eToro's ProCharts is an incredible charting tool that allows traders to perform in-depth technical analyses of various markets. Here's how it works.

You'll need a sophisticated charting tool and access to technical indicators to perform a practical technical analysis. eToro is one of the popular trading platforms known for offering many useful features for technical traders. Recently, the company introduced ProCharts, a brand-new charting tool offering an in-depth technical analysis of various financial markets.

With ProCharts, you can easily stay updated with your favorite instruments and perform market analysis using technical indicators. Let's explore all the features and learn the benefits offered by eToro's ProCharts in this article.

eToro established in early 2007, with a mission to make trading accessible to anyone, anywhere, and reduce dependency on traditional financial institutions. The company has head offices in the United Kingdom, Cyprus, USA, and Australia.

eToro (Europe) Ltd operates as a Financial Services Company authorized and regulated by the Cyprus Securities Exchange Commission (CySEC) under license no. #109/10. Meanwhile, eToro (UK) Ltd is authorized and regulated by the Financial Conduct Authority (FCA) under the license FRN 583263.

As for eToro AUS Capital Pty Ltd, the legal standing is acknowledged by the Australian Securities and Investments Commission (ASIC) to provide financial services under Australian Financial Services License 491139.

A broker that belongs to the 4-digit type, eToro offers both short-term options for day traders and long-term options for investors, such as their innovative Smart Portfolios, a fully managed thematic portfolio.

Since 2007, eToro has been at the forefront of the Fintech revolution. The most recent was launched in 2017, which is Smart Portfolios powered by Machine learning Al. Beyond developing Smart Portfolios, the company integrated Microsoft's machine learning technology into Momentum DD.

The new Smart Portfolios investment strategy uses artificial intelligence to find the steadiest traders who are most likely to generate a double-digit return and bundle traders into one fully-managed portfolio. eToro has hundreds of financial assets for trading across several categories including stocks, commodities, crypto assets, currencies, indices, and ETFs. Each asset class has characteristics and can be traded using a variety of investment strategies.

Some positions on eToro involve ownership of underlying assets, such as non-leveraged positions on stocks and cryptos. Employing CFDs will enable a variety of options, such as leveraged trades, short (sell) positions, fractional ownership, and more. For example, traders can invest as little as USD100 in gold, even if a single unit of gold cost USD1,000. Some of eToro's most popular CFD commodities include gold, oil, natural gas, silver, and platinum.

Currencies are traded on eToro only as CFDs. Also, CFDs enable Sell (short) positions and leveraged trade, even for assets that don't offer the option in traditional trading. Some of the popular currencies include EUR/USD, GBP/USD, AUD/USD, USD/JPY, and USD/CAD.

Furthermore, An Exchange-Traded Fund (ETF) is a financial instrument comprising several assets grouped to serve as one tradable fund. After opening an account in eToro, traders can invest as little as USD250 in an ETF that costs USD500. Some of the popular ETFs on eToro include SPY, VXXB, TLT, and HMMJ.

However, eToro also offers additional functions using CFD trading. All leveraged ETF positions in the UK are under FCA regulations. Meanwhile, all CFD positions executed by eToro Australia are under ASIC regulations.

The company has other advantages. In all financial assets that can be traded, eToro does not charge any deposit or trading frees other than spreads.

eToro charges a USD25 fee for withdrawals and the minimum withdrawal amount is USD50. Long (Buy), non-leveraged crypto, stock, and ETF positions are not executed as CFDs and do not incur any fees. eToro does charge overnight or weekend fees for CFDs positions, such as leveraged positions and short (sell) orders.

Fee updates always apply to open positions. Fees are subject to change at any given time and could change daily, without prior notice, depending on market conditions.

As a beginner, trader can use CopyTrading eToro. Different from the features of other brokers, traders can copy the strategies of professional traders without fee or profit-sharing. Therefore, 100% profit is fully owned by traders. For example, while trader A who is copied by trader B, produces a profit of 10% this month, then trader B also gets a profit of 10%.

The company is the world's leading social trading network. Since eToro operates in complete transparency, each trader has valuable information on their eToro profiles, so other traders that are interested to copy their trades can have assistance in creating their best portfolios.

