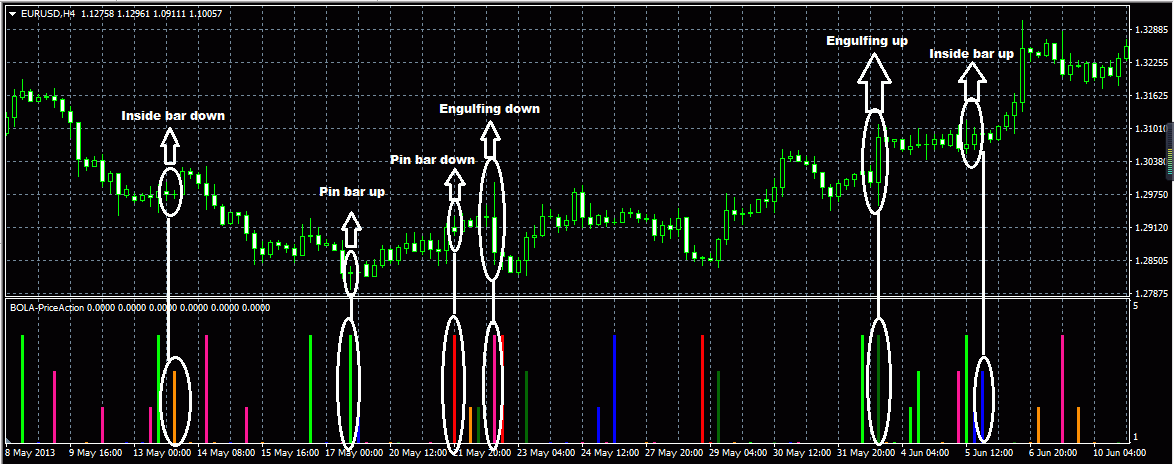

5 Easy Ways of Reading Price Action Signals

-

How Pro Traders Use Bollinger Bands

-

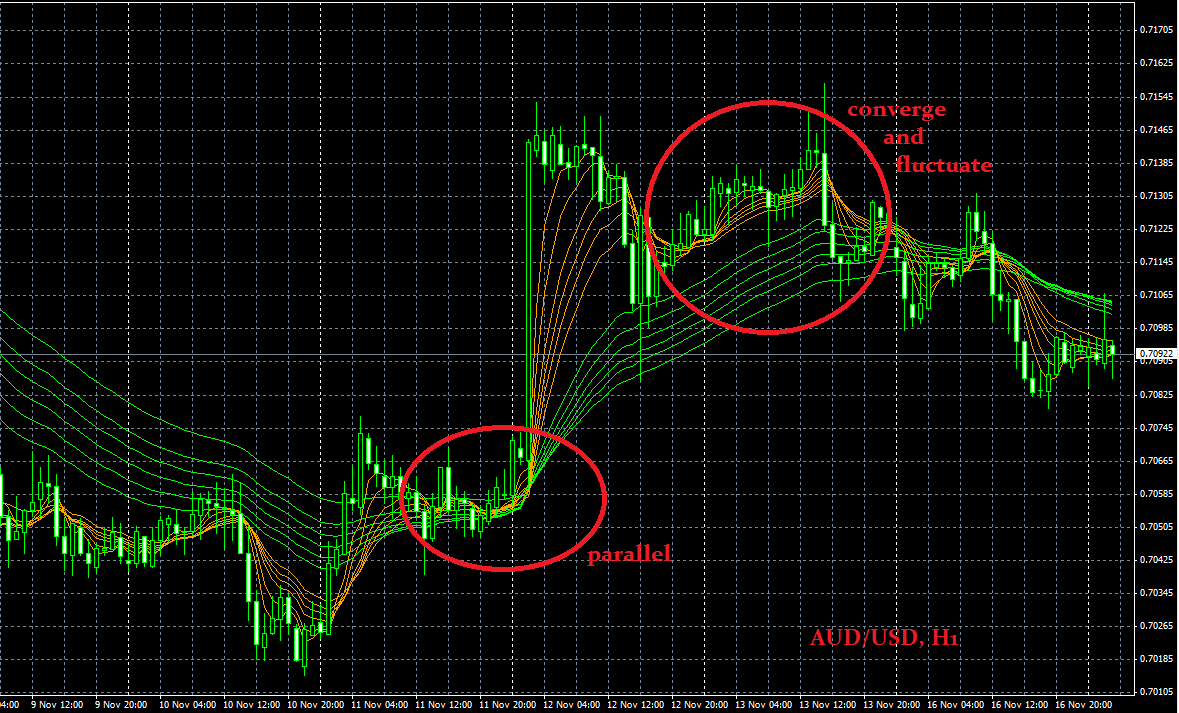

Simple EMA-20 and EMA-60 Crossover Strategy

-

The Concept of Gann Grid

-

Three White Soldiers and Three Black Crows Simple Strategy

-

Best MACD Strategy for H4 Chart

- More