Another feature that is unique to eToro is the personalized, social News Feed. Just like on any social media, traders can post their updates on feed, comment on other's posts, and gradually create a feed that is tailor-fitted to trader's trading and investing interests. On eToro social trading platform, traders will also get notifications when a trader writes a new post and many other important updates.

Introduction to eToro ProCharts

ProCharts is an advanced charting tool created by eToro broker with their clients' best interests in mind. By using their clients' feedback, eToro ultimately found out what the traders needed and worked hard to meet them.

eToro's ProCharts is a handy tool for technical traders. It enables traders to access real-time charts customized according to their preferences. The best thing about it is that you can open several charts of different assets at the same time or the same asset using different parameters. This allows you to see the bigger picture of the market, which can be extremely helpful in your analysis.

It is worth mentioning that ProCharts is only available to Silver tier eToro clients. To upgrade your tier to Silver, you must deposit at least $5,000 in your trading account. Your status will be updated automatically 24 hours after the tier balance requirement is met.

The Benefits of Using ProCharts

eToro's ProCharts is ideal for both day traders and long-term investors who want to gain valuable insights into current market trends to make an informed trading decision. Compared to the previous charting tool, the ProCharts features offers several benefits, such as:

| ✔️ Pros | Explanation 💭 |

| 🖥 Optimized technology | ProCharts works faster and better than the previous charting tool. Not to mention that the chart is updated in real-time, so you can stay ahead of market changes as they occur. |

📊 Multicharts feature | The platform allows traders to open up to eight charts on the screen, allowing you to understand the market condition better. You can also choose the layout according to your preference. |

| 📈 Diverse technical indicators | ProCharts allows you to access over a hundred technical indicators, including Accelerator Oscillator, Bollinger Bands, MACD, and EMA Cross. You can apply multiple indicators on the same chart or use different indicators on multiple charts. |

| 💹 Various chart types | You can choose from 13 chart types: Candles, Line, Area, Bars, Baseline, Hollow Candles, Heikin-Ashi, Hi-Lo, Column, Renko, Kagi, PNF, and Line Break. |

| ⏳ Multiple timeframes | ProCharts comes in several timeframes, from one-minute to weekly intervals. This makes it easy for traders to analyze market movements and confirm trading signals using different periods. |

| 📉 Fully customized chart | You can customize the chart as much as you want using the available drawing tools. This includes highlighting a specific part of the chart, making guidelines in various colors, adding notes, or even adding emojis. |

| Save your layout for future use | Once you're happy with your current layout, you can save the settings and use it repeatedly. So, whenever you open the platform, everything will be exactly the way you left it. |

For more information about eToro, read eToro review here.

Guide to Access eToro's ProCharts

To access ProCharts, you need to follow these steps:

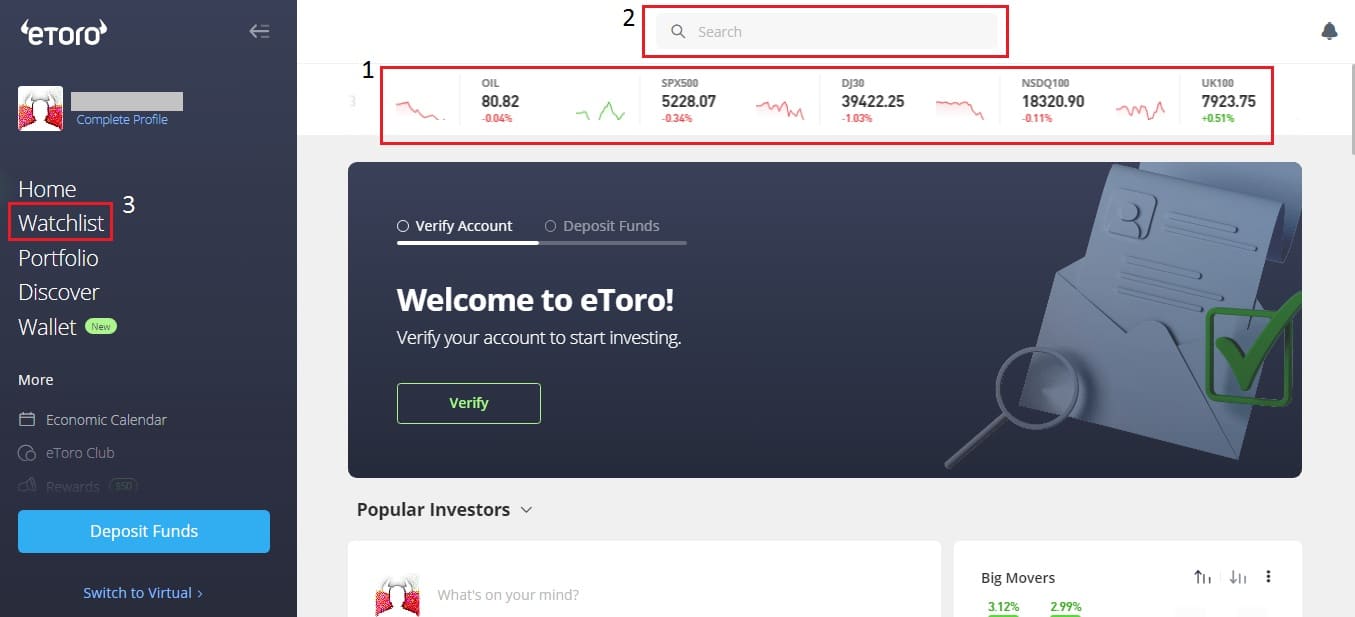

- Head over to eToro's official website and log in to your trading account.

- Click on the asset that you'd like to analyze. You can either 1). Directly click the asset on your dashboard, 2). Use the search bar, or 3). Choose the asset from your Watchlist.

- Under the "chart" section, tap the "ProCharts" button.

- All done! Enjoy eToro's ProCharts feature to analyze the markets.

See Also:

How ProCharts Can Help You Trade Like a Pro

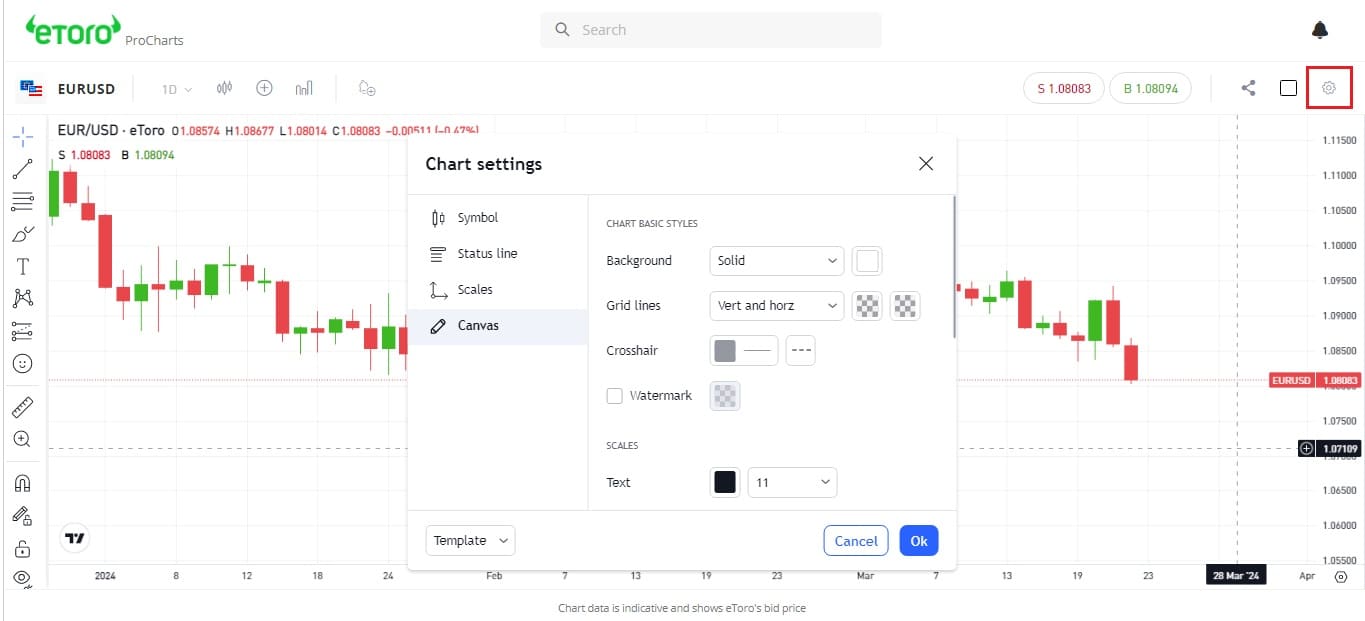

As a professional trader, you need to customize your chart to find all the relevant information easily. To begin with, your chart has to be clean and easy to read.

It is best to keep the background in neutral colors, such as white, gray, or black. If you spend a lot of time watching the screen, changing the default light theme to dark is recommended as it is less tiring for the eyes. You can find this eToro ProChart feature on the top-right corner.

Secondly, you need to determine the chart type. Each type offers a unique perspective on price movements, serving different purposes in market analysis.

Line charts, for instance, offer a simplified view of the price movements of an asset by connecting the closing prices with a straight line. This is great for analyzing the trend over a specific period. Meanwhile, the candlestick chart provides more detailed information on the markets, suitable for finding patterns on the chart. Press the candlestick icon to change the chart type.

Next, use eToro's multiple charts to make an informed trading decision. Use the top-down method starting from the long-term chart to determine the overall trend, then move on to the intermediate chart to look for entry and exit points. Finally, confirm the signals on the short-term chart before opening a trade. To change the layout, click the square icon in the top-right corner.

Don't forget to use relevant indicators on each chart, but don't use too many as it will clutter the chart. These eToro's indicators will help you analyze the markets better and spot trading opportunities. Here's an example of the final customized layout of a pro trader.

Conclusion

Based on the explanation above, we can see that eToro's ProCharts is the key to trading like a pro. It has highly customizable charts with various types, indicators, and drawing tools. The multichart feature also allows you to choose from various layouts and open several charts simultaneously.

Afterward, you can save the layouts you've created so you can use them again. The next time you launch ProCharts, it will automatically display your last settings, so there is no need to set it every time.

FAQs

- Is eToro's ProCharts worth to try?

Absolutely. As the article mentions, ProCharts offers many advantages for beginners and expert traders, such as multicharts. Usually, such features can only be found in premium tools that require monthly subscriptions. This can be quite costly over time. Meanwhile, eToro's ProCharts is accessible for clients with at least $5,000 in their account balance. This feature has no additional charge; you can even get a free 30-day trial at the beginning.

- What other analytical tools are offered by eToro?

Aside from ProCharts, there are two more analytical tools that you can use to improve your trades. The first is eToro Plus. It provides daily, weekly, and quarterly in-depth market reports on various financial markets. The topics are diverse, ranging from supply chain issues to interest rates. This tool can help traders do more thorough research and identify trading opportunities. The second is the eToro Smart Portfolio. This feature allows traders to gain insights from other traders and incorporate the ideas into their investment portfolio. This way, traders can diversify their portfolios and earn consistent profits.

- Where can I access eToro's ProCharts?

The feature is available on the web platform and mobile app. It doesn't matter which platform you use as long as your account is eligible to access eToro's ProCharts.

eToro stands out as an exceptional option for individuals seeking cost-effective stock, CFD, forex, and crypto trading through its impressive mobile app. With an active user community, eToro provides social features dedicated to supporting the needs of traders and investors across the globe.

Dedicated FREE FOREX VPS

Dedicated FREE FOREX VPS Free FOREX Virtual Private Server

Free FOREX Virtual Private Server MT4 Demo Contest, Get $500

MT4 Demo Contest, Get $500 Sign Up for an Account, Claim 60% Deposit Bonus

Sign Up for an Account, Claim 60% Deposit Bonus Free MT4/MT5 VPS 2024

Free MT4/MT5 VPS 2024 Send E-mail and Get Free Merchandise

Send E-mail and Get Free Merchandise $1K Refer a Friend Bonus for Pepperstone Pro clients

$1K Refer a Friend Bonus for Pepperstone Pro clients Maximize Your Earnings with 100% Deposit bonus

Maximize Your Earnings with 100% Deposit bonus Trade to Win, $5,000 Monthly Demo Contest

Trade to Win, $5,000 Monthly Demo Contest Claim 30% + 15% Deposit Bonus from LiteFinance

Claim 30% + 15% Deposit Bonus from LiteFinance